Unemployment Application Instructions

- Filling out a Paper Application. You can decide to fill out a paper application by collecting an application form from your local department of Human Services offices.

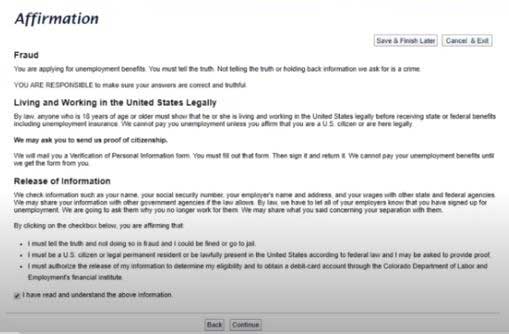

- Online Application. A more convenient application method is filing out an online application form. ...

- Getting Application Assistance Via Phone

What is the maximum unemployment benefit for New Jersey?

What’s the maximum amount of unemployment you can get in NJ? The maximum weekly amount is recalculated annually and is equal to 56 2/3 percent of the statewide average weekly wage. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

When to claim NJ unemployment benefits?

Capitol riot

- Michael Oliveras. ...

- Marcos Panayiotou. ...

- Michael Gianos. ...

- Scott Fairlamb. ...

- Lawrence Stackhouse. ...

- Christopher Quaglin. ...

- Lawrence Dropkin. ...

- Rasha-Abual-Ragheb (aka Rasha Abu) Rasha Abual-Ragheb, a Fairfield resident who also goes by Rasha Abu, was arrested on Jan. ...

- Thomas Brayani. ...

- Thomas Hale-Cusanelli. ...

How long can you collect unemployment benefits in New Jersey?

- Your past earnings must meet certain minimum thresholds.

- You must be unemployed through no fault of your own, as defined by New Jersey law.

- You must be able and available to work, and you must be actively seeking employment.

How do I get my 1099 from NJ unemployment?

- Your Date of Birth

- Your name as it was entered on your last New Jersey Income Tax return filed (last name first)

- Your Zip Code (if address is in USA, otherwise enter 00000)

Will I still receive benefits if my employer files an appeal of my unemployment claim in New Jersey?

If you were determined eligible for benefits, you will continue to receive your benefits as long as you meet all eligibility requirements. If the decision is in favor of the employer, you may be required to repay all or part of the unemployment insurance benefits that have been paid to you.

Should I claim my weekly unemployment benefits if I am appealing a determination in New Jersey?

Yes. If there is an issue with your claim that must be resolved before benefits can be paid, or if you have been denied benefits and are appealing the determination, you must still claim your weekly unemployment benefits for credit while the appeal is pending. If it is determined that you are eligible or if you win your appeal, you will be paid these benefits at a later date. If you have not claimed benefits and you win your appeal, you will not be paid for any weeks that were not claimed while the appeal was pending.

How long does it take to schedule hearing in New Jersey after I filed my appeal for unemployment benefits?

Appeals are scheduled in the order they are received, with the oldest appeals being scheduled first. The time you have to wait will depend on the Appeal Tribunal backlog. You will be notified through the mail when your hearing is scheduled.

Why does the Division of Unemployment Insurance need my email address?

See full answerThe Division of Unemployment Insurance uses email to send reminders, updates, and other information about your benefits. The availability of federal Unemployment Insurance benefit extensions, reminders to report earnings, and 1099 availability notifications are also sent through email. We also use email to provide payment confirmation and appointment reminders, as well as resolve issules. By doing so, we hope to issue benefit payments and deliver important information regarding your claim more quickly and efficiently.Notify us of any changes or corrections to your email address when you certify online for weekly benefits. Make sure to then check your email regularly for messages about your claim. If you do not give us an email address, you will get letters and notices via postal mail and have your appointments conducted over the phone.

Information you'll need to apply for Unemployment Insurance benefits

To save time, get the following information ready before you start your application.

Do you want to apply online?

In order to apply online for Unemployment Insurance benefits, you must have:

Next, get ready the following information about your employer (s)

For each employer that you worked for in the last 18 months, provide the following:

Filling out a Paper Application

You can decide to fill out a paper application by collecting an application form from your local department of Human Services offices.

Online Application

A more convenient application method is filing out an online application form. This method is more convenient since all you need is a computer and a reliable internet connection. You can access the New Jersey Unemployment Insurance program online application form by visiting the following link: http://njsuccess.dol.state.nj.us/html/uimain.html

Getting Application Assistance Via Phone

Another convenient way of requesting for an application form to be sent to you or asking for application assistance is by calling a New Jersey Unemployment Insurance representative through the following toll free numbers depending on your location:

How long can you collect unemployment?

