How To Value A Defined Benefit Pension For Divorce

- Calculate current benefits When valuing a defined pension plan in divorce, the common practice is to assume the...

- Calculate life expectancy Next, we look up the employee’s life expectancy in retirement. The CDC Life Tables,...

- Determine the appropriate discount rate (discount factor) Because defined benefit...

How do I calculate the value of my pension?

You would need to know the following:

- Workplace pension values (current and historical)

- Additional State Pension but not the basic State Pension value

- Personal Pension value

- The estimated value of your property & how much is left on the mortgage

- Money & other asset values

How much is a defined benefit pension worth?

The amount being offered for defined benefit Pension Transfers varies hugely from scheme to scheme with some schemes offering as much as forty times your pensionable income. Industry averages are between 20 - 33 times pensionable income.

How to compute SSS monthly pension?

Use the third formula for calculating your monthly pension.

- For example, if your AMSC is 9,750 PHP, and you’ve made 30 years of contributions to SSS, we can calculate your pension under this formula in the following way. ...

- Then, subtract 30 by 10, to find how many years of contributions you have beyond 10 years. ...

- To calculate 40% of your AMSC, multiply your AMSC by 0.4. ...

How to calculate the asset value of a pension?

- They are separated with no reasonable chance for reconciliation

- No amount of the pension has been paid out

- The couple has obtained the family law value of the pension from the Plan Administrator

- The division of the pension is part of a Separation Agreement

- The exact amount to transfer has been specified

How do you value a defined benefit pension?

CETVs are calculated by the scheme actuary and will vary but the main factors that the CETV is based on are:How far away you are from retirement.Your salary.Your service with the company.Any rules about how your pension will increase, and any other benefits from the scheme.Assumptions on future annuity/interest rates.More items...•

How do you calculate the present value of a defined benefit plan?

Present value is calculated as PV = FV / (1 + i)^n, where the present value equals the future value divided by one plus the expected interest rate over “n” number of years.

How do I calculate the value of my pension?

Rein uses a simple rule of thumb when it comes to valuating a pension or a stream of cashflow, “For every $100 per month of income, you have an asset worth $18,000.” If you have a pension that pays you $3,000 per month, that pension is worth $540,000. If you get $800 per month from CPP, then that is worth $144,000.

How is the commuted value of a defined benefit pension calculated?

The commuted value is then divided by the life expectancy of the employee to calculate the annual pension benefit payable to the employee. If you're a mathematician, here's the typical formula to calculate commuted value: PV = FV/ (1 + k)^n.

Do you include defined benefit pension in net worth?

Why Your Pension Is Included. Your pension is included in the calculation of your net worth because it is an asset even if you will not derive any financial benefit until retirement. Think of it as a piggy bank that you can't break open until you reach a certain age.

How is lump sum value calculated?

For a lump sum, the present value is the value of a given amount today. For example, if you deposited $5,000 into a savings account today at a given rate of interest, say 6%, with the goal of taking it out in exactly three years, the $5,000 today would be a present value-lump sum.

How do you value a defined benefit pension in a divorce?

This means that 75% of the pension value would be considered a marital asset. So if you had $200,000 total in a pension, that amount would be multiplied by 75%, meaning the marital value would be $150,000 to be divided. The pension owner would keep the other $50,000 as a separate asset.

Is the transfer value of a pension the same as the cash value?

Pension fund value is the current value of a defined contribution pension pot. Transfer value (CETV) is the amount your provider will offer you for transferring out of your defined benefit scheme. In other words, your CETV will become your pension fund value after you've transferred out.

What is the lump sum value of pension?

The lump-sum payment is when you receive one large cash payment from your pension plan instead of receiving your pension in monthly installments. Think of it as a “buyout”—your employer is trying to get out from its future pension obligations by giving you one big payment now.

What is the commuted value of my pension?

A commuted value is the sum of money that a beneficiary is entitled to receive as a lump sum payment at retirement through a pension plan. This value is estimated based on factors including the future life expectancy of the beneficiary.

What is a pension commutation example?

