Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

What state does not tax Social Security?

What states do not tax Social Security benefits? Quick Facts. Alaska and New Hampshire are the only states with no sales, income or Social Security tax. Alaska also pay a dividend each year from the Alaska Permanent Fund (PFD) and in 2019 it was $1,606 per resident. What is the highest paying state for disability?

Are pensions taxable income in Ohio?

Social Security retirement benefits are fully exempt from state income taxes in Ohio. Certain income from pensions or retirement accounts (like a 401 (k) or an IRA) is taxed as regular income, but there are credits available. Both property and sales tax rates are higher than national marks.

Is SS taxed in Ohio?

Tax in Ohio and Social Security Ohio residents will not pay taxes on Social Security income, even in instances where the IRS requires you to pay taxes. However, other forms of retirement income will face taxes, including any 401 (k) or IRAs you have. These funds are taxed as regular income, with brackets affecting the percentage you’ll pay.

What is the tax rate for non-Security income in Ohio?

How much income do you need to retire in Ohio?

How to tell if you owe taxes on Social Security?

Does Ohio tax Social Security?

Is Social Security income considered earned income?

Do you pay taxes on Social Security in Ohio?

See more

How much of Social Security is taxable in Ohio?

Ohio does not tax Social Security retirement benefits, including those that are taxed federally. That, along with the state's low cost of living, can make it possible for some to live off Social Security benefits alone in many Ohio counties.

Do you pay taxes on disability Social Security?

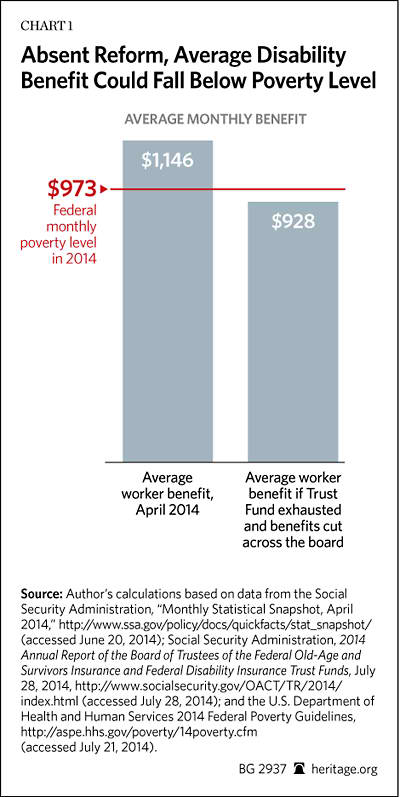

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to file taxes on disability income?

But the good news is that you will never have to pay tax on all of your disability benefits. In fact, no matter how much you make, you will never have to pay taxes on more than 85 percent of your Social Security Disability income.

What income is taxable in Ohio?

For taxable years beginning in 2021:Ohio Taxable IncomeTax Calculation0 - $25,0000.000%$25,001 - $44,250$346.16 + 2.765% of excess over $25,000$44,250 - $88,450$878.42 + 3.226% of excess over $44,250$88,450 - $110,650$2,304.31 + 3.688% of excess over $88,4501 more row•May 6, 2020

How much of my Social Security disability is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

What happens to Social Security disability when you turn 66?

your disability benefits automatically convert to retirement benefits, but the amount remains the same. If you also receive a reduced widow(er)'s benefit, be sure to contact Social Security when you reach full retirement age, so that we can make any necessary adjustment in your benefits.

What is the disability tax credit for 2021?

$8,662The federal DTC portion is 15% of the disability amount for that tax year. The “Base Amount” maximum for 2021 is $8,662, according to CRA's Indexation Chart....YearMaximum Disability AmountMaximum Supplement For Persons Under 182021$8,662$5,0532020$8,576$5,0032019$8,416$4,9092018$8,235$4,8049 more rows•Mar 7, 2022

How much can you make on Social Security disability without being penalized?

During the 36-month extended period of eligibility, you usually can make no more than $1,350 ($2,260 if you are blind) a month in 2022 or your benefits will stop. These amounts are known as Substantial Gainful Activity (SGA).

What is not taxable in Ohio?

Traditional Goods or Services Goods that are subject to sales tax in Ohio include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries and gasoline are all tax-exempt. Some services in Ohio are subject to sales tax.

Who is exempt from Ohio income tax?

Individual taxpayers whose Ohio taxable income is less than or equal to $10,000 are effectively exempt from the tax since they receive a full credit against the tax otherwise due.

How do I become tax-exempt in Ohio?

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

What Will My SSI Payments Be in Ohio?

