How to Calculate Unemployment in Texas

- Visit the Texas Workforce Commission website to access the online unemployment benefits estimator (see Resources).

- Gather pay stubs or income statements from all jobs you worked during the dates from the specified base year.

- Enter the total wages from all jobs you worked during the base year into the "Wages" field for each specified quarter .

What is the maximum amount for unemployment benefits in Texas?

To qualify for EB, you must:

- have exhausted your regular claim for UI benefits in Texas

- not qualify for regular UI benefits in Texas or any other state

- have total base period wages of your original regular UI claim that are: at least 40 times your weekly benefit amount or equal to or greater than 1.5 times the ...

What are the requirements to get unemployment benefits in Texas?

- The unemployment must be for objective business reasons such as a company, project or department shutdown or a lack of work.

- The unemployment must not be a result of quitting or firing.

- The unemployed individual must not be criminally charged for misdemeanors within the company or outside of it.

Are unemployment compensation benefits taxable in Texas?

Unemployment taxes are not deducted from employee wages. Most employers are required to pay Unemployment Insurance ( UI) tax under certain circumstances. The Texas Workforce Commission uses three employment categories: regular, domestic and agricultural.

How much are workers' compensation benefits in Texas?

- Medical travel expenses. You can receive reimbursement for travel expenses to get medical treatment, as long as it's more than 30 miles away from your home and treatment at a ...

- Vocational rehabilitation. ...

- Death Benefits. ...

How to find your weekly benefit allowance?

You will use your base-payments to discover your weekly benefit allowance (WBA) and maximum benefit amount (MBA). Take the following steps to learn what your benefits might be: For your WBA, find your base period quarter with the highest wages. Divide those wages by 25 then round to the nearest dollar.

What is base period wages?

Your base-period wages include the first four out of five fully complete calendar quarters that you worked. This period starts at the date you are applying for benefits, not when you became unemployed. You may receive a “statement of wages and potential benefits amounts” from the state of Texas. This statement will include ...

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How much is WBA in Texas?

Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

What is the WBA in Texas?

Your weekly benefit amount ( WBA) is the amount you receive for weeks you are eligible for benefits. Your WBA will be between $70 and $535 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages.

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

What is the base period for TWC?

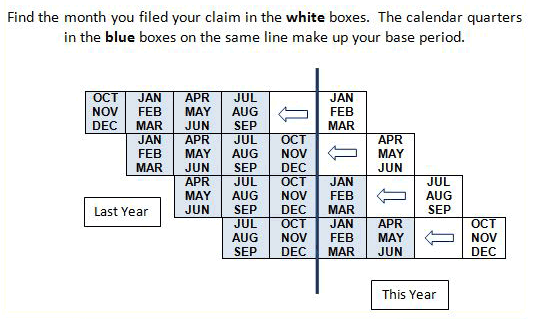

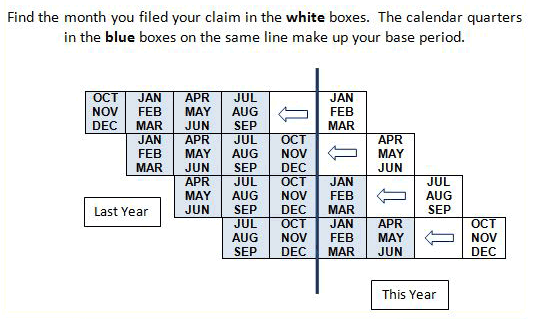

Your base period is the first four of the last five completed calendar quarters before the effective date of your initial claim. We do not use the quarter in which you file or the quarter before that; we use the one-year period before those two quarters. The effective date is the Sunday of the week in which you apply. The chart below can help you determine your base period. If you do not have enough wages from employment in the base period, TWC cannot pay you benefits.

Can you use the TWC unemployment estimate?

You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits. Your benefit amounts are based on your past wages. How we calculate benefits is explained below.

What is unemployment benefits?

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed (working part-time) through no fault of their own. The benefits help unemployed workers who are looking for new jobs. Applicants must meet requirements concerning their past wages ...

What does TWC evaluate for unemployment?

TWC evaluates unemployment benefits claims based on the applicant's: An individual must meet all requirements in each of these three areas to qualify for unemployment benefits. Unemployment Benefits for job seekers and employees provides information for claimants on eligibility requirements.

What is severance pay in Texas?

Severance Pay. Severance pay is a sum of money an employee is eligible to receive upon job separation. You may have a company policy to pay severance pay. Texas law prohibits individuals from qualifying for unemployment benefits while receiving certain types of severance pay.

What is the base period for unemployment?

Base Period. The base period is the first four of the last five completed calendar quarters before the effective date of the initial claim. The effective date is the Sunday of the week in which the person applies for unemployment benefits.

How long can you be disqualified from military benefits?

The person may be eligible for benefits but will be disqualified for 6 to 25 weeks, depending on the situation.

Do you get unemployment if you quit your job?

If the individual chose to end their employment, then he or she quit. Most people who quit their jobs do not receive unemployment benefits. For example, if the person quit the job for personal reasons, such as to return to school full time or stay home with their children, we cannot pay benefits.

Can you get benefits if you are laid off?

Laid Off. Layoffs are due to lack of work, not work performance, so with a layoff the individual may be eligible for benefits. For example, you have no more work available, eliminated the employee's position or closed the business.

Who administers Texas unemployment?

The following link will let you start the online process to file a claim for benefits. Unemployment benefits are administered by the Texas Workforce Commission , the state government agency that helps Texan job seekers and workers.

How long can you receive unemployment benefits?

The calculator indicates your total maximum benefit amount, which is the maximum you can receive for 52 weeks starting with the Sunday of the week that you filed your claim.

When was the WBA updated in Texas?

Use the calculator to estimate your Texas weekly benefit rate amount (WBA) for unemployment benefits. The calculator was last updated in March 2020.

View Electronic Correspondence

If you have an unemployment benefits claim, you can sign up for Electronic Correspondence for online access to your unemployment benefits correspondence.

Submit Your Documents to TWC

If TWC asked you to provide documents, you can upload them using our online UI Submission Portal .

Unemployment Benefits Identity Theft

If you are not claiming unemployment benefits and have information that a claim was filed using your identity, you should report the ID theft claim on TWC’s online portal. Go to Unemployment Benefits ID Theft for more information.

Request Your Waiting Week

TWC cannot pay you for the first week of your claim, also known as the waiting week, until you return to full-time work or exhaust your benefits. If you return to full-time work before exhausting your benefits, you must inform TWC in order to receive payment for that first week.

View Claim & Payment Status

If you have applied for unemployment benefits, view your claim and payment information.

Appeal Online

An appeal is your written notice that you disagree with a TWC decision and want your case decided through the appeal process. Appeals can be submitted online.

Make a Payment on Your Overpayment

An overpayment is caused when TWC pays you unemployment benefits that you are later found not eligible to receive. Overpayments stay on your record until they are repaid. We cannot pay you benefits if you have an overpayment.