How Is the Benefit Cost Ratio Calculated?

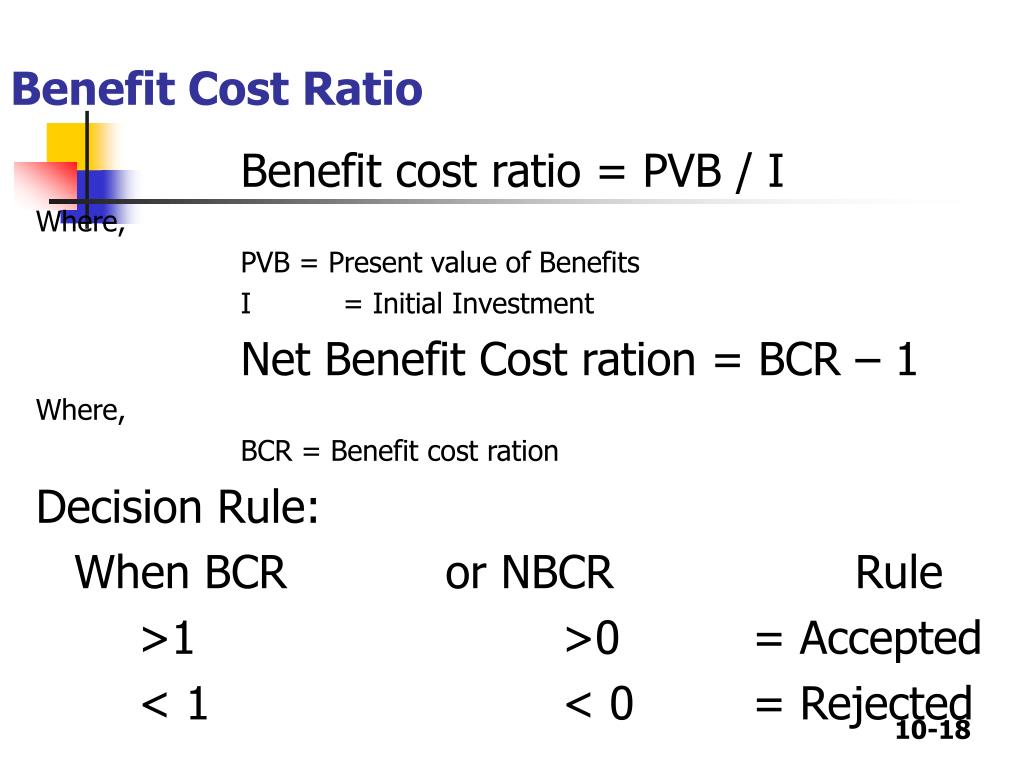

- The BCR Formula. The benefit cost ratio is calculated by dividing the present value of benefits by that of costs and investments.

- Components of the BCR Formula. The Formula for calculating the benefit cost ratio consists of three components: The present value of all benefits, the present value of all costs and, ...

- Input Parameters and Assumptions. The cash flows used for calculating the benefit cost ratio are typically monetary values stemming from a business forecast.

What is the formula for cost benefit analysis?

What is the Cost-Benefit Analysis Formula?

- Example of Cost-Benefit Analysis Formula (With Excel Template) Let’s take an example to understand the calculation of Cost-Benefit Analysis in a better manner. ...

- Explanation. ...

- Relevance and Use of Cost-Benefit Analysis Formula. ...

- Cost-Benefit Analysis Formula Calculator

- Recommended Articles. ...

How to estimate benefits in a cost?

How to Calculate Your Backyard Renovation Cost

- Make a list of what you’re after. Depending on the size of your backyard, it’s possible to either make it look like a private resort or an approachable outdoor living ...

- Hold on to what’s good. ...

- You need a design phase. ...

- Spaces should have more than one use. ...

- Don’t be shocked by the cost of nixing rocks. ...

- If you invest in one thing, make it trees. ...

What is the benefit cost ratio (BCR)?

What is the Benefit-Cost Ratio (BCR)? The benefit-cost ratio (BCR) is a profitability indicator used in cost-benefit analysis to determine the viability of cash flows generated from an asset or project. The BCR compares the present value of all benefits generated from a project/asset to the present value of all costs.

How is a benefit cost ratio computed?

There are two common summary measures used in a benefit-cost analysis. The first is a benefit-cost ratio. To find this ratio, divide the program’s net benefits by its net costs. The result is a summary measure that states, “for every dollar spent on program X, Y dollars are saved.”

