Is a life insurance taxable before it reaches the beneficiary?

Typically, beneficiaries on a life insurance policy will not be required to pay income tax when they receive a death benefit, but there are certain exceptions to this rule.

Is life insurance ever subject to income taxation?

Is life insurance subject to income taxes? Usually, the answer is no. The proceeds of the death benefit are usually considered to be income tax free to the beneficiary because the policy owner had already paid taxes on the premium. Where the taxation would change would be where a tax deduction was taken on the premium.

What are the tax benefits of offering life insurance?

What are the tax benefits of offering life insurance? Companies who meet the non-discrimination requirements for life insurance can generally exclude the cost of up to $50,000 for group-term life insurance from the wages of an insured employee. The company can also exclude the same amount from the employee's wages when calculating the employee ...

Are there tax benefits to having life insurance?

There are tax advantages of life insurance, because death benefit payouts are generally tax free; and some policies have features that can help transfer money to heirs with fewer tax liabilities. 1 Some policies have a cash value that accumulates over time 2 and can be used to pay premiums later, or even tapped into to help live on in retirement. 3

Do you have to pay taxes on money received as a beneficiary?

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan). The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.

How do I avoid tax on life insurance proceeds?

If you want your life insurance proceeds to avoid federal taxation, you'll need to transfer ownership of your policy to another person or entity.

Do you pay taxes if you cash out a life insurance policy?

Is life insurance taxable if you cash it in? In most cases, your beneficiary won't have to pay income taxes on the death benefit. But if you want to cash in your policy, it may be taxable. If you have a cash-value policy, withdrawing more than your basis (the money it's gained) is taxable as ordinary income.

What is the tax on a life insurance benefit?

Is a life insurance payout taxable? One of the perks of a life insurance policy is that the death benefit is typically tax-free. Beneficiaries generally don't have to report the payout as income, making it a tax-free lump sum that they can use freely.

Is life insurance considered an inheritance?

Life insurance is not considered to be taxable income in the way that an inheritance can be taxed. While there are ways to avoid inheritance tax (such as through a trust), these taxes can be considerable if your estate is large. By using life insurance instead, the death benefit can go entirely to your family members.

Who claims the death benefit on income tax?

A death benefit is income of either the estate or the beneficiary who receives it. Up to $10,000 of the total of all death benefits paid (other than CPP or QPP death benefits) is not taxable. If the beneficiary received the death benefit, see line 13000 in the Federal Income Tax and Benefit Guide.

Do you get a 1099 for life insurance proceeds?

If you own a life insurance policy, the 1099-R could be the result of a taxable event, such as a full surrender, partial withdrawal, loan or dividend transaction. If you own an annuity, the 1099-R could be the result of a full surrender, a partial withdrawal or the transfer of the contract to a new owner.

Is 1099 R death benefit taxable?

When a taxpayer receives a distribution from an inherited IRA, they should receive from the financial instruction a 1099-R, with a Distribution Code of '4' in Box 7. This gross distribution is usually fully taxable to the beneficiary/taxpayer unless the deceased owner had made non-deductible contributions to the IRA.

Are Life Insurance Premiums Taxable?

The life insurance premiums you pay are not taxable. They are also not deductible on your tax return.

Do You Pay Inheritance Tax on Life Insurance?

There is no inheritance tax on life insurance. Life insurance death benefits are paid tax-free to your life insurance beneficiaries.

Is There a Penalty for Cashing Out Life Insurance?

If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. The life insurance company wil...

When are life insurance proceeds tax-free?

Generally, your beneficiaries can dodge taxes in these situations.

Are life insurance premiums tax-deductible?

Unfortunately premiums aren’t tax-free, even if you’re paying for an individual policy. You also can’t use a Flexible Spending Account (FSA) or Hea...

When is life insurance taxable?

With so much riding on your life insurance, speak with a licensed accountant if you’re still unsure about the tax implications of your specific pol...

What is the unlimited marital deduction?

The unlimited marital deduction is a provision in the federal Estate and Gift Tax Law that allows you to pass any amount of assets to your spouse d...

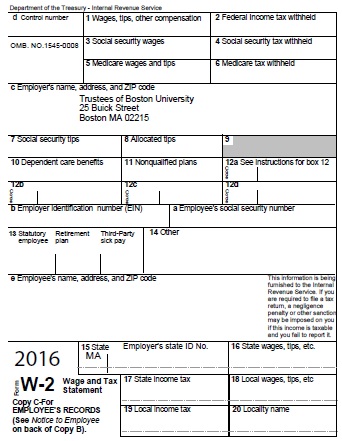

What form do you report wages on?

