Claiming Early Social Security Retirement Benefits

| BIRTH YEAR | FULL RETIREMENT AGE | BENEFIT |

| 1943-1954 | 66 years | $750 |

| 1955 | 66 years, 2 months | $741 |

| 1956 | 66 years, 4 months | $733 |

| 1957 | 66 years, 6 months | $725 |

What is the maximum SS benefit at age 62?

What is the maximum Social Security benefit at age 62? The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much does social security go up each year after age 62?

The actual year-over-year percentage gain for ages 62 to 70 are shown in the following table. Those gains range from 6.5 percent (claiming at 70 rather than 69) to 8.4% percent (claiming at 64 rather than 63).

Is taking social security at 62 a huge mistake?

Your decision about when to start Social Security affects your income for the rest of your life, so it's not a choice to be taken lightly. Unfortunately, far too many people leave the workforce and claim Social Security benefits for the wrong reason.

Should I start taking social security at age 63?

“Should I start taking Social Security at age 63?” Yes. Provided you can bank all that Social Security dough while living on something else until your full retirement age. Mostly because of the indexing con game that Social Security is running where it also tosses out all but 35 years of your earnings history.

How much Social Security will I get if I take it at 62?

How Your Social Security Benefit Is ReducedIf you start getting benefits at age *And you are the: Wage Earner, the Retirement Benefit you will receive is reduced toAnd you are the: Spouse, the Retirement Benefit you will receive is reduced to6270.0%32.5%62 + 1 month70.432.762 + 2 months70.832.962 + 3 months71.333.158 more rows

How much will I receive if I retire at 62?

A single person born in 1960 who has averaged a $50,000 salary, for example, would get $1,349 a month by retiring at 62 — the earliest to start collecting. The same person would get $1,927 by waiting until age 67, full retirement age.

What is my Social Security benefit if I retire at 62?

Early retirement You can get Social Security retirement benefits as early as age 62. However, we'll reduce your benefit if you retire before your full retirement age. For example, if you turn age 62 in 2022, your benefit would be about 30% lower than it would be at your full retirement age of 67.

Can I draw Social Security at 62 and still work full time?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

Can you get on Medicare at age 62?

En español | No, you can't qualify for Medicare before age 65 unless you have a disabling medical condition.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How do I find out how much Social Security I will get?

Benefit Calculators (En español) The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much do you get if you claim FRA at 62?

If you were to claim early at 62, your benefits would be reduced by 30%, leaving you with $1,120 per month. But if you delay benefits until age 70, you'd receive your full benefit amount plus an extra 24%, or $1,984 per month.

How long do you have to work to get Social Security?

Most people become eligible for Social Security retirement benefits once they've earned income for 10 years, but you'll need to work for at least 35 years to receive the maximum benefit amount.

What happens if you exceed the maximum taxable earnings limit?

Once you surpass the maximum taxable earnings limit (which is the highest income that's subject to Social Security taxes), a higher income won't result in additional benefits. To earn this maximum benefit amount, then, you'll need to reach the maximum taxable earnings limit.

What if your earnings are falling short?

If you're earning enough to reach the maximum benefit amount, that's fantastic. But the average worker will struggle to reach the income limits, and not everyone can afford to work 35 years before claiming.

How much will Social Security be reduced at 62?

If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits.

What happens if you claim Social Security at 62?

So if you begin claiming Social Security at 62 and start with reduced benefits, your COLA-adjusted benefit will be lower too. Waiting to claim your Social Security benefit will result in a higher benefit. For every year you delay your claim past your FRA, you get an 8% increase in your benefit. That could be at least a 24% higher monthly benefit ...

What is the reduction for claiming your own FRA?

If claiming spousal benefits provides more, claiming before your FRA on a spouse's record means you'll lose even more than claiming on your own record—the benefit reduction for a spouse is up to 35% while the reduction for claiming your own benefit is up to 30% .

How much does Colleen receive in 2020?

Colleen is 62 as of 2020. If Colleen waits until age 66 and 6 months (her FRA) to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, she'll receive only $1,450 a month. This "early retirement" penalty is permanent and results in her receiving up to 28% less year after year.

How much will Colleen's Social Security increase if she waits to collect Social Security?

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to a total of $2,480 per month. 1 If she were to live to age 89, her lifetime benefits would be about $112,000 more, or at least 24% greater, because she waited until age 70 to collect Social Security benefits. 2 (Note: All figures are in today's dollars and before tax. The actual benefit would be adjusted for inflation and would possibly be subject to income tax.)

What are the factors that determine when you can claim Social Security?

Health status, longevity , and retirement lifestyle are 3 variables that can play a role in your decision when to claim your Social Security benefits.

Can you make catch up contributions to a retirement plan?

In addition, if you can keep working , you can make "catch-up" contribution s to a tax-deferred workplace savings plan like a 401 (k) or 403 (b) or a traditional or Roth IRA. Catch-up contributions allow you to set aside larger amounts of money for retirement.

How much will Social Security be at 62?

Your monthly benefit check will permanently decrease by 20-30%. This chart illustrates how much an estimated $1,000 monthly benefit payment will be worth if you start taking it at age 62, relative to your Full Retirement Age.

Can you defer retirement benefits?

Conversely, you can also defer retirement benefits. This typically increases your annual payout by about 8% for each year you delay beyond your Full Retirement Age, to a maximum of age 70.

What happens if you retire at 62?

