Do you pay taxes on death benefits on an annuity?

When the insured or annuitant dies, a death benefit is paid to the recipient of a life insurance policy, annuity, or pension. Death payments from life insurance plans are not taxed, and named recipients often get the death benefit as a lump-sum payment.

How to cash in a death benefit on an annuity?

Annuity death benefits that can be included in an annuity fall into a number of main categories:

- Guaranteed periods

- Joint life annuity

- Nominee annuity

- Value protection

Do most annuities have death benefits?

Most variable annuity (VA) contracts include an insurance component that provides a death benefit. The death benefit is usually triggered by the passing of the annuitant, although there are contracts in which the contract owner’s death triggers the benefit. That's because annuities allow for the owner and annuitant to be different people.

Does a fixed annuity have a death benefit?

Now, multi-year guarantee annuities, fixed annuities, and variable annuities are all deferred annuities where the death benefits work is the accumulation value. With some variable annuities and index annuities, the death benefit could be attached to what's called an income rider, which is an attached benefit that is typically used for income.

How are annuity death benefits taxed?

How are annuities taxed at death? A person who inherits an annuity has to pay income tax based on the difference between the premium paid into the annuity and the amount still in it when the annuitant died.

Do the beneficiaries of an annuity have to pay taxes?

You'd have to pay any taxes due on the benefits at the time you receive them. The five-year rule lets you spread out payments from an inherited annuity over five years, paying taxes on distributions as you go.

Are death benefits taxable to beneficiary?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

How do I avoid taxes on an annuity death benefit?

To avoid taxes on inheritance, you can use a deferred annuity or a life insurance policy. Annuities offer enhanced death benefits that allow beneficiaries to offset taxes or spread the tax burden over time.

What happens to annuities when someone dies?

Payments will continue to you for as long as you live. But you or your beneficiary are guaranteed to get a least the amount you paid in. If you die before that amount is paid out, your beneficiary will get payments up to the amount that you initially paid for the annuity.

Is a lump sum death benefit taxable?

While some forms of death benefits, such as life insurance payments, are not subject to income tax, the IMRF lump sum death benefit is taxable. Payments from insurance are not subject to income tax because the member paid the premiums on the policy using previously taxed money.

Is 1099 R death benefit taxable?

When a taxpayer receives a distribution from an inherited IRA, they should receive from the financial instruction a 1099-R, with a Distribution Code of '4' in Box 7. This gross distribution is usually fully taxable to the beneficiary/taxpayer unless the deceased owner had made non-deductible contributions to the IRA.

What is the death benefit exclusion?

Death benefit exclusion. If you are the beneficiary of a deceased employee (or former employee) who died before August 21, 1996, you may qualify for a death benefit exclusion of up to $5,000. The beneficiary of a deceased employee who died after August 20, 1996, won't qualify for the death benefit exclusion.

How are death benefits that are received by a beneficiary normally treated for tax purposes?

Creditors have rights to life insurance policy proceeds when the beneficiary is the insured's estate. How are death benefits that are received by a beneficiary normally treated for tax purposes? Death benefits that are received by a beneficiary are generally exempt from federal income tax.

What do you do with an inherited annuity from a parent?

Roll a qualified annuity into an IRA. If you've inherited a qualified annuity, you are permitted to roll it over into an inherited IRA. The reason for doing this is that IRAs typically have lower fees And, they usually have better investment options when compared to annuities.

How is taxable amount of survivor annuity calculated?

Under the Simplified Method, you figure the tax-free part of each full monthly payment by dividing your cost by a number of months based on your age. This number will differ depending on whether your annuity starting date is before November 19, 1996, or after November 18, 1996.

Does a retirement annuity form part of a deceased estate?

Section 3(2)(c)(i) of the Estate Duty Act states that a death benefit paid from a pension fund, pension preservation fund, provident fund, provident preservation fund or retirement annuity fund does not form part of a person's property for purposes of determining what constitutes his estate.

What Happens to an Annuity When the Annuitant or Owner Dies?

First, it’s important to note that some annuities are annuitant driven and some are owner driven. The main difference is whose death triggers the death benefit. If the policy is annuitant driven, proceeds are payable to the beneficiary when the annuitant dies.

