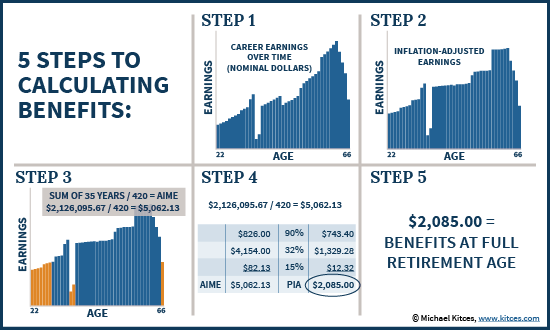

Bend points from the year you turn 62 are used to calculate your Social Security retirement benefits. The example in the table below uses 2020 bend points. It works like this: You take 90% of the first $906 of AIME. You take 32% of the next $5,785 of AIME. You take 15% of any amount over that $5,785. You total those three numbers.

Full Answer

How much does social security go up each year after age 62?

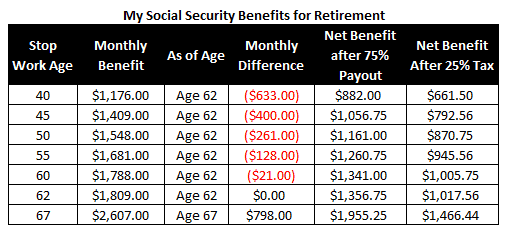

The actual year-over-year percentage gain for ages 62 to 70 are shown in the following table. Those gains range from 6.5 percent (claiming at 70 rather than 69) to 8.4% percent (claiming at 64 rather than 63).

How much can you make and draw social security at 62?

If you start benefits between the month you turn 62 and the month you reach full retirement age, the Social Security Administration will deduct one dollar from your annual benefit amount for every two dollars you make above an annual limit. As of 2019, this limit is $17,640 per year or $1,470 a month.

Should you collect Social Security at age 62?

The earliest you can start Social Security benefits is age 62. However, just because you can start benefits does not mean that you should. Your monthly Social Security paycheck increases significantly for every month and year you delay starting, up until your full retirement age (around age 67).

Are Social Security benefits taxable after age 62?

This is true even if you collect Social Security benefits after you reach your full retirement age - there is no age at which SS benefits become exempt from Federal Income Tax. Here’s how it works: More: Ask Rusty – Should I Quit Work to Preserve My ...

How do I find out how much Social Security I would get at 62?

You can also get basic benefit estimates by calling the Social Security Administration at 800-772-1213.

What is the average Social Security benefit at age 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

How is my Social Security benefit calculated?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA).

Is Social Security based on the last 5 years of work?

No, your Social Security benefits do not depend on the last three or five years of work.

Can I draw Social Security at 62 and still work full time?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $30000 a year?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

How do zero earning years affect Social Security?

If you stop work before you start receiving benefits and you have less than 35 years of earnings, your benefit amount is affected. We use a zero for each year without earnings when we calculate the amount of retirement benefits you are due. Years with no earnings reduces your retirement benefit amount.

How much Social Security will I get if I make 20000 a year?

If you earned $20,000 for half a career, then your average monthly earnings will be $833. In this case, your Social Security payment will be a full 90% of that amount, or almost $750 per month, if you retire at full retirement age.

Is Social Security based on your 3 highest earning years?

While it's true that the last 3 years you work may affect your Social Security benefit amount when you claim, those years alone are not what determine your benefit dollar amount. Rather, your benefit is determined using a formula, which includes the highest earning 35 years of your lifetime working career.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

What happens if you don't give a retirement date?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages .

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

What happens if you file for Social Security at 62?

