- Add together the cost of an employee's fringe benefits for the year

- Divide it by the employee's annual salary

- Multiply the total by 100 to determine the percentage of fringe benefit rate

- Suppose your salaried employee earns $80,000 per year. ...

- $20,000 / $80,000 = 0.25. ...

- 0.25 X 100 = 25% ...

- $80,000 / 40 hours per week / 52 weeks per year = $38.46. ...

- $38.46 X 0.25 = $9.61 (hourly cost of fringe benefit) ...

- $9.61 + $38.46 = $48.07.

How do you calculate fringe benefits?

In just a few tenths of a second, you will see:

- Total Contribution Per Month into a Bona-Fide Plan

- Your Monthly Savings

- Your Annual Savings

How to calculate fringe benefits by hour?

Method 1 Method 1 of 4: Identifying Fringe Benefits Download Article

- Determine what types of wages are required by law. If a wage is required by law, it will not be considered a fringe benefit.

- Locate a copy of your employment contract. You will be able to begin finding fringe benefits by looking at a copy of your employment contract.

- Ask your employer for help. ...

- Determine the fringe benefits you receive (or give). ...

How to figure fringe benefits?

TAS for Tax Professionals

- Fringe Benefit Overview Performance of services. Provider of benefit. Recipient of benefit. ...

- Fringe Benefit Exclusion Rules Accident and Health Benefits Accident or health plan. Employee. ...

- Fringe Benefit Valuation Rules General Valuation Rule Fair market value (FMV). Employer-provided vehicles. ...

- Rules for Withholding, Depositing, and Reporting

How do you calculate fringe?

How to Calculate Fringe Benefits

- Method 1 Method 1 of 4: Identifying Fringe Benefits Download Article. ...

- Method 2 Method 2 of 4: Calculating Your Own Fringe Benefits as an Employee Download Article. ...

- Method 3 Method 3 of 4: Determining the Cost of Fringe Benefits as an Employer Download Article. ...

- Method 4 Method 4 of 4: Valuating Your Fringe Benefits for Tax Purposes Download Article. ...

How do you calculate a fringe rate?

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

How do I calculate my hourly rate from benefits?

Divide the total benefit value for one week by the total number of hours the employee works in one week. The answer is the conversion of the benefits into an hourly rate.

What is the Fringe percentage of a salary?

The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. For example, if the total benefits paid were $25,000 and the wages paid were $100,000, then the fringe benefit rate would be 25%.

How do you calculate employee benefits?

Calculating the benefit load — the ratio of perks to salary received by an employee — helps a business effectively plan. Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

How do I calculate fringe benefits?

"A fringe benefit rate is the percentage of an employee's wages relative to the fringe benefits the employee receives." Calculate the fringe benefit rate by adding the annual cost of all benefits and payroll taxes paid and dividing by the annual wages paid.

How do you calculate hourly rate?

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Next, divide this number from the annual salary. For example, if an employee has a salary of $50,000 and works 40 hours per week, the hourly rate is $50,000/2,080 (40 x 52) = $24.04.

What are fringe benefits examples?

What Are Fringe Benefits Examples. Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

How are reportable fringe benefits calculated?

Calculating reportable fringe benefits amount The lower gross-up rate for the FBT year ending 31 March 2021 is 1.8868. For example, if the taxable value of your fringe benefits is $2,000.00, your reportable fringe benefit amount is calculated as $2,000.00 × 1.8868 = $3,773.

What's included in fringe benefits?

Fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Fringe benefits include, but are not limited to, the costs of leave (vacation, family-related, sick or military), employee insurance, pensions, and unemployment benefit plans.

What is the formula for calculating benefits?

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

How do you calculate benefits paid?

To determine your annual cost for benefits, divide your employees' benefits cost by their total wages earned for the year.

How are total salary benefits calculated?

Add time-off benefits To calculate your total compensation, you will need to assess the value of the paid time off you receive in a year. Multiply the number of days off you have, across all paid time off buckets, by the amount of money you are paid for a day of work to get that total.

Why Use Our Calculator?