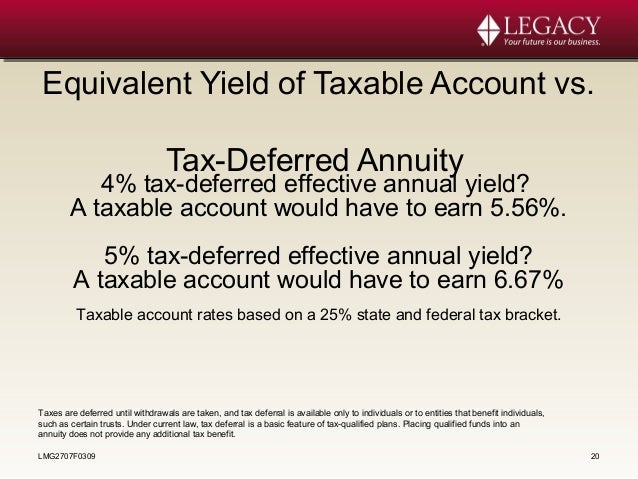

Income Tax and Annuities

Once the money is inside of an annuity, it grows tax-deferred. That means the owner does not have to pay taxes on the growing account balance. After a set number of years, the policy can be annuitized, which turns the annuity into a steady income stream, payable to the annuitant.

How Much Tax Do You Pay on an Inherited Annuity?

For any type of annuity, the Internal Revenue Service will require taxes to be paid by the beneficiary either on the lump sum received or on the regular fixed payments. The payments received from an annuity are treated as ordinary income, which could be as high as a 37% marginal tax rate depending on your tax bracket.

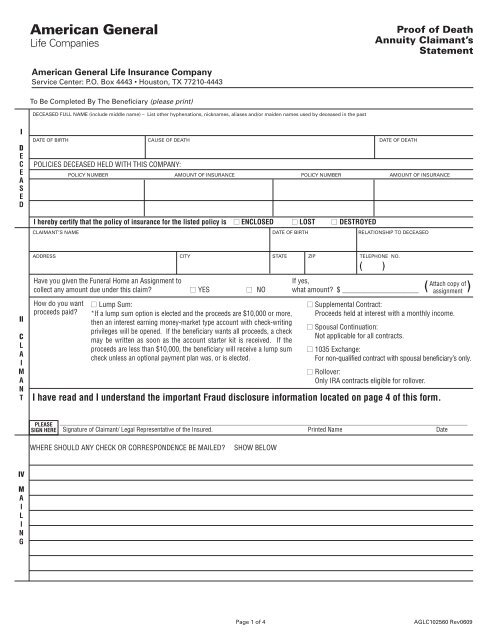

How Death Benefits are Paid

There are a handful of ways that annuity death benefits are paid. In all cases, the recipient pays ordinary income tax on the money distributed to them:

Tax Rules When an Annuity Has Been "Annuitized"

If you die after payments have begun as part of annuitizing your contract, the policy will terminate unless you have a death benefit provision in the original contract.

Rules for Annuities Prior to Annuitization

If your annuity is in the "accumulation" phase, meaning not yet annuitized, there are specific rules for what happens when you die and have identified beneficiaries to receive the proceeds of our annuity:

Death Benefit Riders

Some types of annuities offer a guaranteed death benefit to the beneficiary, no matter the amount remaining in the contract. This is known as a death benefit rider, and the annuity owner pays an annual fee for this benefit. Death benefit riders protect beneficiaries against declines in contract values because of market conditions.

Inherited IRAs Before the SECURE Act

In the years before the SECURE Act was passed, many households bought annuities with their IRA money to create stretch IRAs. A stretch IRA was a tax planning strategy. It came into play when the original annuity owner dies.

What Happens to an Inherited IRA Now?

According to Scott Ditman with Berdon Accountants & Advisors, now the entire IRA must be distributed within 10 years of the owner’s death. The beneficiary has some choices in terms of how long they stretch out those distributions. Ultimately, though, the account must be “emptied” by year 10.

Exceptions to the New Rules

Some exceptions apply to this new 10-year rule, so check with your tax advisor and estate planning attorney to see if those might apply to you.

What About Required Minimum Distributions?

Before going into more detail, let’s quickly review required minimum distributions. Before the SECURE Act was passed in 2019, you would have to start taking mandatory minimum withdrawals from your 401 (k), traditional IRA, or other tax-advantaged retirement account once you turned 70.5.

RMDs and The Five-Year Rule

Now, let’s go back to our original discussion. Say that an account holder who passed hadn’t reached the age when they would be required to start taking mandatory minimum distributions.

What About Distributions from Roth IRA and Non-Qualified Annuities?

Roth IRAs must still be emptied out by the beneficiary within that 10-year period. However, the withdrawals made by the beneficiary are tax-free, according to Ditman.

