Divorce has no effect on a taxpayer’s own Social Security retirement or disability benefits. When a couple divorces, each former spouse keeps their own Social Security earnings history. If a taxpayer were entitled to a retirement benefit on their own record prior to divorce, they would be entitled to that same benefit amount after divorce.

What happens to Social Security benefits if you divorce?

- Support quality journalism

- Get unlimited access to tucson.com and apps

- No more surveys blocking articles

Can You Lose Your Social Security in a divorce?

Your marital status could affect Social Security benefits. Divorce can sometimes leave you with a reduced Social Security check. Eligibility for spousal benefits and survivor benefits can depend how long you were married. Divorce can have a big financial impact as you go from a dual-income to a single-income household and split up your possessions.

Does getting remarried affect Social Security benefits?

Remarriage at any time makes the widow potentially eligible for spouse benefits on her new husband's work record, so marriage is unlikely to leave a woman ineligible for Social Security. However, spouse benefits may be less generous than widow benefits for two reasons.

How does divorce affect Supplemental Security Income (SSI)?

- you were married to your former spouse for at least ten years

- you are at least 62 years old

- you are unmarried, and

- you are not entitled to a larger benefit under your own Social Security record.

Can a divorced woman get ex husband's Social Security?

A divorced spouse may be eligible to collect Social Security benefits based on the former spouse's work record. The marriage must have lasted for at least 10 years, and the divorced spouse must be at least 62 years old.

What percent of Social Security does a divorced spouse get?

50 percentThe most you can collect in divorced-spouse benefits is 50 percent of your former mate's primary insurance amount — the monthly payment he or she is entitled to at full retirement age, which is 66 and 4 months for people born in 1956 and is rising incrementally to 67 over the next several years.

Can I collect my ex husband's Social Security and my own?

you're eligible for some of your ex's Social Security wives and widows. That means most divorced women collect their own Social Security while the ex is alive, but can apply for higher widow's rates when he dies.

Can my ex wife collect on my Social Security if I remarry?

Can I collect Social Security as a divorced spouse if my ex-spouse remarries? Yes. When it comes to ex-spouse benefits, Social Security doesn't care about the marital status of your former spouse; it only cares about your marital status.

How does divorce affect your social security benefits?

Many individuals are unaware that some factors can affect how much you earn from social security benefits after divorce. That has brought the question, “How much social security does an ex-spouse get?”

Eligibility requirements for divorced spouses

Before knowing the answer to the question, “how much social security does an ex-spouse get?” it is vital to know the social security spousal eligibility. Collecting spouse social security does not come on a platter of gold.

Eligibility when your ex-spouse is deceased

Another pertinent question spouses ask is, “Can you collect your spouse’s social security after they die? Or “Can you collect social security from a deceased ex-spouse?” The answer is yes once you meet the social security spousal benefits eligibility.

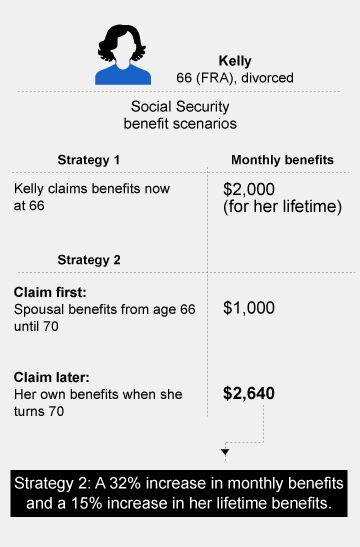

What you should know about full retirement age

As soon as you clock at age 62, you can apply and start receiving your social security benefit after divorce. You will only be getting half of the full social security at this age. In other words, your benefits will be reduced by a certain percentage monthly till your full retirement age.

Should I file for divorce before my spouse starts receiving benefits?

The answer to this question depends on your current circumstances and why you are filing for divorce.

How earnings are calculated for social security

As you make plans for your divorce or retirement, you may ask how social security earnings are calculated – “how does spousal social security work?” First, the Social Security Administration (SSA) is responsible for all forms of social benefits.

How much of this benefit will I receive?

Similar to this question is “What percentage of social security benefits does a widow receive?” To make it easier for you, you should use the Social Security Quick Calculator.

What are the benefits of divorced spouses?

