How to Claim Tax Treaty Benefits on a Form 1040

- Claiming Benefits. Two important forms to file if you want to claim tax treaty benefits as a non-citizen filing a U.S.

- Americans Living Abroad. Unless you surrender your U.S. citizenship, even if you work outside of the country you need to...

- Savings Clause. Most tax treaties contain savings clauses that allow countries to...

Full Answer

How do I claim tax treaty benefits?

- Your name and U.S. ...

- A statement that you are a resident alien and whether you are a resident alien under the green card test, the substantial presence test, or a tax treaty provision.

- Tax treaty and article number under which you are claiming a tax treaty exemption, and description of the article.

How to claim tax treaty benefits on a Form 1040?

- The individual's name

- The individual's U.S. ...

- A statement that the individual is a resident alien under The green card test The substantial presence test, or The residency article of a tax treaty

- The tax treaty under which the individual is claiming a benefit

What are the benefits of a tax treaty?

Launch of the Tax Treaties Explorer: New data for better negotiation

- The Tax Treaties Explorer. The Tax Treaties Explorer is a website that allows you to visualise a new dataset of almost every tax treaty signed by developing countries.

- The launch event. The ICTD and the Global Tax Program of the World Bank recently hosted a webinar to launch the new tool.

- New research using the dataset. ...

- Event materials. ...

What countries have a tax treaty?

- Tax Treaty Negotiations with Colombia (September 7, 2007).

- Tax Treaty Negotiations with Greece (May 15, 2007).

- Entry Into Force of the Tax Convention Between Canada and Mexico (April 26, 2007).

- Tax Treaty Negotiations with Spain (April 4, 2007).

- Entry Into Force of the Tax Convention Between Canada and Finland (January 17, 2007).

How do I claim tax treaty benefits on my taxes?

Exemption on Your Tax Return You must file a U.S. tax return and Form 8833 if you claim the following treaty benefits: A reduction or modification in the taxation of gain or loss from the disposition of a U.S. real property interest based on a treaty.

Do I qualify for U.S. tax treaty benefits?

In general, in order to be eligible for a tax treaty in the US, a person must meet the following criteria: 1) be a resident of a country that has a tax treaty with the US, 2) be a Non-Resident Alien for Tax Purposes in the United States, 3) currently be earning qualifying income in the United States, and 4) have a US ...

Do I qualify for Canadian treaty benefits?

To apply the correct rate of withholding, you should have enough recent information to prove that the payee: is the beneficial owner of the income. is resident in a country with which Canada has a tax treaty. is eligible for treaty benefits under the tax treaty on the income being paid.

Can you claim tax treaty 1040?

To claim the tax treaty on a resident return: File as a resident alien for tax purposes using Form 1040. Complete all applicable income lines and include any amounts that are tax treaty exempt. On Line 21 (Other Income), enter in a negative number for the total amount of the tax treaty exemption being claimed.

How do I claim foreign tax credit?

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Corporations file Form 1118, Foreign Tax Credit—Corporations, to claim a foreign tax credit.

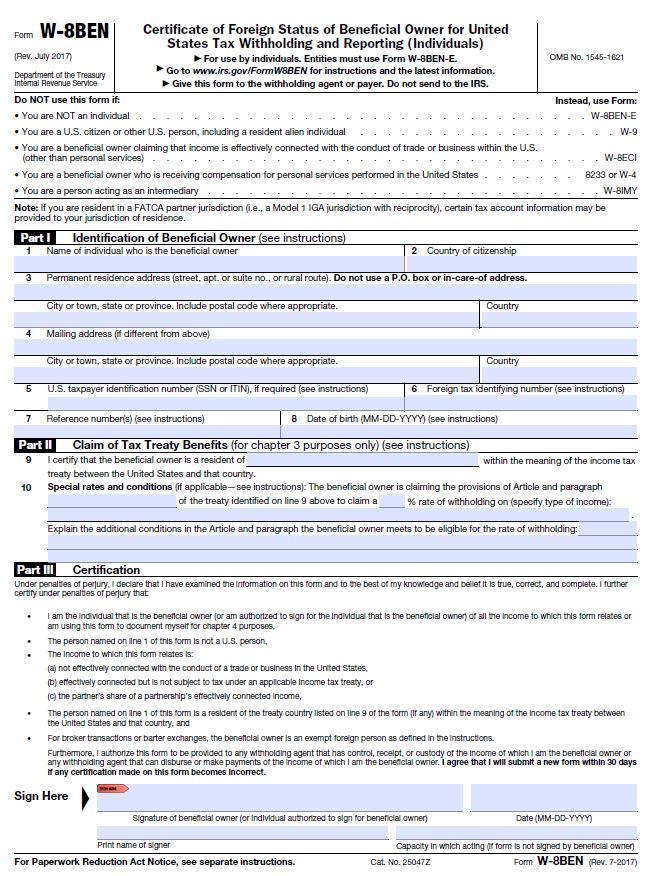

Who needs to fill out Form W 8BEN?