You can collect unemployment benefits for up to 26 weeks as of now. However, the CARES Act extends that period by 13 weeks, allowing you to collect unemployment benefits for up to 39 weeks.

How much do I need to get unemployment benefits in 2020?

You can also claim benefits even if your layoff is expected to be temporary. For claims filed in 2020, you'll need to have earned at least $200 per week for 20 or more weeks during the base year period leading up ...

What time do I file for Social Security?

If the last four digits of your Social Security number are between: 0000 and 2500, file between 8 a.m. and 10 a.m. 5001 and 7500, file between noon and 2 p.m.

How much do you have to make to file a claim in 2020?

For claims filed in 2020, you'll need to have earned at least $200 per week for 20 or more weeks during the base year period leading up to your claim (which, if you're filing in March 2020, is Oct. 1, 2018 through Sept. 20, 2019). Or you'll need to have earned at least $10,000 in total during the base year period.

How long does it take to certify for unemployment benefits?

How to certify for benefits online. Your claim is dated the Sunday of the week in which you filed your initial claim. The first time you claim benefits will be on a Wednesday, 17 days after your date of claim. To receive your unemployment insurance benefits, you must certify for benefits each week which you wish to receive benefits.

When do you have to certify for unemployment?

To receive your unemployment insurance benefits, you must certify for benefits each week which you wish to receive benefits. You can only certify for benefits after the week has passed. Unemployment Insurance weeks begin on a Sunday and end at midnight on Saturday.

Where can I file unemployment in NJ?

The New Jersey Department of Labor and Workforce Development administers the state’s unemployment insurance program. You can file a claim online, over the phone or in person at one of the state’s 14 one-stop career centers. Visit the agency’s contact page for more information if you want to apply over the phone or in person.

How long does it take to get unemployment in New Jersey?

Typically, if you’re eligible for New Jersey unemployment benefits, you can receive payments for a total of 26 weeks. But all states may choose to revise benefits in times of economic crisis, and the federal government may help fund extended state benefits during such times.

How do I check my unemployment claim?

You can check the status of your claim online through the agency’s website. You’ll need to provide your name, Social Security number and date of birth to get an update. If the state denies your claim for unemployment benefits, you can file an appeal and state your case.

What happens if you return to work before the maximum benefit period?

If you return to work before you hit the maximum benefit period, your unemployment benefits will stop. At that time, you’ll call or log into your account online and provide the following information: The name, address and telephone number of your new employer. The date you returned to work.

Why do unemployment claims backdate?

Because of the sudden spike in job losses, some unemployed residents have experienced delays in the claims process. But the state’s department of labor plans to backdate claims based on the week an individual filed to ensure eligible people get the benefits they deserve.

When does the 600 unemployment benefit expire?

You can get $600 per week on top of your regular state benefits. Keep in mind that this benefit is set to expire no later than July 31, 2020. Unemployment benefits are expanded to people who wouldn’t otherwise qualify.

Can unemployment be replaced in NJ?

Unemployment can cause of a lot of uncertainty and fear. While unemployment benefits in NJ may not be enough to replace your full income, they can help soften the financial blow of losing your job. Take some time to determine if you may be eligible and submit an application to get the relief you need.

How Do I Meet New Jersey Unemployment Eligibility Requirements

To qualify for unemployment benefits, you must meet the following initial New Jersey unemployment requirements:

How Much Could I Get

If you are successful in your claim, you will be eligible for up to 60% of your average weekly wage, up to a maximum of $713. Under the provision of the CARES act, you will also receive a supplementary $600 for up to four months on top of your usual allowance. If you submitted your application prior to the change, you do not need to resubmit.

When Do My Benefits End

New Jersey offers unemployment benefits equal to the number of weeks you worked in the base year period, typically up to a limit of 26 weeks total unless extended due to some sort of economic crisis.

For More Information On Filing For Unemployment In Nj

If you plan to file your initial unemployment claim by phone, you must call the Reemployment Center number that corresponds to where you live, which is as follows:

Learn The Unemployment Eligibility Rules Benefit Amounts And More For New Jersey

In New Jerseyas in every other stateemployees who are temporarily out of work through no fault of their own may qualify for unemployment benefits. The eligibility rules, prior earnings requirements, benefit amounts, and other details vary from state to state. Here are the basic rules for collecting unemployment compensation in New Jersey.

How Much Might I Get

Unemployment benefits in New Jersey are typically calculated at 60% of your average weekly wage during your base year, up to a maximum of $713 per week. The minimum weekly benefit amount you can receive ranges from $120 to $138, depending on the number of dependents listed in the application.

New Jersey Unemployment Tips

1 Q: Where do I apply for unemployment?A: In general, you should apply for unemployment in the same state in which you work. So even if you live in New York, if you work in New Jersey, you should apply in New Jersey.