How to tell if you are eligible for unemployment benefits?

You must be:

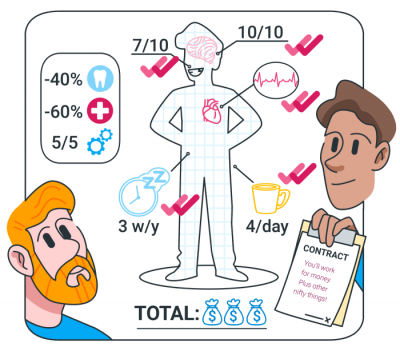

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

What are the maximum unemployment benefits?

You may be eligible for the dependency allowance if you are the main support for any child who is:

- Under the age of 18

- Under the age of 24 and a full-time student at an educational institution

- Over the age of 18 and incapacitated due to a mental or physical disability

How much can you collect on unemployment?

To be eligible for Unemployment Insurance (UI) benefits, you must:

- Have earned at least: $5,700 during the last 4 completed calendar quarters, and 30 times the weekly benefit amount you would be eligible to collect

- Be legally authorized to work in the U.S.

- Be unemployed, or working significantly reduced hours, through no fault of your own

- Be able and willing to begin suitable work without delay when offered

What is the maximum unemployment benefit amount?

Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823. North Carolina and Florida offer unemployment benefits for the shortest length of time with a maximum of 12 weeks.

How are unemployment rates calculated?

In simple terms, the unemployment rate for any area is the number of area residents without a job and looking for work divided by the total number of area residents in the labor force.

How does EDD determine benefit amount?

The EDD will compute your weekly benefit amount based on your total wages during the quarter in your base period when you earned the most. For all but very low-wage workers, the weekly benefit amount is arrive at by dividing those total wages by 26—up to a maximum of $450 per week.

Who is eligible for partial unemployment benefits in New Jersey?

To be eligible for partial benefits, you cannot work more than 80 percent of the hours normally worked in the job. For example, if you worked a 40-hour week, you won't be able to get benefits if you work more than 32 hours.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Is EDD giving extra 300 a week?

We automatically added the federal unemployment compensation to each week of benefits that you were eligible to receive. Any unemployment benefits through the end of the program are still eligible for the extra $300, even if you are paid later.

Whats the most EDD will pay?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

Can I still get unemployment if I go back to work part-time NJ?

Yes, a claimant may be eligible for partial unemployment benefits while working part time due to lack of work. However, the worker's weekly benefit amount will be reduced dollar-for-dollar for all earnings in excess of 20% of the worker's full weekly benefit rate.

How is unemployment calculated in NJ?

If you are eligible to receive unemployment, your weekly benefit rate (WBR) will be 60% of your average weekly earnings during the base period, up to a maximum of $713. This number is then multiplied by the number of weeks that you worked during the base period, up to a maximum of 26 weeks.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

How much can I make and still get unemployment in Texas?

You may earn up to 25% of your Weekly Benefit Amount before we reduce your benefits for that week. If you earn more, then we will reduce your benefit payment by the amount that is over 25%. If you earn more than your weekly benefit amount plus 25%, we cannot pay you benefits for that week.

What is the maximum unemployment benefit in Texas 2020?

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Do higher wages get a larger benefit check?

In a way, this would be up to a cap that is tied to the average earnings in that state. So the employees with a higher wage would receive a larger benefits check but it is still a percentage of what they used to earn. The amount that an employee would receive differs from each state.

Can I file unemployment if I received severance pay?

Have your entire information ready before filing your claim. If you have received severance pay upon your separation from work, you may still be eligible for unemployment benefits. So it is still important to call and file your initial claim during your first week of total or partial unemployment.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

How much is dependent allowance?

Dependency allowance. If you are the whole or main support of a child, you may be eligible for a weekly dependency allowance of $25 per dependent child. Spouses are not included. The total dependency allowance you receive cannot be more than 50% of your weekly benefit amount.

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

How much is the maximum UI benefit?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week. Follow the steps below to calculate the amount ...

What to do if you disagree with your wage?

If you disagree with the wages reported on your Monetary Determination notice, you can provide proof of the wage amounts you are disputing by completing and returning the Wage and Employer Correction sheet that was mailed to you with your notice.

How long can you collect unemployment in the US?

