Check your statement by logging on to my Social Security. You can also use the benefits calculator online at www.socialsecurity.gov/planners/benefitcalculators.htm to get an estimate of the amount of your disability benefits. Or, call your local Social Security office and they will be able to help you estimate what your benefits would be.

How do I calculate my short term disability benefits?

- Policy Features. The individual short-term disability policy features that you select at the time of application play a major role in calculating the premium cost per month.

- Applicant Factors. Applicant risk factors also play a major role in the short-term disability premium cost per month calculation.

- Average Figures. ...

What are the maximum disability benefits?

disability began lowers the benefit rate, it is not included in determining average weekly wage. The maximum benefit allowance for any disability is $170 a week. Benefits paid by the employer or insurance carrier are subject to Social Security and withholding taxes. Benefits are paid for a maximum of 26 weeks of disability during 52 consecutive weeks.

How does Social Security calculate disability benefits?

The following factors go into the formula:

- How long you work

- How much you make each year

- Inflation

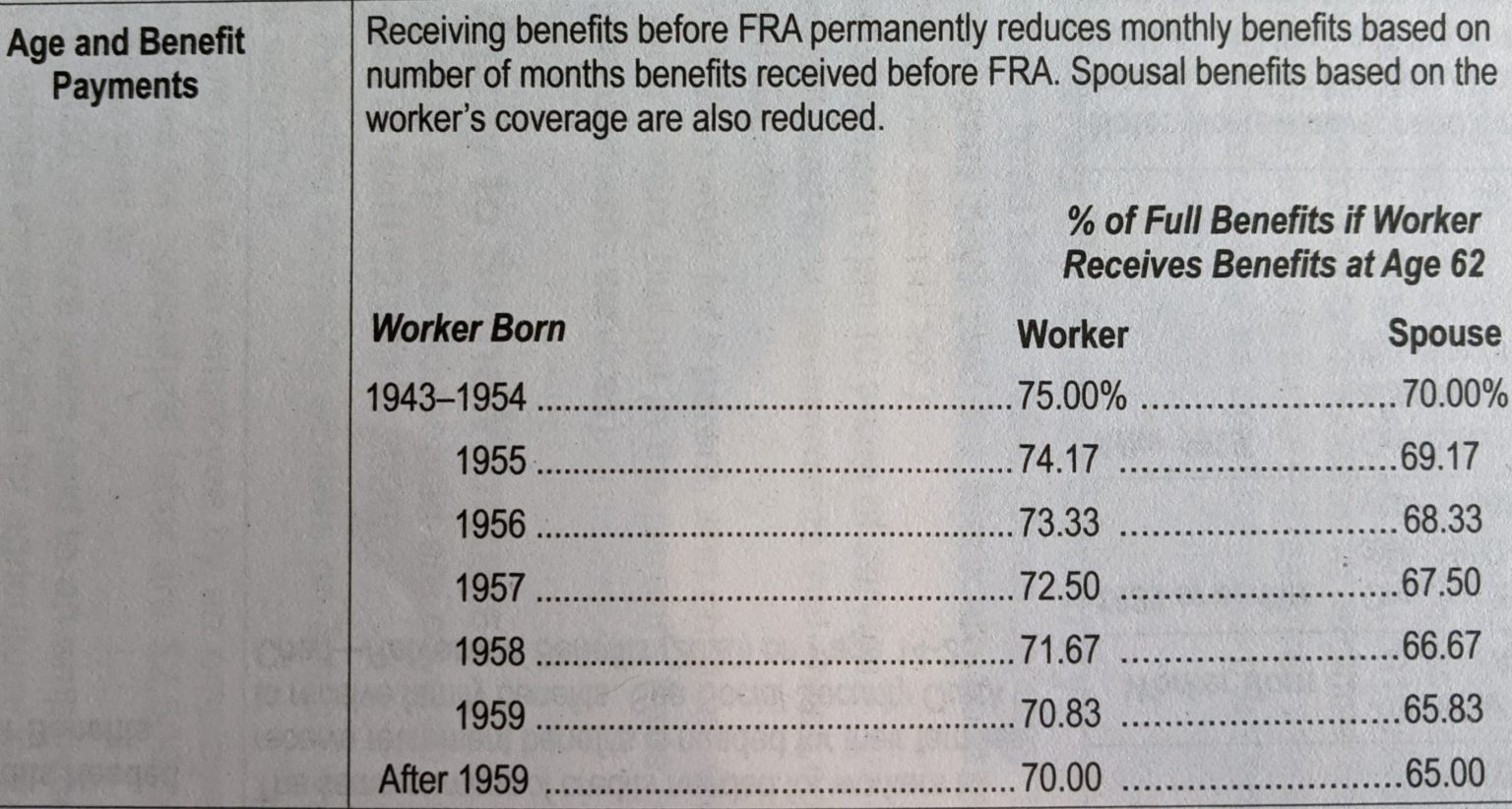

- At what age you begin taking your benefits

How to maximize your disability benefits?

If you qualify for Social Security disability checks, keep in mind:

- The amount you receive is based on a formula.

- Life changes could impact your disability eligibility.

- There may be other ways to receive assistance.

How do they determine how much disability you get?

To calculate how much you would receive as your disability benefit, SSA uses the average amount you've earned per month over a period of your adult years, adjusted for inflation. To simplify this formula here, just enter your typical annual income. This income will be adjusted to estimate wage growth over your career.

