How do you calculate federal unemployment tax?

To keep track of your FUTA savings, follow these tips:

- Know your quarterly average gross payroll (AGP). ...

- Calculate the FUTA you owe based on your AGP. ...

- Add this amount to the tax you pay for other employment taxes (state and local unemployment insurance, state workers’ compensation insurance, etc.)

How much is unemployment taxed federally?

- IR-2021-71, IRS to recalculate taxes on unemployment benefits; refunds to start in May

- IR-2021-81, IRS reminds U.S. territory residents about U.S. income tax rules relating to pandemic unemployment compensation

- New Exclusion of up to $10,200 of Unemployment Compensation

How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

Who is subject to federal unemployment tax?

The following wages are exempt from Federal Unemployment Tax Act payments:

- Wages for services performed outside the United States.

- Wages paid to a deceased employee or a deceased employee's estate in any year after the year of the employee's death.

- Wages paid by a parent to a child under age 21, paid by a child to a parent, or paid by one spouse to the other spouse.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Do you have to file an amended tax return if you already filed your state income tax return?

Other states may have to take specific action to allow the exclusion.". Taxpayers who already filed their state income-tax return and qualify for the exclusion may need to file an amended return, he says. Check with your tax professional or your state's department of revenue as guidance becomes available.

Will unemployment be taxed in 2020?

Some states that usually tax unemployment benefits are likely to follow the federal exclusion for 2020. "Some states start their state tax return preparation with the federal adjusted gross income figure," says Luscombe. "In those states the exclusion would automatically be taken into account also for state income tax purposes.

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.

What are the types of unemployment benefits?

Here are other types of payments taxpayers should check for withholding 1 Benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund 2 Railroad unemployment compensation benefits 3 Disability benefits paid as a substitute for unemployment compensation 4 Trade readjustment allowances under the Trade Act of 1974 5 Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974 6 Unemployment assistance under the Airline Deregulation Act of 1978 Program

What is voluntary withholding?

Withholding is voluntary. Federal law allows recipients to choose a flat 10% withholding from these benefits to cover part or all their tax liability. To do this, recipients should complete Form W-4V, Voluntary Withholding Request, and give it to the agency paying their benefits. Don't send the form to the IRS.

When are estimated tax payments due for 2020?

The payment for the first two quarters of 2020 was due on July 15.

When are 2020 taxes due?

The payment for the first two quarters of 2020 was due on July 15. Third quarter is due September 15, 2020 and fourth quarter on January 15, 2021. Taxpayers can visit IRS.gov to view all payment options.

Is unemployment taxable?

Due to the Coronavirus pandemic, millions of Americans received or are currently receiving unemployment compensation, many of them for the first time. It's important for these individuals to know that unemployment compensation is taxable.

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

When will unemployment be refunded?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer ...

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS start issuing tax refunds in 2021?

The IRS has begun issuing these refunds as of May 10, 2021. There is no tracking nor lookup tool, but taxpayers may be able to see a scheduled transaction in their IRS account - see how to create an IRS account. Here, navigate to the View Tax Records on the homepage and click the Get Transcript button.

Does unemployment change with stimulus 3?

If you filed on eFile.com, see how your unemployment income may have been affected . As a result of Stimulus 3 and the American Rescue Plan Act (ARPA), the taxation of unemployment income, benefits changed in reference to 2020 Federal returns.

Is severance pay taxable?

Remember that any severance pay or unemployment compensation you receive is taxable, in addition to any payouts received for accumulated vacation or sick time. Be sure that enough tax is withheld from these payments. Make sure you receive your final W-2 from your former employer to use for your tax return. Companies are not required to send out W-2s right away, but must provide them to all employees (even former ones) by January 31 of the following year. If you have left the company, this would be the year after you leave.