How do you calculate benefit-cost ratio with example?

Use the following data for calculation of the benefit-cost ratio. Since the BCR of Project B is higher, Project B should be undertaken....Example #3.ParticularsAmountPresent Value of Benefit Expected from Project4000000Present Value of Cost of the Project2000000

How is cost-benefit analysis calculated?

Explanation of Cost-Benefit Analysis Formula It is computed by dividing the present value of the project's expected benefits from the present value of the project's cost.

How do you do benefit-cost ratio in Excel?

0:427:25Lecture 7: Benefit-Cost Analysis - Excel Example - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo the first thing we're going to do is first calculate the benefit cost ratios. And then we'reMoreSo the first thing we're going to do is first calculate the benefit cost ratios. And then we're going to use benefit cost analysis to select in alternative. So first we're going to do the benefit cost

What is PMP benefit/cost ratio?

The benefit-cost ratio (BCR) helps summarize the relationship between a project's costs and benefits by expressing the ratio as a decimal. If the ratio is greater than 1.0, the benefits outweigh the costs. If the ratio is less than 1.0, the costs outweigh the benefits.

How do you calculate cost ratio?

Calculate the cost of sales ratio by dividing the cost of sales by the total value of sales. Then multiply the result by 100 to get the percentage.

What is a good benefit to cost ratio?

The present value of benefits of a series of cash flows equals the likewise discounted costs. This situation is obviously more preferable than options with a BCR lower than 1. However, if there are alternatives with a benefit-to-cost ratio exceeding 1, they are likely to be favored.

What is cost benefit ratio analysis?

A cost-benefit analysis (CBA) is the process used to measure the benefits of a decision or taking action minus the costs associated with taking that action. A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project.

What is cost benefit analysis example?

For example: Build a new product will cost 100,000 with expected sales of 100,000 per unit (unit price = 2). The sales of benefits therefore are 200,000. The simple calculation for CBA for this project is 200,000 monetary benefit minus 100,000 cost equals a net benefit of 100,000.

How is PVR calculated in finance?

Present Value Ratio (PVR) can also be used for economic assessment of project(s) and it can be determined as net present value divided by net negative cash flow at i*.

How do you calculate NPV and BCR?

There are two main criteria used for evaluating projects in Benefit: Cost Analysis (BCA): the Net Present Value (NPV = benefits minus costs) and the Benefit: Cost Ratio (BCR = benefits divided by costs).

How do you calculate NPV in PMP?

Generally calculated using formula PV = FV / [1+i] ^n, where FV = Future value, i = rate of interest, and n = number of years (^ signifies an exponent). Net Present Value is the cumulative sum of PV. This is an example of when PMI might use a similar question setup, but change the call of the question.

What is IRR PMP?

IRR is the “interest rate at which the cash inflow and cash outflow of the project equal zero” and is an economic method for project selection using capital budgeting.

Example of Benefit-Cost Ratio Formula (With Excel Template)

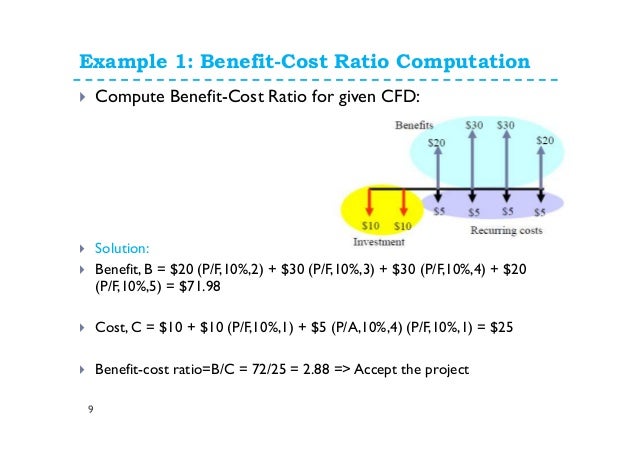

Let’s take an example to understand the calculation of the Benefit-Cost Ratio in a better manner.

Explanation

The formula for Benefit-Cost Ratio can be calculated by using the following steps:

Relevance and Use of Benefit-Cost Ratio Formula

It is a very concept as it is predominantly used in capital budgeting to have a fair idea about the overall value of an upcoming project. However, this technique is more useful for smaller projects compared to larger ones as the latter usually have too many assumptions and uncertainties which makes it hard to quantify the future benefits.

