How to Apply for Deceased Spouse's Social Security Benefits

- Access secure.ssa.gov to find out where to apply for a deceased spouse's Social Security benefits in person (see Resources).

- Enter your five-digit zip code at the bottom of the webpage. ...

- Apply for the deceased's Social Security benefits over the phone via the Social Security Administration at 800-772-1213.

Full Answer

What happens if your spouse dies Social Security?

Social Security will pay you either your retirement benefits or survivor benefits, whichever amount is higher. Also, if your spouse died young enough that you remarried before you turned 60, you won’t be able to collect a widow/widowers benefit. If you wait until after you turn 60, you can get the benefits.

Who can collect the Social Security death benefit?

More than 60 million Americans receive Social Security benefits, and just under 10 percent, or about 6 million, receive survivor benefits. Until this year, Renn said, LGBTQ people who contributed part of their paycheck to the pot weren’t getting anything back in terms of survivor benefits — simply because of their sexual identity.

How do you calculate SS survivor benefits?

There are three basic steps:

- Adjust historical earnings for inflation.

- Get monthly average from the highest 35 years

- Apply monthly average to benefits formula

How to report a death to Social Security?

One of your questions may be how to report a death to Social Security. Follow these steps to report the death of a loved one. For help navigating this process, consider working with a financial advisor. Talk to the funeral director who oversees the arrangements for your loved one.

When can a widow collect her husband's Social Security?

age 60The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

How do I claim my deceased husband's Social Security?

You should give the funeral home the deceased person's Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday.

How does Social Security work when your spouse dies?

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

How much do widows get from Social Security?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

How do you qualify for widows benefits?

Who is eligible for this program?Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirement.Be unmarried, unless the marriage can be disregarded.Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Can I collect my own Social Security and my deceased husband's?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

What to do after a spouse dies?

To Do Immediately After Someone DiesGet a legal pronouncement of death. ... Tell friends and family. ... Find out about existing funeral and burial plans. ... Make funeral, burial or cremation arrangements. ... Secure the property. ... Provide care for pets. ... Forward mail. ... Notify your family member's employer.More items...•

Who is not eligible for Social Security survivor benefits?

Widowed spouses and former spouses who remarry before age 60 (50 if they are disabled) cannot collect survivor benefits. Eligibility resumes if the later marriage ends. There is no effect on eligibility if you remarry at 60 or older (50 or older if disabled).

What documents are needed to report death to Social Security?

Your Social Security number and the deceased worker's Social Security number. A death certificate. (Generally, the funeral director provides a statement that can be used for this purpose.) Proof of the deceased worker's earnings for the previous year (W-2 forms or self-employment tax return).

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

Who gets lump sum when spouse dies?

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

What age can you remarry?

If you remarry after you reach age 60 (age 50 if disabled), the remarriage will not affect your eligibility for survivors benefits.

How much of a deceased spouse's salary will be paid to a spouse who is 60?

A surviving spouse who is between age 60 and full retirement age will receive 71-99% percent of the deceased worker's monthly amount.