Tax Deductions And Credits When Youre Unemployed

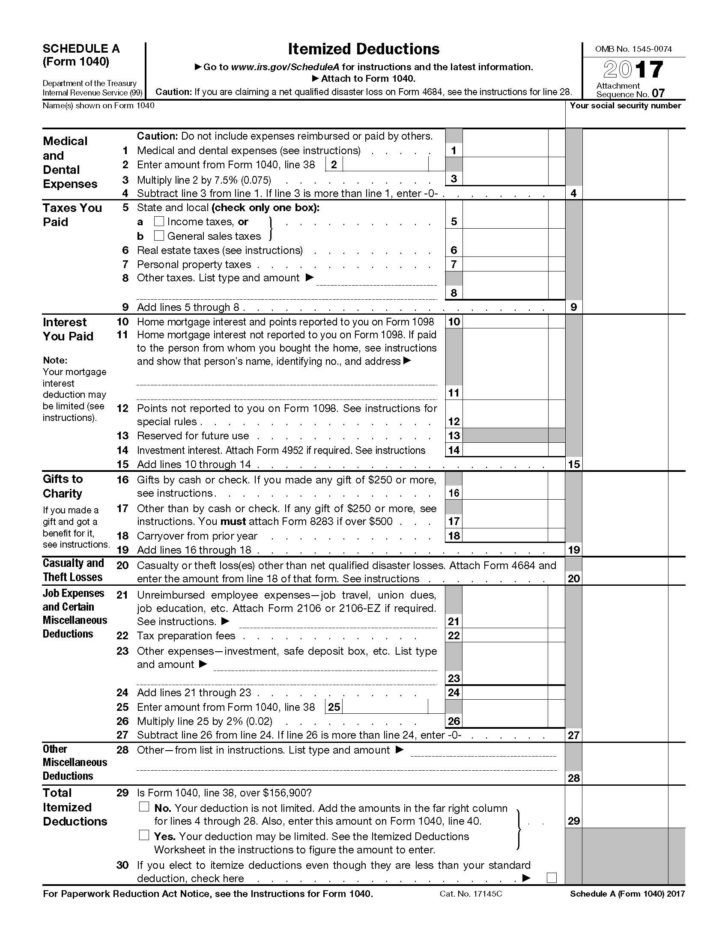

You may be required to file a tax return when youre unemployed, depending on your situation and doing so can have benefits. If youre eligible for any refundable tax credits, the only way to get them is to file a tax return. And itemizing deductions may allow you to recoup certain expenses incurred while you were unemployed.

Do I Have To Pay Unemployment Back

No. Unemployment benefits are yours to keep, except for the amount you may owe in taxes. But make sure youre getting the right amount.

How Do You Claim Unemployment Benefits

Unemployment benefits are offered at the state level. You’ll need to contact your state’s unemployment insurance program and follow its instructions for applying.

Tax Returns And Third Stimulus Payment

The bills mid-tax season passage may have caused a lot of confusion for unemployed taxpayers trying to determine the best time to file.;

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

What Can Disqualify You From Receiving Unemployment Benefits

Each state has its own unemployment criteria and rules. Unemployment programs typically require you to be unemployed through no fault of your own and meet work and wage requirements. If you quit or were fired for cause, you usually don’t qualify for unemployment.

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

Congress Provided a Tax Break on Some Unemployment Benefits

The American Rescue Plan Act, signed on March 11, 2021, provided that taxpayers would not have to pay federal unemployment taxes up to a certain threshold.

How does the federal government tax unemployment benefits?

Federally, unemployment benefits are a form of income. This also means that unemployment benefit income is taxable. If you’ve received unemployment benefits, you’ll need to pay federal taxes on this income.

States Have Different Methods of Handling Unemployment

State taxes work differently compared to federal unemployment taxes. There are more categories to consider overall, with three ways you may pay unemployment benefit taxes.

Work with 1-800Accountant to Prepare Your Taxes

Paying taxes on your unemployment benefits is very important. Knowing whether you have to pay both federal and state taxes or just state taxes on your unemployment benefits can make a big difference when you have to pay taxes.

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

If you are filing Form 1040 or 1040-SR, enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If you are filing Form 1040-NR, enter the total of lines 1a, 1b, and lines 2 through 7.

Get More With These Free Tax Calculators And Money

See if you qualify for a third stimulus check and how much you can expect

Withholding Taxes From Unemployment Compensation

The IRS views unemployment compensation as income, and it generally taxes it accordingly. You can elect to have federal income tax withheld from your unemployment compensation benefits, much like income tax would be withheld from a regular paycheck.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years.

Irs: Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year..

Are Unemployment Benefits Taxable

Your unemployment qualifies as taxable income subject to federal and state taxes, depending on where you live. In some states like Florida, Alaska, Nevada, South Dakota, Wyoming, Texas and Washington, residents do not have state income taxes.

Are unemployment benefits taxable?

Your unemployment qualifies as taxable income subject to federal and state taxes, depending on where you live. In some states like Florida, Alaska, Nevada, South Dakota, Wyoming, Texas and Washington, residents do not have state income taxes.