Sure, you could do it yourself but why? When a boss tells you to get back to work or you’re pushing towards that all important deadline, do you really want to sit there with an old jeweled calculator or one of those stupid promotional calculators that has a curved middle and never seems to work right? What if you’re rushing to meet that deadline but that quiet nagging voice in the back of your head is wondering about your fringe benefits? Satisfy that random curiosity with this calculator!

What are the factors that determine prevailing wage?

All you need to know is four simple factors: The number of employees that are doing prevailing wage work. The fringe benefit portion in dollars of the work per hour. The number of hours worked in a year. The payroll burden as a percentage. (for instance, for 12%, just put 12 in)

What is a fringe benefit rate?

So … what is a fringe benefit rate? A fringe benefit rate is the percent of an employee’s wages relative to the fringe benefits they receive. Calculate a fringe benefit rate by dividing the cost of an employee’s fringe benefits by the wages they receive.

What is fringe rate?

The fringe rate shows you how much an employee actually costs your business beyond their base wages. Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, ...

How to find employee hourly rate?

If you want to find the employee’s total hourly rate (including their fringe benefits), you can divide the employee’s annual salary by the number of weeks per year and hours per week:

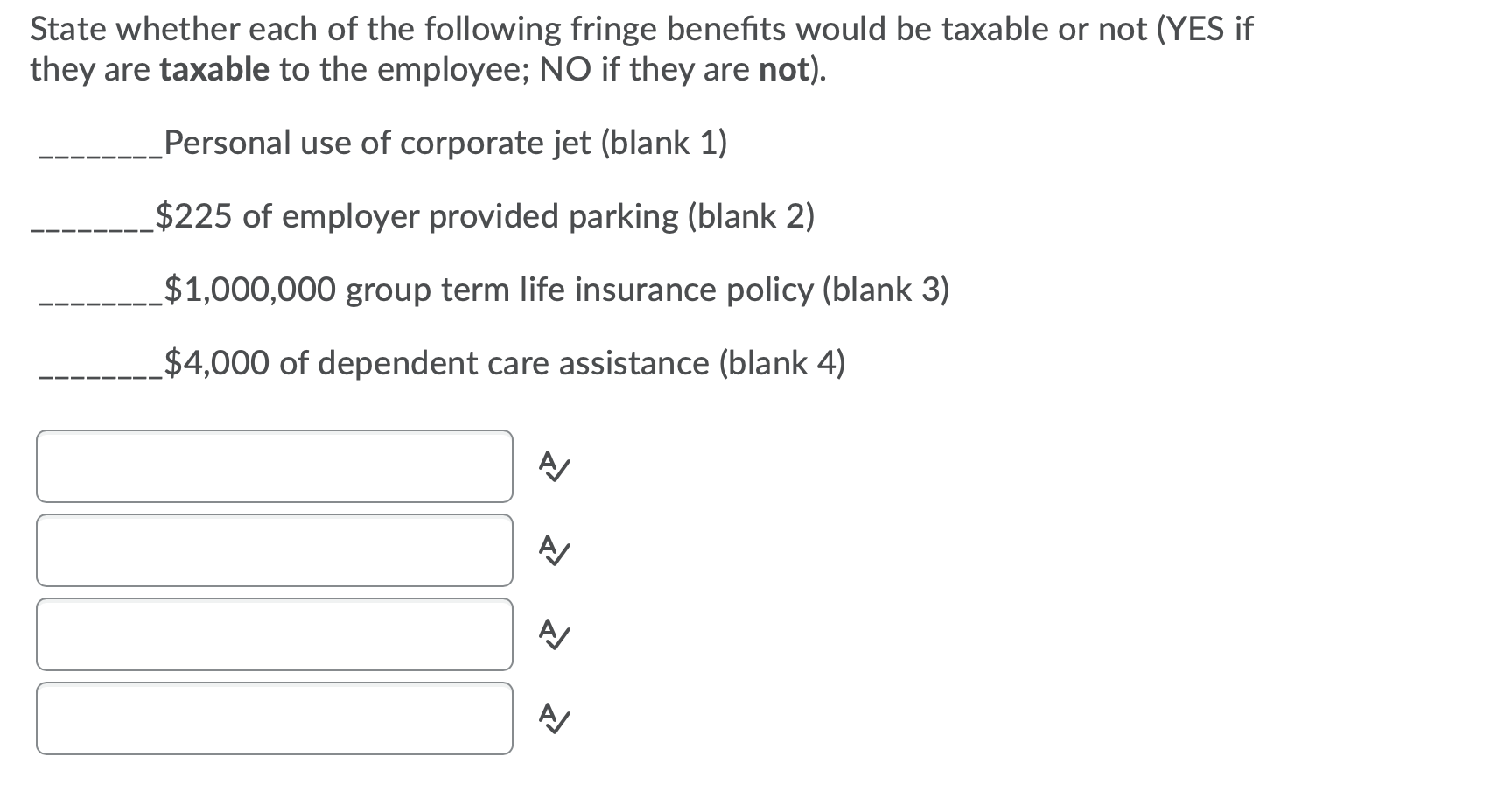

Is fringe benefit taxable?

Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off. Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts.

How to calculate fringe benefits?

The first step is to figure out what amount of fringe benefits should be credited to each employee annually, this is the benefit rate on the prevailing wage rate for each employee. The second step is to analyze the benefit-cost and divide it by the total cost of the benefit given by 40 hours per week in 52 weeks.

What is fringe benefit?

Those employees who do not incur any cash benefits or are not given any contributions are eligible for fringe benefits that equal the amount in cash they should have been given. If an employee is being given a contribution, it should be properly defined. The contribution could be a pension plan, medical help or anything along these lines. In regards to pension plans if there is an immediate need for it then the employee has a 100% vesting. If there is no immediate vesting then the employee is afforded credit according to an annual rate based on work hours of the previous year.

Is social security considered fringe benefit?

Things like social security, compensations, etc. are a part of the job package and should not be considered or taken credit as a fringe benefit.

Can you lower the minimum wage?

