What is the maximum unemployment benefits in CT?

What is the maximum unemployment benefit in Connecticut?

- What is the maximum unemployment benefit in Connecticut?

- How much is unemployment in Connecticut per week?

- How long can you be on unemployment in CT?

- Do I qualify for partial unemployment CT?

- How long do you have to work to get unemployment in CT?

- Can I work and collect unemployment in CT?

- How many hours is part-time in CT?

Did CT extend unemployment benefits?

The House-approved HEROES Act — endorsed by the entire Connecticut House delegation — would extend the $600 a week federal unemployment benefits until January of 2021. These benefits are ...

Will Connecticut extend unemployment benefits?

Thousands in Connecticut who receive unemployment benefits will be eligible for an additional seven weeks of benefits under the federal High Extended Benefits program, according to the state Department of Labor.

How and when to file for extended unemployment benefits?

- 20 weeks of full-time covered employment

- Wages higher than 40 times your most recent weekly benefit amount or

- Total wages in the base period equal to or greater than 1.5 times the highest quarter

Is CT going to extend unemployment benefits?

(Wethersfield, CT) – Connecticut Department of Labor (CTDOL) Interim Commissioner Danté Bartolomeo today reminded federal Extended Benefits claimants that due to the state's declining unemployment rate, the program will end in Connecticut on Saturday, January 8, 2022.

How long is extension for unemployment in CT?

13-weekExtended Benefits, a 13-week extension to regular state unemployment benefits, expire when the state's three-month average unemployment rate falls below 6.5%.

How many extensions are there for unemployment in CT?

On December 27, 2020 the Continued Assistance for Unemployed Workers Act of 2020 was signed into law, known as CARES Act extension. The CARES Act extension adds 11 additional weeks to PUA, totaling 50 weeks of benefits. However, the additional 11 weeks can only be used from December 27, 2020 onward.

How long can you collect unemployment in CT 2021?

ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks, with an expiry date of September 4, 2021. For up-to-date information on Connecticut's rules on unemployment eligibility and amounts during the COVID-19 pandemic, visit the state's COVID-19 page for Workers and Employers.

Are they extending unemployment?

About the PEUC Extension Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

What is the maximum unemployment benefit in CT 2022?

The current weekly benefit rate ranges from a minimum of $15.00 to a maximum of $685.00 (October 2021). In October of 2022, the weekly rate may rise to $703.00 per week.

What is EUC in CT?

Emergency Unemployment Compensation (EUC) is a temporary federal program that gives unemployed workers additional weeks of unemployment insurance when jobs are scarce.

Can I reapply for unemployment?

To continue receiving benefits, you must reopen your claim. You can reopen your claim if it was filed within the last 52 weeks and you have not used all of your benefits. If your benefit year has ended, you may need to reapply for unemployment.

Is CT unemployment paying an extra $300?

Yes, the additional $300 benefit payment will be included with each payment for every week that you receive a benefit, beginning with the week ending January 2, 2021, through week ending September 4, 2021, regardless of the date on which you receive that payment.

What is PEUC CT?

Pandemic Emergency Unemployment Compensation (PEUC) has ended; filers who are eligible to transition to other programs were notified by email with instructions. Pandemic Unemployment Assistance (PUA) ended. Mixed Earner Unemployment Compensation (MEUC) ended.

What is the maximum unemployment benefit in CT 2020?

$667 per weekANNUAL INCREASE TO WEEKLY BENEFIT RATE FOR NEW FILERS Beginning on October 4, 2020, the weekly benefit rate will go up $18 to a maximum of $667 per week.

Can you collect unemployment and social security in CT?

Connecticut requires an offset against unemployment compensation benefits for Social Security pensions, and, in certain cases, other public and private pensions. The offset is reduced to the extent that the employee contributed to the pension (approximately 50% in the case of Social Security).

How long is the maximum unemployment extension?

Tier 3 EUC08: 13 week maximum unemployment extension. Tier 4 EUC08: 6 week maximum unemployment extension. If you use up all of your regular unemployment benefits, normally you don’t have to apply for an unemployment extension because the system automatically applies for you, if you are eligible. It is very important that you keep track ...

What to do if unemployment runs out?

If you get close to your unemployment benefits running out, give your unemployment counselor a call to check to see what you have to do in order to get they unemployment extension. There is another type of unemployment extension called Federal-State Extended Duration (FED-ED), more commonly referred to as Extended Benefits (EB).