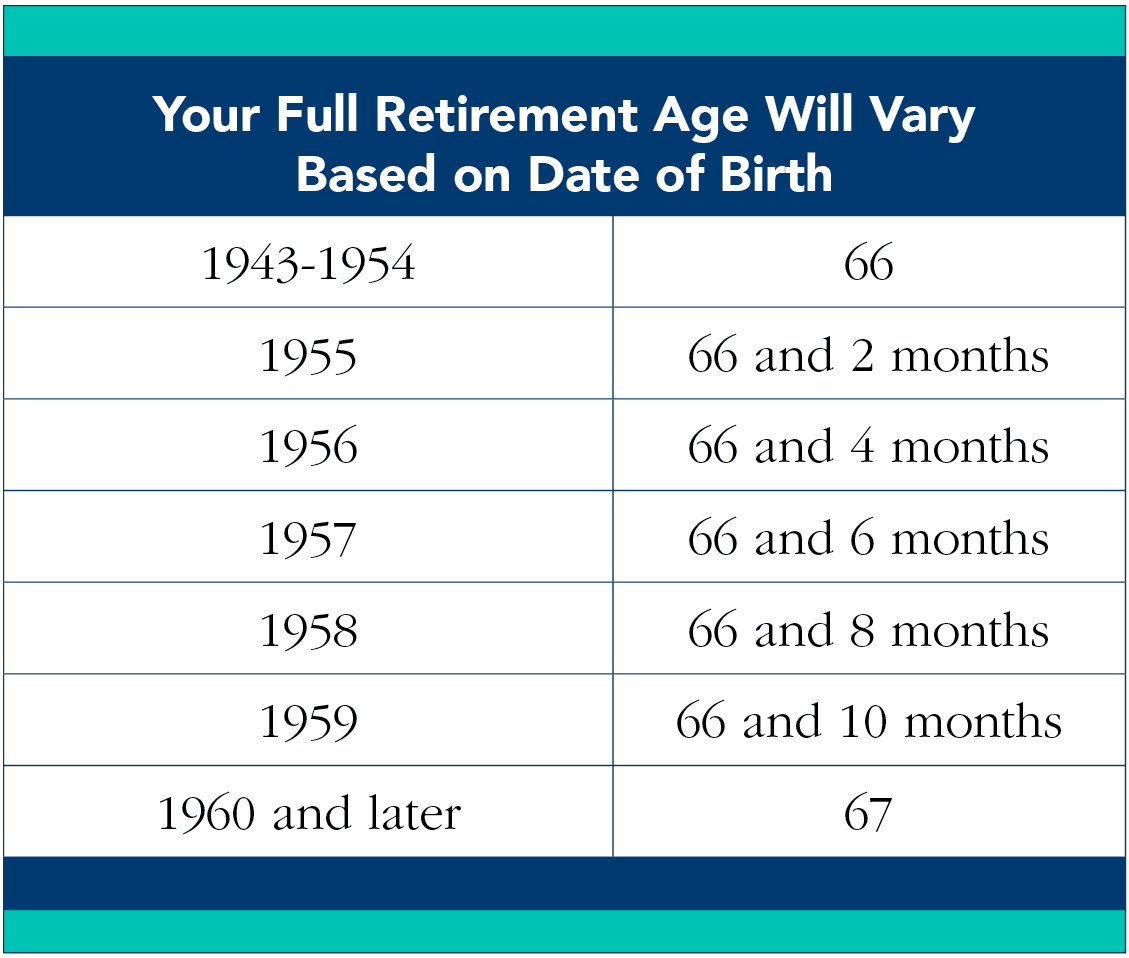

By filing at 62, or any time before you reach full retirement age, you forfeit a portion of your monthly benefit. If you were born in 1960 or later, for instance, filing at 62 could reduce your monthly payment by as much as 30 percent. AARP’s Social Security Benefits Calculator can provide more details on how filing early reduces benefits.

When can I collect Social Security if I was born on the first day of the month?

For example, if you were born on Oct. 1 or 2, 1959, Social Security considers you to be 62 as of Sept. 30 or Oct. 1, 2021.

When will Social Security start in 2021?

For example, if you were born on Oct. 1 or 2, 1959, Social Security considers you to be 62 as of Sept. 30 or Oct. 1, 2021. Your benefits will start in October 2021; you can apply for benefits in June. But if you were born between Oct. 3 and 31, your first full month at 62 is November. If you want to start your benefits as soon as possible, ...