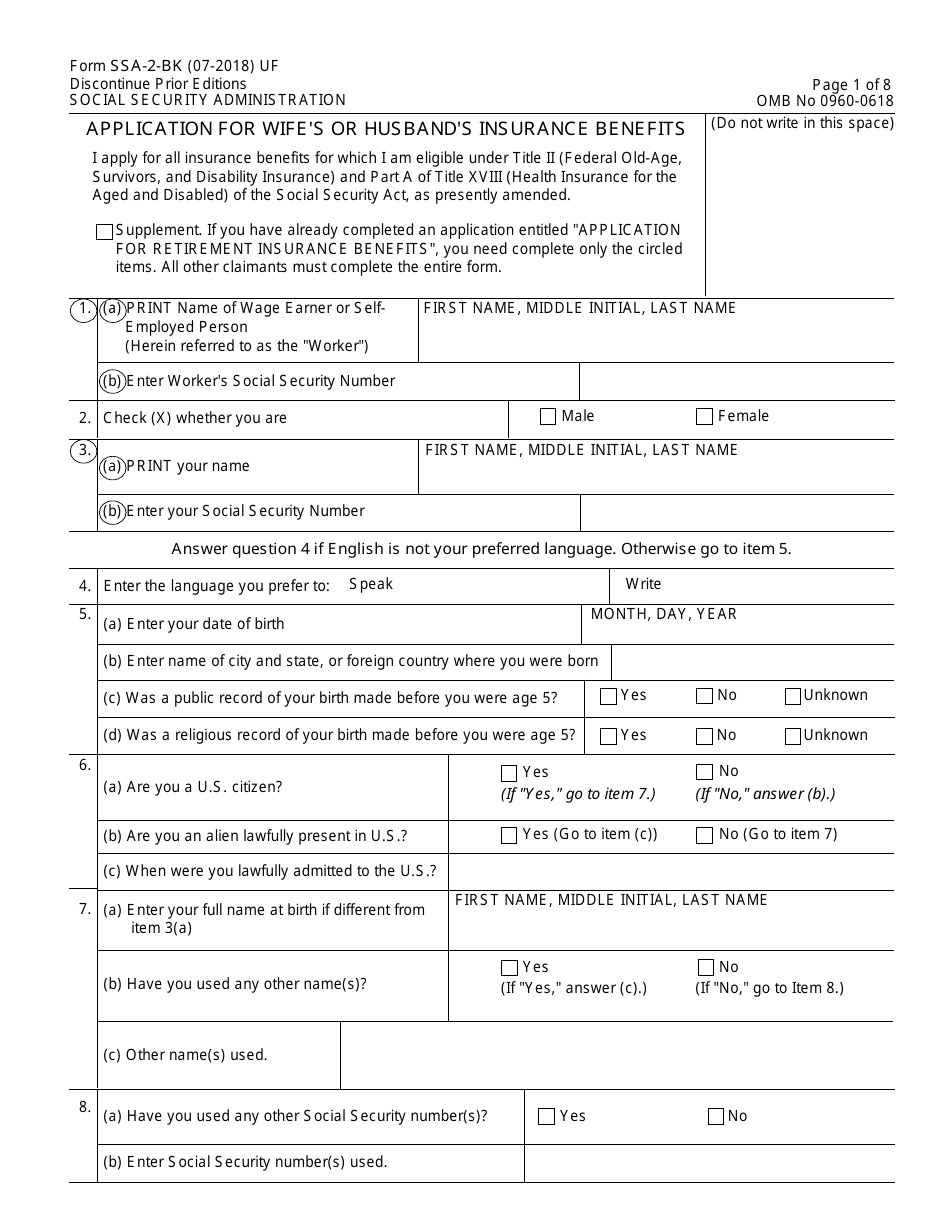

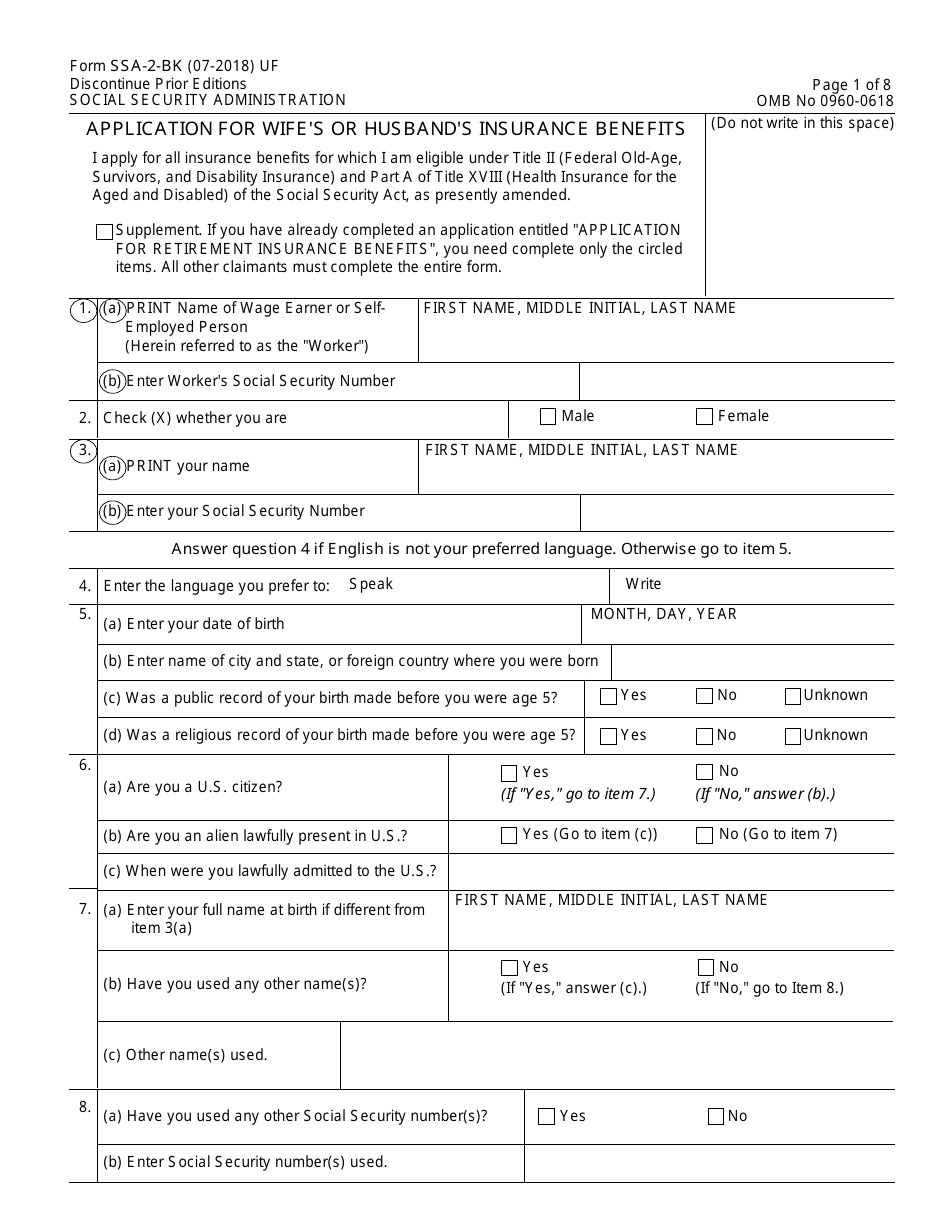

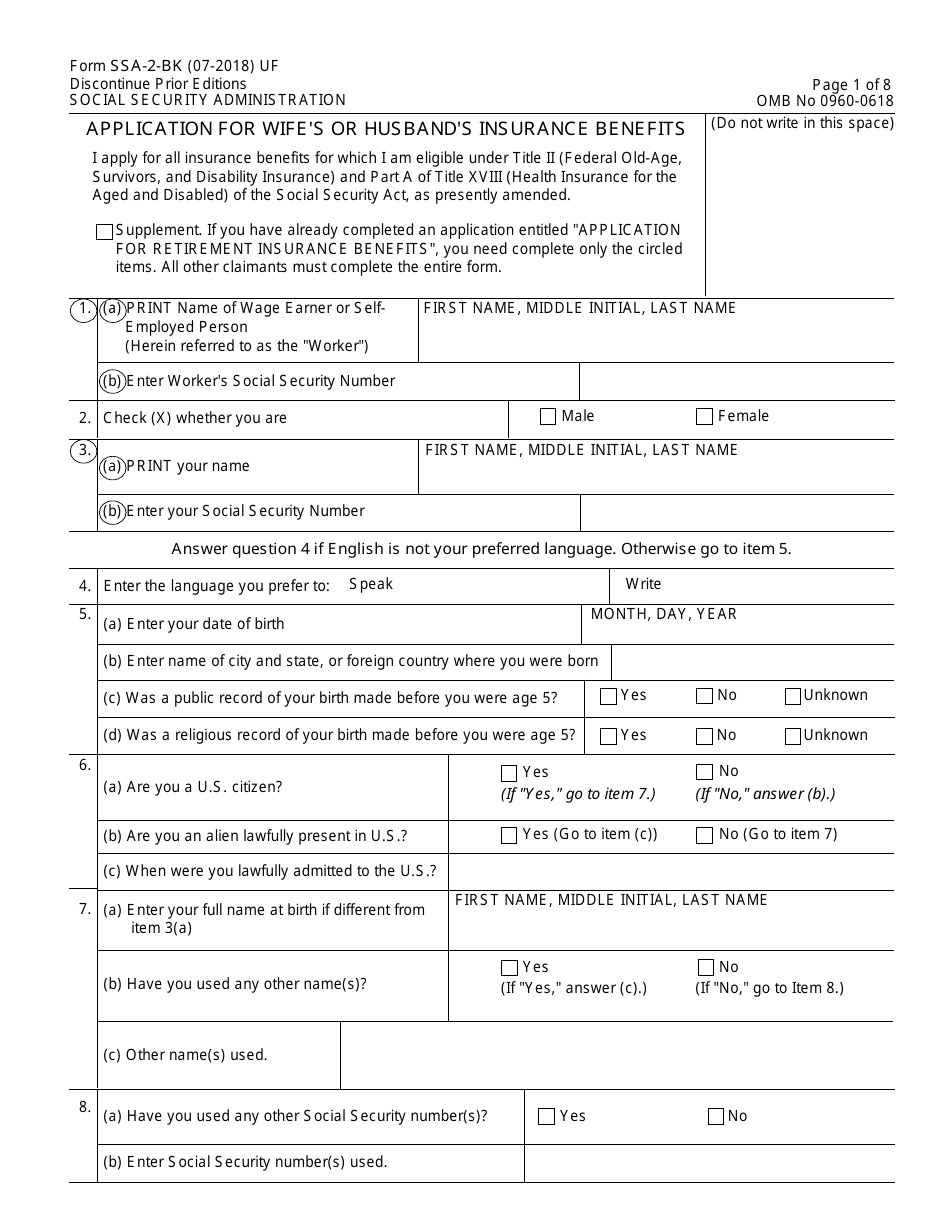

How to apply for spousal benefits?

Applying for Spousal Benefits. Call the Social Security Administration (SSA) at (800)772-1213 to start your application for the survivors' benefit. You should apply for the survivors benefit soon after your husband or wife dies, since survivors benefits are usually paid from the time you apply, not from the date of death.

What is the lump sum death benefit?

Lump Sum Death Benefit. When a disabled worker entitled to Social Security benefits dies, the surviving spouse will receive a one-time death benefit worth several hundred dollars (currently $255) if the surviving spouse was living in the same household.

How long do you have to be married to receive Social Security?

To be eligible for benefits based on the record of a deceased husband or wife, the spouses must have been married to each other for at least a year. In addition, the deceased spouse must have earned sufficient Social Security credits