- Go to the SSS website.

- Log in using your user ID and password then click submit.

- Click the ”e-services” tab.

- Click SUBMIT MATERNITY NOTIFICATION.

- Supply the required and applicable information of employee-member: SS Number, Expected Date of Delivery, and Allocation of Maternity Leave Credits.

How to file for SSS maternity benefits?

Before, the filing of SSS Maternity benefits is through over-the-counter (OTC) or through dropbox at any branch. Submission of documents in person is quite a hassle since you need to travel to the branch near you and wait for your turn to call. Furthermore, filing Maternity benefits personally at the agency has a high risk for pregnant women.

How to apply for the Maternity Benefit online application?

Before filing for the Maternity Benefit Online Application, you must register and create your My.SSS member account in the www.sss.gov.ph. This will be your official account for processing all of your SSS transactions online.

Does social security pay for maternity benefits?

The Social Security System provides maternity benefits to female members who just gave childbirth, experienced losing an unborn child, or emergency termination of their pregnancy. It can be filed online through the Social Security System Website, which has been mandatory since September 01, 2021.

What is the process for SSS maternity benefits?

How long does it take for SSS to pay maternity benefits?

How to submit a pregnancy notification to SSS?

What happens if an employee fails to notify the SSS?

How long do you have to notify your employer if you are pregnant?

How to calculate maternity allowance?

What is maternity benefit?

See more

Until when can I file my SSS maternity benefit?

The 105-Day Expanded Maternity Leave Law implemented on March 11, 2019 increases the number of compensable days of maternity leave, from the initial 60 days for normal delivery, or 78 days for caesarian section delivery, to 105 days for live childbirth? regardless of the type of delivery.

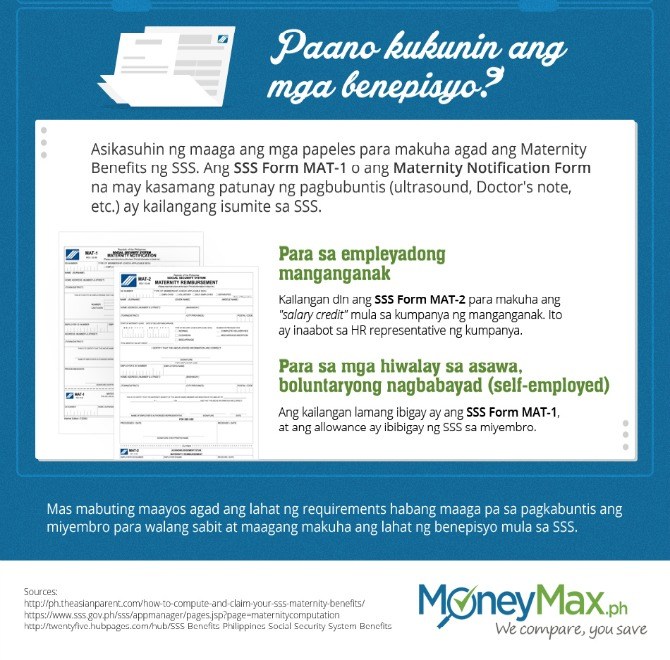

What are the requirements for SSS maternity benefits?

Who qualifies for the SSS Maternity Benefit?The member should have paid at least three (3) months of contributions within the 12-month period immediately before the semester of her childbirth or miscarriage/emergency termination of pregnancy.For employed members – their employers should be notified of the pregnancy.More items...•

When should we submit SSS Mat 1?

60 daysIf you are an employed member, your employer must in turn notify the SSS through the submission of Form MAT-1 at least 60 days from the date of conception.

How much is the maternity benefit in SSS 2021?

How Much is the Maternity Benefit in SSS for 2021? Eligible SSS members may receive maternity benefits of up to PHP 80,000. The maximum benefit applies to members with a monthly salary credit (MSC) of PHP 20,000 (those earning PHP 19,750 and above per month).

Can I file SSS maternity notification online?

They may submit their maternity notification via the My. SSS portal on the SSS website or through the SSS Mobile App. “We would like to remind our members that only contributions paid prior to the semester of childbirth, miscarriage, or ETP will be considered in determining eligibility for maternity benefits.

What documents are needed to apply for maternity leave?

CLAIMING MATERNITY BENEFITSa copy of 13-digit bar-coded identity document.Copies of your last 6 payslips.information supplied by your employer (UI19)a service certificate from the employer.proof of your banking details.a statement of amount received from employer during maternity leave.More items...

When should I apply for maternity notification?

You must submit these documents to your Employer or SSS at least 60 days from the date of conception. For employed members, once you submitted these documents to your employer (or through your HR officer), your employer will then immediately notify SSS about your pregnancy.

How do I know if my SSS Maternity is approved?

Upon approval of the sickness or maternity claim, the SSS will remit the benefit payment to the member's designated bank. The member will be notified thru text blast or email of their benefit payment. They may also confirm details of the payment made either thru Text-SSS, their My.

