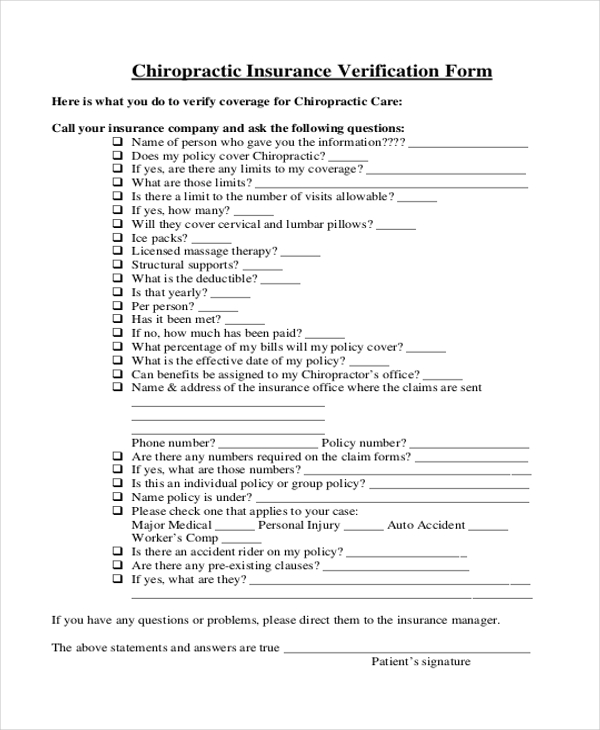

- Obtain demographics and insurance numbers. Before insurance benefits can be verified, get the patient's name, insurance company, the effective date, plan or group number.

- Contact the insurance provider. Check the effective dates and coverage period. ...

- Assess the deductibles, co-payments and coinsurance, if any. Depending on the type of plan, whether it's an Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO), confirm ...

- Ask about preexisting conditions exclusions. This question applies more for PPO's than HMO's. HMO's may not impose a preexisting condition exclusion upon the coverage.

- Inquire about policy limits and coverage. Some policies provide 100 percent coverage for visits such as well care visits, annual dental cleanings or other preventative maintenance visits.

- Insurance Verification Checklist. Ask the right questions during insurance verification. ...

- Get a Copy of the Patient's Insurance Card. ...

- Contact the Insurance Provider. ...

- Record Accurate Information. ...

- Follow Up With Patient as Needed.

How to check your insurance benefits?

- Coronavirus Omicron India Live Updates: Omicron impact in Karnataka – Double jabs must for entry in malls, cinema

- BJP slams Congress after singer Sidhu Moosewala joins Punjab unit

- COVID-19: As worries over Omicron gather pace, India halts plans of resuming regular international flights

How to verify patient insurance in three Easy Steps?

- Coverage—Is the patient covered under the insurance carrier at the date of service?

- Benefit options—What is the patient liability for copays and coinsurance?

- Prior authorization requirements for drugs and infusions.

- Preexisting clauses—Especially important in case the patient has had a lapse in medical insurance coverage.

How do you verify your health insurance?

- If the answer is no, the plan is not compliant with the ACA. ...

- This question helps to identify fixed indemnity plans, which are not regulated by the ACA. ...

- A non-compliant plan may claim to have a cap on out-of-pocket costs. ...

What do I need to know about my insurance benefits?

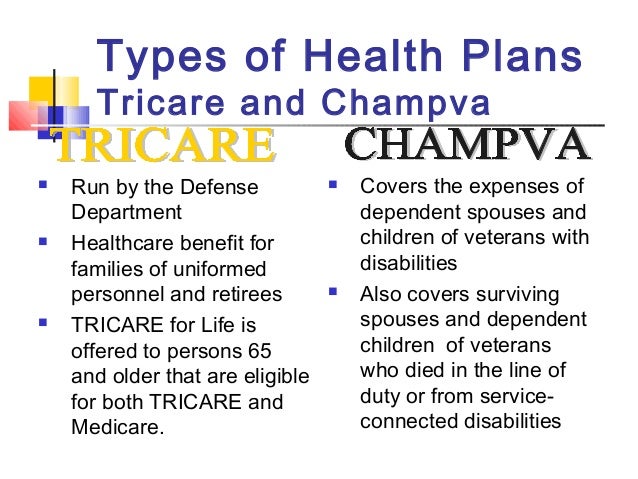

What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

- The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How the patient's insurance information is verified?