Such pension received in advance is called commuted pension. For example, at the age of 60 years, you decide to receive 10% of your monthly pension in advance for the next 10 years worth Rs 10,000. This will be paid to you as a lump sum. Therefore, 10% of Rs 10000x12x10 = Rs 1,20,000 is your commuted pension.

What is a good commutation factor?

The final salary scheme commutation factor is particularly generous. The higher the commutation factor the more generous it is because you receive more lump sum for every £1 of pension sacrificed. Anything above 20:1 is good whereas anything under 12:1 is not very generous.

What’s my CETV transfer value?

A Cash Equivalent Transfer Value (CETV) is the amount your pension scheme will give you if you decide to transfer your pension. It is supposed to r...

What's a good CETV?

It's easy to get excited by a high transfer value and in the past there was much talk about 'multiples' and a 'good multiple'.Recent years have see...

Why are pension transfer values so High 2020?

Although Defined Benefit Pension Transfer values plummeted to their lowest levels as the global pandemic hit the UK in March. They rebounded to rec...

Can i transfer my pension myself?

If your defined benefit pension is worth less than £30,000 you are free to transfer your pension yourself without seeking advice. If your transfer...

Should I transfer my defined benefit pension?

For the vast majority or people, the answer to this question is generally, no. Defined Benefit Pensions provide valuable benefits that will be lost...

How long does it take to transfer a defined benefit pension? (Timescales)

Once you receive your CETV (cash equivalent transfer value, you have 3 months in which to decide whether you will transfer or not before that offer...

How much does a pension transfer cost?

Transferring your Final Salary Pension to a personal pension arrangement may give you access to a large lump sum and offer you the freedom to inves...

FCA Advice on Defined Benefit Pension Transfers

The Financial Conduct Authority are the regulatory body that oversee financial advice in the UK.It's their job to ensure that consumers get quality...

What are defined benefits pensions?

Defined Benefit pensions have incredibly valuable benefits attached to them which will be lost if you transfer. Pension Benefits could include (but are not limited to): Protected pension age (for early retirement) Guaranteed income for life. Tax-free cash. Life insurance. Spouse/survivor's pension provision.

How long does it take to get a defined benefit pension?

Ideally before or as soon you receive your CETV. Across the industry it’s not uncommon to hear of defined benefit pension transfers taking up to 6 months, sometimes longer.

Why can a pension trustee adjust transfer values?

If the scheme is under-funded, transfer values can be adjusted to protect those still within the scheme .

What is cash equivalent transfer value?

What is a Cash Equivalent Transfer Value? Your Cash Equivalent Transfer value is the amount your pension scheme will give you if you decide to transfer out of your defined benefit pension scheme. It is not the same as your Pension Fund amount. You should receive an annual update from your Pension Scheme Administrator that contains this information ...

What does transfer value mean?

A transfer value only tells you how much you'll receive if you transfer your pension. The true market value of your pension is often far higher than any transfer value you will be offered once you factor in the value of: a guaranteed income. an inflation-proof investment. death in service benefits.

Why do transfer values rise as you get closer to retirement?

This is because there’s less time for the scheme to expand its assets to meet the promised payments.

Is a defined benefit pension transfer in your best interest?

For most people a Defined Benefit pension transfer is not in their best interests. That said, whether or not you should transfer is entirely dependent on your individual circumstances and goals. It’s not possible to give you an answer to this questions without doing a full analysis of your situation.

What is a Cash Equivalent Transfer Value (CETV)?

A CETV (also known as a Final Salary Pension Transfer Value) is an amount that is offered to you in exchange for you giving up your entitlement to an inflation adjusted, guaranteed-for-life pension.

How is a CETV calculated?

Unfortunately, the calculations that are used to value defined benefit pension transfer entitlements differ from scheme to scheme.

Why are interest rates the biggest threat to your pension transfer value?

Pension schemes have a considerable reliance on government bonds and government bonds produce a yield based on interest rates set by the Bank of England.

Conclusion

The purpose of this post is to be informative and shed some light on the “black box” that is the pension transfer value calculation process.

Take action

As a deferred member of a defined benefit pension scheme, you are entitled to one free CETV statement a year.

Get in touch

If you would like to understand more about this topic, drop me a line.

What is the best option for a defined benefit pension?

