The cap, which is the amount of earnings subject to Social Security tax, is $147,000 in 2022, up from $142,800 in 2021. Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation.

What is my approximate, estimated Social Security benefit?

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

How to maximize social security benefits?

- How You Fund Retirement Matters. Let’s say you wait until age 70 to draw benefits. ...

- Age Matters. This may seem counter-intuitive, but the longer you wait to claim Social Security (up until age 70), the higher your benefit. ...

- Planning As a Couple Makes a Difference. ...

How do I estimate Social Security benefits?

- Up to 85% of your Social Security may be taxable.

- If your provisional income is above $25,000 as a single filer or $32,000 as a joint filer, you may owe federal income taxes.

- You can pay estimated taxes quarterly, through benefit withholdings, or in full with your federal tax return.

How can you get the maximum Social Security benefit?

Social Security benefits ... you've never checked your earnings record, you'll want to go back as far as you can in comparing reported income to the amount you know you made. This could mean digging out old tax records and paperwork. But once you get ...

How much do you have to earn to get maximum Social Security?

In 2022, if you're under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

What is the formula to calculate Social Security benefits?

For a worker who becomes eligible for Social Security payments in 2022, the benefit amount is calculated by multiplying the first $1,024 of average indexed monthly earnings by 90%, the remaining earnings up to $6,172 by 32%, and earnings over $6,172 by 15%.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much Social Security will I get if I make 80000 a year?

Initial Social Security retirement benefits by age and income levelAnnual Income (Inflation-Adjusted)Age 62Age 70$60,000$1,554$2,741$70,000$1,695$2,990$80,000$1,787$3,152$90,000$1,879$3,3135 more rows•Aug 21, 2018

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $40000 a year?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How much Social Security will I get if I make $30000 a year?

0:362:30How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

How much will my Social Security be if I make 100k a year?

Join Over 1 Million Premium Members Receiving…Current AgeCurrent SalaryEstimated Benefit at 62 and 1 Month35$100,000$1,93640$100,000$1,90545$100,000$1,86550$100,000$1,8182 more rows•Apr 28, 2020

How much Social Security will I get if I make 120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

How is maximum benefit calculated?

The way that the maximum benefit for a particular year is calculated is based upon the maximum wage base for the year, as well as the applicable COLAs that would apply after the PIA ( Primary Insurance Amount) has been calculated for that individual.

What is the maximum Social Security benefit for 2013?

For 2013, the maximum Social Security benefit for someone reaching Full Retirement Age (FRA) in that year will be $2,533, an increase of $20 over 2012.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How Is Social Security Calculated?

There is a three-step process used to calculate the amount of Social Security benefits you will receive.

How to calculate Social Security if you are not 62?

Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward, and use those to create an estimate.

How to calculate indexing year?

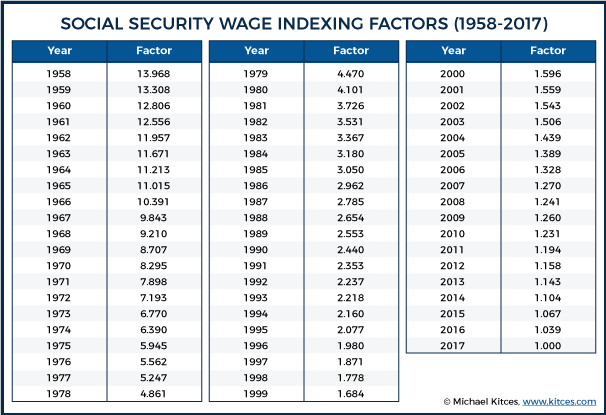

Your wages are indexed to the average wages for the year you turn 60. 4 For each year, you take the average wages of your indexing year (which is the year you turn 60) divided by average wages for the years you are indexing, and multiply your included earnings by this number. 5

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

What is the process used to determine how to adjust your earnings history for inflation?

Social Security uses a process called "wage indexing" to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3

How to find average indexed monthly earnings?

Total the highest 35 years of indexed earnings, and divide this total by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.