Unemployment Benefits By State

| State | Max Benefits | Employment Agency | Phone Number |

| Alabama | 26 weeks $275/wk max | Alabama Department of Labor | 334-242-8025 |

| Alaska | 26 weeks $370/wk max | Alaska Department of Labor and Workforce ... | 907-269-4700 |

| Arizona | 26 weeks $240/wk max | Arizona Department of Economic Security | 1-877-600-2722 |

| Arkansas | 26 weeks $451/wk max | Arkansas Department of Workforce Service ... | 501-682-2121 |

What are the reasons for not receiving unemployment?

- They are ill with COVID-19.

- They might have been exposed to coronavirus.

- They were ordered to stay home by a doctor to prevent the risk of getting exposed to, or spreading, coronavirus.

- Their employer shut down or cut back their business due to coronavirus.

- They were advised not to work by public health officials.

What must an employer say for you to get unemployment?

The CARES Act extends eligibility for benefits to individuals who are:

- self-employed, including gig workers, freelancers, and independent contractors;

- seeking part-time employment;

- have an insufficient work history to qualify for benefits;

- have exhausted all rights to regular or extended benefits under state or federal law or to Pandemic Emergency Unemployment Compensation (PEUC);

What is the maximum unemployment benefit amount?

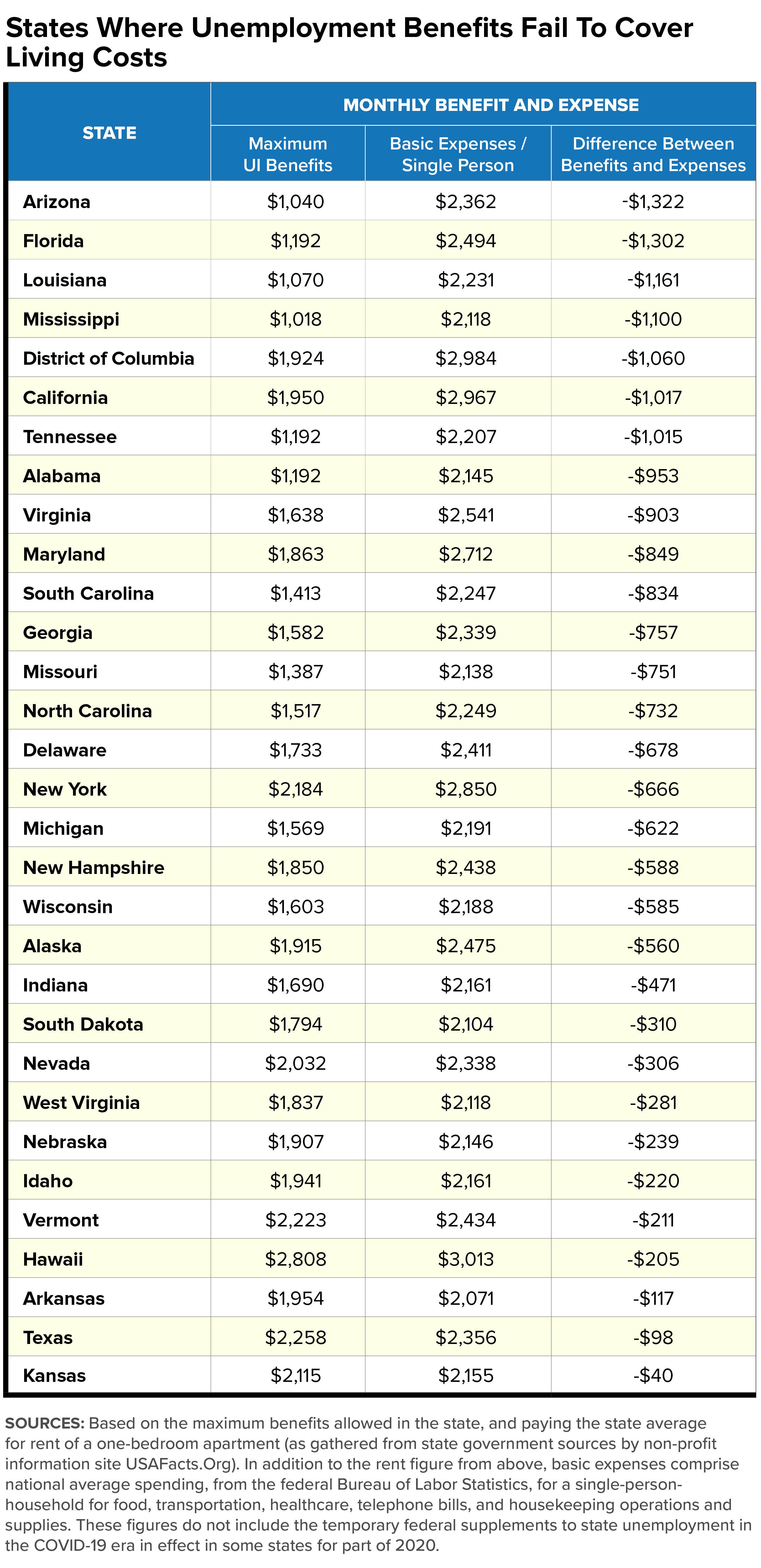

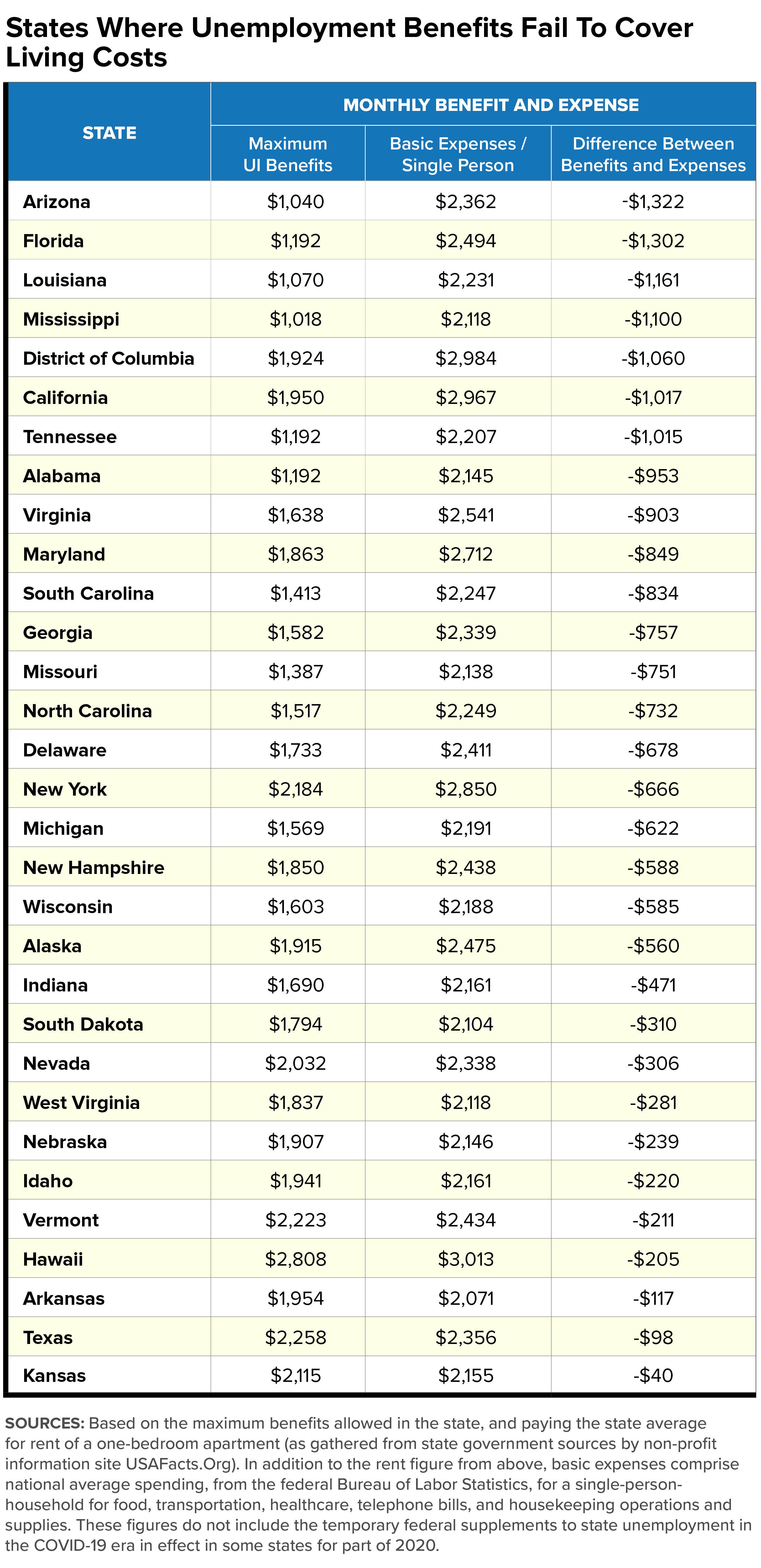

Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823. North Carolina and Florida offer unemployment benefits for the shortest length of time with a maximum of 12 weeks.

How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

What is the highest amount of unemployment you can collect?

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

What is the maximum unemployment benefit in California 2021?

$450The maximum unemployment benefit you can get in California is $750 a week through September 6, 2021. After that, the maximum weekly benefit is $450.

