Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020. 1 The average cost for health care per state and local government employee hour worked was $6.00 and $2.64 for private industry workers.

How much should employees pay for health insurance?

This article will cover:

- How much is health insurance?

- Health insurance plan tiers and cost

- Factors that affect how much you pay for health insurance

- The cost of other health care options

- How the American Recovery Plan Act makes health insurance cheaper

How much does health insurance cost employers?

Insurance Insurance employer cost per hour worked in state and local government was $6.28 (11.5 percent of total compensation ) in September 2021. Health insurance , which was the most expensive insurance component, cost employers $6.12 (11.2 percent) . Life insurance co st was $0.08 (0.1 percent), long-term

What percent of health insurance is paid by employers?

Most employers tend to pay around 65 – 70% of coverage towards employees plans, while small businesses often find other ways to help employees afford insurance. Hopefully, this guide opened your eyes to the realities of employer health insurance.

How much does employee health care cost?

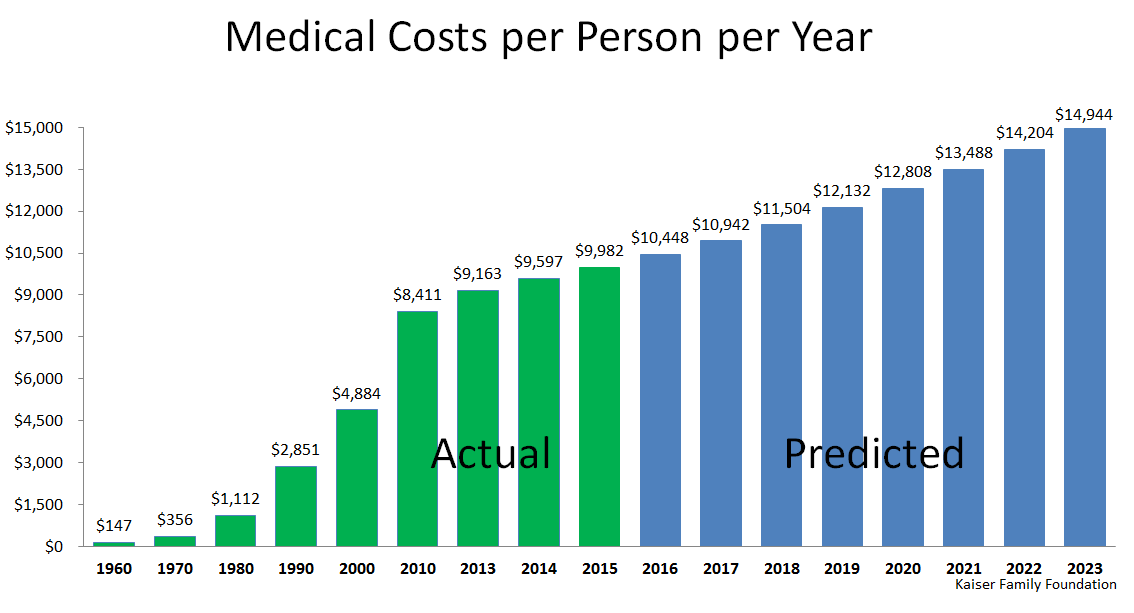

In the U.S. many employers pay a portion of health care costs for employees. As of 2019, the total annual medical costs for employees was just over 13 thousand U.S. dollars. That cost is expected to increase to 13.7 thousand U.S. dollars by 2020.

What percentage of healthcare costs are paid by employers?

Employers paid 78 percent of medical care premiums for single coverage plans and 66 percent for family coverage plans.

What is the cost of benefits to an employer for an employee?

Total employer compensation costs for private industry workers averaged $38.07 per hour worked in December 2021. Wage and salary costs averaged $26.86 and accounted for 70.5 percent of employer costs, while benefit costs were $11.22 and accounted for 29.5 percent.

What is the fully loaded cost of an employee?

The simplest way to derive the average loaded cost of an employee is to count up your total corporate expenses and divide it by the total number of productive hours worked.

How much does an employee really cost?

There's a rule of thumb that the cost is typically 1.25 to 1.4 times the salary, depending on certain variables. So, if you pay someone a salary of $35,000, your actual costs likely will range from $43,750 to $49,000.

