How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

How does collecting unemployment affect your taxes?

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. You'll still pay significantly less in FICA taxes than you would have if you'd been working if you collected unemployment through a significant part of the year.

Do you have to pay taxes on unemployment benefits?

The IRS views unemployment compensation as income, and it generally taxes it accordingly. You can elect to have federal income tax withheld from your unemployment compensation benefits, much like income tax would be withheld from a regular paycheck. Unfortunately, you don't have a choice as to how much you want to be withheld.

Do employers pay unemployment benefits when they fire someone?

Yes, in most cases. If you are fired, apply for unemployment compensation immediately. Your employer does NOT pay unemployment benefits. What they pay is unemployment INSURANCE, a percentage of your pay that is based on claims, or the amount that the employers company has caused your State Unemployment Insurance (SUI) to pay out.

What is the tax treatment of unemployment?

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as: Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund.

When was the American Rescue Plan Act signed into law?

We're reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Do you have to include unemployment benefits in gross income?

Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund. If you received unemployment compensation during the year, you must include it in gross income.

What are the types of unemployment benefits?

Here are some types of payments taxpayers should check their withholding on: 1 Benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund 2 Railroad unemployment compensation benefits 3 Disability benefits paid as a substitute for unemployment compensation 4 Trade readjustment allowances under the Trade Act of 1974 5 Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and 6 Unemployment assistance under the Airline Deregulation Act of 1978 Program

Is unemployment taxable in 2020?

By law, unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted this spring. Withholding is voluntary.

When are quarterly estimated taxes due?

The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively.

When will the IRS recalculate unemployment benefits?

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. COVID Tax Tip 2021-46, April 8, 2021. Normally, any unemployment compensation someone receives is taxable. However, a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. The IRS will automatically refund money ...

Will unemployment be refunded in 2020?

This law change occurred after some people filed their 2020 taxes. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation, the IRS will determine the correct taxable amount of unemployment compensation. Any resulting overpayment of tax will be either refunded or applied ...

Do you have to file an amended tax return?

Taxpayers only need to file an amended return if the recalculations make them newly eligible for additional federal tax credits or deductions not already included on their original tax return.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.

Will unemployment be taxed in 2020?

Some states that usually tax unemployment benefits are likely to follow the federal exclusion for 2020. "Some states start their state tax return preparation with the federal adjusted gross income figure," says Luscombe. "In those states the exclusion would automatically be taken into account also for state income tax purposes.

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Do you have to file an amended tax return if you already filed your state income tax return?

Other states may have to take specific action to allow the exclusion.". Taxpayers who already filed their state income-tax return and qualify for the exclusion may need to file an amended return, he says. Check with your tax professional or your state's department of revenue as guidance becomes available.

How Are Unemployment Benefits Taxed?

Unemployment benefits are designed to replace a portion of your regular wages. As such, the IRS treats them like any other wages and taxes them at your ordinary income tax rate.

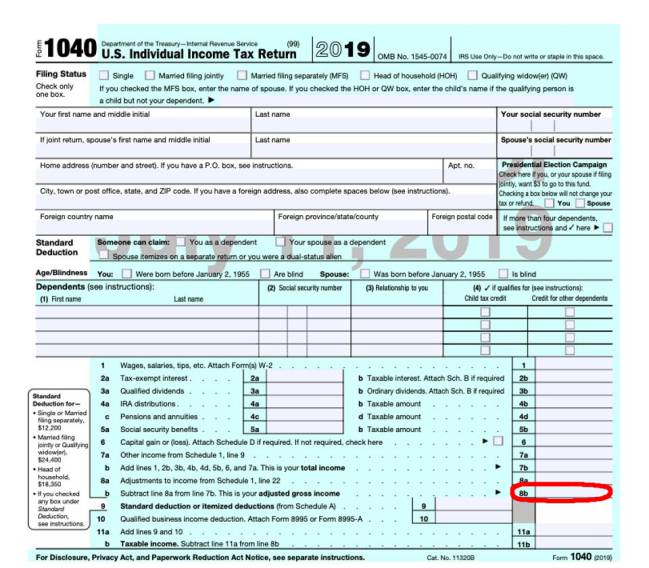

How to Pay Federal Income Taxes on Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your state’s unemployment office to instruct them to withhold taxes.

State Income Taxes on Unemployment Compensation

You may also need to pay state income taxes on your unemployment benefits. This is another tricky area because each state has different rules. Some states don’t have a state-level income tax, and others don’t tax unemployment benefits. Some tax unemployment benefits in full, and others impose taxes on only a portion of benefits.

Do you have to pay taxes on unemployment?

Yes. The IRS considers unemployment benefits "taxable income." When filing this spring, your unemployment checks from 2021 will be counted as income, taxed at your regular rate. This applies both to standard unemployment benefits and the expanded benefits that were available to some during 2021.

Do you have to pay state taxes on unemployment?

Maybe. If your state of residence collects income taxes, you may have to pay taxes on your benefits to both state and federal governments. That noted, there are a few states that waive unemployment income taxes. They are:

How do I know if I already paid taxes on my unemployment benefits?

If you received unemployment insurance this year, you'll receive a Form 1099-G, which shows how much money you received from your unemployment benefits. It will also show whether or not you elected to withhold taxes and, if so, how much was withheld.

How to avoid a large tax bill in the future

Whether or not you decide to withhold taxes from your unemployment benefits depends on your financial situation. If you need the full payment to get by, it may sound appealing to put off paying taxes in the hope of being in a stronger financial situation later on. That noted, it can be devastating to get hit with a big tax bill in the spring.