To qualify for unemployment benefits the state would have to examine the past wages requirements, the reason for unemployment, and availability to work. States have an upper limit on the total weekly benefit amount. It means that there is a common formula to pay half of what the employee used to earn.

- Have earned enough wages during the base period.

- Be totally or partially unemployed.

- Be unemployed through no fault of your own.

- Be physically able to work.

- Be available for work.

- Be ready and willing to accept work immediately.

What are the rules for filing for unemployment benefits?

Townsend says nearly 68,000 Iowans are qualified for unemployment benefits today. Townsend plans to hire 18 people to counsel unemployed Iowans and she will seek to redefine what qualifies as work search activities that are required of Iowans receiving jobless benefits.

How do I become eligible for unemployment benefits?

- If you are not available or unable to work

- If you have not actively sought work

- If you quit your job without good cause

- If you were discharged from your job due to misconduct or for other just causes such as unexcused absences or violations of company rules

- If you are in a training program that limits your availability to work

What are the criteria for unemployment benefits?

Victims will find out this tax season

- Identity theft linked to unemployment benefits surged during the Covid-19 pandemic.

- Unsuspecting victims may get a 1099-G tax form detailing benefits they didn’t receive.

- The good news: They don’t owe tax on those fraudulent benefits. But there are steps they need to take to protect against financial harm.

How many months must someone work to qualify for unemployment?

To qualify for unemployment benefits, you must have worked long enough at a job to be monetarily eligible for unemployment. To calculate your eligibility, divide the last 15 months into five periods of three months, starting from the day you file for unemployment. Exclude the most recent three months from this calculation.

.jpg)

What are the rules for unemployment in Texas?

To be eligible for benefits based on your job separation, you must be either unemployed or working reduced hours through no fault of your own. Examples include layoff, reduction in hours or wages not related to misconduct, being fired for reasons other than misconduct, or quitting with good cause related to work.

What can disqualify you from unemployment benefits in Texas?

After you have been unemployed for eight weeks, you must be willing to accept a suitable job that pays at least 75 percent of your normal wage. If you do not apply for suitable work, accept suitable work, or return to your regular self-employment work, TWC may disqualify you for benefits.

How many hours do you have to work to be eligible for unemployment in California?

You don't need to have worked for any specific length of time, but you must have earned sufficient wages during a predetermined base period to qualify for a claim. Generally, this means you must have started earning wages at least three months before you file for unemployment.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

Can I quit and get unemployment?

Even employees who quit their jobs may be able to collect unemployment, but that depends on their reasons for leaving. In every state, an employee who voluntarily quits a job without good cause is not eligible for unemployment. But state laws vary as to how they define "good cause."

What can disqualify you from unemployment benefits?

Here are the top nine things that will disqualify you from unemployment in most states.Work-related misconduct. ... Misconduct outside work. ... Turning down a suitable job. ... Failing a drug test. ... Not looking for work. ... Being unable to work. ... Receiving severance pay. ... Getting freelance assignments.More items...•

Who qualifies for pandemic unemployment in California?

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

Can I still get unemployment if I work part-time California?

Even if you are still working part-time, you may be eligible for unemployment benefits, depending on your earnings and your situation. California has several programs that offer "partial" unemployment benefits: A portion of the benefit you would receive if you were fully unemployed, reduced to take into account your ...

Can I get EDD if I work part-time?

Yes. You can receive benefits intermittently while working part-time as long as you continue to meet the other eligibility requirements.

Do you have to pay back unemployment during Covid 19?

States tried clawing back overpayments from hundreds of thousands of people earlier in the pandemic. Labor Department officials issued initial rules in May 2021 that let states waive collection in some cases and asked states to refund any amounts already collected toward the overpayment.

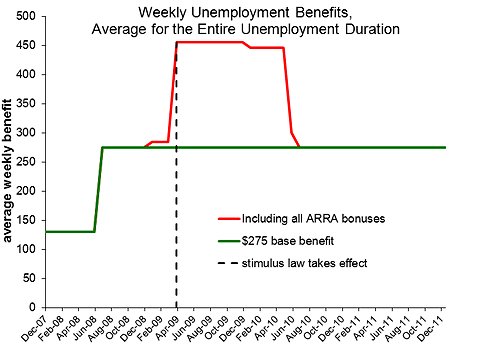

Will unemployment be extended 2021?

The American Rescue Plan Act, signed March 11, 2021, extended the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 to workers for weeks of unemployment ending on March 11, 2021 through September 4, 2021.

Can a part time employee collect unemployment in Texas?