Which state has the highest weekly unemployment benefit?

The amount of unemployment benefits in each of the USA's 50 states:Massachusetts: $823.Washington: $790.Minnesota: $740.New Jersey: $713.Connecticut: $649.Oregon: $648.Hawaii: $648.North Dakota: $618.More items...•

How do I calculate my unemployment benefits in California?

The EDD will compute your weekly benefit amount based on your total wages during the quarter in your base period when you earned the most. For all but very low-wage workers, the weekly benefit amount is arrive at by dividing those total wages by 26—up to a maximum of $450 per week.

Is EDD giving extra 300 a week?

We automatically added the federal unemployment compensation to each week of benefits that you were eligible to receive. Any unemployment benefits through the end of the program are still eligible for the extra $300, even if you are paid later.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

What state is the easiest to get unemployment?

The Best States For Unemployment BenefitsIowa. ... Kansas. ... North Dakota. ... New Mexico. ... Wyoming. ... Utah. Percentage of Weekly Wages Covered By Benefits: 43.1% ... Montana. Percentage of Weekly Wages Covered By Benefits: 42.5% ... Washington. Percentage of Weekly Wages Covered By Benefits: 42.3%More items...

What state has the highest unemployment 2021?

CaliforniaLooking at the annual average unemployment rate for 2021, California also ranks as the state with the highest unemployment rate at 7.7%, but it's tied with Nevada and Hawaii, who both had annual average unemployment rates of 7.7% for 2021.

Are unemployment benefits taxed?

Yes, you need to pay taxes on unemployment benefits. Like wages, unemployment benefits are counted as part of your income and must be reported on your federal tax return. Unemployment benefits may or may not be taxed on your state tax return depending on where you live.

