How to Perform a Cost Benefit Analysis

We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

What steps are part of doing a cost benefit analysis?

step one identify all the private and external costs and benefits step two assign a monetary value to all costs and benefits step three account for the likelihood of any costs and benefits that are uncertain (cost/benefit multiplied by probability)

Which describes the purpose of doing a cost benefit analysis?

- A cost-benefit analysis simplifies the complex decisions in a project.

- The analysis gives clarity to unpredictable situations. ...

- It helps to figure out whether the benefits outweigh the cost and is it financially strong and stable to pursue it

- It is easy to compare projects of every type in spite of being dissimilar

What is the last step of the cost benefit analysis?

Steps to Conduct a Coast-benefit analysis

- Compile List In the first step, we have to collect all the list of cost and benefit which associated with the action or decision. ...

- Give cost and benefit a monetary value. After gathering the lists of all costs and benefits then we have to give them the monetary value. ...

- Make the equation and compare.

What is a simple way to describing cost benefit analysis?

The costs involved in a CBA might include the following:

- Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses.

- Indirect costs might include electricity, overhead costs from management, rent, utilities.

- Intangible costs of a decision, such as the impact on customers, employees, or delivery times.

How do you perform a cost benefit analysis?

Follow these steps to do a Cost-Benefit Analysis.Step One: Brainstorm Costs and Benefits. ... Step Two: Assign a Monetary Value to the Costs. ... Step Three: Assign a Monetary Value to the Benefits. ... Step Four: Compare Costs and Benefits.

When a cost benefit analysis is done?

CBA has two main applications: To determine if an investment (or decision) is sound, ascertaining if – and by how much – its benefits outweigh its costs. To provide a basis for comparing investments (or decisions), comparing the total expected cost of each option with its total expected benefits.

What is a cost benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

What is CBA and CEA?

Cost-benefit analysis (CBA) and cost-effectiveness analysis (CEA) are formal analyt- ic techniques for comparing the positive and negative consequences of alternative uses of resources. Both CBA and CEA require the identification, quantification.

How do you calculate cost-benefit analysis of a project?

How to Conduct a Cost-Benefit AnalysisEstablish a Framework for Your Analysis. ... Identify Your Costs and Benefits. ... Assign a Dollar Amount or Value to Each Cost and Benefit. ... Tally the Total Value of Benefits and Costs and Compare.

How do I do a cost-benefit analysis in Excel?

A typical cost benefit analysis involves these steps:Gather all the necessary data.Calculate costs. Fixed or one time costs. Variable costs.Calculate the benefits.Compare costs & benefits over a period of time.Decide which option is best for chosen time period.Optional: Provide what-if analysis.

What are the two types of cost-benefit analysis?

Several techniques are available, with the most common being the payback period, net present value, and rate of return. Companies can use one or all of the cost-benefit analysis techniques.

Why is cost benefit analysis useful?

This makes it useful for higher-ups who want to evaluate their employees’ decision-making skills, or for organizations who seek to learn from their past decisions — right or wrong .

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

What is cost benefit ratio?

Cost benefit ratio is the ratio of the costs associated with a certain decision to the benefits associated with a certain decision. It’s more commonly known as benefit cost ratio, in which case the ratio is reversed (benefits to costs, instead of costs to benefits). Since both costs and benefits can be expressed in monetary terms, ...

Is cost benefit analysis a guiding tool?

In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is cost benefit analysis?

Cost benefit analysis (CBA) is a systematic method for quantifying and then comparing the total costs to total expected rewards of undertaking a project or making an investment. If the benefits greatly outweigh the costs, the decision should go ahead; otherwise it should probably not.

What are direct costs?

Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. Indirect costs might include electricity, overhead costs from management, rent, utilities. Intangible costs of a decision, such as the impact on customers, employees, or delivery times.

What is a CBA?

A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project. A CBA can also include intangible benefits and costs or effects from a decision such as employee morale and customer satisfaction. 1:39.

What are the forecasts used in a CBA?

The forecasts used in any CBA might include future revenue or sales, alternative rates of return, expected costs, and expected future cash flows. If one or two of the forecasts are off, the CBA results would likely be thrown into question, thus highlighting the limitations in performing a cost-benefit analysis.

What are the downsides of CBA?

One other potential downside is that various estimates and forecasts are required to build the CBA, and these assumptions may prove to be wrong or even biased. The benefits of a CBA, if done correctly and with accurate assumptions, are to provide a good guide for decision-making that can be standardized and quantified.

Why factor opportunity costs?