Working Part Time If you work part time, you may be eligible to continue receiving unemployment benefits as long you meet all other requirements, including looking for full-time work.

How to File A Claim For Unemployment Benefits

The single most important thing to remember when dealing with unemployment insurance is to file a claim as soon as possible after you become unempl...

The Importance of Your Unemployment Base Period

Unemployment insurance benefits are calculated for hours you work and income you earn in what is known as a base period. Literally defined, a base...

How Will I Receive My Unemployment Benefits (money)?

According to the Department of Labor, after you file a claim, it will take approximately two to three weeks before you see your first benefit check...

How Long Can I Receive Benefits?

In most states, you are eligible to receive 26 weeks of payments, although there are some exceptions as noted here:The other factor that determines...

How to Collect Unemployment Benefits If You Are Self-Employed

Statistics show that more and more people are choosing to be self-employed as a sole proprietor or the owner of a small start-up firm, making use o...

Why was My Unemployment Claim Denied?

When you submit a claim for unemployment, it is reviewed by the appropriate agency in your state. They will make a determination as to whether or n...

For More Information on Unemployment in Your State

The federal government provides broad oversight for unemployment benefits, but each state administers their own unemployment insurance program. Her...

What If I was Denied Unemployment Benefits?

If your unemployment benefit application was denied, it is because the state agency found you ineligible for benefits. Most likely causes of inelig...

How Can I Get My Unemployment Benefits Extended?

According to the Department of Labor, Extended Benefits are available to workers who have exhausted regular unemployment insurance benefits during...

Are Unemployment Benefits Taxable?

If you ever suspected the IRS of having a heart, you’d be wrong. Unemployment benefits are indeed considered taxable income. If you received unempl...

When to file unemployment claim?

The single most important thing to remember when dealing with unemployment insurance is to file a claim as soon as possible after you become unemployed.

How many weeks of unemployment benefits are there?

Originally, recipients would be eligible for a maximum of 16 weeks of benefits. In most cases today, that number is now 26 weeks of benefits. Under the direction of the United States Department of Labor, unemployment benefits are administered by each state. Unemployment insurance is funded through taxes paid by employers, ...

Why was my unemployment claim denied?

They will make a determination as to whether or not your claim is valid, entitling you to benefits or not. There are some instances why your claim may be denied.

Are unemployment benefits public record?

No. According to the U.S. Department of Labor, unemployment compensation (UC) information collected and maintained for the administration of the UC program is confidential and, with a few exceptions, are not subject to disclosure. Law enforcement officials, under certain conditions, may have access to unemployment records, as well as some governmental entities, including food stamp agencies and child support enforcement agencies.

Why are my unemployment benefits taking so long to arrive?

When you lose your job, it is frustrating to have to wait for your unemployment benefits to kick in. According to the U.S. Department of Labor, processing takes about two to three weeks for most applicants.

Why do unemployment benefits have to end?

They are not meant to be a permanent solution. If unemployment benefits did not expire, there would be far less incentive for unemployed workers to look for jobs, and the taxes paid to fund the program would become too onerous to maintain.

How long does it take to get your first unemployment check?

According to the Department of Labor, after you file a claim, it will take approximately two to three weeks before you see your first benefit check.

How to calculate unemployment benefits?

Unfortunately, there's no easy way to calculate exactly how much money you'll receive through unemployment benefits or for how long you'll be able to collect those benefits unless your state has an online unemployment calculator . However, there are calculators you can use to estimate your benefits.

How many calculators are there for unemployment?

There are two types of unemployment calculators. One tells you how much money you are entitled to collect, and another tells you how many weeks your benefits will last.

How Much Will Your Benefits Be?

Once you file for unemployment and are approved, you will begin to receive benefits. Your benefits might come in the form of a check, but more often they will come in the form of a debit card or direct deposit to your bank account. It varies by state. You typically can file weekly online, by email, or by phone.

How long does unemployment pay?

In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Do you have to report unemployment on your taxes?

Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal and state tax returns.

What is the eligibility for unemployment?

When you apply for Unemployment Insurance (UI), your initial eligibility for benefits is based on your earnings and your reason for leaving your job. Ongoing eligibility requirements include being able to work, available for work, and actively searching for work.

How to qualify for unemployment benefits each week?

To qualify for benefits, each week, you must be: Physically able to work. Available to work. Actively looking for work (3 work search attempts) You may also be required to register with a Career Center to complete mandatory seminars to remain eligible to receive unemployment benefits.

What affects weekly unemployment?