The types of benefits most relevant to divorced spouses are retirement benefits, spousal benefits (a type of dependent benefit), and survivor benefits. The (complex) interplay among these benefits can have ...

How does Social Security work?

The current Social Security system works like this: when you work, you pay taxes into Social Security. We use the tax money to pay benefits to: Tax revenue goes to people currently on benefits.

What is disability benefit?

Disability benefits – an income benefit for those who fit the definition of “disabled” under Social Security. Retirement and disability benefits are direct benefits in the sense that they are based on each taxpayer’s earnings and the Social Security taxes they paid into the system.

Do you keep your Social Security after divorce?

When a couple divorces, each former spouse keeps their own Social Security earnings history . If a taxpayer were entitled to a retirement benefit on their own record prior to divorce, they would be entitled to that same benefit amount after divorce. The same is true for disability benefits.

Is Social Security complex?

Social Security is a very complex system. Some academics spend their entire careers writing about it. At Sensible Financial we have written about it extensively, most recently in an article originally published on Forbes explaining how retirement benefits are calculated.

Is retirement a direct benefit?

Retirement and disability benefits are direct benefits in the sense that they are based on each taxpayer’s earnings and the Social Security taxes they paid into the system. The last two categories provide cash benefits to a worker’s family members. These auxiliary benefits are based on the worker’s Social Security record, ...

Does divorce affect Social Security?

Divorce Can Impact Auxiliary Social Security Benefits. By contrast, divorce can impact auxiliary Social Security benefits, such as spousal and survivor benefits. Married spouses are entitled to these benefits with a few restrictions. However, divorced spouses must meet strict requirements to receive benefits on an ex-spouse’s record.

What is the benefit of divorced spouse?

As a divorced spouse, the benefit to which you are entitled based on your ex-spouse’s record is one-half of their full retirement amount, or, if applicable, the disability benefit they are entitled to. This assumes that you begin receiving benefits at your full retirement age.

How much does Social Security deduct from your paycheck?

If you are under your full retirement age during the whole year, Social Security deducts one dollar from your benefit payments for every two dollars you earn above the annual limit ($17,640 in 2019). During the year in which you reach your full retirement age, things are a little different.

What if you are eligible for Social Security on your own record?

If the benefit for which you would be eligible based on your divorced spouse’s record is greater, you will receive an additional payment so that your benefit, combined with the supplemental payment, equals the higher benefit amount.

What is the full retirement age for a married couple?

For those born between 1943 and 1959, the full retirement age is between 66 and 67 depending on the year. If your spouse is entitled to any delayed retirement credits for delaying retirement past full retirement age, these will not be a part of your benefit.

How much is a dollar deducted from Social Security?

One dollar is deducted for every three dollars you earn above another limit ($46,920); however, the Social Security Administration only counts earnings from before the month you reached your full retirement age. So if you reach your full retirement age in March, only earnings from January and February would be counted.

Does remarrying affect Social Security?

How Remarriage Affects Your Social Security Benefit. If you are otherwise eligible for Social Security benefits based on your ex-spouse’s record, but you remarry, you are no longer eligible for benefits from your ex-spouse during your subsequent marriage.

Do you have to take Social Security benefits during divorce?

But one thing many people fail to think about is Social Security benefits, possibly because during the divorce process, you do not need to take any action regarding those benefits if neither spouse is currently receiving them. That doesn’t mean they are not an important consideration, though.

What are the factors that affect Social Security?

There are several factors that can affect how much you receive in Social Security benefits, such as the age at which you claim, whether you continue working after you claim benefits, and how much you earned during the years you paid into Social Security. One factor that's easy to overlook, however, is divorce.

How many people over 50 don't know what they can receive in Social Security?

A whopping 91% of Americans over the age of 50 don't understand what factors determine the amount they can potentially receive in Social Security benefits, a survey from the Nationwide Retirement Institute found.

Do you get reduced Social Security if you claim earlier than FRA?

Also, all the normal Social Security restrictions still apply here. So if, for example, you claim earlier than your FRA, your benefits will be reduced. And if you continue working after claiming benefits, you may see a (temporary) reduction in benefits as well, depending on how much you're earning.

Does ex wife's record affect my benefits?

One last thing to keep in mind is that regardless of how much someone is receiving in benefits based on their ex-spouses record, it doesn't affect how much the other person or their current spouse receives in benefits. So if, say, your ex-wife is receiving benefits based on your record, your and your current wife's benefits will not be reduced as ...

