How to Read an Explanation of Benefits

- Service Dates. The Service Dates section (2) indicates the date (s) your medical procedure occurred.

- Description of Service. The Description of Service section (3) lists the procedure that was completed on the service...

- Billed. The Billed section (4) shows the amount the provider billed before any negotiated adjustments, co-pays,...

- Provider—The name of the doctor or specialist who provided the service.

- Service/Procedure—The type of service you received.

- Total Cost—The amount we pay for the service. ...

- Not Covered—The amount of the service not covered (this usually only occurs if the service is denied).

What does the explanation of benefits really mean?

The insurance company sends you EOBs to help make clear:

- The cost of the care you received

- Any money you saved by visiting in-network providers

- Any out-of-pocket medical expenses you’ll be responsible for

What does explanation of benefits stand for?

Explanation of benefits. A health care acronym that stands for the description of medical treatments and services that a health care provider has paid for on the behalf of the individual; sent by the health insurance company to patients.

How to read champva explanation of benefits?

What benefits do I get with CHAMPVA?

- Download the CHAMPVA Program Guide (PDF)

- See a complete list of non-covered services and supplies in the CHAMPVA Policy Manual

- Download fact sheets on CHAMPVA benefits

What does explanation of Benefits (EOB) actually explain?

The Nitty Gritty

- Prior Authorizations. ...

- Personal Note. ...

- Medical Necessity. ...

- Explanation of Benefits (EOB) Knowing how to read an EOB is INCREDIBLY important when trying to understand health insurance. ...

- Primary and Secondary Payers. ...

What do I do with an Explanation of Benefits?

What should you do with an EOB? You should always save your Explanation of Benefits forms until you get the final bill from your doctor or health care provider. Compare the amount you owe on the EOB to the amount on the bill. If they match, that's the amount you'll need to pay.

How do you define Explanation of Benefits?

An EOB is a statement from your health insurance plan describing what costs it will cover for medical care or products you've received. The EOB is generated when your provider submits a claim for the services you received. The insurance company sends you EOBs to help make clear: The cost of the care you received.

How are explanation benefits calculated?

The formula can be calculated a couple different ways. The first is: allowed+adjustment = billed charges. The second more detailed method is: payment+adjustment+patient responsibility = billed charges. Even a third method can be used: payment + patient responsibility = allowed amount.

Are EOBs easy or difficult to understand?

Many people find EOBs difficult to understand since they differ from one insurance company to another. Some insurance companies combine several dates of service or several providers on a single EOB form. Others prepare separate forms for each date of service and provider you visit.

How do you read a health insurance claim?

0:434:35How to Read Your Claim Summary - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou'll see where you got care this is the provider who sent us a bill you'll also see the date ofMoreYou'll see where you got care this is the provider who sent us a bill you'll also see the date of that. Visit. This helps you identify the claim if you've had more than one visit.

What all info does a EOB contains?

The explanation of benefits (EOB) details the charges for the healthcare services received, the amount the health insurance company will pay for those services, and the amount the insured person will be responsible for paying.

What does a negative amount on an EOB mean?

Negative EOB: Results from overpayments by the insurance carrier or is due to charges that the insurance carrier bills to the practice or provider after the original services and insurance payments were recorded.

What is allowed amount on EOB?

The maximum amount a plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.” If your provider charges more than the plan's allowed amount, you may have to pay the difference. ( See. Balance Billing.

What is deductible amount on EOB?

Deductible Amount: the amount of allowed charges that apply to your plan deductible that must be paid before benefits are payable.

What are the key areas to look at the EOB?

Key Sections of an EOBProvider Information. This section includes the name of your health care provider (doctor, hospital, or other health care professional or service). ... Member Information. ... Provided Services and Charges. ... Plan Responsibility. ... Member Responsibility. ... Plan Status. ... Claim Notes.

What are the three figures that are commonly depicted on an EOB?

the payee, the payer and the patient.

Why is it important to understand EOB?

The most important thing for you to remember is an EOB is NOT a bill. It's letting you know which healthcare provider has filed a claim on your behalf, what it was for, whether it was approved, and for how much. You should always review your EOB to make sure it's correct.

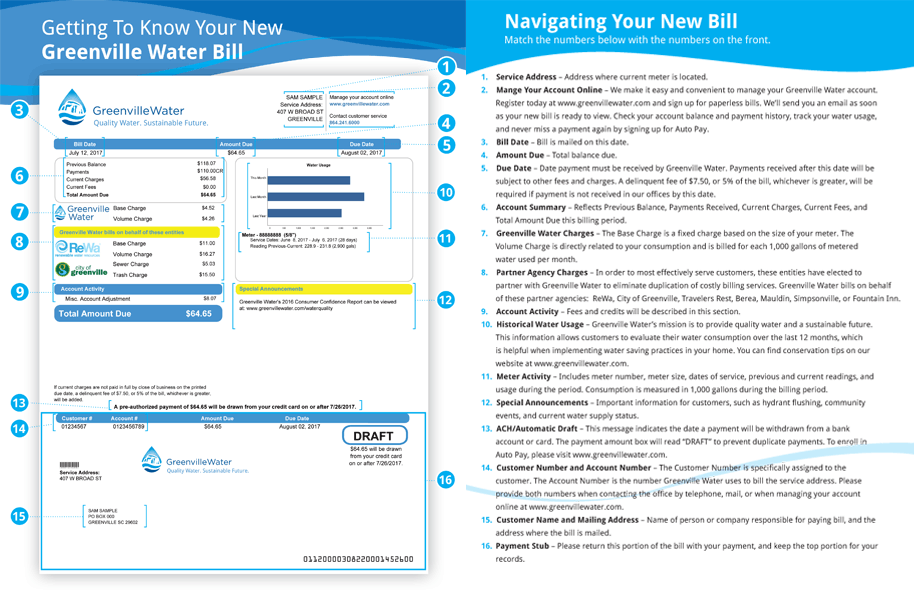

Service Dates

The Service Dates section (2) indicates the date (s) your medical procedure occurred.