Recommended Articles

This is a guide to Benefit-Cost Ratio Formula. Here we discuss how to calculate the Benefit-Cost Ratio Formula along with practical examples. We also provide a Benefit-Cost Ratio a calculator with a downloadable excel template. You may also look at the following articles to learn more –

What is the benefit cost ratio?

The benefit-cost ratio indicates the relationship between the cost and benefit of project or investment for analysis as it is shown by the present value of benefit expected divided by present value of cost which helps to determine the viability and value that can be derived from investment or project.

What is the benefit of using the benefit cost ratio?

The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects should be rejected.

What does BCR mean in investment?

If the Benefit-Cost Ratio (BCR) is equal to one, the ratio will indicate that the NPV of investment inflows will equal investment’s outflows. Lastly, if the investment’s BCR is not more than one, the investment’s outflow shall outweigh the inflows or the benefits, and the project should not be taken into consideration.

How to calculate BCR?

To calculate the BCR formula, use the following steps: Step 1: Calculate the present value of the benefit expected from the project. The procedure to determine the present value is: Aggregate the amounts for all the years. Step 2: Calculate the present value of costs.

What are the limitations of BCR?

The major limitation of the BCR is that since it reduces the project to mere a number when the failure or success of the projector of expansion or investment etc. relies upon various variables and other factors, and those can be weakened by events which are unforeseen.

What is BCR in economics?

The BCR also does not provide any sense of how much economic value will be created, and so the BCR is usually used to get a rough idea about the viability of a project and how much the internal rate of return (IRR) exceeds the discount rate, which is the company’s weighted-average cost of capital (WACC) – the opportunity cost of that capital. ...

What does BCR mean in NPV?

If the BCR is equal to 1.0, the ratio indicates that the NPV of expected profits equals the costs. If a project's BCR is less than 1.0, the project's costs outweigh the benefits, and it should not be considered.

What is BCR in project?

A benefit-cost ratio (BCR) is an indicator showing the relationship between the relative costs and benefits of a proposed project, expressed in monetary or qualitative terms. If a project has a BCR greater than 1.0, the project is expected to deliver a positive net present value to a firm and its investors.

What is the limitation of BCR?

The primary limitation of the BCR is that it reduces a project to a simple number when the success or failure of an investment or expansion relies on many factors and can be undermined by unforeseen events. Simply following a rule that above 1.0 means success and below 1.0 spells failure is misleading and can provide a false sense of comfort with a project. The BCR must be used as a tool in conjunction with other types of analysis to make a well-informed decision.

What is discount rate?

The discount rate is used for discounting the cash flows. Set a rate that is consistent with the requirements of your organization, e.g. capital cost or internal return target, or a risk-adjusted market interest rate. The calculator will apply this discount rate to all cash flows in order to discount them.

What does a BCR of 1 mean?

A BCR of 1 is the result of a present value of the benefits equal to the present value of the costs of a project or investment. A BCR greater than 1 stands for a profitable option. Its value increases as the relative excess ...

What is BCR analysis?

In cost benefit analyses, the BCR is one of the common methods to assess and compare the future profitability of a series of cash flows (see PMI PMBOK®, 6 th ed., part 1, ch. 1.2.6.4, p. 34). It is often used to supplement comparisons based on the net present value. In these cases, the BCR indicates the relation of costs and benefits. It is interpreted as follows: 1 A BCR lower than 1 indicates that the series of cash flows is not profitable. 2 A BCR of 1 is the result of a present value of the benefits equal to the present value of the costs of a project or investment. 3 A BCR greater than 1 stands for a profitable option. Its value increases as the relative excess of the discounted benefits over the discounted costs increases.

What to do if costs are not cash flows?

If some of your costs or benefits are not cash flows, e.g. use of internal resources, convert them into cash flow equivalents for comparison purposes. The same advice is applicable to non-monetary costs and benefits – they need to be converted into a consistent (currency) unit to ensure quantitative comparability.

What is the benefit cost ratio?

A benefit-cost ratio allows you to know whether your strategic plan towards the project is viable or not. A BCR can either be positive or negative. A positive ratio is where you get a value of more than one, while a negative gives you a value of less than one.

Why is benefit cost ratio important?

A benefit-cost ratio will help you know the overall value of money for the project you are about to undertake. This is important and makes the BRC a profitability index for you. You will therefore know how to budget and plan your finances appropriately.

What does negative BCR mean?