Factoring in opportunity costs allows project managers to weigh the benefits from alternative courses of action and not merely the current path or choice being considered in the cost-benefit analysis.

What is competitive advantage?

Competitive advantage or market share gained as a result of the decision. An analyst or project manager should apply a monetary measurement to all of the items on the cost-benefit list, taking special care not to underestimate costs or overestimate benefits.

What is cost benefit analysis?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits.

Why do organizations use cost benefit analysis?

Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, ...

What are the risks and uncertainties of cost benefit analysis?

These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions.

What is sensitivity analysis?

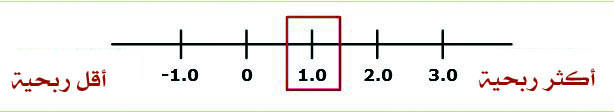

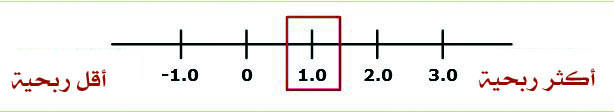

Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.”#N#EXAMPLE of Sensitivity Analysis#N#In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

What is the difference between tangible and intangible costs?

Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools. Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels.

What is direct cost?

Direct costs are often associated with production of a cost object (product, service, customer, project, or activity) Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center.

Who developed the evaluation process?

Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

How does Benefit Cost work?

On the other hand, the Benefit-Cost provides value by calculating the ratio of the sum of the present value of the benefits associated with a project against the sum of the present value of the costs associated with a project.

What is discounting the costs and benefits?

Discounting the costs and benefits – The benefits and costs of a project have to be expressed in terms of equivalent money of a particular time. It is not just due to the effect of inflation but because a dollar available now can be invested, and it earns interest for five years and would eventually be worth more than a dollar in five years.

What is the purpose of identity and classify costs and benefits?

It is essential to costs and benefits are classified in the following manner to ensure that you understand the effects of each cost and benefit. – Direct Costs (Intended Costs/Benefits) – Indirect Costs.

When a massive sum of money is invested in a project or initiative, should it at least break even or recover

When a massive sum of money is invested in a project or initiative, it should at least break even or recover the cost. To determine whether the project is in the positive zone, the costs and benefits are identified and discounted to present value to ascertain the viability.

Is double counting of cost and benefits a problem?

Double counting of cost and benefits must be avoided – Sometimes though each of the benefits or costs is seen as a distinct feature, they might be producing the same economic value, resulting in the dual counting of elements. Hence these need to be avoided.

What Is a Project Cost Analysis?

Project cost analysis compares and analyzes the costs and the benefits. You do this analysis at the stage of the project proposal.

The Purpose of the Cost-Benefit Analysis

Imagine this: You have to choose between Project 1 and Project 2. Now, for a sound financial decision, you will compare one project against another. You will compare the costs incurred and the benefits derived from both projects. This is exactly where cost-benefit analysis comes into the picture.

The Process of Cost-Benefit Analysis

We’ll go step-by-step through the easy process of a cost benefit analysis. These are key steps that establish whether the proposed project is worth taking up. Let’s dive in.

How to Evaluate the Cost-Benefit Analysis

Once you have collected the data, your work is halfway done. You now have everything ready to conduct a precise data-driven cost-benefit analysis!

How Accurate is Cost-Benefit Analysis?

A cost-benefit analysis is a smart way to assess the impact of a potential project on your business. It is undeniably the most reasonable approach to determine the efficiency of a project.

Are There Limitations to Cost-Benefit Analysis?

Cost-benefit analysis is a well-established tool to aid decision-making for a proposed project. Yet, we have shortlisted a few points to remember while defining and measuring the different aspects of the analysis. Take note of these points and you will face no limitations while estimating the strengths and weaknesses of any project.

FAQs

Two main parts of cost-benefit analysis are the identification and measurement of comparable metrics such as ROI, payback period, and customer satisfaction. The accuracy and reliability of this analysis are the basis of the project life cycle.

What is cost benefit analysis?

According to the official definition, cost-benefit analysis (CBA) is a business process that adds up all the benefits of an initiative (i.e. a project) and then subtracts the associated costs. So, for example, the benefits of your project could be $1 million in terms of revenue, and your costs could be $500k.

When was cost benefit analysis invented?

Cost Benefit Analysis dates back to the 18th century , when a French engineer and economist by the name of Jules Dupuit decided to evaluate the feasibility of a construction project by taking a look at how much people were willing to pay for it.

Should you consider long term costs?