How long does unemployment last?

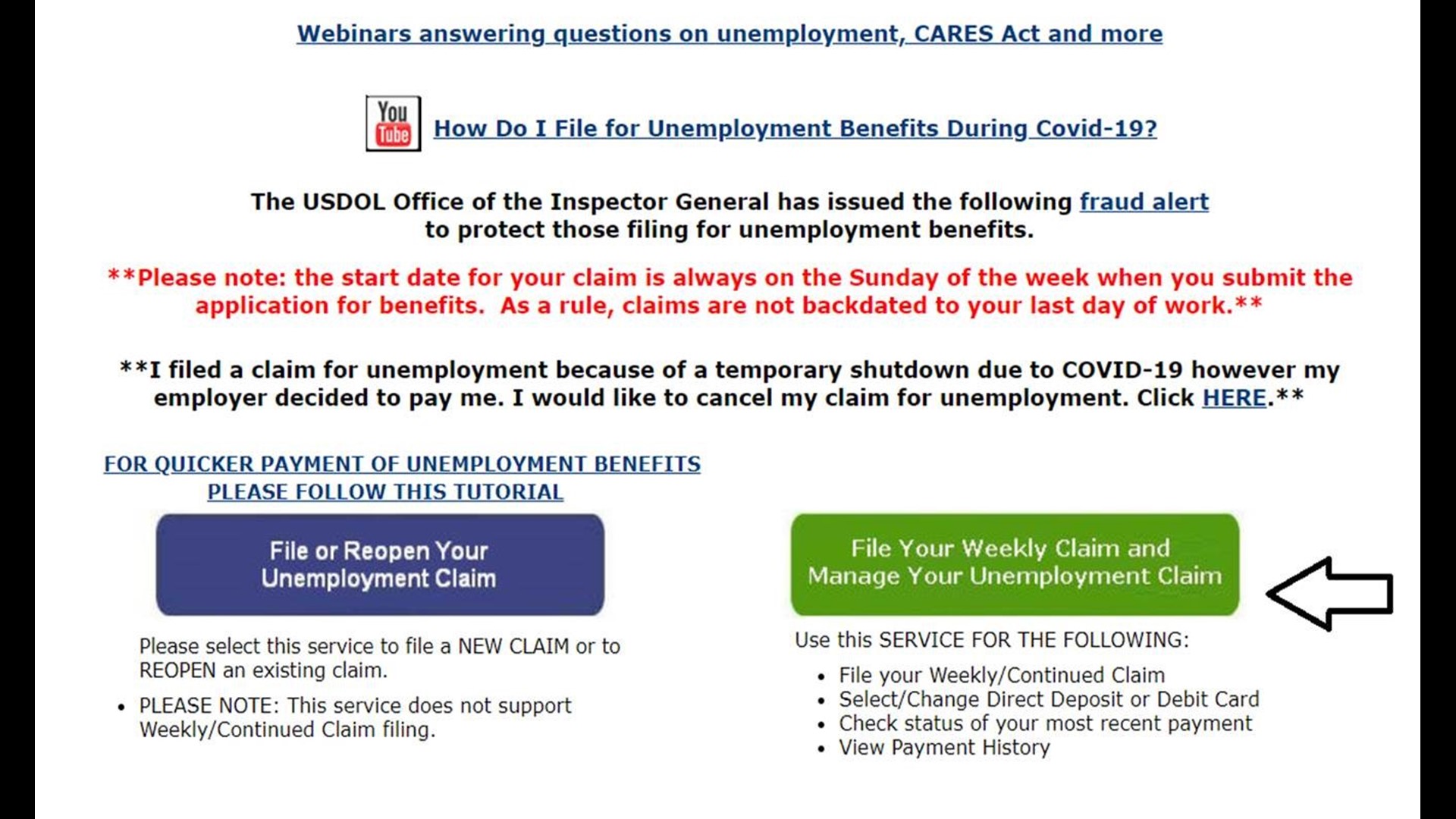

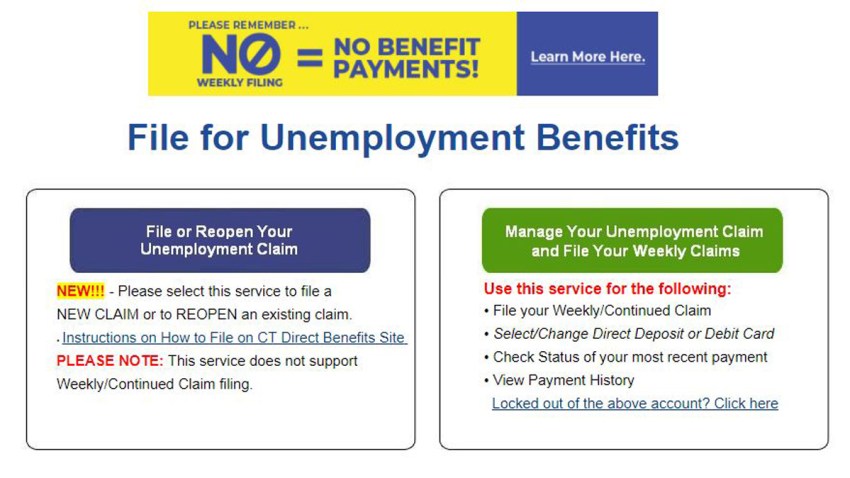

Each unemployment claim is effective for 52 weeks. After that time, claimants must re-apply for benefits using the blue button on www.FileCTUI.com. When you are at the end of your benefit year, you will be notified to re-submit your unemployment claim using the blue button on www.FileCTUI.com.

How much self employment income is required for unemployment?

Eligibility requires claimants to have at least $5,000 in self-employment net income and receive state unemployment benefits; extended benefits; or Pandemic Extended Unemployment Compensation (PEUC). The law excludes Pandemic Unemployment Assistance filers and filers with less than $5,000 in self-employment net income.

When does the FPUC end in Connecticut?

The FPUC program is in effect in Connecticut until the week ending September 4, 2021. Claimants do not need to apply for the program. Supplements are automatically attached to regular benefits.

When does the MEUC program end?

Payments are retroactive to the week ending January 2, 2021 if filers are eligible.

Is unemployment taxed in 2020?

The American Rescue Plan creates a tax exclu sion for the first $10,200 in unemployment benefits for the 2020 tax year for all households with an annual income below $150,000. Unemployment benefits above $10,200 are taxable income. The IRS has issued guidance for taxpayers.

When will the unemployment benefits be extended?

The American Rescue Plan extends expanded unemployment benefits through September 6, 2021, and includes $300 a week in extra compensation. The first $10,200 in benefits collected in 2020 will be tax-free for households with annual incomes less than $150,000. Check with your state unemployment office for information on eligibility ...

How long is unemployment extended?

There are additional weeks of federally funded Extended Benefits (EB) in states with high unemployment. Unemployed workers are eligible for up to 13 or 20 weeks of additional unemployment ...