For the year 2013, the SSI payment from the federal government may be as high as $710 per month (if you have no other income). You may also be elig...

Who Decides Whether You Are Disabled in Ohio?

The Ohio Division of Disability Determination (DDD) is the state agency that works with the SSA and determines whether you are eligible for disabil...

Am I Eligible For Medicaid in Ohio?

If you meet the SSA’s definition of disabled, you should be eligible for Medicaid if: 1. You are a U.S. citizen or qualified alien ( you can see if...

How Can I Apply For Disability in Ohio?

The SSA provides three different ways to apply for disability. Your options depend on whether you are applying for SSI or SSDI.You can apply online...

Should I Hire An Attorney?

Because the disability hearing process is challenging, if you are denied benefits and have to appeal, it makes sense to talk to a disability lawyer...

What is the tax rate for non-Security income in Ohio?

If your non-Social Security income is between $5,250 and $10,500, for instance, your tax rate will be 0.990 percent. But Ohio has a relatively low cost of living and that, combined with the fact that it doesn’t tax Social Security earnings, makes it possible for some seniors to live solely off their Social Security.

How much income do you need to retire in Ohio?

In order to qualify for this credit, your adjusted gross income must be less than $100,000.

How to tell if you owe taxes on Social Security?

One easy way to tell is to take half of the money you received from Social Security and add that to every other form of income you received during the year. Include any tax-exempt interest, as well. If this amount exceeds the IRS’s limits, you’ll owe taxes on your earnings.

Does Ohio tax Social Security?

Ohio does not tax Social Security, although it does tax other forms of retirement income. Retirees in Ohio should be aware, however, that state laws concerning Social Security tax are different than federal guidelines.

Is Social Security income considered earned income?

Social Security and other retirement wages aren’t considered earned income, which means they’re usually taxed differently than money earned through active work. However, in some states, some unearned income is taxed. Fortunately for residents, Ohio is not one of those states.

Do you pay taxes on Social Security in Ohio?

Tax in Ohio and Social Security. Ohio residents will not pay taxes on Social Security income, even in instances where the IRS requires you to pay taxes. However, other forms of retirement income will face taxes, including any 401 (k) or IRAs you have.

Which states impose full income tax on Social Security?

You can click on the state to be directed to its tax authority. Montana. Montana imposes full income taxes on Social Security benefits. Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. New Mexico.

What states tax Social Security?

States That Fully Tax Social Security Benefits 1 Montana. Montana imposes full income taxes on Social Security benefits. 2 Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. 3 New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65.

How much is a married person exempt from a state tax?

Married taxpayers who file jointly are exempt from paying state taxes on their Social Security benefits if their federal AGI is below $60,000. Colorado. People under 65 who receive Social Security benefits can exclude up to $20,000 of benefits from their state taxable income. Recipients 65 and older can exclude up to $24,000 ...

Is SSDI income taxed?

In the following states, SSDI income is taxed according to the taxpayer's federally adjusted gross income ( AGI ). However, some states exempt recipients whose income falls under certain thresholds. For more information, you can click on the state to be directed to its tax authority.

Is Social Security taxable?

Social Security payment s from Social Security Disability Insurance (SSDI) may be taxable in your state. The majority of states, however, exempt disability benefits from state taxation. (Also, read about when you have to pay federal taxes on your disability benefits .)

Does New Mexico have a Social Security exemption?

New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65. You may be eligible for other disability-related income deductions or credits in these states. For more information, contact your tax professional.

Is Social Security income taxed?

Social Security benefits are not taxed for disability recipients who have a federal AGI of less than $85,000 ($100,000 for married couples). In all the instances above, any taxable Social Security benefits are taxed at that state's income tax rate. You may be eligible for other income deductions or credits in your state.

How much is SSI in Ohio?

What Will My SSI Payments Be in Ohio? For the year 2019, the SSI payment from the federal government may be as high as $771 per month (if you have no other income). You may also be eligible for the SSI supplement paid for by the state of Ohio, depending on your living situation.

Where can I apply for SSDI?

You can apply in person at your local field office. The SSA also gives you the option to apply in person at your local field office. This option is for both SSI and SSDI applicants. You can find your local field office by visiting the SSA's website and entering your zip code in the locator.

Does Ohio have short term disability?

The State of Ohio does not provide short-term disability benefits, unlike some other states, but Ohians can apply for disability benefits through the Social Security Administration (SSA).

What is Citizens Disability?

Since 2010, Citizens Disability has been America’s premier Social Security Disability institution. Our services include helping people in applying for SSDI benefits, managing the process through Reconsideration, and representing people in person at their Hearing, and if necessary, bringing their case to the Appeals Council. Our mission is to give a voice to the millions of Americans who are disabled and unable to work, helping them receive the Social Security Disability benefits to which they may be entitled. Learn more about us and disability benefits like SSDI & SSI or give us a call (800)492-3260.