to be entitled to Social Security disability insurance (SSDI) or Social Security retirement benefits. This article focuses on deceased spouses who were entitled to disability benefits; the rules differ a bit when a surviving spouse collects a benefit based on the deceased husband or wife's retirement benefits.

What is the retirement age for a person born after 1960?

Retirement age is 66 for people born before 1956 and 67 for people born after 1960. However, the surviving spouse can begin to collect reduced retirement benefits at age 60. )

When does the mother's benefit stop?

The mother's or father's benefit will stop when the child turns 16 or ceases to be disabled, but can restart again when the surviving spouse (or divorced surviving spouse) turns 60 (or if disabled, turns 50).

Can a deceased spouse's child receive SSDI?

However, if the deceased worker's children are collecting SSDI benefits at the same time, the surviving spouse's benefit might be reduced. The total of the spouse's benefit and the children's benefit cannot be greater than the maximum family benefit, which is generally 150% to 180% of the deceased worker's monthly SSDI benefit .

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

How old do you have to be to get a mother's or father's benefit?

Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you report a death online?

However, you cannot report a death or apply for survivors benefits online. In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, ...

Can you collect survivors benefits if a family member dies?

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You also should bring along your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

What happens to Social Security when a spouse dies?

Social Security When A Spouse Dies: Survivor Benefits Guide. If your spouse dies and you have reached full retirement age, you’re eligible for 100% of their benefits. If your spouse dies and you have reached full retirement age, you’re eligible for 100% of their benefits. If your spouse retired before full retirement age, ...

Who is eligible for Social Security after death?

