How does a cost-benefit analysis work?

- Make a list of all costs and benefits The first thing you’ll need to do to start your cost-benefit analysis is to brainstorm a list of every cost ...

- Give each cost and benefit a monetary value Once you’ve listed all of your expenses and benefits, you have to give them an actual monetary value. ...

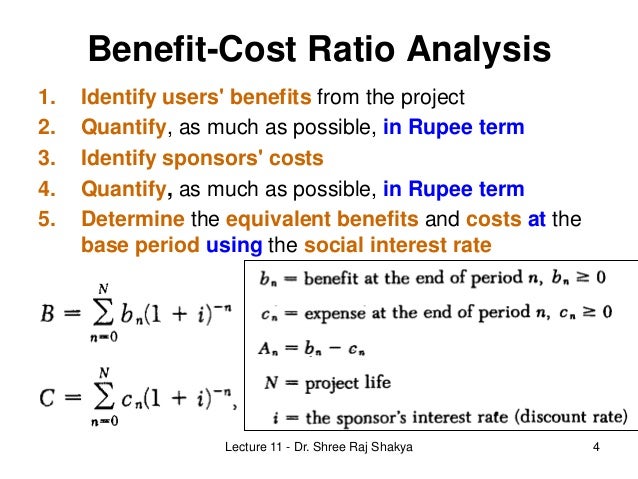

- Calculate the benefit-cost ratio

What are the steps of cost benefit analysis?

Share

- Identify the scope – likely a project, initiative, program or service offering. ...

- Determining the cost. ...

- Determining the benefits. ...

- Compute calculations of the cost-benefit analysis. ...

- Compare the cost and benefit results with a what-if analysis. ...

- Assumptions and limitations that impact decision-making. ...

- Conclusion. ...

What are the advantages of cost benefit analysis?

Dive Brief:

- While a quarter of U.S. ...

- Of the 5,000 workers surveyed, 42% said they had not used any mental health services offered by their employer, and 15% said their employer did not offer such support. ...

- Most of those who reported not using employer funded mental health services said they knew about the support but never needed it, the survey said. ...

What is the formula for cost benefit analysis?

What is the Cost-Benefit Analysis Formula?

- Example of Cost-Benefit Analysis Formula (With Excel Template) Let’s take an example to understand the calculation of Cost-Benefit Analysis in a better manner. ...

- Explanation. ...

- Relevance and Use of Cost-Benefit Analysis Formula. ...

- Cost-Benefit Analysis Formula Calculator

- Recommended Articles. ...

What are some examples of cost benefit analysis?

Examples of Cost-Benefit Analysis. An example of Cost-Benefit Analysis includes Cost-Benefit Ratio where suppose there are two projects where project one is incurring a total cost of $8,000 and earning total benefits of $ 12,000 whereas on the other hand project two is incurring costs of Rs. $11,000 and earning benefits of $ 20,000, therefore, by applying cost-benefit analysis the Cost-Benefit ...

How do you use a cost-benefit analysis?

Follow these steps to do a Cost-Benefit Analysis.Step One: Brainstorm Costs and Benefits. ... Step Two: Assign a Monetary Value to the Costs. ... Step Three: Assign a Monetary Value to the Benefits. ... Step Four: Compare Costs and Benefits.

What is a cost-benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

How is a cost-benefit analysis used in business?

A CBA is a business management technique that allows you to weigh the costs associated with an investment against the benefits the investment is likely to generate. Whenever you're unsure whether to make a change in your business, a CBA can help guide you through the decision-making process.

What are the 5 steps of cost-benefit analysis?

The major steps in a cost-benefit analysisStep 1: Specify the set of options. ... Step 2: Decide whose costs and benefits count. ... Step 3: Identify the impacts and select measurement indicators. ... Step 4: Predict the impacts over the life of the proposed regulation. ... Step 5: Monetise (place dollar values on) impacts.More items...

How do you calculate cost analysis?

How to calculate cost analysisDetermine the reason you need a cost analysis. The way you use a cost analysis can vary depending on why you need a cost analysis done. ... Evaluate cost. ... Compare to previous projects. ... Define all stakeholders. ... List the potential benefits. ... Subtract the cost from the outcome. ... Interpret your results.

What are the pros cons of a company using cost-benefit analysis?

