- Higher purchasing power of customers. If there is deflation in the country, prices decline. Workers’ wages and managers’ salaries will buy more goods and services than before. ...

- Lower Variable Costs (VC) leading to higher Gross Profit. Firstly, prices of raw materials that are used to produce goods and provide services will decrease. ...

- Lower Fixed Costs (FC) leading to higher Net Profit. Firstly, firms will now pay cheaper rent and the prices of land, buildings and office space will most likely decrease as ...

- Narrows the gap between rich and poor. In a way one can say that deflation helps in narrowing the gap between the rich and poor. ...

- Reduce your debt. One of the best ways to prepare for deflation is to focus on paying off debts. ...

- Buy high-quality bonds. ...

- Don't load up on stocks. ...

- Keep an eye on these sectors. ...

- Don't lose sleep over the risk.

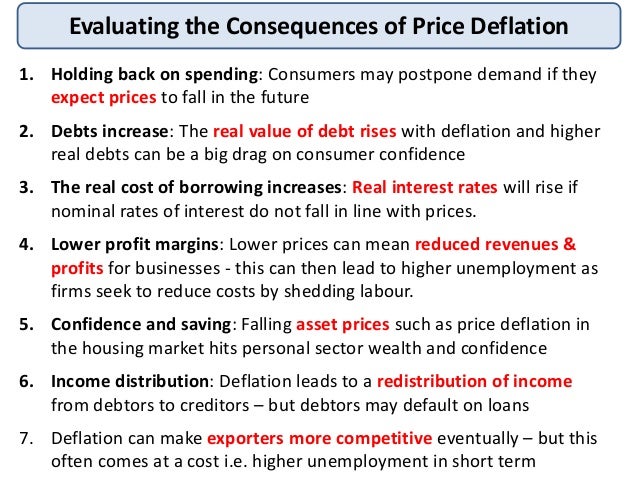

What is so bad about deflation?

Well, once you pull back the curtain here, you see a few things: Deflation can cause unemployment rates to spike, salary and hourly pay to drop, and big-time assets like homes to lose their value (we’ll dig into all that later). And sometimes, it can even spur on a recession. See? Like we said, no good.

Is deflation such a bad thing?

While deflation may seem like a good thing, it can signal an impending recession and hard economic times. When people feel prices are headed down, they delay purchases in the hopes that they can buy things for less at a later date. But lower spending leads to less income for producers, which can lead to unemployment and higher interest rates.

Why is deflation bad for average Americans?

The Fed usually has a hard target of 2% for inflation. Now, the Fed is willing to accept 2% as an average. This means that inflation can exceed 2% at some times. Here is why the Fed is so worried. Deflation Is a Bad Thing Because It Cuts Production. Deflation means that companies are able to charge less for their products.

What is the best investment for deflation?

If you are interested in metals, gold historically offers investors a safe haven during deflationary times. Silver and copper prices, however, fall as industrial use and new housing construction demands decline. Confine your stock market investing to deflation-proof sectors including utilities, health care and agricultural goods.

Does anyone benefit from deflation?

Key Takeaways. In the short-term, deflation impacts consumers positively because it increases their purchasing power, allowing them to save more money as their income increases relative to their expenses.

What should I invest in during deflation?

Deflation hedges include investment-grade bonds, defensive stocks (those of consumer goods companies), dividend-paying stocks, and cash. A diversified portfolio that includes both types of investments can provide a measure of protection, regardless of what happens in the economy.

How do you survive during deflation?

The curse of falling prices. When the prices of some things fall, consumers get a break. ... Pay off debt. ... Keep cash on hand. ... Resist the lure of falling prices. ... Don't spend money before you get it. ... Anticipate "no." ... Find a second source of income. ... Don't "invest" in a home.More items...•

How do you get rich during deflation?

3 Best Investments For Deflationary PeriodsInvestment-Grade Bonds. Investment-grade bonds include Treasuries and those of high-quality, blue-chip companies. ... Defensive Stocks. Defensive stocks are those of companies that sell products or services that we people can't easily cut out of their lives. ... Dividend-Paying Stocks.

Is gold good in deflation?

There is a common view that deflation is bad for gold. The shiny metal is considered an inflation hedge, not a deflation hedge. However, gold is not just about inflation versus deflation. The yellow metal is a safe-haven asset which may shine (or languish) during both inflationary and deflationary periods.

Is deflation good for mortgage?

During deflation, the lower limit is zero. Lenders won't lend for zero percent interest. At rates above zero, lenders make money but borrowers lose and won't borrow as much.

What happens to real estate during deflation?

To summarize, when you have deflation, the value of your real estate drops, the cash flows drop, and if you are using leverage, those drops are amplified by the amount of leverage you are using. Remember, do not have a mortgage if we have deflation.