What are the requirements for maternity 1?

MAT 1 (Maternity Notification) – You need to submit this atleast 60 days from date of conception. Also an ultrasound as evidence of your pregnancy or Doctor's certificate indicating the date of your expected delivery. They will receive the form, record the data and return it to you.

How do I avail PhilHealth maternity benefits?

Pregnant women who are not yet covered by PhilHealth are advised to submit the duly accomplished PhilHealth Member Registration Form and any proof confirming pregnancy such as medical certificate from physician/midwife, laboratory/ultrasound results or photocopy of their admission book.

How do I calculate my maternity pay?

SMP is calculated by averaging your earnings over a period of at least 8 weeks up to and including the last pay day before the end of the qualifying week. For monthly-paid employees, For weekly-paid employees, the last eight pay slips before the end of the qualifying week are taken into account.

How much maternity pay will I get?

£156.66Statutory Maternity Pay ( SMP ) is paid for up to 39 weeks. You get: 90% of your average weekly earnings (before tax) for the first 6 weeks. £156.66 or 90% of your average weekly earnings (whichever is lower) for the next 33 weeks.

SSS Maternity Benefits Computation for 2022 - Guide PH

Do you want to know how much can you get if you would like to avail yourself of the SSS Maternity Benefit? To avail of the SSS Maternity Benefits, you should first check your SSS monthly contributions and ensure that you paid the required month.. The female member should pay at least three (3) monthly contributions to qualify for the SSS maternity benefit.

How to Qualify, Apply for SSS Maternity Benefit?

How to qualify, apply and compute for the SSS Maternity Benefit is the number one commonly question being asked in the SSS Inquiries. We have previously created a guide on how to apply for SSS Maternity Benefit, but we realized that our guide did not cover most of the common question of all our SSS Inquiries readers especially those that are voluntary members.

Ultimate Guide: How to Qualify, Apply for SSS Maternity Benefit for ...

How to qualify, apply and compute for the SSS Maternity Benefit is the number one commonly question being asked in the SSS Inquiries. We have previously created a guide on how to apply for SSS Maternity Benefit, but we realized that our guide did not cover most of the common question of all our SSS Inquiries readers especially those that are voluntary members.

What is SSS Maternity Benefit?

The SSS Maternity Benefit is a daily cash allowance granted by the SSS to a female SSS member who is unable to work due to childbirth or miscarriage. The SSS female member can avail of the SSS maternity benefit for her first four (4) delivery or miscarriage.

How to Know if I am Eligible for SSS Maternity Benefit?

You are Eligible for the SSS Maternity Benefit if you have paid at least 3 monthly contributions within the 12 months immediately BEFORE your Semester of Delivery/Contingency (childbirth or miscarriage).

How to Apply for SSS Maternity Benefit?

Step 1 should be done within 60 days after you confirmed your pregnancy. Make sure to keep your SSS-approved/acknowledged Maternity Notification document as this will be one of the documents you will present when filing your SSS Maternity Reimbursement in Step 2.

When will I receive my SSS Maternity Benefit?

If you are employed, your SSS Maternity Benefit is advanced in full by the Employer to the qualified female employee within 30 days from the date of filing of the maternity leave application.

How much will be my SSS Maternity Benefit Amount?

The computation and the amount of your SSS Maternity benefit are based on your Monthly Salaey Credit of your SSS contribution. The Monthly salary credit (MSC) means the compensation base for contributions and benefits related to the total earnings for the month. The maximum compensation is P16,000, effective January 1, 2014.

What is the process for SSS maternity benefits?

There are two separate procedures to complete the maternity benefit application: the notification process and the claims process .

How long does it take for SSS to pay maternity benefits?

For employed members. Employers are required to provide the maternity benefits to qualified employees in advance, within 30 days from the employee’s maternity leave. SSS will reimburse the employer 100 percent of the determined amount. If the employee member gives birth or suffers miscarriage without the required contributions having been remitted ...

How to submit a pregnancy notification to SSS?

1. Accomplish the SSS Maternity Notification Form and submit it to your employer or directly to SSS together with your proof of pregnancy. 2a. For employed individuals. Once your employer receives your notice, they are then tasked to forward your form and proof of pregnancy to SSS.

What happens if an employee fails to notify the SSS?

If the employee member gives birth or suffers miscarriage without the required contributions having been remitted by the employer, or the employer fails to notify the SSS, the employer will be required to pay the SSS damages equivalent to the benefits the employee would otherwise have been entitled to.

How long do you have to notify your employer if you are pregnant?

First of all, as soon as you (an SSS member) get pregnant, you must immediately notify either your employer if you’re employed or SSS if you’re self-employed of such pregnancy at least 60 days from the date of conception.

How to calculate maternity allowance?