Under the new Public Service Contract Act regarding the discharging of Fringe benefits obligations, employers can decrease the minimum wage of a worker as long as he/she is given fringe benefits that equal the total wage rate that is mandated by law. The path to reaching the minimum wage rate required may be, fringe benefits and cash or minimum wage rate in cash and a small portion of fringe benefits. This choice is up to the employer or according to employee choice.

What is the fringe benefit rate for VSU?

VSU has established 7.65% as the fringe benefit rate for part-time employees, student workers, and summer salary. This includes social security and worker’s compensation. Personnel working less than 75% effort are considered part-time. Fringe benefits for all students should be calculated at 7.65% .

How to calculate summer pay for VSU?

To budget for summer effort, divide the 9-month base salary by 9 to calculate the monthly rate of pay, then multiply that figure by the number of summer months (up to 3) that the faculty member will work on the grant project. VSU allows 9-month faculty to earn up to 33% of their salary during the summer. When all summer pay – including teaching and grant pay – is combined, the total cannot exceed 33% of the faculty member’s academic-year salary. Take a faculty member’s summer teaching plans into account when determining how much time to budget for grant activity, to ensure the budget doesn't exceed the 33% summer pay maximum. Also keep in mind that some funding agencies (including the National Science Foundation) limit summer compensation to 2 months – be sure to check the program guidelines carefully for these restrictions.

How to budget for faculty effort?

To budget for an hourly rate, divide the faculty member’s base salary by 1,344 (the number of duty hours in an academic year), then multiply that figure by the number of hours of effort for which the faculty member will be compensated.

How to pay a faculty member to teach a summer course?

To budget for a summer course, multiply the faculty member’s base salary x 3/32 (one summer course = 3/32 x academic year salary).

How long are VSU faculty appointments?

Many projects will involve the effort of VSU faculty. Most faculty are on 9-month appointments, and their effort and compensation on a grant program can be calculated using the methods below:

How to request academic release time for a faculty member with a 9 month appointment?

When requesting academic year release time for a faculty member with a 9 month appointment, multiply the percentage of release time effort x 9 ( the number of months in an academic year appointment).

What is considered full time?

Personnel working 75% effort or greater are considered full-time.

How many hours a year is fringe benefit?

Example of Fringe Benefit Rate. Let's assume that a company operates 5 days a week for 8 hours a day for 52 weeks a year resulting in a total of 2,080 hours per year.

What is fringe rate?

A fringe benefit rate is a percentage that results from dividing the cost of an employee's fringe benefits by the wages paid to the employee for the hours actually worked.