Keep This in Mind About the SECURE Act

The SECURE Act seeks to ultimately increase its tax revenue from inherited IRAs as a way to compensate for the loss of revenues that it will absorb from taxes that were reduced or eliminated elsewhere.

What happens to an annuity after the owner dies?

After an annuitant dies, insurance companies distribute any remaining payments to beneficiaries in a lump sum or stream of payments. It’s important to include a beneficiary in the annuity contract terms so that the accumulated assets are not surrendered to a financial institution if the owner dies.

Who is the beneficiary of an annuity?

A beneficiary is the person who receives the death benefits, usually the remaining contract value or the amount of premiums minus any withdrawals, upon the annuitant’s death.

What is a beneficiary list?

Beneficiaries can be people or organizations. A list of beneficiaries ensures that the designated people and organizations receive the specified amount or percentage. Minors designated as beneficiaries can’t access their inherited annuity until they reach the age of majority (18).

What is inheritance tax?

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitant’s death. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary.

What happens when a spouse becomes an annuitant?

The spouse then becomes the new annuitant. When a spouse becomes the annuitant, the spouse takes over the stream of payments. This is known as a spousal continuation.

Do annuities end after death?

Because annuities offer many benefits, lottery winners, retirees and structured settlement recipients use them to create predictable cash flow for the present, future and even after their death. Depending on the terms of the contract, annuity payments will end after the death of the annuity owner.

Who is the annuitant in an annuity?

The annuitant is the person on whose life expectancy the contract is based. It is common for the annuity owner to name him or herself as the annuitant.

How are annuities taxed?

How annuities are taxed also depends on how they were purchased. This means when figuring your annuity taxation at death, you’ll also need to think about how you put the funds in when you set it up. If you funded your annuity using money you’ve never paid taxes on, it’s considered a qualified annuity, and the IRS will want its share when you take your distribution. A qualified annuity is funded using money from an account like a 401 (k) or IRA.

How to keep an annuity going after death?

One option to keep your annuity going long after your death is to set up a joint life annuity. This is usually an option set up by spouses who want to make sure the survivor is taken care of if something should happen.

What happens if an annuity goes to your spouse?

If your annuity contract designates that it goes to your spouse, there will be no immediate tax consequences. In this scenario, your spouse would simply reassign the annuity to his own name. The annuity would continue to operate as it did when you were alive, only going to your spouse instead of you.

What is a qualified annuity?

A qualified annuity is funded using money from an account like a 401 (k) or IRA. The other type of annuity you’ll likely encounter when signing your contract is a non-qualified annuity. This means you purchased the annuity using money you’ve already paid taxes on, like cash straight out of your bank account.

Can you take an annuity in a lump sum?

They can take the annuity in a lump sum, at which point they would be required to pay taxes on the appreciation as ordinary income. Instead of that lump sum, though, they can choose to take it over a five-year period, which will avoid the hefty tax, plus keep them from moving into a higher tax bracket.

Can you roll an annuity over to your spouse?

You can choose for your annuity to go to a parent, child or even a friend after your death, as long as you build it into your contract. Unlike your spouse, these other parties can’t simply roll the annuity over to them and continue to take it, though, since they weren’t married to you .

Do annuities grow tax free?

One of the biggest benefits of annuities is that the funds grow tax-free until you’re ready to take them out. If you earn any interest or dividends, you must reinvest them in the annuity to keep those tax benefits, but you’ll be able to enjoy tax-free growth throughout the life of your annuity.

What is an annuity death benefit?

Annuity Death Benefit Provision Explained. An annuity is a contract between yourself and an insurance company. You pay the insurer a set amount of money to purchase the contract. In turn, the insurer agrees to pay you according to a set schedule.

When adding an annuity to your financial plan, is the death benefit important?

When adding an annuity to your financial plan, the death benefit is an important consideration. The annuity company you’re working with should be able to walk you through different death benefit scenarios to help you decide which one is the best fit for your needs.

What are annuity riders?

Annuity Riders. Aside from death benefit upgrades, there are other riders that can increase an annuity’s value. For example, you may be able to add a rider to cover long-term carein case you need nursing home care in retirement. Having this rider could reduce the amount of the death benefit.

What happens if you live longer and receive more money from an annuity?

In exchange, the insurance company increases the death benefit payout your beneficiaries are eligible to receive, since there may be less money left in the annuity by the time you pass away.

How to determine death benefit amount?

Death Benefit Amounts. Generally, there are two ways to determine a standard annuity death benefit. First, you can pay out any remaining assets to your beneficiary. Say you purchased a $500,000 annuity and it paid out $300,000 during your lifetime.

Does an annuity increase the death benefit?