Advantage: Clarity in Unpredictable Situations. ... Disadvantage: Does Not Account for All Variables. ... Advantage: Helps You Make Rational Decisions. ... Disadvantage: Removes Gut Instinct.

What factors should be considered in a cost-benefit analysis?

When conducting a cost-benefit analysis, make sure to factor in these three important things.Analyze all cost types.Analyze potential risks and impacts. Even when the project's benefits outweigh the costs, it is essential toidentify, analyze, and weigh any risks. ... Evaluate the cost-benefit analysis.

What is cost benefit analysis?

Cost benefit analysis (CBA) is a systematic method for quantifying and then comparing the total costs to total expected rewards of undertaking a project or making an investment. If the benefits greatly outweigh the costs, the decision should go ahead; otherwise it should probably not.

Why factor opportunity costs?

Factoring in opportunity costs allows project managers to weigh the benefits from alternative courses of action and not merely the current path or choice being considered in the cost-benefit analysis.

What is a CBA?

A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project. A CBA can also include intangible benefits and costs or effects from a decision such as employee morale and customer satisfaction. 1:39.

What are the forecasts used in a CBA?

The forecasts used in any CBA might include future revenue or sales, alternative rates of return, expected costs, and expected future cash flows. If one or two of the forecasts are off, the CBA results would likely be thrown into question, thus highlighting the limitations in performing a cost-benefit analysis.

What are the downsides of CBA?

One other potential downside is that various estimates and forecasts are required to build the CBA, and these assumptions may prove to be wrong or even biased. The benefits of a CBA, if done correctly and with accurate assumptions, are to provide a good guide for decision-making that can be standardized and quantified.

What are direct costs?

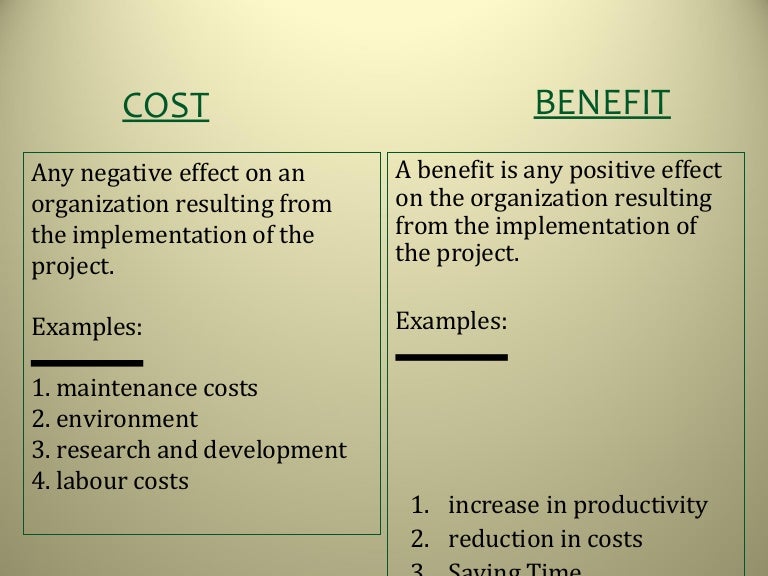

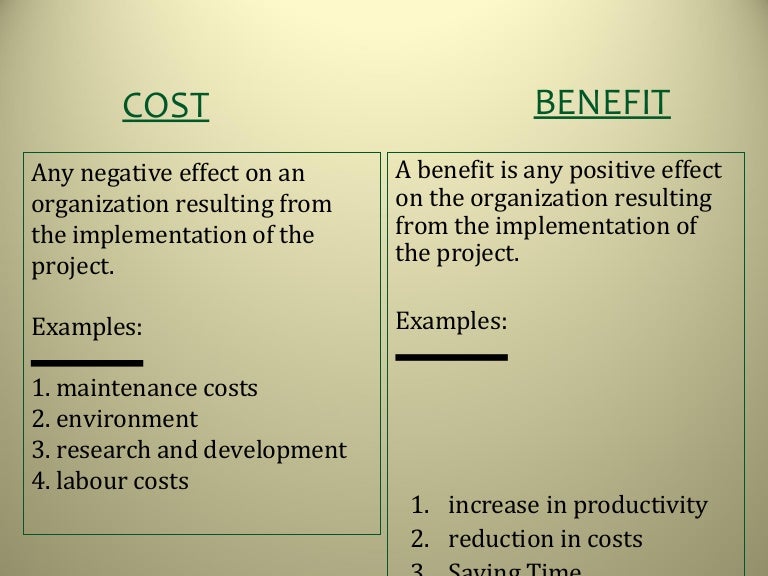

Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. Indirect costs might include electricity, overhead costs from management, rent, utilities. Intangible costs of a decision, such as the impact on customers, employees, or delivery times.