You should consider long-term costs, as well, not just immediate costs. For example, if you’re evaluating the feasibility of migrating the entire company to new software, you have to factor in the software’s costs in the long-term, too. Perhaps even training, if necessary.

Is CBA a good way to evaluate feasibility?

Very few people. And as an unbiased method of assessing benefits, costs, and profits, CBA is an excellent way to evaluate the feasibility of your project. When your project is objectively proven as feasible and profitable, you will: Easily evaluate and control your project’s progress.

What Is A Cost-Benefit Analysis (CBA)?

- A cost-benefit analysis is a systematic process that businesses use to analyze which decisions to make and which to forgo. The cost-benefit analyst sums the potential rewards expected from a situation or action and then subtracts the total costs associated with taking that action. Some consultants or analystsalso build models to assign a dollar val...

Understanding Cost-Benefit Analysis

- Before building a new plant or taking on a new project, prudent managers conduct a cost-benefit analysis to evaluate all the potential costs and revenues that a company might generate from the project. The outcome of the analysis will determine whether the project is financially feasible or if the company should pursue another project. In many models, a cost-benefit analysis will also fa…

The Cost-Benefit Analysis Process

- A cost-benefit analysis should begin with compiling a comprehensive list of all the costs and benefits associated with the project or decision. The costs involved in a CBA might include the following: 1. Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. 2. Indirect costs might include electricity, overhead costs from manag…

Limitations of The Cost-Benefit Analysis

- For projects that involve small- to mid-level capital expenditures and are short to intermediate in terms of time to completion, an in-depth cost-benefit analysis may be sufficient enough to make a well-informed, rational decision. For very large projects with a long-term time horizon, a cost-benefit analysis might fail to account for important financial concerns such as inflation, interest …

How to Do Cost Benefit Analysis?

Steps of Cost-Benefit Analysis

- We all know it’s quite simple to make an investment decision when the benefits overshadow the costs, but only a few of us know the other key elements that go into the analysis. The steps to create a meaningful model are:

Principles of Cost-Benefit Analysis

- Discounting the costs and benefits – The benefits and costs of a project have to be expressed in terms of equivalent money of a particular time. It is not just due to the effect of inflation but be...

- Defining a particular study area – The impact of a project should be defined for a particular study area. E.g., A city, region, state, nation, or the world. It’s possible that the effects of a pro…

- Discounting the costs and benefits – The benefits and costs of a project have to be expressed in terms of equivalent money of a particular time. It is not just due to the effect of inflation but be...

- Defining a particular study area – The impact of a project should be defined for a particular study area. E.g., A city, region, state, nation, or the world. It’s possible that the effects of a proj...

- The specification of the study area may be subjective, but it can impact the analysis to a significant extent.

- Addressing uncertainties precisely – Business decisions are clouded by uncertainties. It must disclose areas of uncertainty and discretely describe how each uncertainty, assumption, or a…

Importance of Cost-Benefit Analysis

- Determining the feasibility of an opportunity: Nobody wants to incur losses in business. When a massive sum of money is invested in a project or initiative, it should at least break even or recover...

- To provide a basis for comparing projects: With so many investment choices around, there has to be a basis for choosing the best alternative. Cost-benefit analysis is one the aptest to tool…

- Determining the feasibility of an opportunity: Nobody wants to incur losses in business. When a massive sum of money is invested in a project or initiative, it should at least break even or recover...

- To provide a basis for comparing projects: With so many investment choices around, there has to be a basis for choosing the best alternative. Cost-benefit analysis is one the aptest to tools to pic...

- Evaluating Opportunity Cost: We know that the resources at our disposal are finite, but investment opportunities are many. Cost-benefit analysis is a useful tool for comparing and selecting the bes...

- Performing Sensitivity AnalysisSensitivity AnalysisSensitivity analysis is a type of analysis th…

Limitations

- Like every other quantitative tool, Cost-benefit Analysis also has certain limitations: A good CBA model is the one which circumvents these hurdles most effectively: Few of the limitations are: 1. Inaccuracies in quantifying costs and benefits – A cost-benefit analysis requires that all costs and benefits be identified and appropriately quantified. However, specific errors, such as accidentall…

Recommended Articles

- This article has been a guide to what is the cost-benefit analysis. Here we discuss how to do cost-benefit analysis along with examples, importance & limitations. You can also have referred to the following recommended articles to learn more about Corporate Finance – 1. Examples of Feasibility Study 2. Cost-Benefit Principle 3. Key Differences Direct Cost vs. Indirect Cost