How do they calculate Social Security disability benefits?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA). The PIA is the basis for the benefits that are paid to an individual.

How are monthly disability payments calculated?

Your SSDI payment will be based on your average covered earnings over a period of years, known as your average indexed monthly earnings (AIME). A formula is then applied to your AIME to calculate your primary insurance amount (PIA)—the basic figure the SSA uses in setting your actual benefit amount.

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

What is the work incentive for Social Security?

There are also a number of special rules, called "work incentives," that provide continued benefits and health care coverage to help you make the transition back to work. If you are receiving Social Security disability benefits when you reach full retirement age, your disability benefits automatically convert to retirement benefits, ...

When do child benefits stop?

The child's benefits normally stop at age 18 unless he or she is a full-time student in an elementary or high school (benefits can continue until age 19) or is disabled.

Does Social Security pay for partial disability?

Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability. We consider you disabled under Social Security rules if all of the following are true: You cannot do work that you did before because of your medical condition.

How much does SSDI pay?

Most SSDI recipients receive between $800 and $1,800 per month (the average for 2020 is $1,258). Benefit estimates depend on your date of birth and on your earnings history.

Is SSDI based on income?

If you are eligible for Social Security Disability Insurance (SSDI) benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. It is not based on how severe your disability is or how much income you have.

How long can you work on disability?

Once you start receiving disability, you may not be able to make enough income to support yourself, but the SSA may allow you to work on the side. However, any month where you make over a certain amount will count as a “trial work period” (TWP). You are permitted to use up to 9 months towards a TWP. These months do not have to be consecutive so long as they are within any 60-month period. Once you use up your 9 months, you may jeopardize your benefits by continuing to work.

How much disability is there in 2020?

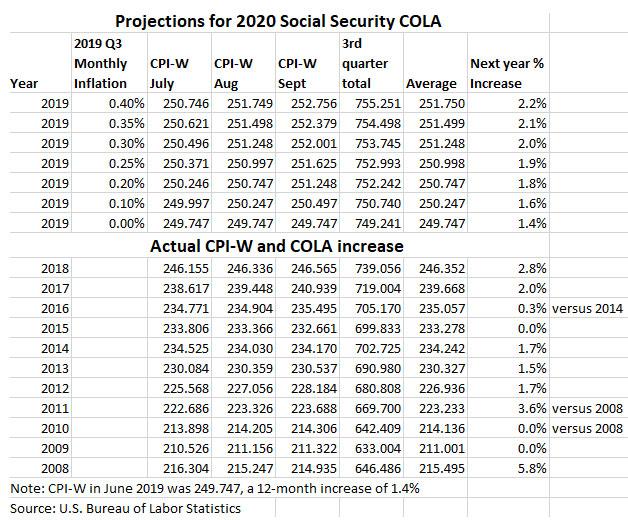

Individuals receiving disability in 2020 have a maximum benefit or $3,011 per month. These benefits reflect the 1.6% COLA for 2020. This is a significant decrease from the 2019 adjustment of 2.8% and the 2018 adjustment of 2%.

Do you have to be a SGA to qualify for disability?

To qualify for disability benefits in the first place, you must not be engaging in “ substantial gainful activity” (SGA). If you earn more than the prescribed income limit, you are engaging in SGA and therefore do not meet the SSA’s strict definition of being disabled.

Can you continue to work after 9 months of disability?

Once you use up your 9 months, you may jeopardize your benefits by continuing to work. You must report any income received while on disability to the SSA, and any income over the following thresholds triggers a trial work period:

Can I receive SSDI if I retired?

Most SSDI applicants can receive benefits as though they retired at the maximum retirement age; however, this calculation may be different for SSI applicants. This calculator is therefore most helpful for SSDI applicants.

What is disability payment?

Your disability payment is based on your average lifetime earnings before you became disabled. The severity of disability does not factor in, although payments from other sources can. Unlike Supplemental Security Income ( SSI ), which also pays benefits to people who are disabled and unable to work but is based on limited income and resources, ...

What is a covered earnings on SSDI?

"Covered earnings" are wages you have received from jobs that have paid into Social Security.

How does SSDI work?

If you are eligible for SSDI benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. This is the only factor that determines your benefit amount, although it may be reduced if you're receiving disability payments from other sources (more on this below).

What is the AIME for SSDI?

Your SSDI payment will be based on your average covered earnings over a period of years, known as your average indexed monthly earnings (AIME). A formula is then applied to your AIME to calculate your primary insurance amount (PIA)—the basic figure the SSA uses in setting your actual benefit amount.

What are some examples of 80% disability?

Examples of these include temporary disability benefits paid by the state, military disability benefits, and state or local government retirement benefits that are based on disability. Some public benefits are not counted toward the 80%, including SSI or VA benefits.

What is the average SSDI payment for 2021?

The average SSDI payment is currently $1,277. The highest monthly payment you can receive from SSDI in 2021, at full retirement age, is $3,148. This article covers how the monthly benefit is calculated.

Can you get reduced SSDI if you are injured?

For instance, if you were injured on the job and are receiving workers' compensation benefits, the amount of SSDI benefits you receive might be reduced. Other disability benefits that are not job-related and are paid for by the federal, state, or local government may also reduce your SSDI benefit amount. Examples of these include temporary ...