Report the amount you receive on the line " Wages, salaries, tips, etc." on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

Is disability insurance taxable?

If you pay the premiums of a health or accident insurance plan through a cafeteria plan, and you didn't include the amount of the premium as taxable income to you , the premiums are considered paid by your employer, and the disability benefits are fully taxable.

Do you report disability as income?

Answer: You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.

Do you have to report life insurance proceeds?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Can you exclude long term care insurance from income?

You can generally exclude from income payments you receive from qualified long-term care insurance contracts as reimbursement of medical expenses received for personal injury or sickness under an accident and health insurance contract.

Federal Tax Lien

The Internal Revenue Code imposes a tax lien ”upon all property and rights to property, whether real or personal,” belong to the taxpayer if any tax payments are either neglected or refused. These also include cash values of insurance policies, because cash values of life insurance policies are not exempt property, and could be subject to a levy.

Liens – When They Attach to Policy or Automatic Premium Loans

With an automatic premium loan, provision is agreed to by life insurance policyholders whenever they acquire their policy or policies. Since this is a contractual provision, the insurer is required to obey and comply with the contract when premiums are not paid.

Right to Income Taxes from Death Process When Government Has or Does Not Have Lien

When the government has a lien for income tax deficiencies, it is good only against the cash surrender value of the taxpayer’s insurance policies. Whatever amount is at risk will be out of reach for the government if the state laws exempt the insurance proceeds from creditors’ claims.

Final Word – Can the IRS Take Life Insurance Money?

Overall, the government and IRS can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts after you were to pass away. Please talk to a lawyer or accountant to learn of ways to protect your life insurance benefits from the IRS.

What are the upsides of life insurance?

Compare Life Insurance Companies. One of the primary upsides to life insurance is that the payout is made to your beneficiaries tax-free. Since life insurance death benefits can be in the millions of dollars, it’s a significant advantage to buying (and receiving) life insurance. But there are other aspects to life insurance ...

What is a cash value life insurance policy?

There’s a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policy owners are called “viatical settlements.” These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

What is taxable amount on a loan?

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion you’ve paid in as premiums. Amounts “above basis” are based on interest or investment gains on cash value.

Why do you need cash value life insurance?

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges.

How long does it take to get a surrender charge?

You can generally expect to get a surrender charge within the first 10 or 20 years of owning the policy, and over the course of time the surrender charge phases out . You won’t be taxed on the entire surrender value, though. You’ll be taxed on the amount you received minus the policy basis.

Can you sell life insurance through a viatical settlement?

None, as long as the policy remains in-force. You sell the policy through a viatical settlement. None. You’re a beneficiary who receives a life insurance payout plus interest. The interest amount. The life insurance payout goes into your estate. Any amount of the estate that’s subject to state or federal estate taxes.

Is a viatical settlement taxable?

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value. Fortunately, the IRS doesn’t treat any portion of what you receive for a viatical settlement as taxable.

What happens if you get $250,000 in life insurance?

So if your $250,000 life insurance benefit gains $25,000 in interest between time of your death and payout, your beneficiaries would likely owe taxes on the accrued $25,000. To avoid this, beneficiaries should choose to receive the lump sum.

What happens if you cancel your life insurance policy?

If you decide to cancel your life insurance policy before it matures, you’re eligible to gain access to your accrued cash value minus any surrender fees. This is called a “life insurance surrender,” and as long as your settlement amount is less than the total you paid in premiums, your surrender payout is tax-free.

How many children does Jerry have?

Jerry has two children, Mike and Bob. Mike takes out a life insurance policy on Jerry for $1 million with the understanding that the payout is split between the two siblings. Bob is named the beneficiary but isn’t listed as an owner of the policy.When the death benefit is paid out, Mike and Bob both receive $500,000.

What is an accelerated death benefit rider?

Many life insurance policies offer an accelerated death benefit rider, which allows you to access part of your death benefit while you’re alive if you’re diagnosed with a chronic or terminal illness.

How long before death can you transfer a life insurance policy?

Just keep in mind that if you transfer the policy less than three years before your death, it might still be subject to the estate tax. Note that the IRS offers an unlimited marital deduction that allows you to transfer unlimited assets to your spouse, free of any estate or gift taxes.

How much estate tax is required for 2020?

If your estate is valued at $11.58 million – the IRS threshold for 2020 – or more, it will be subject to federal estate tax. This applies to life insurance payouts, too.

How much money do you owe if you cancel a life insurance policy?

If you cancel your policy, you’ll likely owe taxes on the $30,000 you’ve earned.