What is competitive advantage?

Competitive advantage or market share gained as a result of the decision. An analyst or project manager should apply a monetary measurement to all of the items on the cost-benefit list, taking special care not to underestimate costs or overestimate benefits.

Why is cost benefit analysis useful?

This makes it useful for higher-ups who want to evaluate their employees’ decision-making skills, or for organizations who seek to learn from their past decisions — right or wrong .

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

What is cost benefit ratio?

Cost benefit ratio is the ratio of the costs associated with a certain decision to the benefits associated with a certain decision. It’s more commonly known as benefit cost ratio, in which case the ratio is reversed (benefits to costs, instead of costs to benefits). Since both costs and benefits can be expressed in monetary terms, ...

Is cost benefit analysis a guiding tool?

In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is cost benefit analysis?

A cost-benefit analysis (CBA) is a process that is used to estimate the costs and benefits of decisions in order to find the most cost-effective alternative. A CBA is a versatile method that is often used for the business, project and public policy decisions. An effective CBA evaluates the following costs and benefits:

What to consider when comparing cost-benefit cash flows?

For this reason, you’ll need to consider the time value of money, discount rate, net present value when comparing cost-benefit cash flows.

What is the purpose of CBA?

There are two main purposes in using CBA: To determine if the project business case is sound, justifiable and feasible by figuring out if its benefits outweigh costs. To offer a baseline for comparing projects by determining which project’s benefits are greater than its costs.

What is a CBA project?

Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. In a project, there is always something that needs executing, and every task has a cost and expected benefits.

What is sensitivity analysis?

A sensitivity analysis is a probability method used in management and business to determine how uncertainty affects your decisions, costs and profits.#N#In a project management CBA, sensitivity analysis is used to determine the benefit-cost ratio of probable scenarios. You can use Excel or more specialized software to do sensitivity analyses.

Can you compare current monetary value with future rate?

As mentioned on the last step, you can’t compare the current monetary value of costs and benefits with future rates. That’s why you’ll have to calculate the time value of money, discount rate, and net present value of cash flows.

Can you do cost benefit analysis without outlining expenses?

You can’t do a cost-benefit analysis without outlining all your expenses first. That’s where our free project budget template comes in. It helps you capture all the expenses related to your project from labor costs, consultant fees, the price of raw materials, software licenses and travel.

What is cost benefit analysis?

Cost-benefit analysis (CBA) is a decision-making process many businesses use to determine the expected pros and cons of particular business decisions.

Why do companies use cost benefit analysis?

Many companies use cost-benefit analysis to help them make important short-term and long-term business decisions. While the process likely looks a little different for every company, the steps are roughly the same.

What are intangible costs?

Your intangible expenses could include the impact on your employees or the effect on your customers and the way they see your company. Intangible costs could also include the social and environmental impact of a particular decision.

Why is cost benefit analysis important?

A cost-benefit analysis can be a valuable tool for businesses to use to determine the impact and profitability of specific business decisions. First, this analysis can help firms to analyze the pros and cons of a single business decision.

How to calculate the benefit to cost ratio?

First, add up the monetary value of each (meaning the sum of all of your costs and the sum of all of your benefits). Then, you’re going to take the total dollar value of your benefits and divide it by the total dollar value of your costs. The resulting number is your benefit-to-cost ratio.

What are indirect costs?

Indirect costs are those the company will incur, but that aren’t directly related to production. These costs would include overhead such as rent, utilities, and management. These are tangible costs, but there isn’t a direct correlation between production and these costs.

What is opportunity cost?

It works the same way with business decisions. With every significant business decision, the opportunity cost is the profit they could have made from a different choice. With a cost-benefit analysis, companies can look at all of those factors at once.

What is cost benefit analysis?