Increasing an Annuity Death Benefit. Your insurance company may offer opportunities to increase your annuity death benefit.

Does an annuity increase if you pass away?

For example, if you pass away during a market upswing, the annuity’s death benefit may automatically increase. Annual increases.

What happens to an annuity when the owner dies?

This establishes the greater death benefit and postpones the paying of taxes on the death benefit. The spouse pays ordinary income taxes when the funds are annuitized ...

What is a qualified annuity?

Qualified Annuities. You fund qualified annuities with pretax dollars, which makes their distributions taxable as income. As with any qualified plan, you or the inheritor will pay ordinary income taxes on any distributions. Investing in an annuity through a qualified plan offers you no additional tax deferment, ...

What is enhanced death benefit?

Enhanced Death Benefits. Annuities provide a standard death benefit, which amounts to the contract value or the amount of your purchase payments, less any withdrawals, whichever is greater. You can also add an enhanced death benefit for an additional cost, which lets you lock in the growth of your investments in the separate accounts ...

What is variable annuity?

Variable annuities are mutual funds wrapped inside an annuity. They offer the advantages of investing in mutual funds with the tax deferment of the annuity. If the accounts grow in value, your account pays out more than if they hold their value or decrease.

What happens if you inherit stocks that were purchased 40 years ago but are now worth $50,000?

So if you inherit stocks that were purchased 40 years ago for $5,000 but are now worth $50,000, your taxes will be based on how much the value increases beyond $50,000 when the stocks are sold, not their increase over the original $5,000.

Is a variable annuity taxable?

Whether a variable annuity death benefit is taxable depends on its classification as a qualified or nonqualified annuity. Qualified annuities, which are held by 401 (k) s or individual retirement accounts, are taxed the same as other qualified plans. Nonqualified annuities have death benefits that don't receive a step up in cost basis ...

Can you invest in an annuity with a qualified plan?

Investing in an annuity through a qualified plan offers you no additional tax deferment, as that is the defining characteristic of the annuity, even a nonqualified one. For this reason, some financial experts advise against investing in annuities within qualified plans.

What happens to an annuity if you leave your job?

The new ruling makes annuities more portable. In other words, if you leave your job, your 401 (k) annuity can be rolled over into another plan at your new job. 1 Also, the new retirement law removes some of the legal risks for annuity providers by limiting whether an account holder can sue them if the provider goes bankrupt and can't honor the annuity payments. 2

How does VA death benefit work?

How Death Benefits Work. The standard death benefit in a VA is set initially at whatever amount is invested. Depending on the VA, the death benefit then resets—either on the contract anniversary date if the contract value has increased or whenever the contract cash value reaches a new high. Additional investments in the annuity can also help ...

What is VA insurance?

Most variable annuity (VA) contracts include an insurance component that provides a death benefit. The death benefit is usually triggered by the passing of the annuitant, although there are contracts in which the contract owner’s death triggers the benefit. That's because annuities allow for the owner and annuitant to be different people.

What is the death benefit charge in the VA?

Fees for a VA death benefit are part of the mortality and expense charge (M&E), included in the VA prospectus, and can be as high as 2% of the contract value . The standard death benefit is initially set at the amount invested and then resets according to the contract. Once set, it only decreases if the contract owner takes a distribution.

Can a beneficiary of an IRA stretch out the minimum distributions?

Before the ruling, a beneficiary of an IRA could stretch out the required minimum distributions from the IRA over time, which also stretched out the taxes owed on the inherited funds. 3 .

Does the VA have an enhanced death benefit?

The additional fee is charged each year. Enhanced death benefits vary, but many contracts offer an annual guaranteed step up. The contract may, for example, guarantee that the death benefit will increase by the greater of 5% a year or reset to the highest contract value. Over time, it is not unusual for a VA to end up having a death benefit ...

Does an annuity increase the death benefit?

Additional investments in the annuity can also help increase the death benefit. Once set, the death benefit doesn't decrease if the contract declines in value, but it does decrease if the contract owner takes a distribution. The adjustment may be a dollar-for-dollar or percentage decrease. Many contracts also offer an enhanced death benefit rider ...

What happens to an annuity if the owner dies?

If the owner dies, the primary beneficiary will receive payments or lumpsum distribution. A predetermined list of beneficiaries from an annuity can ensure that the money is given to them based on a percentage or amount. Minors can not touch their inherited annuity until they’ve reached legal adult age.

Why is an annuity important?