The following is a list of who is eligible to receive Social Security benefits after someone has died: A widow or widower over 60. A widow or widower over 50 and disabled. Surviving divorced spouses, assuming the marriage lasted at least ten years.

What happens if the deceased received monthly benefits?

If the deceased was already receiving Social Security benefits, the surviving spouse is eligible to collect 100% of the benefits as long as they are at least 60 and they were married to the deceased for at least nine months. There are exceptions:

What is spousal benefit based on?

SSA spousal benefits are based on the earnings of the deceased. The longer they worked and the more money they earned over their lifetime, the higher the benefits will be. Survivors benefits are based on a percentage of the deceased person’s Social Security benefit.

What is Social Security survivor benefit?

Social Security survivors benefits are based on a percentage of your spouses’ benefits. If the deceased started collecting reduced benefits before reaching full retirement age, your survivors benefits would be reduced as well. If the deceased died before he/she was eligible to collect, the benefit is based on what they would have received ...

How long do you have to be married to get disability benefits?

If the deceased died in an accident or died in the line of U.S. Military duty, there’s no length of marriage requirement. You can apply for your deceased spouse’s benefits as early as age 50 if you are disabled and the disability occurred within seven years of the spouse’s death.

What happens if my spouse dies before retirement?

If your spouse retired before full retirement age, they received a reduced retirement benefit and you will receive reduced survivors’ benefits.

Who gets the one time payment for a deceased spouse?

In most cases, this one-time payment will go to the surviving spouse that lived with the deceased individual.

How to contact Social Security about lump sum death?

To learn more about the Social Security Lump-Sum Death Benefit you can contact the Social Security Administration at 800.772.1213, visit their website, or visit an office near you.

What Is The Social Security Death Benefit?

The Social Security Death Benefit is a one-time payment of $255 that Social Security pays to the family or other representatives of a deceased Social Security beneficiary. This benefit is also known as the Social Security Widow’s Benefit.

How Long Do You Have To Apply For Social Security Widow’s Benefits?

If you are a surviving spouse or child, you have 2 years from the date of the individual passing away to apply for the Social Security death benefit.

What is death benefit?

Social Security Death Benefit is a payment to surviving family members when the Social Security beneficiary dies.

Does Social Security pay for funerals?

No, Social Security does not pay for funerals. They can offer a one-time payment of $255 to the surviving spouse or child of the deceased Social Security beneficiary.

Who is eligible for death benefit?

The surviving spouse or a child is eligible to receive the death benefit from Social Security.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You should also have your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

How much will I get if my deceased spouse had filed for benefits before their full retirement age?

You can receive as a survivor benefit the greater of the amount your spouse was receiving or 82.5% of your spouse’s full retirement age benefit. Of course, you can receive just your benefit if it is greater than the survivor benefit. Learn what is the full retirement age for SS benefits.

How to apply for survivor benefits after death?

If you were receiving benefits based on your working record or not receiving benefits at all you will need to contact Social Security to apply for survivor benefits. You can apply online, by phone 800-772-1213 or in person at your local office . (Currently due to the coronavirus pandemic local offices are closed.)

How long does a spouse get survivor’s benefits?

The survivor benefit lasts until the surviving spouse passes away. Learn how long it takes to get approved for SS benefits.

How is my survivor benefit calculated? What percentage of Social Security benefits does a widow receive?

The amount of survivor benefit you will receive depends on if you or your spouse were receiving or had not started receiving Social Security benefits.

Can I receive my benefit along with the survivor benefit?

If you and your spouse had both already started claiming, the higher benefit amount becomes the survivor benefit, and the lower of the two benefit amounts will be stopped.

Can I claim one benefit and then switch to another later?

You can collect the survivor benefit at age 60 and then let your benefit increase until age 70. You could switch to your benefit once it exceeds the survivor benefit or let it continue to increase until your reach age 70.

How long do you have to be married to claim Social Security?

To be eligible the spouse must have been married to their spouse for at least nine months at the time of death. The survivor is eligible to claim the greater of their own benefit or their deceased spouse’s benefit but not both. You cannot collect your deceased spouse’s Social Security and your own. If you were divorced from your ex-spouse at ...