Insurance verification establishes the eligibility of a patient's insurance claim, but not the requirement of the insurance provider to actually reimburse the patient. The authorization process binds the insurance payer to authorize the claim through a legally binding promise to pay a specified amount.

What does it mean to verify insurance?

Insurance verification refers to checking the status of a given patient's insurance coverage as well as verifying their eligibility for having a given service covered. Once you have completed the medical insurance verification process, you should know the following: • If the patient's policy is active.

What is the first step in verifying insurance?

Insurance Verification Process [The Key Step In Medical Billing]5.1 1. Patient Enrollment.5.2 2. Insurance Eligibility Verification.5.3 3. Patient Follow up.5.4 4. Updating the Billing System.

What pertinent pieces of information do you need when verifying his insurance benefits?

5 Steps to Verify Patient Insurance as the New Year BeginsInsurance name, phone number, and claims address.Insurance ID and group number.Name of insured (be careful - this isn't always the patient)Relationship of the insured to the patient (if applicable)Policy effective date.Policy end date, if available.More items...•

Which of the following is required for insurance verification?

Listed below are the information to be verified and validated during Insurance Eligibility Verification: Insurance details like Insurance name, ID and group number. Insurer name and Dependent details. Policy Effective and Lapse date.

Why is it important to verify coverage?

Accurate insurance verification ensures a higher number of clean claims which speeds up approval and results in a faster billing cycle. Inadequate verification of eligibility and plan-specific benefits puts healthcare organizations at risk for claim rejections, denials, and bad debt.

What is eligibility and benefits verification?

What is Eligibility and Benefits Verification? To receive payments for the services rendered, healthcare providers need to verify each patient's eligibility and benefits before the patient's visit.

What is claim verification?

Claim verification is generally a task of verifying the veracity of a given claim, which is critical to many downstream applications. It is cumbersome and inefficient for human fact-checkers to find consistent pieces of evidence, from which solid verdict could be inferred against the claim.

What is medical Eligibility Verification?

The Automated Eligibility Verification System (AEVS): • Is a state database that provides up-to-date information on a Medi-Cal beneficiary's. eligibility. • Assists in identifying from which managed care plan the member accesses their Medi-

What are the most common errors when submitting claims?

Common Errors when Submitting Claims:Wrong demographic information. It is a very common and basic issue that happens while submitting claims. ... Incorrect Provider Information on Claims. Incorrect provider information like address, NPI, etc. ... Wrong CPT Codes. ... Claim not filed on time.

What is a precertification or preauthorization?

Prior authorization—sometimes called precertification or prior approval—is a health plan cost-control process by which physicians and other health care providers must obtain advance approval from a health plan before a specific service is delivered to the patient to qualify for payment coverage.

What information will you want to discover on the patient's insurance benefits?

New PatientsPatient's name and date of birth.Name of the primary insured.Social security number of primary insured.Insurance carrier.ID number.Group number.Contact information for the insurance company including phone number, website and address for submitting claims.

What is VerifyTreatment software?

This is very helpful! It would be worth adding that VerifyTreatment is an instant verification software that allows instant access to detailed benefit info from over 500 insurance company databases 24/7. When people need help, there’s no time to waste!! We use it and love it!

How to contact insurance carrier?