What is the number to call for Social Security Disability?

Learn more about us and disability benefits like SSDI & SSI or give us a call (800)492-3260.

What is the OHO office in Ohio?

These are the “Office of Hearing Operations” offices in Ohio. These offices are where hearings are scheduled and generally conducted. Each OHO office supports a number of regional Social Security Administration field offices. You are likely (but not guaranteed) to have your hearing scheduled with a Judge who works in the OHO office that supports the SSA field office nearest to you.

What is the highest percentage of approvals in Ohio in 2020?

In 2020, Ohio ranked 43rd in the nation for highest percentage of approvals at Reconsideration. However, as you can see, in general, the chances of winning approval at Reconsideration are not particularly high. That is why many applicants must continue in the next level, the Hearing.

How many hearing offices are there in Ohio?

Ohio is part of the Social Security Administration’s “Region 5,” which is headquartered in Chicago. There are 6 hearing offices in Ohio. You can see waiting times for hearings & case dispositions for each office below, with comparisons to Ohio and National Averages.

Is Ohio a 30th state in 2020?

However, Ohio recently dipped below the national average. In 2020, Ohio ranked 30th in the nation in terms of percentage approval of Initial Applications. While approval rates have improved in Ohio over the last few years, they still are slightly ahead of the national average.

Is applying for social security a new experience?

Applying for social security benefits is likely a new experience for most applicants, and having an idea of what they can expect from the process can help them be engaged and involved participants with their advocates.

Does the SS income line 1 of the 1040 include OH income?

2) IF the Federal tax return does not include any SS in it's calculation of AGI, then line 1 of the IT-1040 does not include any SS income, and there is no need for subtracting any SS income from OH income, since it isn't in line 1 of the IT-1040 in the first place.

Is Social Security taxed in Ohio?

Social Security retirement benefits are fully exempt from state income taxes in Ohio. Any income from retirement accounts (like a 401 (k) or an IRA) or pensions is taxed as regular income (but there are credits available). 0. 3. 4,114.

Do you have to pay taxes on Social Security in Ohio?

I am a Ohio State resident. "if you did not pay Federal Tax on your Social Security benefit you will have to pay taxes on your benefit in Ohio in 2019". That's not correct. Ohio, like most states starts with the Federal Adjusted Gross Income (AGI). Then it has additions and subtractions (deductions) to that income.

Is SS income taxable in Ohio?

So NO...if SS is not taxed in the Federal forms, it is not taxed on the Ohio forms either. 3) IF the Federal tax return does include some SS income as being taxable (line 5b of the 2019 Federal 1040), then that amount of SS income is included in the Federal AGI, and thus, also included in line 1 of the Ohio IT-1040.

Can you deduct Social Security in Ohio?

Any Social Security benefit that is not taxed on the Federal level cannot be deducted in Ohio. The short answer is if you did not pay Federal Tax on your Social Security benefit you will have to pay taxes on your benefit in Ohio in 2019, December 12, 2020 9:55 AM.

What is the average sales tax rate in Ohio?

When considering the state sales tax rate of 5.75% and county rates as high as 2.25%, the average total sales tax rate in Ohio is about 7.17%. That ranks in the top half of the nation. However, some sales tax exemptions in Ohio should help seniors limit the amount of their budget that goes to sales taxes.

How much is the Ohio exemption?

The exemption is equal to $25,000 off the market value of your home. For example, if your home value is $150,000, only $125,000 of that is taxable after the exemption. According to the Ohio Department of Taxation, this equals average savings of about $435 per eligible homeowner.

What can a financial advisor do in Ohio?

A financial advisor in Ohio can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial planning - including taxes, homeownership, insurance and estate planning - to make sure you are preparing for the future.

Is Ohio tax friendly for retirees?

Ohio is moderately tax-friendly for retirees. Just how friendly depends on where you receive the bulk of your income from and how you spend it. Seniors who rely mostly or fully on Social Security retirements benefits should do rather well under Ohio’s retirement tax system, as Social Security is exempt from state income taxes.

Does Ohio tax Social Security?

Ohio does not tax Social Security retirement benefits, including those that are taxed federally. That, along with the state’s low cost of living, can make it possible for some to live off Social Security benefits alone in many Ohio counties.

Is 401(k) income taxed?

Certain income from pensions or retirement accounts (like a 401 (k) or an IRA) is taxed as regular income, but there are credits available. Both property and sales tax rates are higher than national marks. To find a financial advisor near you, try our free online matching tool, or call 1-888-217-4199.