Description of Service

The Description of Service section (3) lists the procedure that was completed on the service date.

Billed

The Billed section (4) shows the amount the provider billed before any negotiated adjustments, co-pays, deductibles, or any ineligible amount is accounted for.

Allowed

The Allowed section (5) shows the amount of the Billed section that is allowed under the provider contract This is sometimes called the network discount.

Provider Discount

The Provider Discount (6) is the billed amount minus the allowed amount.

Not Covered

Under the Not Covered section (7) is any amount determined to be ineligible for payment by your health plan.

Reason Code

The Reason Code (8) is used to explain the reason for an adjustment or benefit limitation. You can also find an Explanation of Codes toward the bottom.

What is the top part of an explanation of benefits?

The top part of the page usually has important demographic and contact information for the insurance company, the provider, and the patient. The very top of the page has the insurance company's claims processing address and contact number. If you have to appeal a denied claim ...

What is an EOB in insurance?

The EOB, or Explanation of Benefits, really is an explanation of how the claim was processed. It is by no means the last say in the adjudication of a claim, as all insurance companies must give you time to enter the claim and resend a correction or appeal. Ultimately, reading an insurance EOB is difficult and very detailed.

What information does an EOB include?

But this information varies a lot. It can include everything from the patient's insurance ID number, date of service and address, to their policy information. Usually, the EOB will at least list the patient's name, patient account number (which is like the claim number), and the date of service.

What does it mean when your insurance company says your claim was processed incorrectly?

This is important to note: if your claim was processed incorrectly, it may be because it was processed as a different provider. If this is the case you can easily tell just by looking at the top of the page.

What happens if you have already met your deductible?

If your patient has already met their deductible but their insurance is still applying services towards it, you have a basis for an appeal of the claim. Coinsurance is a specified percentage of patient responsibility which they have to meet after they have paid their deductible or co-payment amounts.

How many types of patient balances are there?

Types of patient balances. You'll also notice on the above Explanation of Benefits that there are 3 different types of patient balances. These 3 categories will depend on the patient's insurance policy and whether or not they have to meet a deductible, pay a copay, or are responsible for a coinsurance amount.

What is the bottom line of an EOB?

The bottom line. The bottom line of the EOB usually contains total payment information and directions for appeal. If you have questions, or if something just doesn't match up and you can't figure it out, you always have the right to call the insurance company, ask for more information on how the claim was processed, or begin an appeal of the claim. ...

What is an EOB?

An Explanation of Benefits (EOB) is a statement that your insurance company sends that summarizes the costs of health care services you received. An EOB shows how much your health care provider is charging your insurance company and how much you may be responsible for paying. This is not a bill. If you owe money, you will receive ...

What to do if you are denied EOB?

If you have a complaint or are dissatisfied with a denial of coverage under your health plan, you may be able to appeal the decision or file a grievance.

What happens if you owe money to a health care provider?

If you owe money, you will receive a separate bill from your health care provider. Individual EOBs are likely to differ from the example provided. Depicted in EOB statement example above, are these points for reference:

What happens when you receive an EOB?

A health care provider will bill your insurance company after you’ve received your care. Then you’ll receive an EOB. Later, you may receive a separate bill for the amount you may owe. This bill will include instructions on who to direct the payment to--either a health care provider or your health insurance company.

What is the EOB page 2?

Any outstanding amount you are responsible for paying. Page 2, contains a glossary of the terms and definitions included on your EOB, as well as instructions for how you can appeal a claim, if necessary. Page 3, provides more specific details about the cost of the care you received.

What is an EOB?

An EOB is a statement from your health insurance plan describing what costs it will cover for medical care or products you’ve received. The EOB is generated when your provider submits a claim for the services you received. The insurance company sends you EOBs to help make clear: The cost of the care you received.

What is page 3 of a medical deductable?

Depending on your health plan, page 3 may also reflect what portion of your out-of-pocket medical expenses count toward your annual deductible. Additional information, may include language assistance instructions, as well as more specific details about filing an appeal in your state of residence.

Cost summary total chart

You’ll find this chart on page 2 of your EOB. It shows the month and year-to-date totals of what your provider billed for services. Your share is the amount you may owe (such as copay, coinsurance deductible, denied claims). If you owe anything, your provider will send you a bill.

Out-of-pocket maximum cost chart

This chart starts on page 3. It shows the most money you will have to pay for covered services in a plan year.

Monthly claim details

These are the details of the claims that make up your monthly total. It is usually the same total for the month listed in the cost summary above, but this chart lists each claim processed by provider and date. We’ve included notes with more information about your claims.

Remember, your EOB is not a bill

It is simply a statement of services you received with details on how you and your plan will share the costs. To make sure your provider is billing you correctly, you should always compare your EOB to bills you receive from your provider.