The most common way to contact payers (and, incidentally, the most time-consuming) is over the phone. Just pull up the info you got from your patient, find the insurance carrier’s phone number, and dial away. Once you get someone on the phone, double check that you’re talking with a representative on the provider services line, as some payers have lines exclusively for hospital admissions or referrals. After you confirm you’re speaking with the right rep, this resource says you’ll have to provide some information about your practice to confirm that this is a HIPAA-secure exchange. Finally, the rep will ask you to provide some of the patient’s information (usually the patient’s name, date of birth, and the policy number) so he or she can locate the correct policy.

Do you have to ask about secondary insurance?

Don’t forget to ask about secondary insurance! If the patient holds other policies, then you’ll need to complete all of these steps for each one.

Is Payer-supplied provider directory outdated?

One caveat: Payer-supplied provider directories have been known to contain outdated information. This might not necessarily be the case for eligibility resources, but it doesn’t hurt to remain cautious and aware of the possibility.

Do you have to tell your insurance when your insurance changes?

In a perfect world, patients would remember to tell you the moment their insurance changes. But patients have a lot on their plates too, and if their insurance plan is changing due to something like birth, adoption, marriage, divorce, or a change in employment, it might slip their mind to keep their therapist’s front office in the loop. As such, it’s a good idea to reverify your patients’ insurance plans on a regular basis— monthly, if possible.

Insurance verification maximizes your cash flow, minimizes your denied claims and keeps patients happy

Insurance verification maximizes your cash flow, minimizes your denied claims and keeps your patients happy.

What is insurance verification?

Insurance verification is the process of confirming a patient's insurance coverage and benefits prior to an encounter. More importantly, it's the process of confirming that a patient's insurance plan covers the services you provide and is in your network.

The importance of verifying patient health insurance in medical billing

Insurance verification matters equally whether you have long been in practice or are just now opening a medical practice .

What is the difference between an insurance authorization and insurance verification?

Whereas insurance verification is the process of confirming a patient's insurance information, insurance authorization is the act of obtaining an insurer's approval for certain services. This approval is separate from the process of creating and filing medical claims.

How do you verify insurance coverage?

One of the responsibilities of insurance companies is to identify their patients and provide a way for medical offices to verify patient insurance coverage. This means that you will never be without a way to verify insurance for your patients, unless it is after hours or on the weekend.

Why is verifying insurance important?

Medical insurance will only pay for a patient's medical services if it is active. This means that the patient has paid their periodic premium for coverage, and has added all necessary dependents on the policy. This ensures that their medical bills will be paid.

Who verifies patient insurance?

Usually when a patient calls the office to make an appointment, the front office staff, such as the receptionist or scheduler , will be the one who pulls the patient medical record and prepares it for the office visit.

What to do after you verify coverage?

After you verify that your patient is covered, you check the copay, coinsurance, or deductible amounts, so that you can collect the right amount while the patient is in the office. For more information on how to verify specific benefits and what this means, see our article on verification of benefits.

What happens if a patient doesn't have insurance?

If the patient doesn't have active insurance coverage, then their health insurance won't pay their medical bills, no matter what. This means that verification of patient insurance coverage is extremely important. If a patient's coverage is not active, then you have to collect from the patient when they come into the office.

What happens if an insurance company releases information to you without verifying who you are?

If the insurance company simply released information to you without verifying who you are, it would be a breach of HIPAA confidentiality. After this, you will need a few more things to identify the patient, so the operator can determine their coverage. You typically need the patient's name, ID number, and date of birth.

Why do medical billers have to rely on front office staff?

Unfortunately, because medical billers don't always do the verifying, they have to rely on the front office staff to make them aware of any important changes with a patient's insurance. This means that sometimes claims get sent to the wrong insurance company, or they are denied due to lack of coverage, because they are inactive. ...

What is medical verification?

The medical insurance verification process is one that is well-known to be annoying at best and disastrous at worst. A simple clerical error or missed question can lead to a patient’s coverage being denied. It’s paramount that you get the right information from the patient in order to prevent denials and to maximize reimbursements.