You must give Form W-8BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Submit Form W-8BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

What are Canadian tax treaty benefits?

The U.S./Canada tax treaty, in summary, alleviates tax issues for U.S. citizens and residents living in Canada and Canadians living in the U.S. Most countries around the globe, including Canada, have some form of income tax that residents are obligated to pay.

How do I claim foreign income in Canada?

You can claim a deduction if you reported foreign income on your return that is tax-free in Canada because of a tax treaty such as support payments you received from a resident of another country and reported on line 12800 of your return.

How do I reclaim withholding tax?

If you've had too much withholding tax (WHT) deducted from your foreign dividends, you can often reclaim the overpayment. Doing so involves writing to the tax authorities in the country that the company is based in and asking for a refund.

Can I claim back US withholding tax?

Where this occurs, the recipient of the income will need to file a 1040NR US tax return to claim back overpaid US tax. In some instances, where services were performed in the US, you may also have to file a state tax return (where tax was over or under paid).

How do I claim a US treaty from China?

How to claim the US-China tax treaty?For example, if you receive a Form W-2, to report wages: ... Enter the treaty-exempt amount as negative amount (-5000) under Federal Taxes / Less Common Income / Miscellaneous Income 1099A, 1099C / Other Reportable Income.File a Form 8833 from IRS to claim an exception.

Can I be taxed in two countries?

If you are resident in two countries at the same time or are resident in a country that taxes your worldwide income, and you have income and gains from another (and that country taxes that income on the basis that it is sourced in that country) you may be liable to tax on the same income in both countries.

What is a tax treaty?

A statement that you are a resident alien and whether you are a resident alien under the green card test, the substantial presence test, or a tax treaty provision. Tax treaty and article number under which you are claiming a tax treaty exemption, and description of the article.

What is a treaty exemption?

You claim a treaty exemption that reduces or modifies the taxation of income from dependent personal services, pensions, annuities, social security and other public pensions, or income of artists, athletes, students, trainees, or teachers. This includes taxable scholarship and fellowship grants.

What is an exemption from withholding?

Exemption from Withholding. If a tax treaty between the United States and your country provides an exemption from, or a reduced rate of, withholding for certain items of income, you should notify the payor of the income (the withholding agent) of your foreign status to claim the benefits of the treaty.

What form do you need to file a treaty based return?

If you claim treaty benefits that override or modify any provision of the Internal Revenue Code, and by claiming these benefits your tax is, or might be, reduced, you must attach a fully completed Form 8833 , Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), to your tax return.

What is 8833 tax credit?

A credit for a specific foreign tax for which foreign tax credit would not be allowed by the Internal Revenue Code. You must also file Form 8833 if you receive payments or income items totaling more than $100,000 and you determine your country of residence under a treaty and not under the rules for determining alien tax status.

What is a reduced rate of withholding?

A reduced rate of withholding applies to a foreign person that provides a Form W-8BEN claiming a reduced rate of withholding under an income tax treaty only if the foreign person provides a U.S. Taxpayer Identification Number (TIN) (except for certain marketable securities) and certifies that: It is a resident of a treaty country;

How much income is required to be disclosed in a partnership?

The payments or items of income that are otherwise required to be disclosed total no more than $10,000.

Why are tax treaties important?

Tax treaties between countries serve to clarify or erase any confusion over benefits. Most U.S. tax treaties have specific provisions for Americans who live and work within that country’s borders. Take the U.K., for example.

How much can you be fined for not filing a treaty?

There are consequences to not filing this form when you’re supposed to—you can be fined up to $1,000 for each year you failed to report your treaty position.

What is 8833 tax form?

Tax Form 8833 is how you’d claim and report certain U.S. income tax treaty benefits, which can include anything from lower tax rates to full tax exemptions on certain types of income and pensions. Read on to learn more about this form and how to claim these benefits in your yearly tax filing. Ready to file Form 8833?

Can you pay taxes twice on the same income?

Paying taxes twice on the same income is a concern most U.S. citizens have if they earn income abroad. Luckily, the U.S. has entered into tax treaties with many countries to help alleviate that concern. Tax Form 8833 is how you’d claim and report certain U.S. income tax treaty benefits, which can include anything from lower tax rates ...

What is the saving clause in a tax treaty?

