What are direct labor costs?

Direct labor costs refer to costs that are derived directly from supply chain employees involved in the production. This could be assemblers, manufacturers, heavy machinery users, fabricators, craftsmen and artisans, delivery drivers and other logistical employees essential for getting goods into consumer's hands.

What is included in direct labor?

Direct labor includes the cost of regular working hours, as well as the overtime hours worked. It also includes related payroll taxes and expenses such as social security, Medicare, unemployment tax, and worker’s employment insurance. Companies should also include pension plan contributions, as well as health insurance-related expenses.

What is the difference between direct and indirect labor?

The work must be exactly related to a specific job for it to be called direct labor. If you cannot connect an employee’s work to a particular work order or service or if she does not directly manufacture the product, then her labor is indirect instead of direct.

What is the importance of budgeting in direct labor?

Budgeting is essential to direct labor, because it lets you know whether enough hours are available to satisfy production requirements. A direct labor budget consists of the projected production units and the number of direct labor hours needed to make each unit.

What is included in direct labor cost?

Direct labor refers to the salaries and wages paid to workers that can be directly attributed to specific products or services. It includes the cost of regular working hours, overtime hours worked, payroll taxes, unemployment tax, Medicare, employment insurance, etc.

Does labor cost include employee benefits?

Labor, which can account for as much as 70% of total business costs, include employee wages, benefits, payroll and other related taxes.

Does direct labor include fringe benefits?

When not classified as a direct labor expense, fringe benefits are considered indirect costs. Wages, salaries and fringe benefits paid to employees who are not directly involved in producing raw materials into finished goods fall into the category of indirect labor.

Is insurance a direct labor cost?

Remember, direct labor cost includes expenses other than just wages. Insurance, bonuses, taxes — all of these items play a part in what you ultimately pay your employees.

What are examples of direct labor?

Direct labor refers to any employee that is directly involved in the manufacturing of a product. If your business manufactures bicycles, the employees producing the bicycles are considered direct labor. Assemblers, welders, painters, and machinists would all be considered direct labor.

What is the difference between direct labor and indirect labor?

They are usually split into direct and indirect labor costs, based on the worker's contribution to the production process. While direct labor comprises work done on certain products or services, indirect labor is employee work that can't be traced back or billed to services or goods produced.

Are benefits included in cost of sales?

The key components of cost generally include: Parts, raw materials and supplies used, Labor, including associated costs such as payroll taxes and benefits, and. Overhead of the business allocable to production.

What are examples of indirect labor costs?

A company's office rent, utilities, and property taxes are examples of fixed indirect labor costs because they do not fluctuate when the number of employees working in a factory changes. Other examples include insurance, depreciation on equipment, and administrative salaries.

What are direct expenses examples?

Examples of Direct Expenses are royalties charged on production, job charges, hire charges for use of specific equipment for a specific job, cost of special designs or drawings for a job, software services specifically required for a job, travelling Expenses for a specific job.

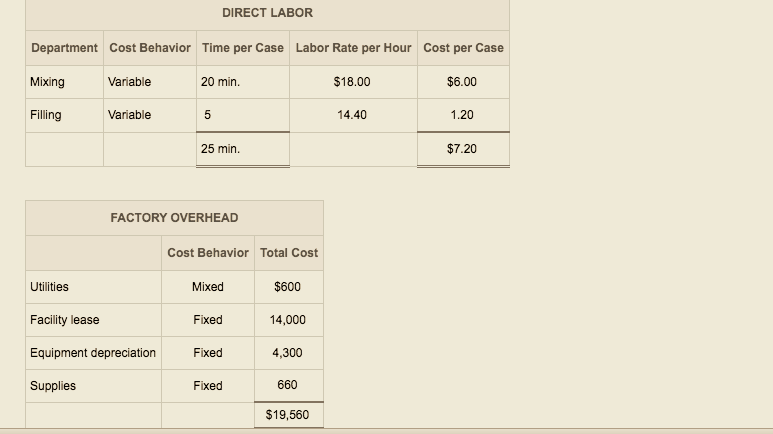

How to calculate direct labor cost?