A cost-benefit analysis (CBA) is a decision-making process that allows a business to compare the forecasted costs and benefits of a possible project and is usually expressed in monetary terms. If the benefits of investing in the project are greater than the costs, then the business will want to invest since it will be ...

What is the benefit of adding a new product line?

The benefit of adding the new product line is $300,000, which represents increased sales. As a business owner, you ask yourself whether the cost is worth the benefit. In this example, the costs are $200,000 greater than the benefit. Your decision should be that you are not going to add the product since the cost is greater than the benefit.

Why do I need a CBA?

As a business owner, you want to be able to choose projects that will meet business goals. A CBA can help you determine, among other things, the financial viability of a project if you need to hire additional staff, and how you want to prioritize investments so you can make an informed decision.

What is a CBA?

A CBA is the process of comparing the costs of a project to the benefits generated from it and determining if a business should invest in the project. While a CBA is usually expressed in monetary terms, intangible costs like time and health risks are sometimes also taken into consideration along with ...

What is net present value?

Net present value (NPV) is a calculation that takes the time value of money into account. You discount cash flow back to the present based on the following formulas, which account for each year of cash flows. They are discounted at the business’s hypothetical 3% cost of capital. 2

Do you have to take current interest rates and the time period of the project into account?

You have to take current interest rates and the time period of the project into account. In a larger company, for example, before a financial manager performs a discounted cash-flow analysis, they often calculate their company’s payback period so they can see how quickly they will make back their investment.

What is cost benefit analysis?

Cost-benefit analysis is a process that project managers and business executives use to determine the expenses and incentives of a major company project. When companies perform a cost-benefit analysis, they calculate the costs and benefits for the project or decision and determine which calculation is larger.

Why do companies use cost benefit analysis?

Companies and businesses often use a cost-benefit analysis to determine and evaluate all the expenses and revenues that a project might generate. The analysis helps companies examine the feasibility of the project in terms of finances and other important factors, such as opportunity costs. Opportunity costs consider alternative benefits ...

What are the costs of a project?

When performing a cost-benefit analysis on your project, it's important to analyze a comprehensive list of expenses and positive outcomes the project will create. Costs or expenses that the project creates can include: 1 Direct costs: Direct costs are purchases that a business makes that directly relate to the creation of its goods and services. These costs can include material purchases, employee salaries and equipment or tool rentals. 2 Indirect costs: Indirect costs are other expenses that help keep the business or company operating, including insurance, facility rentals and utility costs. 3 Intangible costs: Intangible costs are costs that companies can't easily quantify. These costs can include customer satisfaction, employee morale or overall productivity. 4 Potential risks: Potential risks are any challenges or issues that a company might face during a project or after the project's completion. These can include other direct or indirect costs, such as spending more than the company expected, and intangible costs, such as loss of business or profit. 5 Opportunity costs: Opportunity costs are the loss of potential benefits or profit from making one decision over another. For example, if a company decides to sell some property, they might be missing out on potential profit from renting the property on a monthly basis.

What are intangible costs?

Intangible costs: Intangible costs are costs that companies can't easily quantify. These costs can include customer satisfaction, employee morale or overall productivity. Potential risks: Potential risks are any challenges or issues that a company might face during a project or after the project's completion.

What are opportunity costs?

Opportunity costs: Opportunity costs are the loss of potential benefits or profit from making one decision over another.

What happens if the benefits exceed the costs?

If the benefits exceed the costs, the project or decision is generally a positive one for the company to make. However, if the costs exceed the benefits, the company often evaluates that project's plan and determines if there's a way to adjust it or save money.

Why is cost benefit analysis important?

Provides a competitive advantage. Cost-benefit analysis can help companies develop an advantage over competing businesses because it can help them quickly create innovative ideas and determine how they can stay relevant in the current market. Continuously generating new ideas and performing a cost-benefit analysis on them can help companies stay ...

Cost Benefit Analysis - Explained

What is a Cost-Benefit Analysis? How does a Cost-Benefit Analysis Work? Academic Research for Cost Benefit Analysis

What is a Cost-Benefit Analysis?

Cost benefits analysis refers to a technique used to measure the return against cost in both financial and environmental aspects. The technique provides a better analysis of the data under evaluation. The current economy is based on analytics, and people make many decisions based on daily activities.

What Is A Cost-Benefit Analysis?