How much do employee benefits cost Canada?

Effective January 1, 2022, employees and employers contribute 5.70% up to the maximum (C$3,499.80).

How much is a typical benefits package worth?

The average benefits package is over 30% of an employee's compensation.

How do you calculate the cost of an employee?

Calculate an employee's labor cost per hour by adding their gross wages to the total cost of related expenses (including annual payroll taxes and annual overhead), then dividing by the number of hours the employee works each year. This will help determine how much an employee costs their employer per hour.

How much do employee benefits cost UK?

Surprisingly, the cost of benefits provision is very competitive and is usually 14% of payroll. Mandatory employee benefits in the UK include retirement, holiday pay, maternity/paternity pay (companies often exceed the statutory limit as part of a comprehensive benefits offer), and sick pay.

Why is employer sponsored health insurance important?

Understanding the average cost of employer-sponsored health insurance can help small business owners explore coverage options for themselves, their families, and their employees. According to an April 2019 eHealth survey of small business owners, ...

What are the benefits of employer health insurance?

The Employer Health Benefits 2019 Summary of Findings noted that the level of employer contributions to worker premiums tends to vary: 1 31 percent of covered small firm employees had their employer pay the entire premium for their single coverage. 2 35 percent of covered small firm employees were enrolled in a plan where they contribute more than one-half of the premium for family coverage. 3 In 2019, the average amount covered employees contributed was $1,242 for single coverage and $6,015 for family coverage.

What percentage of small firm employees have employer pay?

31 percent of covered small firm employees had their employer pay the entire premium for their single coverage. 35 percent of covered small firm employees were enrolled in a plan where they contribute more than one-half of the premium for family coverage. In 2019, the average amount covered employees contributed was $1,242 for single coverage ...

How much has the average health insurance premium increased in 2019?

The KFF 2019 survey found that the average single premium increased by 4 percent, and the average family premium increased by 5 percent over the previous year. However, a long-term view of employer-sponsored health insurance costs reveals a larger change in the costs over time. According to the KFF report, the average premium for employer-sponsored ...

How much health insurance do you have to pay for employees?

If you do choose to offer health coverage to your employees, then you’re typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers’ premiums.

What is the most common type of health insurance?

Employer-provided health insurance remains the most common type of health coverage in the U.S., according to the Kaiser Family Foundation. Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey.

Is employer health insurance more affordable than individual health insurance?

Although average premium costs have risen over the past several years, employer-provided health insurance may often be a more affordable option than individual health ...

General Employer-Sponsored Health Insurance Statistics

Employer-sponsored healthcare coverage is an essential perceived benefit among employees, which is the top reason why many companies offer it. Additional reasons include boosted productivity and tax benefits.

Employer-Sponsored Health Insurance Cost Statistics

Among the benefits provided by businesses to their employees, employer-sponsored health insurance remains the most expensive. Coverage is also costly for employees, as premiums, deductibles, copays, and coinsurance amounts have increased dramatically over the past decade.

Employer-Sponsored Health Insurance Affordability Statistics

Because of high—and continuously increasing—health insurance premiums, many covered individuals express concerns about affording coverage generally and paying for prescription medications specifically.

Employer-Sponsored Health Insurance Statistics Related to HMOs, PPOs, and Other Plans

Point of Service (POS) plans are the most common among employer-sponsored health insurance coverage. However, HMOs typically require slightly lower employer and employee contributions, whether for individual or family plans.

Employer-Sponsored Health Insurance Coverage Statistics

Most employers are satisfied with the breadth of their health insurance network and the choice of provider networks available to employees. Large and small firms typically offer plans that cover additional health benefits like health risk assessments, smoking cessation, weight management, or behavioral or lifestyle coaching.

Conclusion

While health insurance coverage is a popular way for employers to attract the most talented employees, affordability remains a top concern among both employers and employees. This concern applies to general policy premiums, deductibles, copays, and coinsurance, and specific coverages like prescription medications.

Sources

eHealth Insurance. Average Cost of Employer-Sponsored Health Insurance. Accessed on 8/9/21.

