Does Social Security still pay death benefits?

There are a couple of things to keep in mind. For starters, a person is due no Social Security benefits for the month of their death. “Any benefit that’s paid after the month of the person’s death needs to be refunded,” Sherman said. With Social Security, each payment received represents the previous month’s benefits.

Who qualifies for Social Security death benefits?

- Widows/Widowers or Surviving Divorced Spouse's Benefits.

- Child's Benefits.

- Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

- Lump-Sum Death Payment.

- Parent's Benefits (You must have been dependent on your child at the time of his or her death.)

How do you calculate survivor Social Security benefits?

There are three basic steps:

- Adjust historical earnings for inflation.

- Get monthly average from the highest 35 years

- Apply monthly average to benefits formula

Who can collect the Social Security death benefit?

More than 60 million Americans receive Social Security benefits, and just under 10 percent, or about 6 million, receive survivor benefits. Until this year, Renn said, LGBTQ people who contributed part of their paycheck to the pot weren’t getting anything back in terms of survivor benefits — simply because of their sexual identity.

How much money do you get from Social Security when a parent dies?

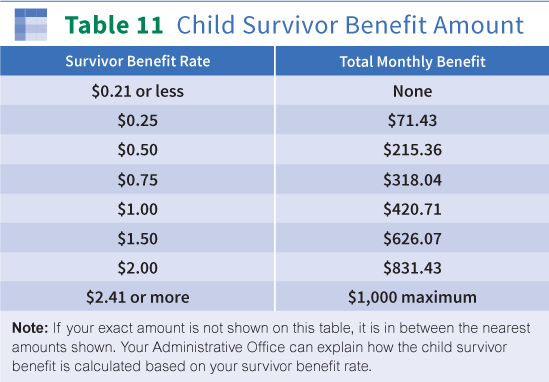

Within a family, a child can receive up to half of the parent's full retirement or disability benefits. If a child receives survivors benefits, they can get up to 75% of the deceased parent's basic Social Security benefit.

Who is eligible for Social Security survivor benefits?

A widow or widower can receive benefits: At age 60 or older. At age 50 or older if disabled. At any age if they take care of a child of the deceased who is younger than age 16 or disabled.

Does everyone get the $255 death benefit from Social Security?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

How much do widows get from Social Security?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

When a parent dies who gets Social Security?

Within a family, a child can receive up to half of the parent's full retirement or disability benefit. If a child receives Survivors benefits, he or she can get up to 75 percent of the deceased parent's basic Social Security benefit.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Who is eligible for the $250 death benefit from Social Security?

A widow or widower age 60 or older (age 50 or older if they have a disability). A surviving divorced spouse, under certain circumstances. A widow or widower at any age who is caring for the deceased's child who is under age 16 or has a disability and receiving child's benefits.

Why does Social Security only pay $255 for burial?

In 1954, Congress decided that this was an appropriate level for the maximum LSDB benefit, and so the cap of $255 was imposed at that time.

Why does Social Security only pay $255 one time death benefit?

The reason had to do with the rise in monthly benefit payments, which would have greatly increased the death benefit without the imposition of a separate limit. At the time, most calculated death benefit amounts were less than $255, so the lower amount was paid.

When my husband dies do I get his Social Security and mine?

Social Security will not combine a late spouse's benefit and your own and pay you both. When you are eligible for two benefits, such as a survivor benefit and a retirement payment, Social Security doesn't add them together but rather pays you the higher of the two amounts.

What happens when both spouse's collect Social Security and one dies?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

When can a widow collect her husband's Social Security?

age 60The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

Can you report a death online?

However, you cannot report a death or apply for survivors benefits online. In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, ...

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

When does a spouse's benefit automatically convert to a survivor's benefit?

As for benefits available to survivors: If a spouse or qualifying dependent already was receiving money based on the deceased’s record, the benefit will auto-convert to survivors benefits when the government gets notice of the death, Sherman said.

What happens to the checks if someone dies in January?

So if a person dies in January, the check for that month — which would be paid in February — would need to be returned if received. If the payment is made by direct deposit, the bank holding the account should be notified so it can return benefits sent after the person’s death.

When can I apply for reduced Social Security benefits?

They can apply for reduced benefits as early as age 60, in contrast to the standard earliest claiming age of 62. If the survivor qualifies for Social Security on their own record, they can switch to their own benefit anytime between ages 62 and 70 if that payment would be more.

Can a funeral home report a death to the government?

In most cases, funeral homes notify the government. There’s a form available that those businesses use to report the death. “The person serving as executor [of the estate] or the surviving spouse can also call Social Security,” said certified financial planner Peggy Sherman, a lead advisor at Briaud Financial Advisors in College Station, Texas.

Can I use someone else's Social Security after they die?

Using someone else’s Social Security benefits after they die is a federal crime. Funeral homes often alert the government when someone passes away. Depending on the situation, survivors benefits may be available. There is a lot to deal with when a loved one passes away.