- A cost-benefit analysisis the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective. Generally speaking, cost-benefit analysis involves tallying up all costs of a project or decision and subtracting that amount from the...

How to Conduct A Cost-Benefit Analysis

- 1. Establish a Framework for Your Analysis

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization. Identify the goals and objectives you’re trying to address with the proposal. W… - 2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action. When tallying costs, you’ll likely begin with direct costs, which include expenses directly related to the production or develo…

Pros and Cons of Cost-Benefit Analysis

- There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.

What Is A Cost-Benefit Analysis (CBA)?

- A cost-benefit analysis is a systematic process that businesses use to analyze which decisions to make and which to forgo. The cost-benefit analyst sums the potential rewards expected from a situation or action and then subtracts the total costs associated with taking that action. Some consultants or analystsalso build models to assign a dollar val...

Understanding Cost-Benefit Analysis

- Before building a new plant or taking on a new project, prudent managers conduct a cost-benefit analysis to evaluate all the potential costs and revenues that a company might generate from the project. The outcome of the analysis will determine whether the project is financially feasible or if the company should pursue another project. In many models, a cost-benefit analysis will also fa…

The Cost-Benefit Analysis Process

- A cost-benefit analysis should begin with compiling a comprehensive list of all the costs and benefits associated with the project or decision. The costs involved in a CBA might include the following: 1. Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. 2. Indirect costs might include electricity, overhead costs from manag…

Limitations of The Cost-Benefit Analysis

- For projects that involve small- to mid-level capital expenditures and are short to intermediate in terms of time to completion, an in-depth cost-benefit analysis may be sufficient enough to make a well-informed, rational decision. For very large projects with a long-term time horizon, a cost-benefit analysis might fail to account for important financial concerns such as inflation, interest …

What Is A Cost-Benefit Analysis?

Cost-Benefit Analysis in Project Management

- In project management, a cost-benefit analysis is used to evaluate the cost versus the benefits in your project proposal and business case. It begins with a list, as so many processes do. There’s a list of every project expense and what the expected benefits will be after successfully executing the project. From that, you can calculate the cost-benefit ratio (CBR), return on investment (ROI)…

The Purpose of Cost-Benefit Analysis

- The purpose of cost-benefit analysis in project management is to have a systemic approach to figure out the pluses and minuses of various paths through a project, including transactions, tasks, business requirements and investments. The cost-benefit analysis gives you options, and it offers the best approach to achieve your goal while saving on investment. There are two main p…

How to Do A Cost-Benefit Analysis

- According to the Economist, CBA has been around for a long time. In 1772, Benjamin Franklin wrote of its use. But the concept of CBA as we know it dates to Jules Dupuit, a French engineer, who outlined the process in an article in 1848. Since then, the CBA process has greatly evolved. Let’s go through this checklist to learn how to do a cost-benefit analysis:

Cost-Benefit Analysis Example

- Now let’s put that theory into practice. For our cost-benefit analysis example, we’ll do an assessment of a project that involves delivering a product as its main goal.

How Accurate Is Cost-Benefit Analysis?

- How accurate is CBA? The short answer is it’s as accurate as the data you put into the process. The more accurate your estimates, the more accurate your results. Some inaccuracies are caused by the following: 1. Relying too heavily on data collected from past projects, especially when those projects differ in function, size, etc., to the one you’re working on 2. Using subjective impression…

Are There Limitations to Cost-Benefit Analysis?

- Cost-benefit analysis is best suited to smaller to mid-sized projects that don’t take too long to complete. In these cases, the analysis can help decision-makers optimize the benefit-cost ratio of their projects. However, large projects that go on for a long time can be problematic in terms of CBA. There are outside factors, such as inflation, interest rates, etc., that impact the accuracy of …

Templates to Help with Your Cost-Benefit Analysis

- As you work to calculate the cost-benefit analysis of your project, you can get help from some of the free project management templateswe offer on our site. We have dozens of free templates that assist every phase of the project life cycle. For cost-benefit analysis, use there three.

Make Any Project Profitable with Projectmanager

- No matter how great your return on investment might be on paper, a lot of that value can evaporate with poor execution of your project. ProjectManager is an award-winning project management softwarethat has the tools you need to realize the potential of your project. First, you need an airtight plan.