What is the maximum unemployment benefit in California 2020?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week.

How much does EDD pay per week?

The EDD provides a weekly benefit amount calculator here. The minimum weekly benefit amount is $40. The maximum weekly benefit amount is $450. Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, discussed below, eligible individuals may qualify for an extra $600 weekly payment.

How does EDD determine how much money you get?

Your benefit amount is based on the quarter with your highest wages earned within the base period. A base period covers 12 months and is divided into four consecutive quarters. The base period includes wages subject to SDI tax that were paid about 5 to 18 months before your disability claim began.

When will the 600 dollars be available for unemployment?

It provides an additional $600 per week in benefits and payments through July 31, 2020.

How many weeks of unemployment benefits are there in 2020?

It adds an additional 13 weeks of benefits through December 31, 2020. Most states currently offer 26 weeks of unemployment benefits (see the unemployment benefits by state section below). it expands benefits for part-time, seasonal, self-employed, and contract workers (such as those in the gig economy). Offers to reimburse the cost ...

What is the expanded unemployment benefit?

Expanded Unemployment Benefits Under the CARES Act. The Coronavirus Aid, Relief, and Economic Security (CARES) Act included a section that expanded unemployment benefits by an additional $600 per week on top of the benefit offered by states. This provision is being rolled out on a state by state basis, however, ...

How long do you have to wait to apply for unemployment?

You should apply for unemployment compensation as soon as you are unemployed. Most states will make you wait for one week before you are able to apply for unemployment benefits. However, this is currently waived due to the coronavirus outbreak.

When will the 600 unemployment benefit be rolled out?

