- Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments.

- Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation.

- Those earnings are converted to a monthly insurance payment based on your full retirement age.

- Your monthly payment will decrease or increase if you retire earlier or later than your full retirement age (up to age 70).

What is the maximum Social Security benefit After retirement?

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment. 10 Ways to Increase Your Social Security Payments.

What exactly are Social Security retirement benefits?

Social Security's benefits formula is always based on a 35-year work history. If you work exactly 35 years, you'll get benefits equaling a percentage of average wages over your entire career.

How to maximize your Social Security retirement benefits?

This will net you the lowest possible benefit, as depending on your lifetime earnings record, you will need to draw on your total Social Security earnings years earlier than “full retirement age.”

How do I estimate my SS Benefits?

You may want to may want to consider using my company's software — Maximize My Social Security or MaxiFi Planner — to ensure your household receives the highest lifetime benefits. Social Security calculators provided by other companies or non-profits may provide proper suggestions if they were built with extreme care. Best, Larry

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How many years do you have to work to get maximum Social Security?

35 yearsQualifying for Social Security in the first place requires 40 work credits or approximately 10 years of work. 2 To be eligible to receive the maximum benefit, you need to earn Social Security's maximum taxable income for 35 years.

How do you determine amount of Social Security you will receive?

We: Base Social Security benefits on your lifetime earnings. Adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Calculate your average indexed monthly earnings during the 35 years in which you earned the most.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Is it better to take Social Security at 62 or 67?

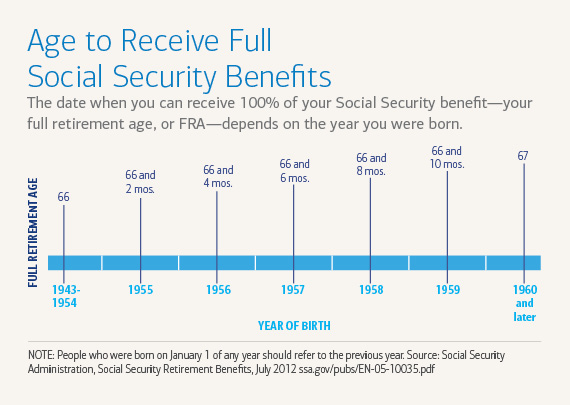

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $80000 a year?

Initial Social Security retirement benefits by age and income levelAnnual Income (Inflation-Adjusted)Age 6266 Years, 4 Months (FRA)$70,000$1,695$2,312$80,000$1,787$2,437$90,000$1,879$2,562$100,000$1,970$2,6875 more rows•Aug 21, 2018

How much Social Security will I get if I make $40000?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

How the Retirement Estimator Works

The Retirement Estimator calculates a benefit amount for you based on your actual Social Security earnings record. Please keep in mind that these are just estimates.

Who Can Use the Retirement Estimator

You can use the Retirement Estimator if you have enough Social Security credits to qualify for benefits and you are not:

How Long Can You Stay On Each Page?

For security reasons, there are time limits for viewing each page. You will receive a warning if you don’t do anything for 25 minutes, but you will be able to extend your time on the page.

When can I claim my Social Security benefits?

You can claim earned benefits as early as age 62, the minimum retirement age. However, if you claim before your full retirement age, your monthly benefits will be lower. If you claim later than full retirement age, your benefits will be higher.

How much does Social Security pay out if only one spouse works?

If only one spouse worked, then the Social Security Administration calculates half of the worker spouse’s PIA and adjusts it (between 32.5% and 50% ) based on the age of the claiming spouse. If both spouses worked, then the Social Security Administration first pays out benefits on one’s own earnings record.

What happens to Social Security benefits if you claim a survivor before your full retirement age?

Moreover, if a survivor claims this benefit before their survivors full retirement age, the benefits are reduced by a percentage based on their birth year. (See the survivors full retirement age by birth year below. Note that survivor benefits have a different full retirement age than other Social Security benefits.)

What is the difference between a higher and lower earning spouse's PIA?

So take as an example a couple where the lower-earning spouse’s PIA is $1,100, and the higher-earning spouse’s PIA is $2,000. Because the $2,000 PIA is greater than half of the lower-earning spouse’s PIA, the lower earning spouse will not receive a spousal benefit.

What is the maximum amount of Social Security benefits in 2020?

The maximum amount of earnings a worker can use toward Social Security changes every year. In 2020, that maximum is $137,700. That 35-year total is divided by 12 to reach the “average indexed monthly earnings” (AIME). That AIME figure is then used in a formula.

What is PIA in Social Security?

Your PIA is what your monthly benefit would be if you started collecting Social Security at your full retirement age (FRA). Your full retirement age is calculated based on your birth year: The other factor that determines your Social Security benefit amount is how old you are when you claim.

How long do you have to work to get Social Security?

The Social Security Administration bases those benefits on the highest 35 years of a worker’s salary history. (If someone worked less than 35 years, all of their working years will be used.)

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.