Choose the best option. After you have calculated the value of a defined benefit pension, you may want to compare the result with the following options: Annuity. Often, a privately-bought annuity can be a good alternative if the non-employed spouse wants to secure lifelong income. Immediate cash-out.

How to divide a defined pension plan in divorce?

There are three methods to dividing defined pension plans in divorce. 1. Present value (cash-out) method. The non-employee spouse receives a lump-sum settlement from the pension or receives a like-for-like marital asset of equal value. 2.

What is the funding deficit?

The funding deficit means that some pension plans are at greater risk of cutting benefits than others. Recently, the Treasury Department even allowed a Cleveland pension plan to cut benefits for CURRENT retirees. Benefits fell by an average of 20%.

What would happen if the pension plans were liquidated?

In other words, if the plans were liquidated today, they wouldn’t have enough assets to pay their obligations. Government pension plans aren’t much better. According to the Tax Foundation, states have a combined $1.4 trillion in pension plan deficits.

What is the present value method?

Present Value method has significant advantages. The first method allows spouses to part ways with no future obligations. The non-employed spouse immediately receives an equivalent asset, while the employed spouse is free to enjoy his or her full retirement benefits.

When valuing a defined pension plan in divorce, the common practice is to assume the employee leaves TODAY?

That’s because once a couple separates, all future benefits are considered separate property, not marital.

Can a non-employed spouse receive a pension?

Non-Employed Spouse. The non-employed spouse will receive an immediate cash benefit , rather than being contingent on when the employed spouse decides to retire. That’s why finding a good valuation for a defined benefit pension plan can be an essential step in helping separating couples move on.

Understanding the risks

Anyone considering transferring out of a DB Scheme should appreciate that once a transfer has taken place the decision is irrevocable and that the valuable benefits from the scheme are lost.

Find out what your defined benefit scheme is worth

If you’re looking for a financial adviser to support you with your pensions, we’re here to help. Our continued excellence in this area has resulted in Wren Sterling receiving the Pension Transfer Gold Standard for our work with DB transfers.

What is defined benefit pension?