What percentage of my spouse's Social Security benefits are at 62?

63 is about 25 percent. 64 is about 20 percent. 65 is about 13.3 percent. 66 is about 6.7 percent. If you start receiving spouse’s benefits at age 62, your monthly benefit amount is reduced to about 32.5 percent of the amount your spouse would receive if their benefits started at full retirement age.

How much do widows get from a divorce?

A divorced widow or widower, age 60 will receive up to 99% of the deceased worker’s basic amount. Disabled and divorced widow or widower aged 50 through 59 would receive 71½%.

How long do you have to be married to collect Social Security benefits?

To get these benefits, you must: Have been married for at least 10 straight years. You are at least 62 years old.

What happens if you delay your retirement?

If you delay your retirement benefits until after full retirement age, you also may be eligible for delayed retirement credits that would increase your monthly benefit. Here’s a comparison of how retirement works drawing your own benefits vs. drawing a spouse’s benefits if your full retirement is at age 67.

What age can an ex-spouse receive Social Security?

You are unmarried. You are age 62 or older . Your ex-spouse is entitled to Social Security retirement or disability benefits. The benefit you are entitled to receive based on your own work is less than the benefit you would receive based on your ex-spouse’s work.

When do child benefits end?

Benefits for a child under age 18 or student ages 18 or 19 end if you get married again. If you get married again after age 60, this does not prevent you from becoming entitled to benefits on your prior deceased spouse’s Social Security earnings record.

How old do you have to be to get ex spouse's Social Security?

You must be at least 62 years old.

How long can a divorced spouse collect Social Security?

Divorced Spouse Social Security: New Rules. The basic rules for divorced spouses and Social Security say that if an individual was married for at least 10 years and then divorced, they are eligible to collect spousal benefits on the earnings record of their ex-spouse as long as they are at least age 62 and currently single.

How old do you have to be to get a divorced spouse's benefits?

Divorced spouses who are caring for their deceased spouse's natural or legally adopted child who is younger than age 16—or disabled and entitled to benefits—can apply at any age. However, the benefits will last only until the child reaches age 16 or is no longer disabled.

When can I switch over my Social Security to my own?

Divorced spouses can file for survivor benefits as early as age 60 (age 50 if they are disabled) and switch over to their own benefit as early as age 62.

When can I file for survivor benefits?

They also have the option of filing for their own benefit first, as early as age 62, then filing for survivor benefits when they reach full or "normal" retirement age (66 to 67 for most people) if that will result in a higher benefit. 7 .

Can I apply for Social Security based on my ex spouse's earnings?

Which set of rules applies depends on the applicant's date of birth.

Can a divorced spouse file for Social Security at the same time?

However, under the new rules, divorced spouses who were born on or after Jan. 2, 1954, are now deemed to be filing for all available benefits (spousal as well as their own) at the same time when they apply for Social Security.

How Pension Benefits are Divided

A pension benefit plan must first be reduced to its current value before it can be divided up. The present value is used to determine the portion of the benefits that can be rewarded to the spouse through an offset division of marital assets.

Are You Eligible to Receive Pension Benefits in a Divorce?

As discussed above, the federal government does consider retirement pensions that are not Social Security marital assets that can be divided and awarded to the other spouse. However, a spouse must meet certain criteria to be eligible to receive pension benefits from their ex-spouse. A spouse is eligible to receive benefits if:

Family Law Attorneys

Divorce proceedings can get rather complex when financial assets are divided, especially when Social Security benefits are involved. There are many laws and regulations to navigate to determine if a spouse is eligible to receive pension benefits from an ex-spouse and how much they are entitled to.

Before ending your marriage, you need to read this

Former college teacher. Textbook contributor. Personal finance writer. Passionate advocate of smart money moves to achieve financial success.

How could divorce affect your Social Security benefits?

There's a very important reason why divorce could impact the amount of Social Security income you receive: It could affect your eligibility for spousal benefits. These benefits are based on your spouse's work history.

What to do if divorce will affect your benefits

Obviously, if you're unhappy, you don't want to stay married for a long time just to preserve eligibility for Social Security benefits. But if you are close to the 10-year mark, you may want to consider trying to put off your legal divorce long enough to preserve your benefit eligibility.