This provision is being rolled out on a state by state basis, however, the benefit is retroactive to April 5, 2020. The additional $600 weekly benefit brings the state and federal unemployment benefits up to an average of the median weekly wage in the United States.

Do all workers get maximum unemployment?

Additionally, this table lists the maximum unemployment insurance benefits you can receive. Not all workers will receive the maximum benefit. Benefits are often based on your previous salary, if or when you previously claimed unemployment compensation, and how long you have been working. Each state may also have additional rules regarding whether or not you are out of work through no fault of your own, whether or not you receive any additional income from employment or side gigs, or whether or not you receive additional income from a pension or retirement benefits.

Is unemployment taxable income?

Be aware that unemployment insurance benefits are considered taxable income . However, most states do not automatically withhold any taxes from your unemployment benefits. You may opt to do so, which will save you from a large tax bill down the road.

How long does it take to get unemployment benefits?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How Long Will I Receive Benefits?

Usually, most states permit an individual to obtain unemployment for a maximum of 26 weeks or half the benefit year. A benefit year is a period when your claim is established, and it will remain open for one year (52 weeks).

How to Claim for a Benefits Extension?

If you are presently filing weekly claims for unemployment benefits, carry on filing your weekly claim if you are jobless or are working reduced hours. Thye will inform you by mail if you are eligible for the added benefits.

How to File An Initial Claim in Your State?

If you have been separated from work, you can file your initial claim during your first week of total or partial unemployment.

How to File Your Weekly Claim?

Through the Internet – You can file your weekly claim online. You must have a User ID and PIN to file your weekly claim online.

What happens if you work temporarily and get unemployment?

If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced. Ensure that you contact your state unemployment insurance department once you are unemployed.

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

How much is the maximum UI benefit?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week. Follow the steps below to calculate the amount ...

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

What to do if you disagree with your wage?

If you disagree with the wages reported on your Monetary Determination notice, you can provide proof of the wage amounts you are disputing by completing and returning the Wage and Employer Correction sheet that was mailed to you with your notice.

How to calculate weekly wage if you worked 2 or fewer quarters?

Note: If you worked 2 or fewer quarters, divide the highest quarter by 13 weeks to determine your average weekly wage.

How much do you have to earn to collect unemployment?

To be eligible (UI) benefits, you must: Have earned at least: $5,400 during the last 4 completed calendar quarters, and. 26 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

What is the eligibility for unemployment?

When you apply for Unemployment Insurance (UI), your initial eligibility for benefits is based on a number of factors, including your earnings and your reason for leaving your job. Ongoing eligibility requirements include being able to work, available for work, and actively searching for work.

What is unemployment insurance?

Unemployment Insurance (UI) eligibility and benefit amounts. Unemployment Insurance (UI) offers benefits to workers who have lost their jobs through no fault of their own. Learn more about eligibility, and how your benefits are determined. Skip table of contents.

How do I get unemployment benefits?

To be eligible (UI) benefits, you must: 1 Have earned at least:#N#$5,400 during the last 4 completed calendar quarters, and#N#26 times the weekly benefit amount you would be eligible to collect 2 Be legally authorized to work in the U.S. 3 Be unemployed, or working significantly reduced hours, through no fault of your own 4 Be able and willing to begin suitable work without delay when offered

What happens if there is an issue on your claim?

If there is an issue on your claim, a determination will be sent, which indicates whether or not you are eligible for benefits.

How much is the maximum UI benefit in 2021?

As of Oct. 3, 2021, the maximum weekly benefit amount is $974 per week, which does not include any additional dependency allowance.

What affects your weekly benefits?

Several factors can affect your weekly benefit amount including part-time work, self-employment, going to school full-time, and travel.

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How many times is your base period wage?

Your total base period wages are at least 37 times your weekly benefit amount.

What is past wages?

Past Wages. Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts. We use the taxable wages, earned in Texas, your employer (s) have reported paying you during your base period to calculate your benefits. If you worked in more than one state, see If You Earned Wages in More ...

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

How much is WBA in Texas?

Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

How much does TWC reduce child support?

If you owe court-ordered child support, we will reduce your weekly payment by up to 50 percent to pay your child support. The Office of Attorney General ( OAG) notifies TWC if you owe child support. We deduct the amount directly from your payment and send the funds to OAG, who will give the money to the custodial parent.

How to calculate WBA?

