Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

What is Connecticut FICA tax?

What is Connecticut FICA Tax? The FICA Tax (Federal Insurance Contributions Act) is a United States payroll tax (or employment) imposed by the federal government on both employees and employers to fund the Social Security and Medicare —federal programs that provide benefits for retirees, the disabled, and children of deceased workers.

What states charge tax on social security?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

What you should know about taxes and Social Security benefits?

- $29,393 Taxable Social Security

- $21,255 IRA Withdrawal

- $50,000 pension

How much Social Security is taxed in CT?

In general, social security benefits that are taxable for federal income tax purposes will also be subject to Connecticut income tax. However, Connecticut income taxation of social security benefits is limited to 50% of the benefits received, even if a greater percentage of benefits is subject to federal income tax.

Is CT phasing out tax on Social Security?

Despite the Governor's opposition, the percentage of Social Security, pension and annuity retirement income you do not have to pay state income tax on continues to increase. For the 2021 tax year it is 42% and for 2022, 56%. The percentage will continue to increase to 100%.

Is Connecticut tax friendly to retirees?

Connecticut But, beginning in 2022, income from a pension or annuity is exempt for joint filers with less than $100,000 of federal adjusted gross income and other taxpayers with less than $75,000 of federal AGI (42% was exempt for the 2021 tax year).

How much of my pension is taxable in CT?

Beginning with the 2021 tax year, taxpayers can deduct 50% of TRS pension income from their Connecticut taxable income (CGS § 12-701(a)(20)(B)(xx)). For the 2016-2020 tax years, the deduction was 25%.

Is Connecticut a good state to retire in?

Connecticut boasts a low crime rate In addition to being one the oldest and wealthiest states in the country, Connecticut is also one of the safest. Easton, Ridgefield, and Madison top the state's safety rankings.

At what age do seniors stop paying property taxes in CT?

LOCAL OPTION SENIOR PROPERTY TAX FREEZE The law allows towns to freeze property taxes on homes owned by people age 70 or older who have lived in the state at least one year (CGS § 12-170v).

What income is taxable in Connecticut?

You must file a Connecticut income tax return if your gross income for the taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

What income is taxed in CT?

Income Tax BracketsSingle FilersConnecticut Taxable IncomeRate$10,000 - $50,0005.00%$50,000 - $100,0005.50%$100,000 - $200,0006.00%4 more rows

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What states do not tax Social Security?

States That Don't Tax Social SecurityAlaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

What are the CT income tax brackets for 2021?

Connecticut state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with CT tax rates of 3%, 5%, 5.5%, 6%, 6.5%, 6.9% and 6.99% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

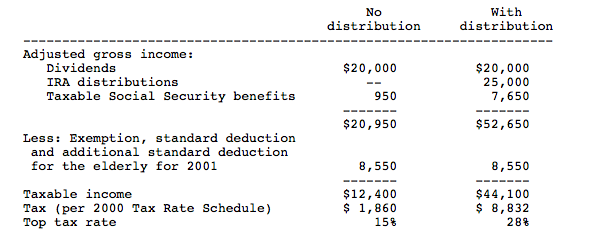

Does Connecticut tax IRA distributions?

Last year, a law was passed that gave a tax exemption for pension and annuity payouts. This year a new law expands the premise of that 2020 law to include IRA distributions. The new law provides an incremental income tax exemption on taxpayers' receipts from IRAs (except Roth IRAs) beginning in the 2023 taxable year.