What information is needed to confirm a primary care physician?

Confirm the basic information. Patient’s name, policy and group number, the name of the primary, and the relationship of the primary to the patient

How to make sure information is up to date?

The best way to make sure information is up to date is to verify a patient’s information with the patient before they come in. The important information you need is: Full name. Date of birth. The name of the primary insured. Name of the insurance provider. Insurance provider’s contact information. Insurance ID. Group number.

How long before a patient comes to the office should you contact your insurance company?

It’s recommended to contact the insurance company at least 72 hours before the patient comes to your office. This will reduce the risk of being denied and will allow you to have the information you need.

What is sequence health?

Sequence Health offers patient engagement solutions for medical practices of all sizes. Sequence Health is also a provider of medical online marketing services to help increase your patient volumes and grow your brand’s presence.

Do you need to collect copays?

You’ll need to collect a patient’s due co-pay and make sure that they get a receipt. A patient will need this information to verify their own health insurance. Also, answer any questions that the patient has about their insurance, as it pertains to your services. This will make sure that the patient understands what they will need to pay and what insurance will cover.

What does a health insurance plan send you?

Your plan will send you a membership package with enrollment materials and a health insurance card as proof of your insurance.

What to do if you didn't receive a health insurance card?

If you didn’t receive a card, call your insurer to see if you should have received one already and to make sure your coverage is effective. You can find your insurer’s phone number on their website.

Do you have to pay your first premium to the Marketplace?

Once you enroll in a Marketplace plan, you must pay your first premium to your health insurance company – not the Health Insurance Marketplace® – so your medical coverage can begin. If you’ve already paid your premium, you can check if your health insurance is active online or in your plan materials to make sure your health insurance has started:

Can health insurance companies end my coverage?

Make sure you continue to pay your monthly premiums to your health insurance company on time. They could end your coverage if you fall behind.

How to verify eligibility and benefits?

Deductibles don’t update in real time. Calling. Another way to verify eligibility and benefits is to call the insurance company. When you do this, you will want to make sure that you have the number on the back of the insurance card for that patient.

What is eligibility check?

What is an “eligibility check” or “verification of benefits”? It is the process of verifying that a patient is going to be covered by insurance, what the patient will owe, and what codes are covered.

What to ask a mental health representative on the phone?

When you get a representative on the phone you will want to ask for Outpatient Mental Health benefits in an office setting. This will tell the representative exactly which benefits to look for.

Can you cover the bases if you ask for those variables?

You can cover the bases if you ask for those variables.

Is availability free?

Availity ( www.availity.com ): This is one of the most common tools used to verify eligibility and benefits. It is free to create an account and you can add users for free as well. Here are some pros and cons to Availity:

The Basics of Insurance Eligibility Checks

We won’t cover Medicare here. For this article, we will speak to commercial payers. There are some limitations around non-covered services and advanced beneficiary notices (ABN) which we will cover in a separate article.

Insurance Websites

One of the simplest methods is to go directly to payer portals and sites. Insurance companies like Blue Cross Blue Shield, Aetna, or United Healthcare allow providers to enter information directly into their portal. Look for “Member Services” or “Provider Portal” to find the payer’s eligibility and benefits tools.

Through a Clearinghouse

If your practice accepts many different insurance plans and providers you may want to explore a more centralized option. Tools like Availity and Ability Network make it possible to check a larger number of payers in one portal.

Check eligibility through your software

PatientStudio has integrated eligibility checks inside your software! Your practice management system can check a patient’s eligibility before their visit or generate an eligibility check immediately if you need a quick response.

Call the Payer

If you’re more old school, you can call the payer directly. Most often you will get the payer’s interactive voice response system (IVR). This is the automated system when you call an insurance company. The IVR will go through questions to confirm information to provide the basics of that patient’s eligibility.