- List your yearly earnings. Your Social Security benefit is based on your average indexed monthly earnings (AIME).

- Adjust earnings to account for inflation. If you have earnings decades in the past, the SSA increases these amounts so that all income is expressed in today's dollars.

- Add up your income for the 35 highest years. Social Security benefits are based on your average earnings for 35 years of work.

- Divide your total by 420. Once you've totaled your 35 highest-earning years, get the average by dividing that total amount by the number of months in 35 years, which ...

- Check your figure with the SSA's quick calculator. Once you've done the calculation yourself and understand how the AIME formula works, you can use the calculator available on the ...

How do I Check my SS Benefits?

These fact sheets include:

- Retirement Ready (Fact Sheet For Workers Ages 18-48) [ English | Spanish ]

- Retirement Ready (Fact Sheet For Workers Ages 49-60) [ English | Spanish ]

- Retirement Ready (Fact Sheet For Workers Ages 61-69) [ English | Spanish ]

- Retirement Ready (Fact Sheet For Workers Ages 70 and Up) [ English | Spanish ]

What are the benefits of SSA?

Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays disability benefits to you and certain members of your family if you have worked long enough... Social Security and Retirement.

How can I determine my Social Security benefits?

- The SSA counts up the number of years from the year you turned 22 to the year before you became disabled.

- It throws out between one and five years (the longer you’ve been working, the more “dropout years”).

- The resulting number is how many of your highest-earning years will go into the PIA calculation.

How do you find out your Social Security benefits?

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

How do they decide how much you get from Social Security?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA). The PIA is the basis for the benefits that are paid to an individual.

What factors determine Social Security benefits?

Your monthly Social Security benefit is determined by four main factors: your work history, your earnings history, your birth year, and your claiming age.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Why is my Social Security being reduced?

If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

What is the minimum Social Security benefit for 2019?

The first full special minimum PIA in 1973 was $170 per month. Beginning in 1979, its value has increased with price growth and is $886 per month in 2020. The number of beneficiaries receiving the special minimum PIA has declined from about 200,000 in the early 1990s to about 32,100 in 2019.

How does Social Security calculate AIME?

They use the sum of the top 35 years of indexed earnings, divide that number by 35 for the annual average, and then they divide that number by 12 for the monthly average. This is your AIME.

How does Social Security calculate monthly benefits?

The Social Security Administration calculates your monthly benefits based on your lifetime earnings. Using that number, they index (adjust) those earnings for external changes like inflation. The number they come up with is called the average indexed monthly earnings.

What is a PIA?

The PIA is calculated with the formula in effect for the year retirees turn 62. Even if retirees start getting their benefits at 66 years old, the formula for them is that which was in effect when they were 62. Your PIA is the monthly benefit that you will get at your full retirement age.

What is the AIME amount for 2021?

For example, a person who had maximum-taxable earnings in each year since age 22, and who retires at age 62 in 2021, would have an AIME equal to $11,098. Based on this AIME amount and the bend points $996 and $6,002, the PIA would equal $3,262.70. This person would receive a reduced benefit based on the $3,262.70 PIA.

How is Social Security calculated?

Social Security benefits are typically computed using "average indexed monthly earnings.". This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount ( PIA ). The PIA is the basis for the benefits that are paid to an individual.

Can you get higher PIA than PIA?

Benefits can be higher than the PIA if one retires after the normal retirement age. The credit given for delayed retirement will gradually reach 8 percent per year for those born after 1942. A table illustrates the complex interaction among normal retirement age, actuarial reduction, and delayed retirement credit.

Is a person entitled to a PIA before 62?

We pay reduced benefits to one who retires before his/her normal retirement age. A person cannot collect retirement benefits before age 62.

Can disability benefits be reduced?

In such cases, disability benefits are redetermined triennially. Benefits to family members may be limited by a family maximum benefit.

What is the effect of Social Security on lower income earners?

The effect of these calculations is that a Social Security benefit "replaces" more of the income of lower-wage earners than it does for higher-wage earners. The effect is to help level the playing field in retirement between workers of different income levels.

What percentage of a spouse's Social Security benefit is a PIA?

If you're married, the PIA will also figure in any benefit amount that your spouse would be due, generally 50 percent of your PIA if the spouse turns on the tap at full retirement age. The PIA is also the basis of a survivor's benefit and a child's benefit.

How many years of work do you have to work to get Social Security?

It starts with Social Security examining your earnings history — with an emphasis on the money you earned during your 35 highest-paid years. That means that if you worked 40 years, Social Security would use your highest-paid 35 years in its calculations and ignore the other five.

What is PIA in Social Security?

The next step is to calculate your all-important primary insurance amount (PIA).

Why do I get my unemployment benefits early?

The reason: If you start early, you will get more payments for a longer period of time, but with smaller amounts of money in each payment .

Is there a limit to how high a salary can go on Social Security?

There are limits to how high it can go, however, because wages above the ceiling aren't subject to Social Security tax and aren't counted in your benefit calculation. OK, now that we know the rules of the retirement road, let's see how Social Security figures out the dollars and cents that become your monthly benefit.

Is Social Security an earned benefit?

The first is that a Social Security benefit is an earned benefit. It's not a freebie. We Americans earn our benefits by working for many years and paying the Social Security tax in each of those years. That tax is 6.2 percent of your wages up to a ceiling ($127,200 in 2017).

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SSI disability?