Then multiply her hourly rate by her annual work hours to get her yearly hourly wages. Add all of your annual hidden costs together, including benefits and your portion of taxes. When you add all of your hidden costs to the employee’s annual wages, the result is likely much higher than the gross wages she receives each payday.

What is direct labor?

Direct labor refers to wages you pay workers for manufacturing a certain product or fulfilling a specific service. It is a direct amount that pertains to only the people who actually make the product or perform the service. The work must be exactly related to a specific job for it to be called direct labor. If you cannot connect an employee’s work ...

What taxes count toward direct labor cost?

Your mandatory obligations as an employer also count toward your direct labor cost. This includes your portion of Social Security and Medicare taxes, federal and state unemployment insurance, and workers’ compensation and state disability insurance, if applicable.

Why is budgeting important for direct labor?

Budgeting is essential to direct labor, because it lets you know whether enough hours are available to satisfy production requirements. A direct labor budget consists of the projected production units and the number of direct labor hours needed to make each unit. To arrive at the total direct labor hours, multiply the projected units by ...

Is direct labor the same as indirect labor?

Direct cost is not the same as direct labor.

What is direct labor cost?

Direct labor costs refer to the total cost incurred by the company for paying the wages and other benefits to the employees of the company against the work performed by them which are related directly to the manufacturing of the product of the company or for the provision of the services.

What is included in an expense?

expense does not only include the wages paid to the employees. It also includes the other amount paid, which are directly related to the products such as payroll taxes associated with employee wages, workers’ compensation insurance, life insurance, medical insurance, and other company benefits.

What is payroll tax?

Payroll Taxes – It includes Payroll taxes of those employees who are engaged in the manufacturing of the products or provision of the services count. Worker’s Compensation – This includes worker’s compensation paid to those employees who are engaged in the manufacturing of the products or provision of the services.

What is direct labor cost?

Direct labor cost is wages that are incurred in order to produce goods or provide services to customers. The total amount of direct labor cost is much more than wages paid.

Can an employer bill customers based on hours worked?

In the services industries, such as auditing, tax preparation, and consulting, employees are expected to track their hours by job, so their employer can bill customers based on direct labor hours worked.

What is direct labor cost?

Direct labor costs refer to costs that are derived directly from supply chain employees involved in the production. This could be assemblers, manufacturers, heavy machinery users, fabricators, craftsmen and artisans, delivery drivers and other logistical employees essential for getting goods into consumer's hands.