Before the coronavirus, most states offered unemployment benefits for a maximum of 26 weeks. The CARES Act allowed states to add an additional 13 weeks of eligibility. And later coronavirus relief bills gave further extensions, with a current end date of September 6, 2021.

When will the supplemental unemployment benefits end?

Second, about half of states intend to end these supplemental benefits before the September 6, 2021 deadline. Third, the length of time a person could get unemployment got extended.

How much does Jane make on unemployment?

Specifically, they can earn the equivalent of 50% of their weekly unemployment benefits without penalty. Because Jane receives $470 each week, she can earn up to $235 per week without it having any effect on her $470 per week benefit. Unfortunately for Jane, she makes $400 per week.

Can I get unemployment if I work full time?

If you’re in school. If you choose to attend classes full time, most states will no longer consider you unemployed. A few states will have exceptions to this rule.

Can I work part time while receiving unemployment?

Some states will let you work part-time while still receiving unemployment. Other states will deduct a certain amount of money from your weekly benefits based on how much money you earn from your job. Keep in mind that in some states, working part-time could result in an unreasonable loss in unemployment benefits.

Is there a one size fits all method for unemployment?

They also determine what effect working part-time or going to school can have on your unemployment eligibility. Unfortunately, there’s no one-size-fits-all method of determining the unemployment you can receive.

Does unemployment go up or down?

Your unemployment benefits can go up or down based on other factors that don’t relate to your total wages. These variables will mainly affect how much money you receive, but they can also affect how long you can receive weekly unemployment payments. Some of these variables include:

When will I know my weekly benefit amount?

After you apply for benefits, we will mail you an Unemployment Claim Determination letter that tells you how much you are potentially eligible to receive.

How much can I get each week?

In Washington state, the maximum weekly benefit amount is $929. The minimum is $295. No one eligible for benefits will receive less than $295, regardless of their earnings.

How can I estimate my weekly benefit amount?

You can estimate your own weekly benefit amount to see how much you are potentially eligible to receive. To do this, you need to know which calendar quarters will make up your base year.

Alternate base year (ABY) claims

You could be eligible for an alternate base year claim if you do not have the required 680 hours of work in your regular base year.

Earning deductions chart

This chart helps determine how much you may get if you report partial earnings during a week.

What is the maximum weekly benefit for 2021?

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2021, the maximum weekly benefit rate is $731. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

Can I collect unemployment if my hours were reduced?

If your work hours were reduced, but not completely cut, you may still be able to collect Unemployment Insurance benefits. NOTE: When claiming benefits, you must report your part-time wages when earned, even if you have not yet been paid. How we calculate partial Unemployment Insurance benefits.

Weekly Benefit Rate Estimator

You can use this tool to estimate a weekly Unemployment Insurance benefit amount.

Benefit Weeks Calculator

Use this calculator to estimate the maximum number of weeks of benefits you may receive.

Partial Unemployment Benefit Calculator

If you work part time, your benefits are reduced in increments based on your total hours of work for the week.

How is unemployment computed?

Unemployment is computed and one half of what your weekly pay was at the time of the discharge up to your state's maximum benefit. You will have to verify with your state's unemployment office to see what the highest payout for your state is. For further details refer unemployment benefits article.

How long does it take to get a determination from unemployment?

This determination is normally issued about six weeks from the date you filed your claim. You must be eligible on all issues in order to get paid.

How long can I get unemployment?

How long will I receive benefits: Usually, most states permit an individual to obtain unemployment for a maximum of 26 weeks, or half the benefit the benefit year. A few states have standardized benefit duration, while most have different durations depending upon the worker.

What are the issues that affect your unemployment claim?

Below is a general description of the issues which can affect your claim: You were discharged (fired), you quit, or you are on a suspension or leave of absence from your last employer or other recent employers. You are a school employee and you are not working because you are between terms or on a vacation or holiday.

Can I backdate my unemployment claim in Florida?

Your claim cannot be retroactively backdated to the date of job separation which began the period of your unemployment. I am working part-time.

Do you lose unemployment benefits if you claim a week?

If your gross earnings for a claim week are equal to or greater than your weekly benefit amount, no unemployment compensation benefits will be paid to you for that week. You do not lose the benefits - the benefits are just not paid for that week. The benefits remain as available credits.