How do I start receiving retirement benefits?

Call 1-800-772-1213 (TTY 1-800-325-0778) from 8:00 a.m. to 7:00 p.m., Monday through Friday, to apply by phone.

How do I apply for full Social Security retirement benefits?

You can apply:Online; or.By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. ... If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

Is it better to apply for Social Security online or in person?

While some may prefer to apply in person at their local Social Security office, an increasing number of retirees are finding it easier and more convenient to claim their benefits by retiring online at www.socialsecurity.gov.

How long does it take for retirement benefits to start?

Benefit applications can take up to three months to process, so apply three months before your planned start date. If you are drawing spousal or survivor benefits on another person's earnings record, your payment date depends on that person's birthday and follows the schedule above.

How many months in advance should you apply for Social Security benefits?

four monthsYou can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

What documents do I need to apply for Social Security?

Social SecurityYour Social Security card or a record of your number.Your original birth certificate, a copy certified by the issuing agency, or other proof of your age. ... If you were not born in the U.S., proof of U.S. citizenship or lawful alien status.More items...

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the average Social Security benefit at age 62?

According to payout statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $1,130.16 a month, or $13,561.92 a year.

How do I find out my full retirement age?

If your birth year is 1960 or after, your normal retirement age is 67. Anyone born between 1955 and 1959 has a normal retirement age between 66 and 67 – that is, 66 plus a certain number of months. For instance, if you were born in 1958, your FRA is 66 and eight months.

What age is full retirement for 1955?

66 and 2 monthsIf you were born between 1955 your full retirement age is 66 and 2 months (En español)

Does Social Security start the month you turn 66?

If you start receiving benefits at age 66 and 2 months you get 100 percent of your monthly benefit. If you delay receiving retirement benefits until after your full retirement age, your monthly benefit continues to increase.

How long will it take to process my federal retirement application?

It takes around 60 days (2 months) to process applications for common cases. Your application could take longer if: We need additional information...

Who processes my federal retirement application?

Your agency's HR and payroll offices work to create your retirement application package, and then they send it to OPM for processing.

How does my agency's HR office process my application?

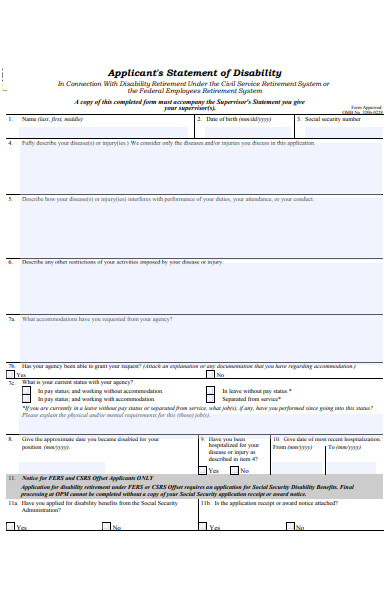

Your HR office will work to: Complete the Agency Check List of Immediate Retirement Procedures (SF-2801, Schedule D for CSRS or SF-3701, Schedule D...

What happens after my agency's HR office processes my application?

They will send your retirement package to your agency's payroll office, who will work to: Authorize your final pay check and lump sum payment for u...

How do I check the status of my retirement application?

After OPM receives your retirement package from your agency, we'll notify you and then assign you a claim number. After you get this notification a...

What information will I get about my retirement benefits once OPM finishes processing my application?

OPM will send you a welcome letter and personalized retirement booklet. Your booklet will detail your entire retirement benefits package, including...

I got my retirement benefits under the FERS program, but I should have received benefits under CSRS. How can I switch to CSRS?

You'll need to apply for corrected retirement program coverage. Learn more about how to switch retirement programs

Am I eligible for voluntary early retirement?

Maybe. If your agency undergoes a major reorganization, reduction in force, or transfer of function, and a significant percentage of the employees...

Do I need to submit a letter of resignation?

No. A completed and signed retirement application is equivalent to a letter of resignation. If you leave the federal service but you're eligible fo...

How long will it take to process my federal retirement application?