By filing at 62, or any time before you reach full retirement age, you forfeit a portion of your monthly benefit. If you were born in 1960 or later, for instance, filing at 62 could reduce your monthly payment by as much as 30 percent.

When will Social Security start in 2021?

For example, if you were born on Oct. 1 or 2, 1959, Social Security considers you to be 62 as of Sept. 30 or Oct. 1, 2021. Your benefits will start in October 2021; you can apply for benefits in June. But if you were born between Oct. 3 and 31, your first full month at 62 is November. If you want to start your benefits as soon as possible, ...

How many retirement estimates does Quick Calculator give?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

Why are retirement benefits unreliable?

Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable.

What does "0" mean in retirement?

If you entered 0, we assume you are now retired. Enter the last year in which you had covered earnings and the amount of such earnings.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How Claiming Social Security Early Works

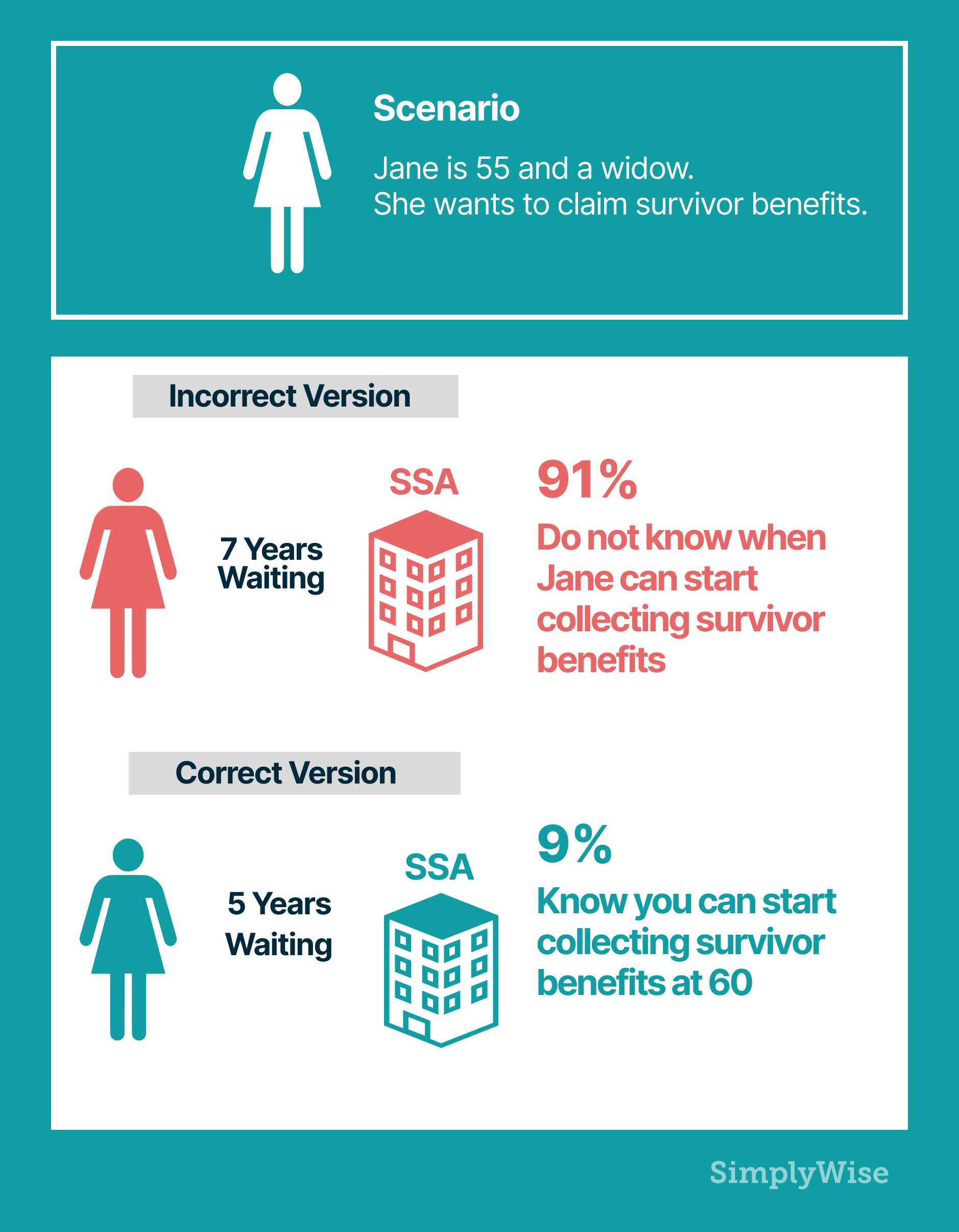

If you’re claiming Social Security based on your own record or you’re taking spousal benefits, you can start benefits as early as age 62. If you’re a surviving spouse, you can begin receiving benefits at 60. However, by taking benefits earlier, you’ll face a lifetime benefit reduction.

When Taking Social Security at 62 Makes Sense

Choosing when to take your Social Security retirement benefits is one of the biggest personal finance decisions you’ll ever make. However, you may want to start benefits as early as age 62 in the following situations.

When to Delay Taking Social Security

Obviously, there’s a lot of guesswork involved in terms of when to collect Social Security benefits. If these circumstances apply, consider waiting to claim benefits so you can collect more money each month.

Can You Undo Your Decision to Claim Social Security?

You have two opportunities to reverse your decision to take Social Security retirement benefits.