Is it a crime to use someone else's benefits after they die?

It may be no surprise that using someone else’s benefits after they die is a federal crime, regardless of whether the death was reported or not. If the SSA receives notice that fraud might be happening, the allegation is reviewed and potentially will warrant a criminal investigation.

Who is eligible for lump sum death payment?

Who is eligible for Social Security Lump Sum Death Payment? To be eligible for this payment, the surviving spouse must be living in the same household with the worker when he or she died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, the spouse met one ...

How do I contact Social Security by phone?

Visit SSA's Publications Page for detailed information about SSA programs and policies. You may also contact Social Security by phone at: 1-800-772-1213 (TTY: 1-800-325-0778) 1-800-772-1213.

What is the second kind of Social Security death benefit?

The second kind of benefits are often called survivor or Social Security death benefits. Here are the rules:

How much is a lump sum death benefit?

The lump-sum Social Security death benefit is a one-time payment of $255. If a person is already claiming spousal benefits at the time their spouse dies, that person does not need to submit a separate application for the lump-sum Social Security death benefit. The $255 will automatically be credited.

What happens if you suspend your Social Security benefits?

But if you suspend your benefits, any benefits based on your record (meaning spousal benefits or benefits for minor/disabled children) will be suspended, too. Retirees who un-suspend their benefits will no longer get a lump sum payment as of April 30, 2016.

What is the purpose of Family Maximum Benefit?

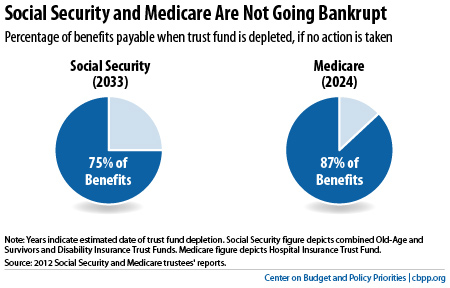

The point of the Family Maximum Benefit (FMB) is to keep family members who are living together from all claiming full auxiliary benefits from the same record. Social Security is pretty strapped for cash, and doesn’t want too many people to claim benefits from the record of only one person who paid into the system.

What does the age of retirement affect?

The age at which you begin taking retirement benefits affects how much your monthly payments will be for the rest of your life… and beyond. Your filing age will set the amount that will go to your survivors as Social Security death benefits.

How old do you have to be to get Social Security?

The mother or father of the deceased’s children (including an ex-spouse), who is caring for the deceased’s minor children, can claim Social Security death benefits until the children reach age 16.

How long can you wait to get back Social Security?

Unfortunately, though, the Social Security Administration does not make retroactive payments after a period longer than six months. If you wait more than six months to claim Social Security death benefits, you will not be entitled to back payment for the time over six months.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

What happens if a deceased spouse files for Social Security?

If the Deceased DID File for Benefits. If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged.

How much Social Security can a 62 year old woman get?

From age 62 to 69, she could receive $1,200 per month as a survivor’s benefit. Once her own benefit has grown to the maximum, at age 70 and beyond, she can simply take that and receive $1,860 per month for the rest of her life. The Social Security Administration discusses this strategy at this link.

What happens if a spouse dies after full retirement age?

If the deceased spouse never filed for benefits, and died after their full retirement age, the survivor receives the deceased’s benefit in the same amount it would have been on the date of the deceased’s death (including delayed retirement credits) reduced for the filing age of the survivor.

How long do you have to be married to receive Social Security?

In general, spouse survivor benefits are available to: Surviving spouses, who were married at least 9 months, beginning at age 60. Benefit amount may depend on the age at which you file ...

What is the maximum amount you can draw if you are a deceased spouse?

This rule states that if your deceased spouse filed early, you’ll be forever limited to either the amount they were drawing, or 82.5% of their full retirement age benefit.

What is a surviving spouse?

A surviving spouse, who was residing with the deceased spouse, or. A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse , or.

How to claim survivor benefits?

How To Claim Survivor’s Benefits. To begin receiving survivor’s benefits, you must make a claim with the Social Security Administration . Survivor’s benefit’s claims may not be made online. You can start the claims process over the telephone, 1-800-772-1213, or go to your local Social Security office.

How much is the lump sum death benefit?

Lump-Sum Death Benefit. In addition to a monthly survivor income, if you lived in the same household as your spouse , you'll receive a one-time, lump-sum payment of $255. If you were married but living apart, you may also be able to receive payments if you received them on your spouse's record before they died.

How long does a lump sum death payment last?

The lump-sum death payment will be paid as long as the SSA currently insured your spouse. This means their earnings were subject to SSA withholding during six quarters of the full 13-quarter period—three years and three months—before their death.

What age can you claim survivor income?

3. If you're a widow or widower and remarry before age 60—or age 50 if you have a disabling condition— you're not eligible for survivor income.

What is the Social Security benefit for 2021?