It takes around 60 days (2 months) to process applications for common cases.

Who processes my federal retirement application?

Your agency's HR and payroll offices work to create your retirement application package, and then they send it to OPM for processing.

What happens after my agency's HR office processes my application?

They will send your retirement package to your agency's payroll office, who will work to:

How do I check the status of my retirement application?

After OPM receives your retirement package from your agency, we'll notify you and then assign you a claim number. After you get this notification and claim number, you can contact us to get an update on the status of processing your retirement application.

What information will I get about my retirement benefits once OPM finishes processing my application?

OPM will send you a welcome letter and personalized retirement booklet. Your booklet will detail your entire retirement benefits package, including how much your monthly annuity payment will be, your enrollment in health care and life insurance coverage, and information you will need to prepare your annual tax returns.

Am I eligible for voluntary early retirement?

Maybe. If your agency undergoes a major reorganization, reduction in force, or transfer of function, and a significant percentage of the employees will be separated or will be reduced in pay, then the head of your agency can ask OPM to allow early optional retirement for eligible employees.

Do I need to submit a letter of resignation?

No. A completed and signed retirement application is equivalent to a letter of resignation.

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

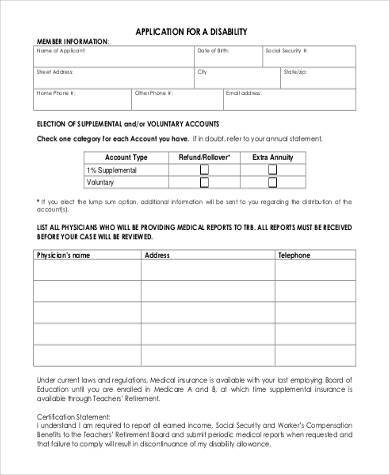

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

How to save for retirement?

Use automatic deductions from your payroll or your checking account. Make saving for retirement a habit. Be realistic about investment returns. If you change jobs, keep your savings in the plan or roll them over to another retirement account. Don’t dip into retirement savings early.

How much of your pre-retirement income should you replace with retirement?

Current savings. The worksheet assumes that you’ll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings.

How does Social Security work?

Social Security is a program run by the federal government. The program works by using taxes paid into a trust fund to provide benefits to people who are eligible. You’ll need a Social Security number when you apply for a job. Find how to apply for a Social Security number or to replace your Social Security card .

What does Social Security provide?

Social Security provides you with a source of income when you retire or if you can’t work due to a disability. It can also support your legal dependents (spouse, children, or parents) with benefits in the event of your death.

How much does Social Security pay?

Social Security pays benefits that are generally equal to about 40 percent of your pre-retirement earnings. The Social Security Administration helps you estimate your benefits. Learn from Investor.gov how you can boost your retirement savings. If you have a financial advisor, talk to them about your plans.

How long can a 65 year old woman live in retirement?

How long will you live in retirement? Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years , but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

How long do people live after retirement?

Show Description of Infographic. In the United States, people live an average of 20 years after retirement. The three most common options to save for retirement are: Retirement Plans offered by an employer. Savings and Investments. Social Security.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What is Medicaid benefits?

Healthcare. Medicaid provides free or low-cost health benefits to adults, kids, pregnant women, seniors, and people with disabilities. Children’s Health Insurance Program (CHIP) offers free or low-cost medical and dental care to uninsured kids up to age 19 whose family income is above Medicaid’s limit but below their state’s CHIP limit. Housing. ...

What is TANF benefits?

TANF may also offer non-cash benefits such as child care and job training. Supplemental Security Income (SSI) provides cash to low-income seniors and low-income adults and kids with disabilities. Eligibility and Application Requirements. All programs have income limits.

What is the food stamp program?

Food Stamps (SNAP Food Benefits) The Supplemental Nutrition Assistance Program (SNAP) is a federal nutrition program. Known previously as "food stamps," SNAP benefits can help you stretch your food budget if you have a low income. Open All +.

What age can a child get Medicaid?

It covers medical and dental care for uninsured children and teens up to age 19.