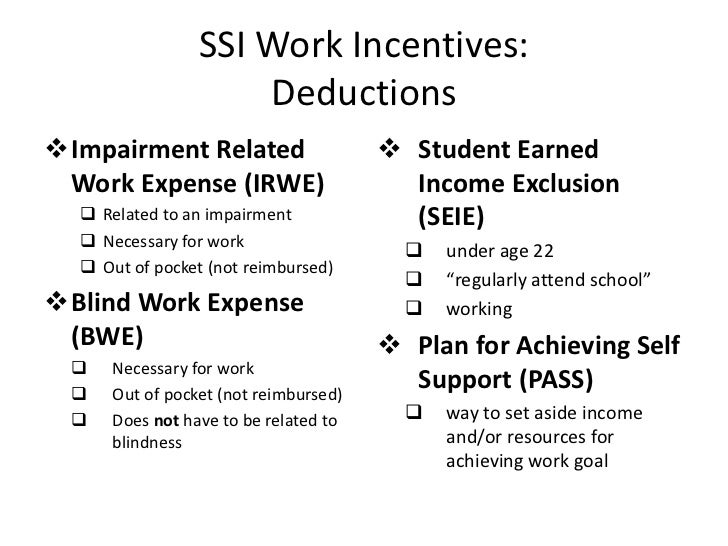

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.

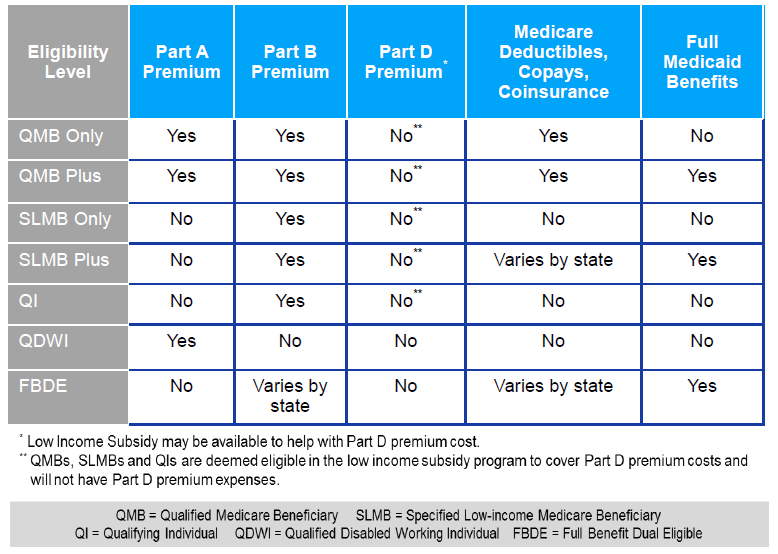

What percentage of the population will be 65 in 2029?

By 2029, it is projected that over 20% of the aggregate population in the United States will be 65-plus years of age. For Medicare recipients 65 years of age or older, the proportion of total income represented by Social Security payouts is about one-third.

How long do you have to be on Medicare if you are 65?

If you are under 65, you may apply for Medicare if you have received payments for Social Security Disability Insurance (SSDI) for a minimum of 24 months or if you have been diagnosed with end-stage renal disease (ESRD).

When did Medicare start?

It seems like Social Security has been around forever since this benefit is vital to so many people. It can be hard to believe that Social Security was only enacted in 1935, and Medicare did not exist until 1965. Millions of Medicare recipients have been greatly impacted by these benefits. Baby Boomers, in particular, have played ...

How many credits do you need to get Social Security?

For example, in 2018, $1,320 yielded one credit. Up to four credits may be earned per year, and the minimum required is 40 credits.

How much does the SSA withhold?

If you make more than $45,360 in 2018 after filing a claim for Social Security benefits, SSA withholds $1 in benefits for every $3 you earn in excess of this higher limit.

How to calculate Social Security benefits?

Your Social Security benefit is based on your average indexed monthly earnings (AIME). You can calculate this by looking at your annual income each year. Make sure you only include the portion of your income that was subject to Social Security tax.

How many years do you have to work to get Social Security?

Add up your income for the 35 highest years. Social Security benefits are based on your average earnings for 35 years of work. If you haven't worked for at least 35 years, Social Security will average in zeroes for as many years as you are short. If you've worked more than 35 years, choose the 35 years in which you earned the most income.

How much will Social Security be reduced if you retire early?

However, if you claim your benefit before you reach full retirement, your benefits will be reduced by 30 percent.

What is the age of full retirement?

1. Determine your normal retirement age (NRA). Your NRA, also called "full retirement age," is based on the year you were born, but varies generally from 65 to 67. This is the age at which you will receive your full benefit amount. If you file a claim for Social Security benefits before this age, you'll get less money.

Who is Jennifer Mueller?

Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

Is Social Security taxable if spouse is still working?

This is also true if your spouse is still working, since Social Security benefits are also taxable. Decide whether you plan to keep working. If you don't intend to completely quit working after you file your claim for Social Security benefits, the SSA may withhold some of your benefits.

How much will Social Security pay in 2021?

Let’s say that you file for Social Security benefits at age 62 in January 2021 and your payment will be $600 per month ($7,200 for the year). During 2021, you plan to work and earn $23,920 ($4,960 above the $18,960 limit). We would withhold $2,480 of your Social Security benefits ($1 for every $2 you earn over the limit). To do this, we would withhold all benefit payments from January 2021 through May 2021. Beginning in June 2021, you would receive your $600 benefit and this amount would be paid to you each month for the remainder of the year. In 2022, we would pay you the additional $520 we withheld in May 2021.

Can I get Social Security if I retire in 2021?

Under this rule, you can get a full Social Security check for any whole month you’re retired, regardless of your yearly earnings.In 2021, a person younger than full retirement age for the entire year is considered retired if monthly earnings are $1,580 or less.

Can I work and get Social Security?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you’re younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn’t truly lost. Your benefit will increase at your full retirement age to account for benefits withheld due to earlier earnings. (Spouses and survivors, who receive benefits because they have minor or disabled children in their care, don’t receive increased benefits at full retirement age if benefits were withheld because of work.)