What qualifies a child for SSI?

What Conditions or Disabilities Automatically Qualify My Child for SSI?

- Total blindness and/or deafness

- Cerebral palsy

- Down syndrome

- Severe intellectual disability in children older than 4 years of age

- Symptomatic HIV infection

- Birth weight lower than 2 pounds, 10 ounces

Can a child work while receiving SSI?

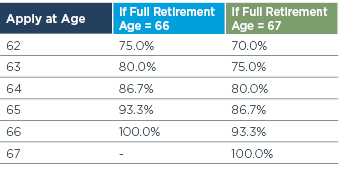

You can receive Social Security retirement or survivors benefits and work at the same time. However, if you are younger than full retirement age and earn more than certain amounts, your benefits will be reduced.

How can a child qualify for SSI?

- Have a medically determinable physical or mental impairment or impairments.

- The impairment or impairments must cause marked and severe functional limitations.

- The impairment must be expected to last or have lasted for at least one year or be expected to result in death.

How do you calculate taxable social security benefits?

- $25,000 if you’re filing single, head of household, or married filing separately (living apart all year)

- $32,000 if you’re married filing jointly

- $0 if you’re married filing separately and lived together with your spouse at any point in the year

Does a dependents Social Security count as income?

The short answer is yes, Social Security income is counted as income for dependents, but the full answer is a bit more complicated, especially when it comes to taxes. Find out more information about dependent adult Social Security benefits below.

Is my child's SSI considered income?

Supplemental Security Income (SSI) is provided under Title XVI of the SSA. It is designed to help persons who are aged, blind, or disabled, who are very low income and have limited assets. SSI is not taxed and does not count towards MAGI.

Can a child still receive Social Security benefits in college?

Generally, no. There was a time when Social Security did pay benefits to college students, but the law changed in 1981. Currently, Social Security pays dependent or survivor benefits only to students attending classes at a secondary school (grade 12 and below).

Will my Social Security benefits increase when my child turns 18?

Answer: When your daughter turns 18, she will stop receiving money from Social Security. Your benefit will not go up, but your wife, son and stepdaughter's benefits could go up, because at that point there would be $888 to split between three people.