What is HRA insurance?

The individual coverage HRA (ICHRA) is a health benefit for employers of all sizes. With an ICHRA, small organizations can reimburse employees tax-free for individual health insurance premiums and other medical expenses. It can function as a stand-alone benefit or as a separate option in an organization’s health benefits program, ...

What is a QSEHRA?

A qualified small employer health reimbursement arrangement (QSEHRA) is a health benefit for employers with fewer than 50 full-time equivalent employees who don’t want to offer employees group health insurance.

How does reimbursement work for employers?

The reimbursement process for employers and employees include the following steps: You set an allowance. The employer decides how much tax-free money to offer employees every month. This represents the maximum amount your organization will reimburse the employee for health care.

What is HRA administration?

Many employers choose to use an HRA administration provider like PeopleKeep to review documents and maintain compliance. Once an expense is deemed eligible, the employer reimburses the employee through their preferred method (e.g., payroll, check, cash).

How much did employers contribute to health insurance in 2016?

Under group health insurance in 2016, employers contributed an average of $5,306 per employee toward single coverage (82% of the premium). For family coverage, they contributed an average $12,865 (or 71% of the premium). ...

What percentage of health insurance is paid by employers?

Across the nation, employers are contributing, on average, 82 percent for single coverage and 70 percent for family coverage. Small employers tend to pay a similar percentage for single coverage ...

How much does an employer pay for health insurance?

Employers Pay 82 Percent of Health Insurance for Single Coverage. In 2019, the average company-provided health insurance policy totaled $7,188 a year for single coverage. On average, employers paid 82 percent of the premium, or $5,946 a year. Employees paid the remaining 18 percent, or $1,242 a year. For family coverage, the average policy totaled ...

What is NCS premium?

A premium is an agreed upon fee paid for coverage of medical care benefits for a defined period of time (usually 1 year). Premiums may be paid by employers, unions, employees, or shared by both the insured individual and the plan sponsor (s) ...

What is the National Compensation Survey?

The National Compensation Survey (NCS) program publishes comprehensive estimates on the incidence (the percentage of workers with access to and participation in employer provided benefit plans) and provisions of employee benefit plans.

What percentage of private industry workers have access to retirement plans?

77 percent of private industry workers offered retirement benefits participated in them in 2019. 51 percent of private industry workers had access to only defined contribution retirement plans. 73 percent of all civilian workers had access to paid vacations in March 2016.

Who pays medical insurance premiums?

Premiums may be paid by employers, unions, employees, or shared by both the insured individual and the plan sponsor (s) depending on the plan. Estimates are available for the share (in percent) of the premium paid by the employee and employer and the percent of workers with a contribution requirement. Estimates for medical plan premiums are not ...

Is the cost of medical insurance based on actual decisions?

Estimates for medical plan premiums are not based on actual decisions regarding medical coverage made by employees; instead they are based on the assumption that all employees in the occupation can opt for available coverage. March 2020 civilian worker single coverage estimates show that:

What is the BLS?

From there, the BLS provides more detailed information about exactly what these benefits are, including insurance paid time off, retirement and other legally required benefits (like social security, workers’ compensation, and unemployment insurance).

What are the different types of insurance?

According to the BLS report, the term “insurance” encompasses four different types of coverage: health, life, short-term, and long-term disability. How much employers spend on each varies widely across sectors and industries.

How much does an employer pay per hour?

In the public sector, the average employer-paid portion of all insurance types is $3.14 per hour per employee, which is about 8.7 percent of compensation. Of course, this varies across industries. For example:

How much do covered workers contribute to insurance?

On average, covered workers contribute approximately 18% of the premium for single coverage, and 30% of the premium for family coverage. For workers in smaller firms, the average contribution percentage for family coverage is closer to 39%.

Is BLS a good benchmark?

When you’re trying to figure out how much your business should spend on employee benefits, BLS data can be a good place to start, but cost is just one of many facets of your employee benefits package which can and should be benchmarked. While your entire benefits package doesn’t need to be benchmarked, there is an essential list you should measure. ...

Which sector pays the smallest amount of health insurance?