Your eligibility for weekly benefits may be affected if you: Aren’t able, available, or actively seeking work. Refuse, quit, or are fired from a job. Receive other income.

How much do you have to earn to collect unemployment?

To be eligible for Unemployment Insurance (UI) benefits, you must: Have earned at least: $5,400 during the last 4 completed calendar quarters, and. 26 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

Can I get unemployment if I work for a non profit?

You may not be eligible for Unemployment Insurance (UI) benefits if your only source of employment is from working as: An employee of a non-profit or religious organization. A worker trainee in a program run by a nonprofit or public institution. A real estate broker or insurance agent who work only on commission.

Can I get PUA if I am self employed?

If you’re self-employed, a contractor, or otherwise not traditionally eligible for Unemployment Insurance (UI) benefits, you may be eligible for Pandemic Unemployment Assistance (PU A). If you’re unemployed due to the COVID-19 public health emergency, and are able and available to work, learn more about PUA.

Is unemployment insurance covered in Massachusetts?

Learn about the requirements for staying eligible and discover what can affect your weekly benefits. Most Massachusetts workers are covered by the Unemployment Insurance (UI) program, although workers in some jobs may not be eligible for benefits.

How to determine the amount of unemployment in Illinois?

Your base period is based on the first four of the last five completed calendar quarters immediately preceding the beginning of your benefit year. To determine the exact amount and duration of your Illinois unemployment compensation, go to the benefit table on the IDES website.

How often do you get unemployment benefits in Illinois?

Certification takes place by telephone through an Illinois unemployment number or online on a bi-weekly basis. You must certify every two weeks to receive your benefits.

What is insured work in Illinois?

Insured work is performed for an employer who is required to make payments to the state as part of the Illinois Unemployment Insurance Act. While most types of work falls under this law, there are some types of work that are considered uninsured work.

What is the Illinois Department of Employment Security?

The Illinois Department of Employment Security (IDES) is the state agency that oversees the administration of Illinois unemployment benefits, provides employment services and analyzes and disseminates labor market information for Illinois residents and employers.

What happens if you are denied unemployment in Illinois?

If your appeal is denied, Illinois unemployment laws guarantee your right to appeal to the Board of Review, an independent five-person body, who will also review your case. If you are rejected at this level, your final option is to file an appeal with the Circuit Court of the county where you live.

How long does it take to appeal unemployment in Illinois?

If you file an Illinois unemployment application and are denied, you have the right to file an appeal. You must file your appeal within 30 days after you receive your letter of denial. Your appeal will be heard by an Administrative Law Judge where you will be given the opportunity to present your case.

What information is required for a W-2?

Employer information for the past 18 months, including names, mailing addresses, phone numbers, dates of employment and reasons for separation. Wage records in the form of pay stubs or W-2 forms may also be required.

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How to calculate WBA?

To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

How many times is your base period wage?

Your total base period wages are at least 37 times your weekly benefit amount.

What is the date of a medical claim?

The date and nature of your illness, injury, disability, or pregnancy. It must be medically verifiable, i.e., substantiated by a health care practitioner, a health professional, or evidenced by sufficiently strong physical facts.

Can you get unemployment if you were fired?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Can you use the TWC unemployment estimate?

You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits. Your benefit amounts are based on your past wages. How we calculate benefits is explained below.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment benefits?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim.

How Long Will I Receive Benefits?

Usually, most states permit an individual to obtain unemployment for a maximum of 26 weeks or half the benefit year. A benefit year is a period when your claim is established, and it will remain open for one year (52 weeks).

How to Claim for a Benefits Extension?

If you are presently filing weekly claims for unemployment benefits, carry on filing your weekly claim if you are jobless or are working reduced hours. Thye will inform you by mail if you are eligible for the added benefits.

How to File An Initial Claim in Your State?

If you have been separated from work, you can file your initial claim during your first week of total or partial unemployment.

How to File Your Weekly Claim?

Through the Internet – You can file your weekly claim online. You must have a User ID and PIN to file your weekly claim online.

What happens if you work temporarily and get unemployment?

If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced. Ensure that you contact your state unemployment insurance department once you are unemployed.

What is the second step in unemployment?

If you have been determined to be financially eligible, the second step involves the nature of your job loss or separation. In other words, are you out of work through no fault of your own? This decision is based on the information you supply when you file for benefits, and information collected from your former employer.

What is UC in unemployment?

Unemployment compensation (UC) is money paid to workers who have lost their jobs through no fault of their own. Any unemployed person may file a claim for UC benefits. Your eligibility is based on the information provided by you and your employer (s) after you file an application for UC benefits.