Can an investor lose money during deflation if they buy TIPS?

TIPS do not lose their value during deflation.

Why is deflation good?

This is because deflation causes a decrease in the value of financial assets and it becomes very hard to accumulate wealth with the aim of causing artificial inflation.

What is the sign of a deflationary economy?

Deflation is popularly seen as the sign of a decaying economy. This is because in a deflationary economic system demand for goods and services are on the decline. Subsequently, the market forces end up decreasing the prices of goods and services in a bid to satisfy the elusive quantity of demand.

How would deflationary market economics affect the economy?

Deflationary market economics would force banks to encourage spending. With a very much dwindling supply of money powering the market, interest rates will be decreased by the banks in a bid to encourage people to have access to cash they could use for personal purposes. This in turn, would lead ordinary citizens to have access to banks in a way that was not possible during pre-deflationary times. Hence, deflationary market economics need to be studied further in order to leverage its usefulness more to our current system.

Is deflation a psychological erosion?

It is a psychological erosion of faith in market instruments. For obvious reasons, economists worldwide consider deflation to be of negative consequence. However, with so little real world examples of the results of state manufactured deflation available, it is interesting to consider if the traditional sense of suspicion placed behind deflation is ...

Is deflation a good thing?

Hence, deflation is a good way to bring about progressive changes to the society that wants to specialise of financial equity.

What are the disadvantages of deflation?

Disadvantages of Deflation. The biggest disadvantage of deflation is that it creates problem of unemployment because due to deflation prices of goods falls which results in lower profits for companies which in turn force the companies to reduce the production of goods by cutting down production in factories or even closing some factories which in ...

Why does deflation hit rich people?

Deflation hits hard rich people as compared to poor people because in case of deflation value of majority of assets falls and rich people hold more assets as compared to poor people and hence they are at more loss as compared to poor people.

What is the definition of deflation?

Deflation refers to that situation where there is general decline in prices of goods and services, it happens when inflation rate fall below zero percent.

Why is cash the king in deflationary times?

In simple words cash is the king in deflationary times as holders of cash are benefited and holders of assets are at disadvantageous because the value of assets keeps declining in case of deflation.

Why is deflation bad?

Bad deflation occurs when aggregate demand falls faster than any growth in aggregate supply. Negative money shocks, like what happened during the Great Depression, create "bad" deflation.

Why do economists fear deflation?

Economists fear deflation because falling prices lead to lower consumer spending, which is a major component of economic growth. Companies respond to falling prices by slowing down their production, which leads to layoffs and salary reductions. This further lowers demand and prices. However, for a period of approximately five years, ...

How long did the price of goods go down in Switzerland?

For a period of approximately five years, prices of consumer goods went down in Switzerland without any widespread negative impact on the country's economy, leading some economists to revise their opinion about the ill effects of deflation.

How long did Switzerland's prices go down?

This further lowers demand and prices. However, for a period of approximately five years, prices of consumer goods went down in Switzerland without any widespread negative impact on the country's economy. 1 In fact, their economy prospered in the midst of falling prices. This has caused some economists to revise their opinion about ...

Is deflation a symptom of a struggling economy?

However, the view that deflation is always a symptom of a struggling economy may not be true , though it is deep-seated in economic theory. This belief is primarily the result of studying the Great Depression, which cannot be considered the archetypal example of what happens during persistent deflationary periods.

Is deflation positive or negative?

After researching deflationary periods in the United States, Britain, and Germany during the late 19th century, a team of economists from the National Bureau of Economic Research (NBER) made the claim that deflation can be more positive than negative in a paper issued in February 2004. 2 .

Does deflation cause a recession?

In addition, the ratio of public debt to gross domestic product (GDP) increases as the government is forced to spend more money on social welfare programs. Deflation can push an economy into a recession. However, this was not the case in Switzerland.

What are the economic benefits of deflation?

It is only through fear-mongering that deflation can be depicted as an evil rather than one of economics' most virtuous "goods.". It is only through fear-mongering that deflation can be depicted as an evil rather than one of economics' most virtuous "goods.". The following commentary comes ...

Is deflation a bubble?

Deflation is the great bubble-destroyer. No asset-bubble can ever withstand the economic "shock" of deflation. Again we see the hypocrisy of politicians and bankers (and the media talking-heads who parrot them).

Advantages of deflation

Here are a few ideas how customers and businesses might benefit from deflation:

Disadvantages of deflation

Rapid inflation has many serious side effects. While we could conclude that a period of falling prices could be positively desirable, here are some reasons why most customers and businesses would not actually benefit from deflation.

What is deflation in economics?

Deflation, in simple terms, is erosion in the prices of products and services by way of reduced demand. It can spiral even further, as businesses chase that limited demand with even lower prices. For the consumer, the lower prices may seem like a benefit, especially following a period of prolonged inflation or when wages are stagnant or falling.