Why do you need a trust?

Trusts help lower estate tax liabilities and can help you avoid going through the drawn out probate process. Be sure that you discuss this with a financial adviser. There is nothing worse than having your life insurance go to creditors instead of beneficiaries.

What is comparelifeinsurance.com?

Comparelifeinsurance.com was started to help people learn about life insurance and compare life insurance quotes online. The key to finding cheap life insurance rates starts with education and we have a wealth of content online to help you build a strong knowledge base about life insurance coverage.

When is a life insurance claim paid out?

When a life insurance claim is made, proceeds are paid out to the beneficiary as soon as the investigation is completed. This means that the proceeds transfer right from the insurer to the beneficiary and do not become part of the benefactor’s estate where the money comes from to pay off debts. Creditors, including the IRS, can make a claim ...

What is the top estate tax rate?

If the estate is not exempt from taxes, the top estate tax rate that is charged will be 40%.

Can the IRS take money from a life insurance policy?

The IRS may not have the right to take money from the benefactor of a life insurance policy, but that does not mean that the beneficiary is safe. The life insurance proceeds become part of the beneficiaries assets. The payout, while it is not taxable income for the beneficiary, will still be reported by the insurer.

Can the IRS claim your life proceeds?

One obvious scenario where the IRS can stake claim on your life proceeds even when you are the beneficiary is when you and the benefactor file joint tax returns. When you are filing with your spouse, you and your spouse owe the debt together.

Can a surviving spouse claim a levy on life proceeds?

As the surviving spouse, the debt is still due and a levy can be placed on life proceeds to ensure that the IRS gets their money sooner rather than later. Another circumstance when a creditor will have the right to claim proceeds that are meant to go to a beneficiary is when there is joint debt.

How much is taxable income for an employee?

An employee can receive up to $50,000 worth of coverage tax-free. The cost of any insurance above $50,000, less any amount paid for the insurance by the employee, is taxable income to the employee. For example, if the employer provides basic coverage of $80,000 at no cost to the employee, the employee is taxed on the cost of $30,000 of insurance.

Why is a private letter ruling helpful to other employers?

While a private letter ruling only applies to the taxpayer that requested it, the ruling is helpful to other employers because it describes a situation in which the IRS views the separation between the basic and supplemental policies as adequate to avoid aggregation under Code Section 79. Employers would not expect that employees purchasing ...

What is a private letter ruling 201350032?

Private Letter Ruling 201350032 describes a typical situation and approved the steps that the employer took for the premiums to be considered as properly allocated among policies and avoid aggregation of the policies. It involves a common scenario in which:

What is the tax code for group term life insurance?

Internal Revenue Code (“Code”) Section 79 governs the taxation of this employer-provided life insurance.

Can an employee purchase life insurance for themselves?

Employees could separately purchase supplemental life insurance for themselves (and in some cases, their spouses and dependents) through the voluntary employees beneficiary association (VEBA) that the employer uses to fund certain welfare benefits for active employees and retirees. The employees were responsible for paying the entire cost ...

Can you purchase supplemental life insurance on your spouse?

Supplemental Life Insurance. In addition to providing basic life insurance, employers may give employees the opportunity to separately purchase supplemental group term life insurance (and even insurance on their spouses and dependents), but entirely at the employee’s expense.

Is the cost of insurance coverage taxable on W-2?

The employer is required to report the cost of insurance coverage amounts over $50,000 as taxable imputed income on the employee’s Form W-2. Since this amount is treated as wages, it is also subject to Social Security and Medicare taxation (which involves a tax on both the employer and employee).

How to remove life insurance from taxable estate?

Using Life Insurance Trusts to Avoid Taxation. A second way to remove life insurance proceeds from your taxable estate is to create an irrevocable life insurance trust (ILIT). To complete an ownership transfer, you cannot be the trustee of the trust and you may not retain any rights to revoke the trust.

How to transfer insurance policy?

Here are a few guidelines to remember when considering an ownership transfer: 1 Choose a competent adult/entity to be the new owner (it may be the policy beneficiary), then call your insurance company for the proper assignment, or transfer of ownership, forms. 2 New owners must pay the premiums on the policy. However, you can gift up to $15,000 per person in 2020, so the recipient could use some of this gift to pay premiums. 4 3 You will give up all rights to make changes to this policy in the future. However, if a child, family member, or friend is named the new owner, changes can be made by the new owner at your request. 4 Because ownership transfer is an irrevocable event, beware of divorce situations when planning to name the new owner. 5 Obtain written confirmation from your insurance company as proof of the ownership change.