Most tax treaties contain savings clauses that allow countries to tax their own residents as if no treaty existed, saving potential tax revenue losses. For example, U.S. citizens and residents cannot claim tax treaty benefits to reduce their U.S. tax bill because of the terms of the savings clause.

Which country taxes non-citizens?

The United States is the only country to tax its citizens regardless of where they earn their income. In addition, the U.S. taxes non-citizens' earnings from activities while they live here.

Why do you file 8833?

You file Form 8833 as a supplement to your annual tax return, Form 1040, if the benefits of the tax treaty might reduce the amount of tax you owe on your U.S. income.

Can you claim supplementary tax credit on 2555?

tax law provides exemptions and credits to help avoid having citizens paying taxes twice on the same income. You can claim the credit using supplementary Form 1116 or exclude income using Form 2555.

Can tax treaties change?

Tax Treaties. The nature of international politics makes it nearly certain that the terms, benefits and existence of tax treaties can change from year to year. While treaties with some countries, such as Canada, have remained largely the same since 1980 or earlier, there is no guarantee.

What is a US tax treaty?

US tax treaties (also known as double taxation agreements (DTA) are specific agreements between the USA and foreign countries that outline how nonresidents will be taxed in each country.

Which countries have a double tax treaty with the USA?

Currently, the US tax treaty network covers approximately 65 countries all over the world, including:

Who can claim a tax treaty benefit?

Whether or not you are eligible to avail of tax treaty relief will depend on four factors:

Which types of wages paid to a nonresident alien are exempt under a tax treaty?

The exact type of tax relief you can claim from a double taxation agreement will depend on the treaty that the US has signed with your home country.

How can I claim tax treaty benefits?

When you start working in the US, your employer will ask you to fill out some important payroll forms (such as forms W8-BEN and 8233).

Can I claim tax treaty benefits on my tax return?

Yes, if you pay too much tax during the year or you did not provide W-8Ben or 8233 form on time, you will be entitled to a tax refund.

Who can help me to claim my tax treaty benefits?

If you find US tax to be daunting, the good news is that help is on hand!

What Are Tax Treaties?

Income tax treaties are agreements the United States has entered into with nearly every country in the world to avoid this potential double taxation issue. It affects US taxpayers abroad as well as foreign nationals living in the States.

How Can Tax Treaties Reduce My Taxes on Foreign-Earned Income?

Tax treaties can include (but are not limited to) income tax, estate and gift tax, commerce, friendship, and navigation.

What Is Form 8833?

Form 8833, “Treaty-Based Return Position Disclosure Under Section 6114 or 7701 (b),” is used by taxpayers to make a treaty-based return position disclosure as required by Section 6114, or such dual-resident taxpayers whose treaty-based return position disclosure is required under Reg. 301.7701 (b)-7.

Penalty for Failing to File Form 8833

If you are required to file Form 8833 but fail to do so, the penalty for individual taxpayers is $1,000, and for C corporations, it is $10,000. There is a chance you could be exempted from paying the fine if you can provide a reasonable explanation as to why you did not file Form 8833.

Termination of US Residency

One issue to be aware of is that filing Form 8833 could trigger a termination of your US residency.

Get Professional Advice

While Form 8833 can at first glance look relatively painless, there are any number of “what ifs” and “maybes” that could affect how you complete the form and whether you need to include it in your US-based tax return at all.

Further Information on Form 8833

For additional information about US tax treaties, consult IRS Publication 901 – U.S. Tax Treaties. This 34-page pamphlet contains a general discussion about the effects of tax treaties on certain types of income mentioned in this article. It also includes a brief discussion of provisions relative to most foreign countries.

What form do you use to claim treaty benefits?

Use form 8233 and the Tax Treaty Statement if the individual is a student, a teacher or researcher.

What is the requirement for a nonresident alien to receive treaty benefits?

Third, the nonresident alien must have either a social security number or an Individual Taxpayer Identification Number (ITIN) to be able to receive treaty benefits.

When did the IRS accept W-8BEN?

Effective for payments made on or after January 1, 2001, any tax treaty claim made on forms 8233 or W-8BEN which do not contain a social security number or a permanent U. S. Taxpayer Identification number cannot be accepted.

Can a non-resident alien be exempt from federal income tax?

Eligibility. In order for foreign nonresident alien students and scholars to be exempt from federal and state income tax withholding the non-resident alien must meet certain criteria. First, there must be a treaty provision that exists between the United States and the nonresident alien’s country of residence.

When to use W-9?

Use Form W-9 and Attachment to Form W-9 if the person is a resident for tax purposes. Valid indefinitely until the person's circumstances change so that the information reported is no longer valid (for example, the resident becomes a green card holder or citizen, or treaty time limits run out).