To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

What are the requirements to qualify for unemployment?

However, according to the U.S. Department of Labor, there are two main criteria that must be met in order to qualify: 2 . 1. You must be unemployed through no fault of your own.

How long do you have to work to get unemployment?

Earnings Requirements: To receive unemployment compensation, workers must meet the unemployment eligibility requirements for wages earned or time worked during an established (usually one year) period of time.

How is unemployment determined?

Eligibility for unemployment insurance, the amount of unemployment compensation you will receive, and the length of time benefits are available are determined by state law. Each state has its unemployment agency dedicated to overseeing employment and unemployment based matters.

Can you get unemployment if you quit your job?

1. You must be unemployed through no fault of your own. In this case, a person’s unemployment must be caused by an external factor beyond his or her control, such as a layoff or a furlough. Quitting your job with a good reason or being fired for misconduct in the workplace will most likely render you ineligible for unemployment benefits.

Can you collect unemployment if you are fired?

Unemployment Eligibility When You're Fired: If you were fired from your job, you might be eligible for unemployment, depending on the circumstances. There are a variety of factors that will determine whether you can collect benefits.

Can you get unemployment if you work part time?

Unemployment When You Work Part-Time: Many states provide partial unemployment benefits to individuals whose work hours have been reduced through no fault of their own .

Who administers unemployment?

Eligibility Guidelines Vary. Unemployment programs are administered by the state, so check your state unemployment website for eligibility criteria.

What are the requirements for unemployment in Indiana?

Requirement #1: You are able to work. Indiana unemployment laws require you to be able to find new work before you can receive benefits. You must be able to work. You must be available to work. You must be actively searching for a full-time job.

How do I apply for unemployment in Indiana?

Here’s a quick overview of how the unemployment insurance process works in Indiana.

How to contact Indiana unemployment?

The DWD has FAQs and tutorials on its website. If you need additional assistance, you can reach the department’s benefit call center at 800-891-6499. TDD service is available at 317-232-7560. The call center is open on weekdays from 8 a.m. to 4:30 p.m.

Does Indiana pay unemployment tax?

It’s important to know that only employers pay this tax, and it doesn’t come from your paycheck. For that reason, you meet certain Indiana unemployment requirements to qualify for unemployment benefits. The Indiana Department of Workforce Development (DWD) manages the state’s unemployment benefits program.

How to calculate unemployment benefits?

The amount of weekly benefits is calculated as follows: 1 We calculate your total insurable earnings for the required number of best weeks (the weeks that you earned the most money, including insurable tips and commissions) based on the information you provide and/or your record (s) of employment 2 We determine the divisor (number of best weeks) that corresponds to your regional rate of unemployment Temporary COVID-19 relief 3 We divide your total insurable earnings for your best weeks by your required number of best weeks 4 We then multiply the result by 55% to obtain the amount of your weekly benefits.

What is the minimum unemployment rate in Canada?

a minimum unemployment rate of 13.1% applies to all regions across Canada. if your region’s unemployment rate is higher than 13.1%, we’ll use the higher actual rate to calculate your benefits.

How many weeks of EI benefits are available for seasonal workers?

Seasonal workers: If you’re a seasonal worker, you may be eligible for 5 additional weeks of benefits up to a maximum of 50 weeks. Maximum number of weeks of EI regular benefits payable Temporary COVID-19 relief. Number of hours of insurable employment. Regional Unemployment Rate.

How many weeks of unemployment in Canada?

In regions of Canada with the highest rates of unemployment, we’ll calculate using the best 14 weeks. In regions of Canada with the lowest rates of unemployment, we’ll use the best 22 weeks. In other regions, the number of weeks used to calculate benefits will be somewhere between 14 and 22, depending on the unemployment rate in those regions.

How much can I get in 2021?

As of January 1, 2021, the maximum yearly insurable earnings amount is $56,300. This means that you can receive a maximum amount of $595 per week.

How long do you have to collect the $500?

you’ll receive at least $500 per week before taxes, but you could receive more. you’ll be eligible for up to 50 weeks of regular benefits. if you received the Canada Emergency Response Benefit (CERB), the 52-week period to accumulate insured hours will be extended.

What is the maximum income for a family supplement?

As your income level rises, the Family Supplement gradually decreases, so that when the maximum income of $25,921 is reached no supplement is payable.

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)