There is more data for the private sector, and the data is broken out for all the available industries and categories. The private sector pays the smallest share of health insurance, coming in at an average of just $2.70 per hour per employee, making up about 8% of total compensation.

How much does paid leave cost?

Paid leave benefits vary by employer, but cost on average about $5,000 per employee . This, of course, varies by industry and from company to company, and changes depending on whether a worker is entry-level, management, hourly or in an exempt position.

What are the benefits of an employer?

Though salary numbers are more frequently discussed, the health insurance, retirement, time off and legally required benefits, like Social Security contributions, offered by a company are equally , if not more, important. Many employees might not realize how costly these benefits are for an employer to provide.

How much has health care increased since 2005?

Benefits Pro noted an increase of 368 percent since 2005 in the cost of employee benefits. During that time, health care alone has increased by 28 percent. This could be due in part to a spike in cases of chronic illness or to higher costs from health care providers.

How much does an employer spend per hour?

That equates to $5,698 per worker, per year. Employers spend an average of $2.65 per employer, per hour, for payments required by law, like Social Security and Medicare. Retirement plans and investment benefits cost employers an average of $0.55 an hour for defined benefits and $0.78 per hour for defined contributions, per employee.

How much has unemployment increased since 2004?

Since 2004, unemployment insurance costs have risen by 106.8 percent .

Which cities have lower benefits?

Some cities, like Miami, enjoy lower benefit costs. Others, like the greater Phoenix area, have seen an increase in the recent past due to the influx of Fortune 500 companies that have set up shop there.

How much does it cost to train an employee?

In addition to this, Training Magazine reports that in 2019, companies spent on average $1,286 dollars per employee to train them on their roles. When you consider that most employees need up to 6 months ...

When creating your benefits package and forecasting costs for your business, it’s helpful to use accurate benchmarking data to

When creating your benefits package and forecasting costs for your business, it’s helpful to use accurate benchmarking data to guide your decisions. A great place to start is by reviewing the United States Bureau of Statistics to get an idea of what the true cost of employee benefits are across the U.S.

What happens if you miss enrolling dates?

Missing enrolling dates, not having all proper documentation on file, charging employees the wrong amount for their coverage, and failure to terminate coverage within the proper time frame are all common mistakes in paperwork that can have severe financial penalties and thus impact on your business.

Can an employee start off with a single health plan?

While an employee may start off their career needing an individual/single health benefits plan, this situation could change as they potentially get married or have kids. This change will increase the cost of their benefits package for the employer.

Is it bad to have employees who are not happy?

The costs of benefits can be challenging for your budget; however, having employees who are not happy or healthy can be even more detrimental . The people you hire will make the difference between whether you fail or succeed as a company, so if managed well, your investment will pay off. Bookmark ( 0)

Who is Stacy Pollack?

Stacy Pollack. Stacy Pollack is an Organizational Development professional with a passion for improving the workplace. She began her career in recruitment and quickly fell in love with training, coaching, and human resources. Her very first job was as a gymnastics coach.

General Employer-Sponsored Health Insurance Statistics

Employer-Sponsored Health Insurance Cost Statistics

Employer-Sponsored Health Insurance Affordability Statistics

Employer-Sponsored Health Insurance Coverage Statistics

Average Cost of Employer-Sponsored Health Insurance FAQ

- What is the avearge cost of health insurance through an employer?The average annual cost of health insurance premiums through an employer is $7,470 for single coverage and $21,342 for family covera...

- Is employer-sponsored health insurance cheaper?Yes, employer-sponsored health insurance is cheaper. While the cost of the plans themselves might not change much, the fact that emplo…

- What is the avearge cost of health insurance through an employer?The average annual cost of health insurance premiums through an employer is $7,470 for single coverage and $21,342 for family covera...

- Is employer-sponsored health insurance cheaper?Yes, employer-sponsored health insurance is cheaper. While the cost of the plans themselves might not change much, the fact that employers cover aroun...

- Do employees pay for employer-sponsored health insurance?Yes, employees pay for employer-sponsored health insurance. While these plans are employer-sponsored, your employer does not typically cover...

- Can I get a premium tax credit if my employer offers insurance?No, you cannot get a premiu…

Conclusion

Sources