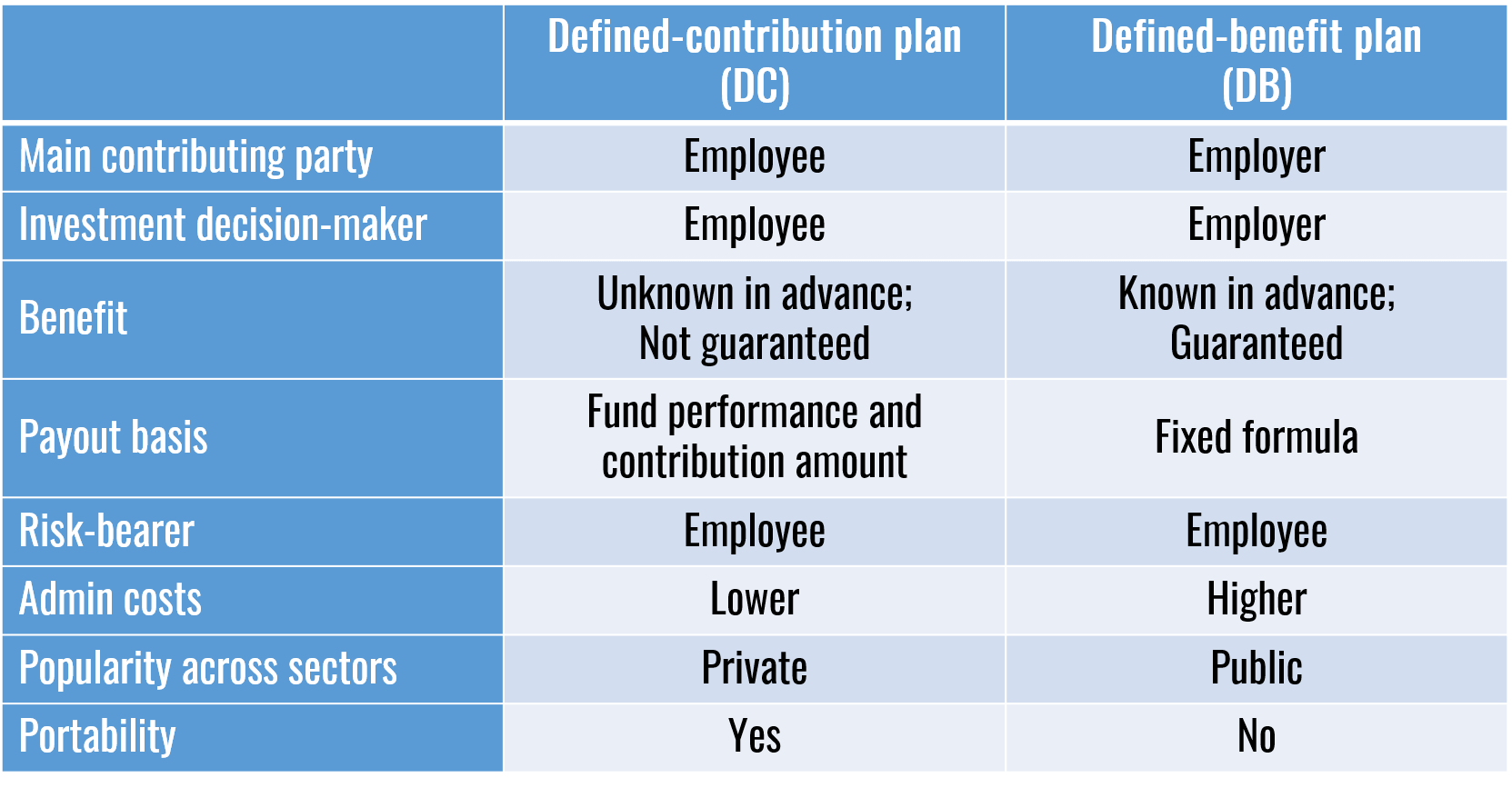

In this type of pension plan, employers guarantee their employees a defined amount, or benefit, upon retirement, regardless of the performance of the investments involved, and with certain tax-advantages. This can vary from plan to plan, but while employers are the main contributors of DB plans, employees may also be able to contribute. DB plans in the U.S. do not have contribution limits.

What is pension in insurance?

Pensions. Traditionally, employee pensions are funds that employers contribute to as a benefit for their employees. Upon retirement, money can be drawn from a pension pot or sold to an insurance company to be distributed as periodic payments until death (a life annuity).

Why is the cost of living adjustment important?

Due to inflation, prices of goods and services are expected to rise over time, and the cost-of-living adjustment (COLA) helps to maintain the buying power of retirement payouts. While the COLA is mainly used for the U.S. Social Security program, which is technically a pension plan that is public, it also plays an important role in private pension plans. Generally, it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. Unfortunately, most private pensions are not adjusted for inflation. Overfunded pensions, which are pension plans that have more assets than obligations, may be able to afford a COLA if their beneficiaries advocate for it successfully, but the same usually cannot be said for underfunded pensions. Each of the three calculations allows the option to input a custom figure as COLA. If no such adjustment is desired, just use "0" as the input.

What is single life pension?

A single-life pension means the employer will pay their employee's pension until their death. This payment option offers a higher payment per month but will not continue paying benefits to a spouse who outlives the retiree. In contrast, a joint-and-survivor pension payout pays a lower amount per month, but when the retiree dies, ...

How do pensions work after retirement?

Upon retirement, pensions generally provide two methods of distributing benefits. Single-life plans pay a monthly benefit for the remainder of the beneficiary's life , but as soon as they pass away, pension payments halt . A drawback to this is that surviving spouses will be left without a major source of income. Unsurprisingly, this option is most commonly used by retirees without spouses or dependents. However, there are exceptions for single-life pensions that have guarantee periods; if the retiree passes away within the guarantee period (usually five or ten years), dependents are eligible to receive income until it ends. Monthly benefits for plans with guarantee periods tend to be lower than for those without a guarantee period.

What is commuted value in DB?

In the context of pensions, the former is sometimes called the commuted value, which is the present value of a future series of cash flows required to fulfill a pension obligation.

What is the most common DB plan?