Divide the total monthly salary credit by 180 days to get the average daily salary credit. This is equivalent to the daily maternity allowance. Multiply the daily maternity allowance by 60 (for normal delivery or miscarriage) or 78 days (for cesarean section delivery) to get the total amount of maternity benefit.

What is maternity benefit?

The Social Security System (SSS) offers maternity benefits – in the form of a cash allowance – to women who are unable to work due to childbirth or miscarriage/emergency termination of pregnancy. You are entitled to these benefits regardless of whether you’re employed or not, as long as you consistently pay your monthly ...

How long do you have to notify SSS of maternity benefits?

Many people asks about SSS maternity benefit how long to claim. You have to notify, also, the probable date of childbirth at least 60 days from the date of conception. You have to accomplish Maternity Notification Form. The ER must notify the SSS through the submission of the MN Form after the receipt from the employee.

How long do you have to pay SSS?

To receive the benefits that are available to women, check below the qualifications required to obtain: You must have paid at least three monthly contributions within the 12-month period immediately preceding the semester of your delivery; You have notified your pregnancy through your ER if employed, ...

What are the benefits of being a member of Social Security?

One of the great advantages of being a member is to have access to the SSS Maternity benefits. It is a value that able women can receive, when they are away from their work for reasons of childbirth or miscarriage.

Guide in Filing and Claiming SSS Maternity Benefits

Suppose you are a woman, pregnant, or have suffered from miscarriage or other pregnancy problems. You can receive financial support from SSS through their SSS Maternity Benefits.

Forms, documents, and other Requirements

When filing for SSS Maternity Benefits, you need to know the notification and reimbursement procedure. Still, before we proceed with that, you will first need to know the requirements that you need to prepare and pass for you to be able to file and claim your maternity benefits.

Normal Delivery

Here are the documents you need to prepare if you gave birth through a normal delivery:

SSS Maternity Reimbursement Application Procedure

Now that you are aware of the requirements that you need, filing for SSS Maternity Reimbursement is easy. Here are the steps you need to follow when filing for a SSS Maternity Reimbursement procedure:

What are the SSS Maternity Benefits?

The Social Security System provides maternity benefits to female members who just gave childbirth, experienced losing an unborn child, or emergency termination of their pregnancy.

What is the difference between the MBA and MBRA of the SSS?

MBA stands for Maternity Benefit Application, while MBRA means Maternity Benefit Reimbursement Application.

Requirements to avail SSS Maternity Benefits

To avail of the SSS Maternity Benefits, the most important thing is that you have paid your monthly contributions for three months within 12 months right before the semester of childbirth or the loss of an unborn child.

FAQs

The ADSC or Average Daily Salary Credit depends on the amount of your SSS contribution.

Conclusion

The Social Security System of the Philippines supports its female members in one of the most critical days in their life.

What is SSS maternity benefit?

It is a government-mandated benefit in the form of cash allowance granted to a female member who was unable to work due to childbirth or miscarriage. Self-employed and voluntary members are also covered by this benefit.

What is the benefit of SSS maternity leave?

SSS maternity leave benefit is really a great help to all mothers who would need some time off work to care for their newly born and recuperate from labor.

What is the process for SSS maternity benefits?

There are two separate procedures to complete the maternity benefit application: the notification process and the claims process .

How long does it take for SSS to pay maternity benefits?

For employed members. Employers are required to provide the maternity benefits to qualified employees in advance, within 30 days from the employee’s maternity leave. SSS will reimburse the employer 100 percent of the determined amount. If the employee member gives birth or suffers miscarriage without the required contributions having been remitted ...

How to submit a pregnancy notification to SSS?

1. Accomplish the SSS Maternity Notification Form and submit it to your employer or directly to SSS together with your proof of pregnancy. 2a. For employed individuals. Once your employer receives your notice, they are then tasked to forward your form and proof of pregnancy to SSS.

What happens if an employee fails to notify the SSS?

If the employee member gives birth or suffers miscarriage without the required contributions having been remitted by the employer, or the employer fails to notify the SSS, the employer will be required to pay the SSS damages equivalent to the benefits the employee would otherwise have been entitled to.

How long do you have to notify your employer if you are pregnant?

First of all, as soon as you (an SSS member) get pregnant, you must immediately notify either your employer if you’re employed or SSS if you’re self-employed of such pregnancy at least 60 days from the date of conception.

How to calculate maternity allowance?

Divide the total monthly salary credit by 180 days to get the average daily salary credit. This is equivalent to the daily maternity allowance. Multiply the daily maternity allowance by 60 (for normal delivery or miscarriage) or 78 days (for cesarean section delivery) to get the total amount of maternity benefit.

What is maternity benefit?

The Social Security System (SSS) offers maternity benefits – in the form of a cash allowance – to women who are unable to work due to childbirth or miscarriage/emergency termination of pregnancy. You are entitled to these benefits regardless of whether you’re employed or not, as long as you consistently pay your monthly ...