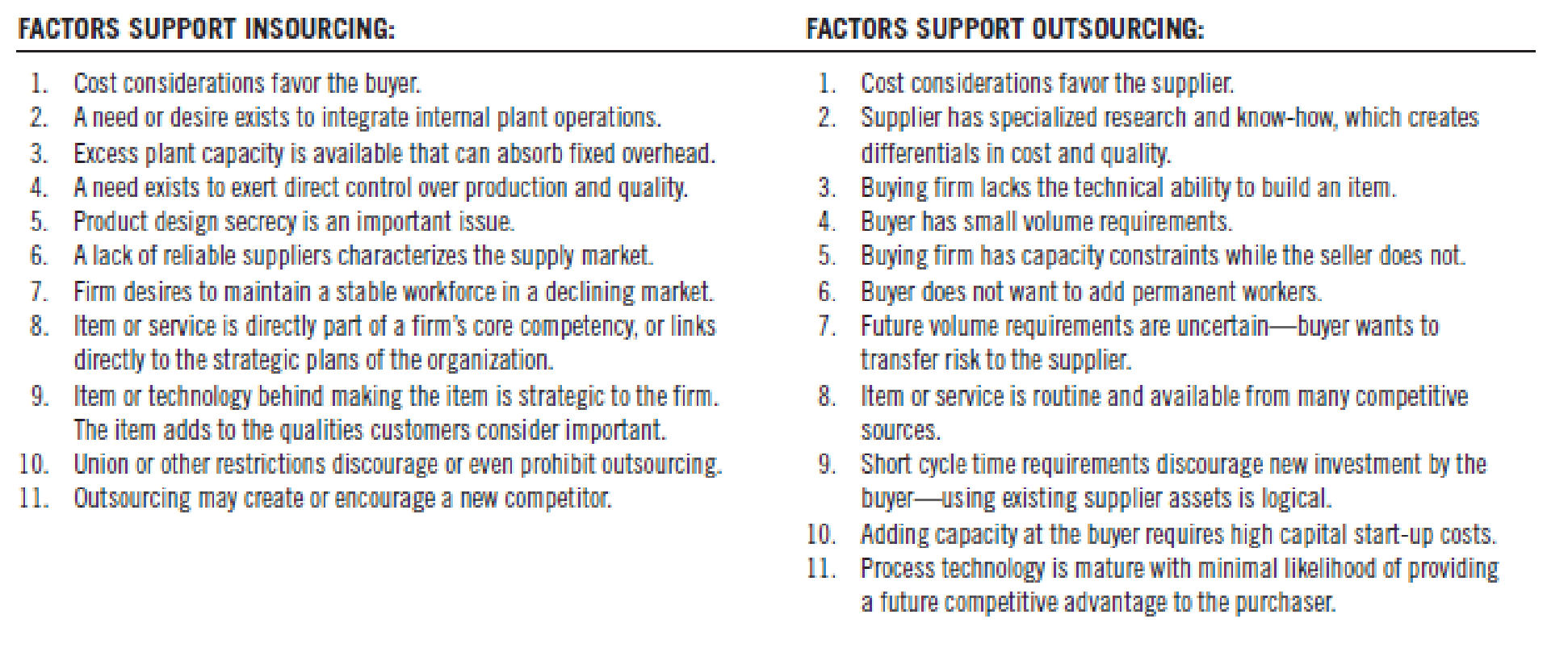

What is indirect cost of labor?

The indirect cost of labor refers to amounts paid for employees that support the commodity but aren't directly involved in making it. Understanding the cost of labor helps companies price products, and without an understanding of direct and indirect costs companies may find it challenging to arrive at the right cost of products.

What are some examples of variable labor costs?

Variable labor costs increase and decrease with production. A good example of a common variable labor cost is the rate of an hourly employee. Several industries rely on variable labor, especially around shopping holidays. These include retailers, restaurants, manufacturing companies and more.

What is labor cost?

Labor cost is an important value that finance and accounting professionals calculate to determine the direct and indirect price that a company pays for labor. The direct cost of labor includes the cost of wages and benefits for employees who are directly involved in producing the product or service commodity.

What is the difference between fixed and variable labor costs?

Cost of labor can be further broken down into fixed and variable costs: Fixed: Fixed costs are usually contracted costs but sometimes includes essential costs that are predictable. Variable: Variable costs increase and decrease with variables like production demand and economic conditions. Related: Learn About Being an Estimator.

What are indirect labor costs? What are some examples?

An example of indirect labor costs is the salaries of employees in the human resources department.

What are fixed and variable costs?

Cost of labor can be further broken down into fixed and variable costs: 1 Fixed: Fixed costs are usually contracted costs but sometimes includes essential costs that are predictable. 2 Variable: Variable costs increase and decrease with variables like production demand and economic conditions.

How to calculate direct labor costs?

Here are the steps to calculate direct labor costs: 1. Identify which expenses are direct labor expenses. Employees must be directly involved in production or providing services in order to count as direct laborers. These employees may be hourly or salaried. 2.

What is direct labor?

The nature of an organization determines the types of employee wages considered direct labor expenses . Direct labor in manufacturing businesses includes employees who work directly in production, including: Assembly line operators. Machine operators. Painters.

How much is direct labor per hour?

For instance, if you determine the total direct labor expenses for an employee are $60,000 per year and the employee works 2,000 hours per year (40 hours a week for 50 weeks of the year), divide $60,000 by 2,000 to determine the employee's direct labor cost per hour: $60,000/2,000 = $30 per hour. 3. Calculate labor costs for other time periods.

How much does Bright Blooms make per hour?

At $25 per hour, they made $24,000. In addition to employee wages, the owner of Bright Blooms spends $200 each month on benefits and insurance for his employees. The total costs of these benefits for the quarter is $200 times three months, which is $600 per quarter per employee. With 10 employees, the cost is $6,000.

Is indirect labor considered direct labor?