What happens if you run out of unemployment?

If you have exhausted unemployment benefits or are worried about running out of them, there are extended benefits funded by the federal government that will provide unemployment compensation beyond the maximum number of weeks provided by your state.

How many weeks of unemployment benefits are there?

What benefits will unemployed workers be eligible for? Ordinarily, workers in most states are eligible for 26 weeks of unemployment benefits, although some states provide less coverage.

Does the Cares Act extend unemployment?

In times of high unemployment, the federal government provides funds to the states to extend unemployment insurance programs for additional weeks of benefits beyond what each state offers. 5 . In addition to employees who have traditionally been eligible to collect unemployment insurance compensation, the CARES Act extends benefits ...

Do you get paid for additional weeks of unemployment?

You will automatically be paid for the additional weeks. In others, you may need to apply. 14 . If you are currently collecting unemployment benefits: Benefits are provided through the state unemployment offices and information on eligibility will be posted online. If you are eligible, you will be advised on how to collect when your regular ...

What is extended unemployment?

The Extended Benefits Program provides additional weeks of unemployment benefits when a state is experiencing a higher than usual unemployment rate. Claimants on EB will receive the same weekly benefit rate they received when collecting regular unemployment.

When will unemployment be extended in 2021?

If a claimant is collecting PEUC as of September 6, 2021 , their benefit weeks will switch to Extended Benefits even if they have not exhausted all 53 weeks of PEUC. If a claimant is collecting PEUC as of September 6, 2021 and the claimant’s state is not currently operating an EB program, then no more weeks of unemployment benefits will be available ...