Generally speaking, the longer an employee works for a company or the higher their salary, the higher their projected benefits in retirement. Social Security is the most common DB plan in the U.S. Most American workers are qualified for collecting Social Security benefits after retirement.

Why are there fewer defined benefit pension plans?

The unfortunate reality is that there are going to be fewer and fewer defined benefit pension plans offered in the future because they are more costly and complicated to administer and the employer bears more risk and responsibility.

What is the cornerstone of retirement?

A cornerstone of retirement income planning. In wealth planning, pensions are often ignored but Rein believes that they are incredibly important, “Defined Benefit Pension Plans and Government Benefits form the cornerstone of retirement planning. If you work for an employer that offers a defined benefit pension, ...

What does Rein believe about retirement?

Rein believes that the retirement planning industry largely ignores the value and importance of pension plans as an asset. Rein uses a simple rule of thumb when it comes to valuating a pension or a stream of cashflow,

When was the last update on retirement?

Last Updated: January 24, 2020. Advertiser Disclosure. Whenever the topic of retirement planning comes up, it is often associated with building as much wealth as possible so that you can reach that time when you no longer have to work to create income.

What is the fraction of a pension?

The fraction is the portion of the benefits that were attributable to the marriage period. By way of a simple example, if a person was married for 15 years while they were contributing to a pension, but overall they contributed 20 years to a pension, then the coverture fraction would be 15/20 or 75%.

What is defined contribution pension?

Pensions are defined benefit plans. Once this is determined, then a valuation date must be established. The value of a defined contribution plan is simply the account balance as of a given date. However, the characterization of the account (community vs. separate property) requires a detailed tracing of the account from marriage through separation.

What is actuarial valuation?

The actuarial valuation determines what the current value is of a defined benefit pension for this purpose. Keep in mind that the actuarial valuation is a pre-tax valuation. So be sure you’re comparing apples to apples.

What is the marital value of a pension?

This means that 75% of the pension value would be considered a marital asset. So if you had $200,000 total in a pension, that amount would be multiplied by 75%, meaning the marital value would be $150,000 to be divided. The pension owner would keep the other $50,000 as a separate asset.

What is deferred distribution?

In contrast to a partial or immediate offset, deferred distribution of a pension provides for the division of pension benefits to take place at a later date. This usually occurs when benefits are actually being paid by the plan.

What is defined benefit plan?

A defined benefit plan provides a retired employee with monthly payments when they first retire through the remainder of their lives. The amount is determined (defined) by a formula that is used by the plan.

Can a spouse keep a portion of a pension?

If the equity in the marital home is worth less than the pension, then the spouse keeping the family home may still receive a portion of the pension, although that amount would not be 50%.

What is indexing pension?

The indexing of your pension ensures that it keeps pace with the cost of living, which will help protect you from inflation. There are two types of inflation protection methods: fixed rate and variable rate. Fixed rate is easy to understand, the amount of pension is adjusted by the rate specified in the plan.

When do you start receiving pension payments?

You usually must start receiving pension payments when you reach age 65 or the normal retirement age set by your employer. You may be able to start receiving payments as early as age 50.

What is commuted value?

The commuted value is sometimes called the cash value or lump sum value of a pension plan. This is because the commuted value represents the amount that could be paid to an employee today in exchange for all future payments from the pension plan. The commuted value is then divided by the life expectancy of the employee to calculate ...

What is inflation protection?

Inflation protection means the amount of pension after retirement is adjusted according to inflation. Typically, a government pension is fully indexed to the Consumer Price Index (CPI) on your first day of retirement.

What is variable rate inflation?

Variable rate is a little more complicated; this type of inflation protection uses a variable method (such as Consumer Price Index) to adjust the amount of your pension. If you’re not sure about which option is best for you, speak to a Certified Financial Planner.

Is a pension better than a pillow?

Of course, a pension is better than your pillow because the pension invests the money.

Does a private pension have inflation protection?

We’ll also help you with estate planning, address tax minimization, and answer all of your retirement questions. Private pension normally do NOT offer inflation protection. So, your monthly income will effectively decrease over time as it’s eaten away by inflation. Call us at 1-888-554-6661 to get started.