This often occurs in industries that use billable hours to bill clients, such as financial professionals and lawyers. Though divided into groups , all of these billable hours are considered direct labor costs. Peripheral services, such as facility maintenance and administrative roles, are considered indirect labor.

What is the cost of labor?

The cost of labor is the sum of all wages paid to employees, as well as the cost of employee benefits and payroll taxes paid by an employer. The cost of labor is broken into direct and indirect ( overhead) costs.

How can a firm increase or decrease variable labor cost?

A firm can easily increase or decrease variable labor cost by increasing or decreasing production. Fixed labor costs can include set fees for long term service contracts. A firm might have a contract with an outside vendor to perform repair and maintenance on the equipment, and that is a fixed cost.

What are the two main categories of labor costs?

Key Takeaways. Costs of labor can be categorized into two main categories, direct (production) and indirect (non-production) cost of labor. Direct costs include wages for the employees that produce a product, including workers on an assembly line, while indirect costs are associated with support labor, such as employees who maintain factory ...

What are fixed and variable costs?

Examples of Fixed and Variable Costs of Labor. Labor costs are also classified as fixed costs or variable costs. For example, the cost of labor to run the machinery is a variable cost, which varies with the firm's level of production. A firm can easily increase or decrease variable labor cost by increasing or decreasing production.

What is included in sales price?

The sales price must include the total costs incurred; if any costs are left out of the sales price calculation, the amount of profit is lower than expected. If demand for a product declines, or if competition forces the business to cut prices, the company must reduce the cost of labor to remain profitable.

Does XYZ Furniture underallocate labor?

Since indirect labor costs can be difficult to allocate to the correct product or service, XYZ Furniture may underallocate labor costs to one product and overallocate labor costs to another. This situation is referred to as undercosting and overcosting, and it can lead to incorrect product pricing.

Understanding Labor Costs

The word ‘labor costs’ refers to the overall cost of all labor, which is a crucial aspect of any business. These costs include wages, payroll taxes, benefits. Furthermore, labor costs work as one of the main significant operating costs.

Importance of Labor Costs

Enterprises may produce higher-quality outputs at minimum costs by effective implementation of labor costs. Every manufacturing company's labor costs must be collected, evaluated, and properly controlled in order to achieve the following goals:

Experts on Direct Labor Costs Vs Indirect Labor Costs

As previously stated, labor cost is divided into two segments. It includes— direct labor cost and indirect labor cost. Let’s learn what’s the definition of both these terms according to CIMA, London:

Understanding Direct Labor Costs

The term ‘Direct labor cost’ is derived directly from supply chain personnel who participate in product manufacturing or in the specific work or service performance and that can be conveniently assigned to a job, process, or production unit.

Understanding Indirect Labor Costs

Indirect labor pertains to any employee whose role is not crucial to the direct development of a product, a job, or a service but indirectly contributes to it.

Indirect Cost Labor Formula

Indirect labor costs are included in overhead costs and are distributed to products based on proper allocation criteria such as machine hours, direct labor hours, and direct material costs, among others. Check the following formula:

Direct Labor Costs Vs Indirect Labor Costs

It's critical to know the distinction between direct and indirect work when planning and budgeting. Here we have listed some of the most significant differences that will help you understand direct labor cost vs indirect labor costs in a better way:

Why are direct labor costs recorded as a debit?

Direct labor costs, because they are easily traceable to products, are recorded as a debit to the work-in-process inventory account and a credit to wages payable. Indirect labor, such as the salaries of factory management, cannot be easily traced to products.

Is labor a period cost?

If the labor cost was incurred as part of the manufacture of products, it is considered a product cost, but if the labor was part of the general and administrative costs of the company, it is considered to be a period cost. Period costs are expensed immediately.

Is fringe expense the same as labor?

In most companies, fringe expenses are considered the same type of labor costs as the employee hours they are associated with. For example, health insurance premiums paid on behalf of a direct labor employee are considered to be direct labor as well. Inventory Cost Flows.

Is period cost expensed immediately?

Period costs are expensed immediately. However, product costs can be further broken down into direct and indirect labor costs. Recording. Generally accepted accounting principles require that all product costs are included as part of the company's inventory balance until the products are sold.