When will I get my unemployment benefits if I was born in October?

There is a one-month lag in the benefit payment. If your birthday is Oct. 1 or 2, you qualify for an October benefit and it will be paid in November. If you were born later in October, your first benefit month is November and you will be paid in December.

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

What age do you get FRA?

This is the amount you will get if you start benefits at your Full Retirement Age (FRA). Your FRA can vary depending on the year you were born. For people born between 1943 and 1954, as in our example, the FRA is age 66. For people born on Jan. 1, the FRA is based on the year prior.

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

Although you'll receive reduced checks by claiming early, you can still receive thousands of dollars per month

The age at which you file for Social Security benefits will have a major impact on the amount you receive each month. While you can receive larger monthly payments by delaying benefits, many workers choose to file as early as possible at age 62. That can be a smart strategy in many cases, and there are several advantages to claiming early.

How the length of your career affects your benefits

One of the most important factors when it comes to your benefit amount is the number of years you've worked. Most people become eligible for Social Security retirement benefits once they've earned income for 10 years, but you'll need to work for at least 35 years to receive the maximum benefit amount.

How much you'll have to earn to reach the maximum benefit amount

Your income is another crucial factor in reaching the highest benefit amount. The more you're earning, the more you'll be eligible to collect in benefits -- up to a certain point.

What if your earnings are falling short?

If you're earning enough to reach the maximum benefit amount, that's fantastic. But the average worker will struggle to reach the income limits, and not everyone can afford to work 35 years before claiming.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is the Social Security retirement age for 2022?

For example, if you were born in 1960, your full retirement age is 67. If you choose to begin receiving Social Security income at age 62 , which will be in 2022, your full retirement age benefit will be reduced by 30%, Assuming that full monthly benefit would be $1,000, you will be left with a monthly Social Security check of only $700. 1 .

What does it mean to take Social Security early?

When you elect to take benefits early, you make a permanent choice—meaning that your benefits are reduced over the course of your lifetime, not just until full retirement age. Your Social Security break-even age is the point in your life when the total of those lower benefits comes to equal the total of benefits you would have received ...

How much do coworkers get in retirement?

If a coworker with the same birth date and similar earnings history elects to receive their benefit at full retirement age five years later, their benefit will be $1,000 each month. 1 For the first five years, you received a total of $42,000 (or $8,400 per year), while your coworker received nothing, so you are ahead.

How long can you defer Social Security?

Those who are able to defer taking Social Security income until after full retirement age are given a delayed retirement credit each year past that age until age 70, equivalent to an annual 8% increase for people born in 1943 or later. 3 Waiting until 70 creates the fewest number of checks received, but results in a much higher monthly benefit.

When will my coworker catch up to me in Social Security?

The answer is when you are both 78 years and eight months, or 11.67 years ($42,000 ÷ $3,600) after your full retirement age.

Is the break even age for Social Security the same as the age of retirement?

Still, the break-even age—the age when total Social Security income from two retirement options is the same—can be good to know, as external factors may affect the actual worth of benefits received. These include inflation as measured by annual cost-of-living increases, the time value of money, probable investment returns, and marginal tax rates.

What happens if you wait to claim Social Security at age 70?

So the trade-off is receiving fewer checks from Social Security but the ones you do get would be larger.

What is the maximum age you can retire?

Currently, the full retirement agefor most people is either 66 or 67 years old , based on Social Security Administration guidelines.

What is break even age?

Your break-even age is the point at which you’d come out ahead by delaying Social Security benefits. Your actual Social Security break-even age can depend on the amount of benefits you’re eligible to receive, your tax situation and things like how inflationmight affect the purchasing power of your benefits.

What is the break even point for unemployment?

The break-even point represents when the cumulative benefits even out. So if you wait until age 70 to start taking benefits, it would take you until age 79 to break even with the benefit amount you’d receive if you started taking them at age 62. If you were to start receiving benefits at age 66, it would take you until age 75 to break even with ...