How long can you get unemployment if your IUR is 6%?

Additionally, states have two options to compute and determine when they are experiencing high unemployment: Trigger a maximum of 13 weeks of Extended Benefits if a state’s 13-week IUR is at 6% or higher. Trigger a maximum of 13 weeks of Extended Benefits if a state’s three-month Total Unemployment Rate (TUR) is at 6.5% and rising, ...

How many weeks of unemployment are there?

Regular Extended Benefit weeks are 50% of a state’s regular unemployment weeks, with a maximum of 13 weeks available. This means that in states where there are less than 26 weeks of regular unemployment, there will be less than 13 weeks of Extended Benefits.

When will the PEUC be extended?

EB & PEUC. In March 2020 Congress passed the CARES Act, which among other things created the PEUC extension, a program which provides an additional 13 weeks of benefits to claimants who have exhausted their regular unemployment benefit weeks. On December 27, 2020 the Coronavirus Response and Relief Package was signed into law, ...

How long does it take for EB to be re-determined?

While a state’s Extended Benefits eligibility is re-determined weekly, when a state first becomes eligible for EB, it remains in place for a minimum of 13 weeks, and when a state loses eligibility to provide EB, it remains in an “off” period for a minimum of 13 weeks.

Can you stop unemployment if your unemployment rate drops?

A state’s Extended Benefits eligibility is re-determined weekly, so EB can be discontinued at any time if a state’s unemployment rate drops below the determined triggers, even if a claimant has not yet collected all EB weeks originally allotted.

How many weeks of unemployment benefits are extended?

Extended State Unemployment Benefits (EB)— Provides an additional 13 additional weeks of benefits when a state is experiencing high unemployment. Some states have also enacted a voluntary program to pay up to 7 additional weeks (for a total of 20 weeks maximum) during periods of extremely high unemployment. Note that extended state benefits are ...

How long does unemployment pay in Texas?

The MBA for extremely high unemployment is 30 percent of the regular UI claim’s MBA or will pay up to 7 weeks.

How many weeks of unemployment in Texas?

A similar worker in Texas would get 26 weeks of regular UI + 13 weeks of PUEC + 7 weeks of Extended State Unemployment benefits + 7 more weeks for entering extremely High Unemployment Period (HUP) for a total of 59 weeks.

Can you get PUA if you have exhausted other benefits?

Workers who get PUA are not eligible for PEUC or Extended State Unemployment benefits. Pandemic Emergency Unemployment Compensation ( PEUC )—A total of 54 weeks of coverage if you have exhausted other benefits.

When will the unemployment stimulus be extended?

It includes further unemployment program extensions until September 6th, 2021 for the PUA, PEUC and FPUC programs originally funded under the CARES act in 2020 and then extended via the CAA COVID Relief Bill. The need for another unemployment stimulus was reinforced by the prevailing high unemployment situation in many parts of the country due to the ongoing COVID related economic fallout.

How much is the extra unemployment payment?

Further the extra unemployment payment amount will range between $300 and $400, depending on how much states can fund their portion of the payment.

When will the UIC cut end?

This straight line cut would be in effect till the end of September 2020 (or first week of October in some states based on their UIC payment schedule), in order to allow states to implement the second phase approach which ties wages earned before a job loss to the amount of supplementary unemployment benefits paid.

When will the $300 supplement be extended?

This amount is the same as the $300 weekly supplement approved under the CAA COVID relief bill (discussed in earlier updates below) was funded until March 14th, 2021 but will now be extended through to week ending September 4th, 2021. This provides another 25 weekly payments for a maximum of $7,500.

Is the $10,200 unemployment tax taxable?

Another valuable provision in the ARP bill for unemployed workers is to make the first $10,200 in unemployment payments non-taxable to prevent the surprise tax bills many jobless Americans faced in 2020 when filing their tax return. The provision will only be applicable to households with incomes under $150,000 and is only available for 2020 unemployment benefit payments. See how this could impact you if you already filed a return.

Is unemployment retroactive?

Are unemployment benefits in the stimulus retroactive. Yes, it is expected that unemployment benefits – both supplementary and extended – would be retroactive to the start of the program or latest extension, so many eligible recipients should get a pretty significant unemployment check payment if and when Congress passes the stimulus relief bill.