Do seniors pay taxes in Ohio?

Seniors with retirement income in addition to Social Security benefits will have to pay income taxes on that money, though they may qualify for a tax credit. Sales taxes and property taxes are especially important for retirees, who generally operate on a fixed budget. In Ohio, both taxes are slightly above U.S. marks.

How many states will have tax benefits in 2020?

As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, ...

How does SSDI work?

How SSDI Works. When SSDI Benefits Are Taxed. State Taxes on SSDI. Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of recipients do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for ...

How much disability income can I avoid?

If you are single, the threshold amount is currently $25,000.

How long does a disabled person have to be disabled to work?

First, the SSA says, "Your condition must significantly limit your ability to do basic work such as lifting, standing, walking, sitting, and remembering—for at least 12 months.".

Why did Roosevelt include Social Security in the New Deal?

The purpose of the New Deal was to lift the country out of the Great Depression and restore its economy.

Is SSDI income taxed?

Key Takeaways. Many Americans rely on Social Security Disability Income (SSDI) benefits for financial support. If your total income, including SSDI benefits, is higher than IRS thresholds, the amount that is over the limit is subject to federal income tax.

What is the senior citizen credit in Ohio?

Senior citizen credit: Taxpayers who were 65 or older during the tax year can claim a credit of $50 per return. This credit is also available on the Ohio school district income tax return (SD 100). Lump sum distribution credit: Instead of the senior citizen credit, a taxpayer who receives a total, lump sum distribution may be able ...

How many credits does Ohio offer?

Ohio offers two credits based on retirement income and two credits for taxpayers age 65 and older. These credits are claimed on the Ohio Schedule of Credits and are only available to taxpayers whose modified adjusted gross income less exemptions is less than $100,000.

Can you claim senior citizen credit on Ohio taxes?

If the taxpayer elects to claim the lump sum distribution credit, the taxpayer cannot claim the senior citizen credit on the same year's Ohio income tax return or any future return. Note: Claiming this credit does not affect your ability to claim the senior citizen credit on a school district income tax return.

Can you claim retirement income credit in Ohio?

Retirement income credit: Taxpayers can claim a credit based on the total amount of retirement income included in their Ohio adjust gross income. The credit is calculated using the following table: Lump sum retirement credit: Instead of the retirement income credit, a taxpayer who receives a total, lump sum distribution may be able ...

Is Ohio retirement income considered qualifying income?

Any retirement income that has not been deducted in calculating Ohio adjusted gross income is considered "qualifying income" for purposes of determining eligibility for the joint filing credit. However, amounts deducted on Ohio Schedule A, such as Social Security, railroad retirement or military retirement benefits, are not qualifying income.

Is stock option income considered retirement income?

This includes any amount included in the taxpayer's federal adjusted gross income. Please note, stock option income and non-qual ified deferred compensation generally do not qualify as retirement income.

Is Ohio taxable for retirement?

Ohio only taxes retirement income included in federal adjusted gross income. If your rollover did not result in you recognizing income on your federal return, it will not be taxable to Ohio. However, if your rollover results in recognizing income that is included in your federal adjusted gross income (e.g.

What is the tax rate for non-Security income in Ohio?

If your non-Social Security income is between $5,250 and $10,500, for instance, your tax rate will be 0.990 percent. But Ohio has a relatively low cost of living and that, combined with the fact that it doesn’t tax Social Security earnings, makes it possible for some seniors to live solely off their Social Security.

How much income do you need to retire in Ohio?

In order to qualify for this credit, your adjusted gross income must be less than $100,000.

How to tell if you owe taxes on Social Security?

One easy way to tell is to take half of the money you received from Social Security and add that to every other form of income you received during the year. Include any tax-exempt interest, as well. If this amount exceeds the IRS’s limits, you’ll owe taxes on your earnings.

Does Ohio tax Social Security?

Ohio does not tax Social Security, although it does tax other forms of retirement income. Retirees in Ohio should be aware, however, that state laws concerning Social Security tax are different than federal guidelines.

Is Social Security income considered earned income?

Social Security and other retirement wages aren’t considered earned income, which means they’re usually taxed differently than money earned through active work. However, in some states, some unearned income is taxed. Fortunately for residents, Ohio is not one of those states.

Do you pay taxes on Social Security in Ohio?

Tax in Ohio and Social Security. Ohio residents will not pay taxes on Social Security income, even in instances where the IRS requires you to pay taxes. However, other forms of retirement income will face taxes, including any 401 (k) or IRAs you have.