Why is deflation so hard to predict?

Hedge funds, wars and trends in demand can all put pressure on one commodity that can affect the entire economy. This is what makes deflation hard to predict, difficult to define and almost impossible to verify until it has set in or almost passed. It also makes it difficult to determine if it is, in fact, all bad.

When was the last time the US economy was deflationary?

Deflation Over Time. The last time the U.S. economy suffered from a prolonged deflationary period was during the Great Recession, officially lasting from December 2007 to June 2009, and the ensuing global recession in 2009. 1 Before that, a prolonged deflationary period occurred during the Great Depression.

What is the fear of deflation?

The fears of deflation are often confused with temporary declining prices. While deflation is characterized by a sustained aggregate fall in the combined index of Consumer Price Index or gross domestic product , the U.S. economy is so much more complex than it was in the '20s and '30s.

Is deflation a bad thing?

Deflation carries with it a bad stigma, and it most likely haunts the Federal Reserve every time a change in the direction of interest rates is made. One of the major issues with the theories of the negative impact of deflation is that there really isn't much historical data on the subject to study.

Is deflation a concern?

The consensus among policymakers and economists is that the threat of deflation alone is a concern. And the limited amount of data available to study, along with the somewhat ambiguous nature of deflation itself, are only a couple of the hurdles involved with studying its effects.

How to prepare for deflation?

Here’s how to prepare. Pay off debt. With deflation, debt gets more expensive over time, taking a bigger and bigger bite out of your real income. So the less debt you have going into a period of deflation, the better.

What are the early days of deflation?

The early days of deflation are typically marked by prices that seem too good to be true. You may be tempted by luxury goods and electronics selling at far lower prices than you've ever seen. But keep in mind that prices could fall further, and a few months later, you might wish you had kept more cash around.

What happens when the price of something falls?

When the prices of some things fall, consumers get a break. But widespread deflation can trigger a destructive cycle in which profits plunge, companies cut jobs and pay, spending plummets and stagnation sets in. The economic fallout caused by the novel coronavirus pandemic has some analysts and regular folks speculating that deflation could happen in the U.S. While you should understand this financial possibility, experts stress that you shouldn't panic. You can't control or know when deflation will happen, says Roger Ma, certified financial planner at lifelaidout and author of "Work Your Money, Not Your Life," so focus on what you can control. Here’s how to prepare.

Is zero percent interest rate better than depreciation?

But with deflation, the calculation changes, since even a zero percent interest rate is better than depreciation . Another reason to maintain a robust emergency fund: A deflationary economy may go hand in hand with layoffs and frozen wages.

What does deflation mean for mortgages?

Deflation also means lower long-term borrowing costs. The national average for 30-year mortgages fell from 6.46% to 5.47% before the Fed's Dec. 16 announcement, according to Freddie Mac. Mike Woelflein is a business and personal finance freelance writer.

What is deflation in gasoline?

deflation. , a persistent and general decrease in prices. While deflation may not sound so bad at first -- in mid-December, gasoline prices were down nearly 60% from July's record highs and holiday discounts abounded -- but it can have serious consequences for the economy and your wallet.

Why do stocks suffer in a deflationary environment?

Stocks suffer in a deflationary environment because companies have to discount their products to sell them. Makers of big-ticket items, such as cars and appliances, take a hit. But some sectors hold up better than others.

Does deflation cause a downward spiral?

By contrast, prolonged deflation can turn into a self-fulfilling downward death spiral, as it did during the Great Depression and during the 1990s in Japan, which saw its stock market suffer a long descent during the "lost decade.".

Is deflation good for the market?

Deflation differs from disinflation, which is a mere slowing of the rate of increase in prices. That's an important distinction. Disinflation can be good for the market. A study by the Minneapolis-based Leuthold Group found that from 1872 through the last deflation threat in 2002, the

Restructuring of The Market

Getting Rid of The Excess

- Deflation is a good way to get rid of asset bubbles building up inside the market. This is because deflation causes a decrease in the value of financial assets and it becomes very hard to accumulate wealth with the aim of causing artificial inflation. Adversely, this can lead to distress selling and ultimately result in the collapse of the market e...

Higher Standards of Living

- As mentioned before, deflation causes the prices of goods and services to fall. Ideally, from a consumerist perspective, this would essentially mean that he/she has been afforded more spending power. Accessibility of basic requirements to those below the poverty line is not discussed enough in the context of economies that are obsessed with development indexes. De…

Accessibility of Banks

- Deflationary market economics would force banks to encourage spending. With a very much dwindling supply of money powering the market, interest rates will be decreased by the banks in a bid to encourage people to have access to cash they could use for personal purposes. This in turn, would lead ordinary citizens to have access to banks in a way that was not possible during …