Updated May 25, 2021. The Social Security Administration (SSA) pays two types of payments to eligible surviving spouses and children. Other relatives of insured workers can also receive payments. The payments survivors might receive are an ongoing monthly survivor income and a lump-sum death benefit of $255. 1.

How old do you have to be to get a survivor payment?

If you were married to an ex-spouse for at least 10 years and you're age 60 or older, you can receive a lifetime monthly survivor payment. An ex-spouse who remarries after reaching age 60 still is eligible. 4

How much can a widow receive?

A widow, widower, or surviving divorced spouse can receive 100% at full retirement age or older. It's possible to obtain 71.5% at age 60, to as much as 99% before full retirement age. This depends on the beneficiary's age when payments began. A disabled widow, widower, or surviving divorced spouse, ages 50–59, can receive 71.5%.

How long do you have to work to receive survivor income?

Who receives survivor income and how much varies in each instance. For you to be eligible for the payment, your relative must have worked for a total of 10 years. They could also have worked a total of 1.5 years in the three years before their death. 2.

What happens to Social Security when a spouse dies?

En español | When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A surviving spouse can collect 100 percent of the late spouse’s benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age. (Full retirement age for survivor benefits differs from that for retirement and spousal benefits; it is currently 66 but will gradually increasing to 67 over the next several years.)

How long do you have to be married to receive survivor benefits?

In most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death. But there are a few exceptions to those requirements: 1 If the late beneficiary’s death was accidental or occurred in the line of U.S. military duty, there’s no length-of-marriage requirement. 2 You can apply for survivor benefits as early as age 50 if you are disabled and the disability occurred within seven years of your spouse’s death. 3 If you are caring for children from the marriage who are under 16 or disabled, you can apply at any age.

Can a deceased spouse receive survivor benefits?

If you are the divorced former spouse of a deceased Social Security recipient, you might qualify for survivor benefits on his or her work record. If you are below full retirement age and still working, your survivor benefit could be affected by Social Security's earnings limit.

How much does Social Security pay for a deceased spouse?

First, Social Security pays a death benefit of $255 if the surviving spouse lived with the deceased spouse. 3 This payment is made only once. More important is the monthly income. At a basic level, the monthly amount depends on the earnings of the deceased spouse over their whole life.

How does a Social Security statement work?

Each person’s Social Security statement provides an estimate of survivor’s benefits. The amount you can get will vary from couple to couple. But knowing how these payments can look will help you estimate how much you may be able to claim.

Is it hard to get Social Security after losing a spouse?

The loss of a spouse is painful. It can be even harder when you have to make tough choices about money soon after. Whether and when to take Social Security is one of those choices. The rules for getting Social Security survivor benefits depend on a number of factors.

Can you get a higher survivor benefit if you haven't started?

If you haven't started getting benefits yet, waiting longer will help both of you get a higher benefit. This includes the survivor benefit once one of you passes away. You can get the most out of the survivor benefit by having the spouse who earns more wait until age 70 to begin collecting.

Benefits

Examples

- After a worker eligible for primary Social Security benefits dies, a few classes of protected individuals are entitled to claim auxiliary survivor benefits (equal to 100% of the deceaseds benefits). The folks with this kind of Social Security eligibility include: Take the case of a family of four, with one retired worker, one spouse and two minor c...

Results

- The longer you wait to claim primary benefits up to age 70, the more time they have to grow. You will get larger per-month benefits if you wait longer to begin collecting them. Thats why many experts encourage people to think of 70 as the true full retirement age for Social Security purposes. Certain retirees are grandfathered in (no pun intended) and can still take advantage o…

Quotes

- Im glad you asked! Many Americans are so excited to start collecting checks when they hit their sixties that they forget to plan a Social Security strategy that makes sense for their spouse, too. The age at which you begin taking retirement benefits affects how much your monthly payments will be for the rest of your life and beyond. Your filing age will set the amount that will go to your …

Background

- The Bipartisan Budget Act of 2015 changed the auxiliary benefit rules in important ways. First, as of April 30, 2016, the file-and-suspend strategy for maximizing spousal benefits is no longer allowed. That strategy allowed one member of a couple, usually the higher earner, to file for primary benefits at 62 and then suspend those benefits, allowing them to grow until the filer rea…

Effects

- If you remarry, it doesnt keep your ex from being eligible to claim benefits on your record. But having an ex who is claiming benefits on your record wont keep your new spouse from being able to claim benefits either.

Overview

- Social Security is a form of enforced savings and insurance designed to keep older folks out of poverty, not make them rich. It should be part of your retirement plan, not all of it.

Prevention

- Our advice? Start thinking about Social Security and other retirement issues earlier rather than later. That way, youll have time to consider your options and discuss them with your family. Taking Social Security benefits early, meaning before full retirement age or before age 70 if you want to take advantage of Delayed Retirement Credits doesnt only reduce your benefits. Remem…