On the other hand, a negative benefit-cost ratio implies that the project is losing money and is, therefore, a bad investment. If you get a BCR of 1, then it is even, meaning that the project will give back the same value of benefits as the amount spent on it.

What happens if the benefits outweigh the costs?

Keep in mind that this is a numerical equation. If the benefits outweigh the costs, then that project is a wise investment, and you can proceed. However, if the costs outweigh the benefits, it would be best to take a step back, reconsider and make necessary adjustments.

Is 100% assurance always 100%?

In as much as it may help ensure you are on the right track for success, it is not always a 100% assurance since there are many variables involved in a project. This means that a benefit-cost ratio of more than one shows higher chances of success and not 100% guaranteed success.

Can you get a false sense of confidence with a higher BCR?

Unfortunately, some people get a false sense of confidence with a higher BCR and end up failing . It can be challenging to account for all indirect benefits. During the initial calculation of the BCR, it may prove challenging to factor in all indirect benefits as some are unnoticeable at this point.

What is cost benefit analysis?

The term “cost-benefit analysis” refers to the analytical technique that compares the benefits of a project with its associated costs. In other words, all the expected benefits out a project are placed on one side of the balance and the costs that have to be incurred are placed on the other side. The cost-benefit analysis can be executed ...

How to calculate cash inflow from a project?

Step 1: Firstly, Calculate all the cash inflow from the subject project, which is either revenue generation or savings due to operational efficiency. Step 2: Next, Calculate all the cash outflow into the project, which are the costs incurred in order to maintain and keep the project up and running.

Which is better, project 1 or project 2?

Therefore, as per the benefit-cost ratio, project 2 is better, while the net present value suggests project 1 is better. Although this is a stalemate mind of the situation, the inherently net present value gets the preference. Therefore, project 1 will be considered better.

Formula

Steps to Calculate Benefit-Cost Ratio

Examples

Advantages

Disadvantages

- To calculate the BCR formula, use the following steps: 1. Step 1: Calculate the present value of the benefit expected from the project. The procedure to determine the present value is: 1. The amount for each year = Cash Inflows*PV factor 2. Aggregate the amounts for all the years. 1. Step 2: Calculate the present value of costs. If the costs are in...

Conclusion

- Example #1

EFG ltd is working upon the renovation of its factory in the upcoming year, and for they expect an outflow of $50,000 immediately, and they expect the benefits out of the same for $25,000 for the next three years. The inflation rate that is currently prevailing is 3%. You are required to assess … - Example #2

Sunshine private limited has recently received an order where they will sell 50 tv sets of 32 inches for $200 each in the first year of the contract, 100 air condition of 1 tonne each for $320 each in the second year of the contract, and the third year they will sell 1,000 smartphones valuing at $5…

Recommended Articles

- The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects shou...

- It compares benefit and cost at the same level that is it considers the time value of money before giving any outcome based on absolute figures as there could be a scenario that the pr…

- The benefit of using the benefit-cost ratio (BCR) is that it helps to compare various projects in a single term and helps to decide faster which projects should be preferred and which projects shou...

- It compares benefit and cost at the same level that is it considers the time value of money before giving any outcome based on absolute figures as there could be a scenario that the project appears...

What Is The Benefit-Cost Ratio (BRC)?

- The major limitation of the BCR is that since it reduces the project to mere a number when the failure or success of the projector of expansion or investment etc. relies upon various variables and...

How The Benefit-Cost Ratio (BCR) Works

- We can conclude that if the investment has a BCR which is greater than one, the investment proposal will deliver a positive NPV and on the other hand, it shall have an IRR that would be above the discount rate or the cost of project rate, which will suggest that the Net Present Value of the investment’s cash flows will outweigh the Net Present Value of the investment’s outflows …

What Does The BCR Tell You?

- This article has been a guide to Benefit-Cost Ratio and its definition. Here we discuss the formula to calculate Benefit-Cost Ratio (BCR) along with examples. Advantages and limitations. You can learn more about excel modeling from the following articles – 1. Advantages of Net Present Value 2. Cost-Benefit Analysis Examples 3. Mutual Fund Expense Ratio 4. Calculate Benefit-Cost Ratio

Example of How to Use The BCR

Limitations of The BCR

- Benefit-cost ratios (BCRs) are most often used in capital budgetingto analyze the overall value for money of undertaking a new project. However, the cost-benefit analyses for large projects can be hard to get right, because there are so many assumptions and uncertainties that are hard to quantify. This is why there is usually a wide range of potential BCR outcomes. The BCR also doe…