When does Form 8233 expire?

Use forms 8233 and Tax Treaty Affidavit if the person is a nonresident alien for tax purposes—Form 8233 expires at the end of each calendar year. A new one must be submitted each year that the nonresident alien is eligible to claim treaty benefits.

What is the Social Security number used for?

Social Security Number: Used for employees, independent contractors, and scholarship/fellowship recipients. ITIN Individual Taxpayer Identification Number: Used for independent contractors and some scholarship/fellowship recipients.

Do international students have to be exempt from federal taxes?

Eligibility. For international students and scholars to be exempt from federal and state income taxes, certain criteria must be met. Most important, a treaty provision must exist between the United States and your country of residence . You must meet the treaty eligibility requirements for the treaty article being claimed.

Can foreign students claim tax treaties?

However, virtually all treaties also contain an exception to the Saving Clause for foreign students and scholars to allow them to claim tax treaty benefits after becoming residents for tax purposes, as long as they would otherwise qualify for those benefits.

What is the effect of tax treaties?

The Effect of Tax Treaties. Residency for treaty purposes is determined by the applicable treaty. If you are treated as a resident of a foreign country under a tax treaty, and not treated as a resident of the United States under the treaty (i.e., not a dual resident), you are treated as a nonresident alien in figuring your U.S. income tax. ...

Who is entitled to certain credits, deductions, exemptions, and reductions in the rate of taxes of those foreign

Therefore, a U.S. citizen or U.S. treaty resident who receives income from a treaty country and who is subject to taxes imposed by foreign countries may be entitled to certain credits, deductions, exemptions, and reductions in the rate of taxes of those foreign countries.

How to access IRC section?

To access the applicable IRC sections, Treasury Regulations, or other official tax guidance, visit the Tax Code, Regulations, and Official Guidance page. To access any Tax Court case opinions issued after September 24, 1995, visit the Opinions Search page of the United States Tax Court.

Do some states honor the tax treaties?

Some states honor the provisions of U.S. tax treaties and some states do not . Therefore, you should consult the tax authorities of the state in which you live to find out if that state taxes the income of individuals and, if so, whether the tax applies to any of your income, or whether your income tax treaty applies in the state in which you live.

Can you claim dual residency benefits?

If you are a resident of both the United States and another country under each country's tax laws, you are a dual resident taxpayer. If you are a dual resident taxpayer, you can still claim the benefits under an income tax treaty. The income tax treaty between the two countries must contain a provision that provides for resolution ...

Can foreign citizens be taxed?

Under these treaties, residents ( not necessarily citizens) of foreign countries may be eligible to be taxed at a reduced rate or exempt from U.S. income taxes on certain items of income they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific items of income.

Do tax treaties reduce taxes?

Tax treaties generally reduce the U.S. taxes of residents of foreign countries as determined under the applicable treaties. With certain exceptions, they do not reduce the U.S. taxes of U.S. citizens or U.S. treaty residents.

What are the benefits of a treaty partner?

However, those who are subject to taxes imposed by a treaty partner are entitled to certain credits, deductions, exemptions and reductions in the rate of taxes paid to that foreign country . These treaty benefits are generally only available to residents of the United States.

What is the saving clause in a tax treaty?

Most tax treaties have a saving clause that preserves the right of each country to tax its own citizens and treaty residents as if no tax treaty were in effect. However, the saving clause generally excepts specified income types from its application, which may allow you to claim certain treaty benefits even if you are a U.S. citizen or resident.

What is the tax gap?

International Tax Gap Series. The United States has income tax treaties with a number of foreign countries. Under these treaties, residents of foreign countries may be: taxed at a reduced rate or. exempt from U.S. income taxes on certain items of income received from sources within the U.S. Because treaty provisions are generally reciprocal (apply ...

What is technical explanation?

The Technical Explanation provides more detail on the intent of the treaty language. Remember that tax treaties are updated periodically and amended by protocols, so be sure to check for the latest information on specific treaties when claiming treaty benefits. References and Links.

Do tax treaties reduce taxes?

While tax treaties may reduce U.S. tax for nonresidents and foreign tax for U.S. residents and citizens, each treaty must be reviewed to determine eligibility for these provisions. This article provides some highlights about tax treaties and how to properly apply their provisions. Most tax treaties have a saving clause that preserves the right ...

Can you claim treaty exemptions retroactively?

Once you reach this limit, you may no longer claim the treaty exemption. In some cases, if you exceed the limit, the income is taxed retroactively for earlier years. Treaties may also have other requirements to be eligible for benefits. Publication 901, U.S. Tax Treaties, provides a summary of these treaty provisions.