What happens if you get a death benefit of $500,000?

If the death benefit is $500,000, for example, but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. According to the IRS, if the life insurance policy was transferred to you for cash or other assets, the amount that you exclude as gross income when you file taxes is limited to ...

What is an apportionment clause in a will?

A will can include an "apportionment clause” that leads to tax liabilities for the beneficiary. The clause may state, for instance, that if there are any estate taxes due, they will be paid proportionally by the beneficiaries who receive the assets from the benefactor. Under this circumstance, there would be an estate tax due, but not an income tax. It is possible that some income tax may be due when the life insurance company pays out the proceeds of the policy to the beneficiary over an extended period of time. The face amount of the policy, however, is received income tax-free. The law also requires the insurance company to pay interest to the beneficiary from the date of death until they pay out the proceeds.

What happens when you transfer a life insurance policy?

In transferring the policy, the original owner must forfeit any legal rights to change beneficiaries, borrow against the policy, surrender, or cancel the policy, or select beneficiary payment options. Furthermore, the original owner must not pay the premiums to keep the policy in force.

What is a poor decision that investors seem to frequently make?

One poor decision that investors seem to frequently make is to name "payable to my estate" as the beneficiary of a contractual agreement, such as an IRA account, an annuity, or a life insurance policy.

How much is ownership transfer exemption?

Federal taxes won't be due on many estates, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017, which doubled the exemption amount to $11.4 million in 2019, rising to $11.58 million for 2020 and $11.70 million in 2021.

How to contact a life insurance agent about estate taxes?

Connect with a licensed life insurance agent online or by calling 1-855-303-4640. ----------.

What is the difference between permanent and term life insurance?

A permanent (or cash value) life insurance plan provides coverage for the insured person's entire life. They also accumulate cash value over time. Term life insurance. Term life plans provide coverage for a set agreed-upon length of time , called a term. They do not accrue cash value like permanent policies.

Is life insurance taxable?

If you’re shopping for a life insurance policy, you may be wondering if life insurance is taxable. Income to the beneficiary is one of the main purposes of a life insurance plan. Typically, the death benefit of a life insurance policy is not subject to income tax. However, some exceptions may apply.

Does life insurance have to be reported to the IRS?

An exception is if you receive interest on a benefit — any interest that has been earned must be reported to the IRS and is potentially subject to income tax. There are two main categories of life insurance policies: A permanent (or cash value) life insurance plan provides coverage for the insured person's entire life.

Do death benefits fall under estate tax?

Because the insurance policy increases the estate’s value, the benefits may fall under the estate tax if your estate is large enough.

Is life insurance subject to income tax?

Life Insurance Benefits Not Subject to Income Tax. Here’s the good news. For the most part, the federal government doesn’t tax the proceeds benefits from a life insurance policy.

How does whole life insurance work?

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash value as policyholders pay into the plans with their premium dollars. A portion of the premium dollars enters a fund that accumulates interest.

How much life insurance is exempt from taxes?

However, these taxes only apply when the employer pays for more than $50,000 in life insurance coverage. Even in those cases, the premium cost for the first $50,000 in coverage is exempt from taxation. 2 . If, for example, an employer provides an employee, for the duration of their employment, with $50,000 in life insurance coverage in addition ...

What is the difference between term and whole life insurance?

First, there is the distinction between term life insurance and whole life insurance. Term life provides coverage for a set number of years, while a whole life policy is effective for life. 1 A policyholder also must calculate how much coverage they need. This depends largely on why they are buying life insurance.

Is whole life insurance tax deferred?

Similar to retirement accounts, such as 401 (k) plans and IRAs, the accumulation of cash value in a whole life insurance policy is tax-deferred. Even though this money qualifies as income, the IRS does not require a policyholder to pay taxes on it until they cash out the policy.

Do life insurance policies pay lump sums?

Some life insurance plans allow the policyholder to pay a lump sum premium upfront. That money gets applied to the plan's premiums throughout the plan's duration. The lump-sum payment also grows in value because of interest.

Is life insurance taxable if it is $100,000?

Alternatively, if the employer-provided life insurance coverage is for $100,000, the employee has to pay taxes on part of it. The premium dollars that pay for the $50,000 in coverage they receive in excess of the IRS threshold count as taxable income. Therefore, if the monthly premium amount is $100, the amount that is taxable is the amount ...

Is life insurance taxed?

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged). These premiums are also not tax-deductible. If an employer pays life insurance premiums on an employee’s behalf, any payments for coverage of more than $50,000 are taxed as income. Interest earned for prepaid insurance is taxed as interest ...