How Does SSI and Social Security Benefits Differ?

- Don’t need to pay into the SSI program. Social Security benefits are connected to something like an “insurance” program. ...

- Source of funds. Social Security benefits come from a fund that is created by the taxes paid into the system. ...

- Additional help with medical costs with SSI. ...

- Food assistance. ...

Why is SSDI better than SSI?

Neither?

- STEP ONE: CHECK MEDICAL CRITERIA. SSI and SSDI have the exact same medical criteria. ...

- STEP TWO: CHECK SSDI. You can qualify for SSDI if you worked and paid taxes, but it depends how much you worked and how recently you worked.

- STEP THREE: DON’T GIVE UP TOO EASILY. ...

- STEP FOUR: CHECK SSI. ...

- STEP FIVE: OTHER OPTIONS. ...

What's the difference between SSA and SSI?

What Are the Differences Between SSI and SSA Benefits?

- SSI Eligibility. The fact that SSI does not consider work history distinguishes it from Social Security benefits. ...

- Social Security Eligibility. Social Security provides financial support for retirees, children and spouses of deceased workers and dependent parents of deceased workers.

- Benefit Payouts. ...

- Social Security Disability Insurance. ...

Is SSI the same as Social Security benefits?

There is often confusion about Social Security and Supplemental Security Income (SSI) because you apply for both programs with the Social Security Administration. But, the programs are different. The Social Security benefit programs are “entitlement” programs.

What is the difference between SSI and Social Security?

- Medicare will soon provide free at-home covid tests

- Billions distributed from the Provider Relief Fund

- Reasons why Congress won’t send another stimulus check

What are the 3 types of Social Security?

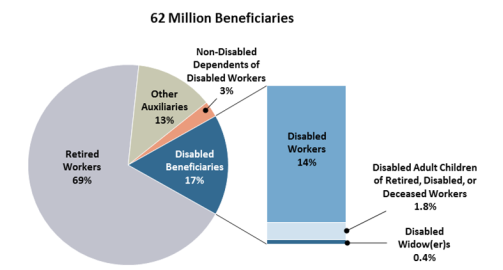

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

Can you get SSI and Social Security retirement at the same time?

SSI payments are also made to people age 65 and older without disabilities who meet the financial qualifications. You may be eligible to receive SSI monthly payments even if you are already receiving Social Security Disability Insurance or retirement benefits.

Are SSI and disability the same thing?

We manage two programs that provide benefits based on disability or blindness, the Social Security Disability Insurance (SSDI) program and the Supplemental Security Income (SSI) program. SSDI provides benefits to disabled or blind persons who are “insured” by workers' contributions to the Social Security trust fund.

What's the difference between SSI and retirement?

Unlike Social Security disability and retirement benefits, SSI is not funded by payroll deductions. Instead, the SSI benefit is funded by general fund taxes.

How long can you receive SSI?

For those who suffer from severe and permanent disabilities, there is no “expiration date” set on your Social Security Disability payments. As long as you remain disabled, you will continue to receive your disability payments until you reach retirement age.

What happens to SSI when I turn 65?

When you reach the age of 65, your Social Security disability benefits stop and you automatically begin receiving Social Security retirement benefits instead. The specific amount of money you receive each month generally remains the same.

Who qualifies for SSI?

To get SSI, you must meet one of these requirements: • Be age 65 or older. Be totally or partially blind. Have a medical condition that keeps you from working and is expected to last at least one year or result in death. There are different rules for children.

Which pays more SSDI or SSI?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

What are the two types of Social Security disability?

The Social Security Administration (SSA) offers two types of disability benefits: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Will my SSI change when I turn 62?

The good news is that you can collect retirement and SSI benefits at the same time, so your monthly benefit amount will not change—it will just be a combination of SSI and retirement benefits.

Is it hard to get SSI?

According to government statistics for applications filed in 2018, many people receive technical denials: 45% for SSDI applicants and 18% for SSI. In that same year, approval rates at the application level based on medical eligibility alone were 41% for SSDI and 37% for SSI.

What does SSI mean?

SSI stands for Supplemental Security Income. Social Security administers this program. We pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

How is SSI financed?

SSI is financed by general funds of the U.S. Treasury--personal income taxes, corporate and other taxes. Social Security taxes collected under the Federal Insurance Contributions Act (FICA) or the Self-Employment Contributions Act (SECA) do not fund the SSI program. In most States, SSI recipients also can get medical assistance ...

When is SSI paid?

In some States, an application for SSI also serves as an application for food assistance. SSI benefits are paid on the first of the month.

How old do you have to be to get SSI?

To get SSI, you must be disabled, blind, or at least 65 years old and have "limited" income and resources. In addition, to get SSI, you must also: be either a U.S. citizen or national, or a qualified alien; reside in one of the 50 States, the District of Columbia or the Northern Mariana Islands; and.

Is disability the same as SSI?

Both programs pay monthly benefits. The medical standards for disability are generally the same in both programs for individuals age 18 or older. For children from birth to the attainment of age 18 there is a separate definition of disability under SSI.

Is Social Security based on prior work?

Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work. ...

What is the difference between Social Security and SSI?

Social security is mainly concerned with retirement benefits while SSI is designed to assist persons and children in fulfilling their basic needs. SSA provides a number of welfare and development programs to US citizens where social security and SSI takes priority. The organization has documented clear guidelines for eligibility criteria in order ...

What is the difference between Social Security and Supplemental Security Income?

The key difference between social security and SSI is that Social Security is a program that provides a number of benefits for persons including retirement income, disability income, Medicare, and death and survivorship benefits whereas SSI (Supplemental Security Income) is a national income program designed to provide assistance to aged, blind, and disabled persons and children who have little or no income to fulfil basic needs.

How is Social Security funded?

Social Security is primarily funded by tax acts of FICA and SECA. SSI is funded by the U.S. Treasury general funds.

What is a Social Security program?

What is Social Security? Social security program, officially termed as the Old-Age, Survivors, and Disability Insurance ( OASDI ), is a program that provides a number of benefits for persons including retirement income, disability income, Medicare, and death and survivorship benefits and is operated by the SSA.

How old do you have to be to receive Social Security?

A person may be eligible to receive retirement income between the ages of 62-70 years of age. The amount of funds received is based on the lifetime earnings. SSA adjusts the actual earnings of the individual to account for changes in average wages since the year the earnings were received. Then Social Security calculates ...

Why is Social Security facing challenges?

Currently, the social security program is facing challenges in maintaining the social security program significantly due to longer life expectancies, an increasing population entering retirement age, and inflation.

When was the SSI program created?

SSI was founded in 1974 and is administered by the Social Security Administration (SSA) and is funded by the United States Treasury General Funds. The main intention of this program is to standardize the eligibility criteria in order to provide assistance for the most needed. The program was restructured, and the new federal program was ...