An annuity is a good way to save for retirement. It protects you from the risk of living too long, and it can also protect you from market risks. Lottery winners, retirees, and structured settlement owners often use an annuity because it helps them know how much money they will have now and in the future.

What is a lump sum death benefit?

Lump-Sum. Standard death benefits from deferred annuities are payable to a designated beneficiary are a choice of a lump sum or a series of payments. Some deferred annuities offer an enhanced death benefit as a life insurance alternative to increase the inheritance for the beneficiaries.

How long can a non-spousal beneficiary withdraw from an annuity?

Non-spousal beneficiaries can withdraw the proceeds over 5 years. Since the taxes are only owed when withdrawing income, the beneficiary can prevent from falling into a higher tax bracket. Another option is to elect annuity payments paid over the beneficiary’s life expectancy.

How long do you have to take out an annuity?

The beneficiary or beneficiaries of an annuity have five years to take out the proceeds. They can take them out gradually or in a single lump sum anytime, as long as they withdraw all of the death benefit with 5 years of the annuitant’s death.

What happens to an annuity after a guaranteed period?

After the guaranteed period is complete, the income stops.

What happens if an annuity owner names a child as the primary beneficiary?

If an annuity owner names a child the primary or contingent beneficiary, under that owner’s state’s Uniform Transfers to Minors Act, the child’s money will be placed in a custodial account for that child’s benefit to a certain age.

What is the death benefit of an annuity?

Death Benefits. If your annuity has a death benefit, you select the beneficiary to receive proceeds after your death. The amount is generally either a guaranteed minimum or all of the funds in the account. The guaranteed minimum might include all of the payments minus your previous withdrawals. If your annuity permits a "stepped-up" death benefit, ...

What happens if you leave an annuity to a nonspousal beneficiary?

If you leave your death benefits from an annuity to a nonspousal beneficiary, the amount becomes part of your gross estate valuation. Because it is left to a beneficiary, it might not pass through the probate process, but that does not mean the value of the annuity is not part of your estate valuation for tax purposes.

What is included in gross estate valuation?

This includes not only annuities but real estate, stocks and bonds, cash, trusts, mutual funds, insurance or business interests. For estate evaluation, the fair market value of the assets is used. Estate deductions include mortgages, debts, funeral expenses, estate expenses and property passing to your spouse. To ensure that your estate need not pay more taxes than necessary, consult an estate planning professional.

What is estate planning for variable annuities?

1. Estate Planning for Variable Annuities. 2. Does the Inheritance of an Annuity Affect Social Security Payments? 3. The Taxes on the Inheritance of a Tax Deferred Annuity. When you die, all of the assets titled in your name become part of your estate. For federal tax purposes and for states that impose estate tax, ...

What is an annuity?

Purchasing an annuity means that you establish an agreement with an insurance company under which you receive periodic payments, beginning at a specific date and generally continuing for the rest of your life. You may purchase the annuity in either a lump sum or by a series of payments to the insurance company.

Can you buy an annuity in a lump sum?

You may purchase the annuity in either a lump sum or by a series of payments to the insurance company. Investment options vary by the type of annuity. Like many retirement accounts, annuities are tax-deferred, meaning you do not pay money on income until you actually begin receiving payments.

Is an annuity death taxed?

If your death benefits from an annuity pass to your spouse, it is not usually included in your taxable estate. If the death benefit passes to any other beneficiaries, it is part of your estate valuation.

What Is An Annuity Death Benefit?

- When the holder of an annuity contract passes away, the money and the death benefit available from the annuity come into play. Many annuity products come with the provision for the annuity holder to include a death benefit for a beneficiary, which they choose while setting up the contra…

Annuities and Income Taxes

- Now, let us get back to the point where we started this discussion. Any money in an annuity contract grows tax-deferred until the annuitant decides to withdraw the same. Any payment that an individual receives from the contract throughout his or her lifespan is taxed as per income tax law. When the annuitant passes away, the fate of the available death benefit depends on who th…

Tax Scenario For Non-Spouse Beneficiaries

- If the selected beneficiary of an annuity is anyone other than the spouse, the recipient will have to pay tax on the available amount as per the normal tax rate for him or her. In order to spread out this tax liability, the recipient may choose to receive the money in payments over a period of time, rather than as a lump sum. In these cases, the annuity value is added to the estate of the annuit…

Ready For Personal Guidance?

- You may be attracted to annuities for their ability to offer guaranteed lifetime income, a guaranteed minimum interest rate, or a guard against financial losses. If you are ready to investigate different annuity strategies and see what might make sense for you, a financial professional at SafeMoney.com can help you. Use our Find a Financial Professional sectionto c…