COVID-19 stimulus and taxes

For the 2020 tax season, the American Rescue Plan helped reduce Americans’ tax liability by making the $10,200 received from unemployment benefits federal tax-free for those with an adjusted income of $150,000 or less. If you made more than $150,000, you do not qualify for any exclusions under the plan.

Does taxable income vary by state?

While federal income taxes are easier to understand, state taxes are another story.

Paperwork you need to file for taxes if you received unemployment

In January, you will receive Form 1099-G for unemployment benefits. It contains information like wages, federal taxes withheld (box 4) and state taxes paid (box 11). States can send this through the mail. You can also access it online, especially if that is how you file for benefits.

How to have taxes withheld from unemployment benefits

It is tempting to forgo paying taxes on unemployment benefits until it comes time to file. However, doing this could leave you with a serious tax liability. States allow you to have taxes withheld for federal and state (if applicable) when you receive approval for benefits.

What happens if I filed my taxes before the rescue plan went into effect?

Keep in mind, the goal of the American Rescue Plan was to reduce the tax liability of those on unemployment, not eliminate it. If you did not have taxes withheld on a federal level, that exclusion would apply to only the first $10,200 received. Any amount exceeding this will require you to owe taxes.

How much is Florida unemployment tax?

State Taxes on Unemployment Benefits: There are no taxes on unemployment benefits in Florida. State Income Tax Range: There is no state income tax. Sales Tax: 6% state levy. Localities can add as much as 2.5%, and the average combined rate is 7.08%, according to the Tax Foundation.

How much is unemployment taxed in Massachusetts?

State Taxes on Unemployment Benefits: Massachusetts generally taxes unemployment benefits. However, for the 2020 and 2021 tax years, up to $10,200 of unemployment compensation that's included in a taxpayer's federal adjusted gross income is exempt for Massachusetts tax purposes if the taxpayer’s household income is not more than 200% of the federal poverty level. Up to $10,200 can be claimed by each eligible spouse on a joint return for unemployment compensation received by that spouse. Note that, since the Massachusetts income threshold is different from the federal income threshold (AGI of less than $150,000), some taxpayers may be eligible for a deduction on their federal tax return but not on their Massachusetts tax return.

What is the Colorado income tax rate?

Income Tax Range: Colorado has a flat income tax rate of 4.55% (the approval of Proposition 116, which appeared on the November 2020 ballot, reduced the rate from 4.6 3% to 4.55% ). The state also limits how much its revenue can grow from year-to-year by lowering the tax rate if revenue growth is too high.

Is unemployment taxed in Maine?

State Taxes on Unemployment Benefits: Unemployment benefits are usually fully taxable in Maine. However, to the extent its included in federal adjusted gross income (AGI), up to $10,200 of unemployment compensation received in 2020 is not taxed by Maine for people with a federal AGI less than $150,000 (for joint filers, up to $10,200 per spouse is exempt from state tax). If you filed your 2020 Maine personal income tax return before the exemption was available, you should file an amended state tax return to claim the exemption.

Is Iowa unemployment taxed?

State Taxes on Unemployment Benefits: Unemployment benefits are generally fully taxable in Iowa. However, the state adopts the federal $10,200 exemption for unemployment compensation received in 2020. The Iowa Department of Revenue will make automatic adjustments for people who already filed a 2020 Iowa income tax return. As a result, taxpayers won't need to file an amended Iowa tax return if their only adjustment pertains to unemployment compensation. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040, Line 14, using a code of M.

Does Connecticut tax unemployment?

State Taxes on Unemployment Benefits: Connecticut taxes unemployment compensation to the same extent as it is taxed under federal law. As a result, any unemployment compensation received in 2020 (up to $10,200) exempt from federal income tax is not subject Connecticut income tax.

Does Arizona tax unemployment?

State Taxes on Unemployment Benefits: Arizona generally taxes unemployment compensation to the same extent as it is taxed under federal law. The state also adopted the federal exemption for up to $10,200 of unemployment compensation received in 2020. Taxpayers who filed their original 2020 federal return claiming the exemption should file their Arizona return starting with federal adjusted gross income from their federal return. Taxpayers who didn't claim the exemption on their original federal return and are waiting for the IRS to adjust their return to account for the exemption should wait to amend their Arizona return. The Arizona Department of Revenue is analyzing this situation and will announce additional guidance later.