What is the maximum socila secuity benefit at 63?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2021, your maximum benefit would be $3,148. However, if you retire at age 62 in 2021, your maximum benefit would be $2,324. If you retire at age 70 in 2021, your maximum benefit would be $3,895.

Why do so many people claim social security at 62?

The simplest explanation for why so many people claim Social Security at 62 is because they can't claim benefits any earlier. Many people count the days until they can get benefits because they need this money to leave the workforce or to survive comfortably if they've already been forced out of a job.

How much does social security go up each year after age 62?

The actual year-over-year percentage gain for ages 62 to 70 are shown in the following table. Those gains range from 6.5 percent (claiming at 70 rather than 69) to 8.4% percent (claiming at 64 rather than 63).

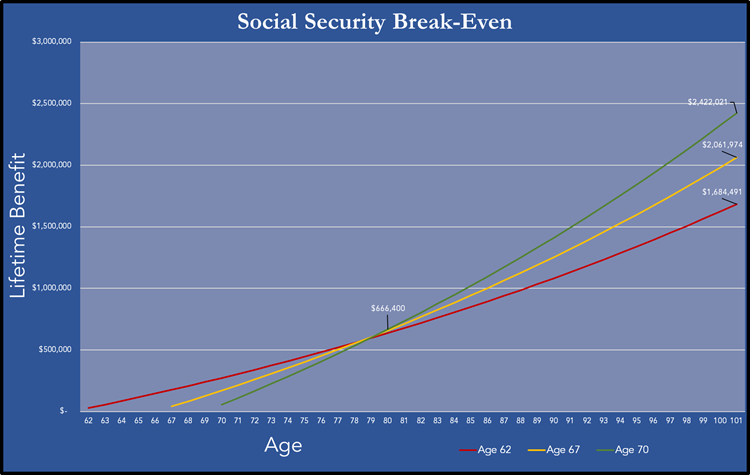

Should we take Social Security at 62, 66 or 70?

Your first step in maximizing your Social Security benefits should be to visit the Social Security Administration (SSA) website. (between 66 and 67), and age 70. Remember that you don't have to start taking your benefits at those milestone ages; you and your spouse can start collecting anytime between ages 62 and 70.

What is the average Social Security benefit at age 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the maximum I can make if I draw Social Security at 62?

If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

How much would I receive if I retire at 62?

A single person born in 1960 who has averaged a $50,000 salary, for example, would get $1,349 a month by retiring at 62 — the earliest to start collecting. The same person would get $1,927 by waiting until age 67, full retirement age.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much will I get from Social Security if I make $30000?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $100 000 a year?

Here's how much your Social Security benefits will be if you make anywhere from $30,000 to $100,000 per year. The average Social Security benefit is around $1,544. With inflation on the rise, retirees are expected to get as much as a 6% cost-of-living increase in their 2022 checks to shore up their budgets.

How much Social Security will I get if I make $40000?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $50000 a year?

For example, the AARP calculator estimates that a person born on Jan. 1, 1960, who has averaged a $50,000 annual income would get a monthly benefit of $1,338 if they file for Social Security at 62, $1,911 at full retirement age (in this case, 67), or $2,370 at 70.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What is the maximum Social Security benefit at age 62?

If you're at the maximum taxable earnings limit and you retire in 2018, then the most you can receive in monthly benefits at age 62, 65, and 70 is $2,158, $2, 589, and $3,698, respectively. Data source: Social Security.

What is the retirement age for people born after 1960?

The results from applying the bend points are added together and rounded down to get your monthly retirement benefit at full retirement age, which for people born after 1960 is age 67 .

How is Social Security calculated when you retire?

The precise amount that Social Security will pay you in benefits when you retire is determined by your average monthly income over your highest-paid 35 years of work. If you work fewer than 35 years, then Social Security uses zeros in its calculation.

What are bend points on Social Security?

Once Social Security has calculated your average monthly income (don't worry, they adjust it for inflation), then it subjects that monthly figure to something called "bend points.". These bend points give you credit for a specific proportion of your monthly income at different thresholds.

Why do people retire sooner than they want?

Unfortunately, many people retire sooner than they want because of a job loss or declining health. If that happens to you, and you've saved too little because you've based your retirement savings on the maximum Social Security you can collect, you could run the risk of outliving your money.

How much does Social Security replace?

While it's true that Social Security is designed to replace approximately 40% of a retiring worker's pre-retirement income, that 40% figure is based on the average American's income. The more you make, the lower the percentage of income Social Security will replace.

Do you get more Social Security if you don't retire?

If you didn't, you're not alone. A recent poll conducted by Nationwide shows that Americans commonly think that they'll receive more in Social Security benefits when they retire than they actually will.

How do Social Security benefits depend on earnings?

Social Security benefits depend on earnings. The amount of a person's retirement benefit depends primarily on his or her lifetime earnings. We index such earnings (that is, convert past earnings to approximately their equivalent values near the time of the person's retirement) using the national average wage index.

What is the retirement age for a person born in 1943?

c Retirement at age 66 is assumed to be at exact age 66 and 0 months. Age 66 is the normal retirement age for people born in 1943-54. People who retired at age 66 and who were born before 1943 received delayed retirement credits ; those born after 1954 will have their benefits reduced for early retirement.

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much Social Security will I get in 2021?

What is the maximum Social Security benefit? En español | The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is: $3,895 for someone who files at age 70. $3,148 for someone who files at full retirement age (currently 66 and 2 months). $2,324 for someone who files at 62.

What is the maximum taxable income for 2021?

The maximum taxable income in 2021 is $142,800.