Who benefits from a pension after death?

Under current law, we recognize these wartime periods to decide eligibility for pension benefits:

- Mexican Border period (May 9, 1916, to April 5, 1917, for Veterans who served in Mexico, on its borders, or in adjacent waters)

- World War I (April 6, 1917, to November 11, 1918)

- World War II (December 7, 1941, to December 31, 1946)

- Korean conflict (June 27, 1950, to January 31, 1955)

What happens to a pension when someone dies?

- Your Pension number or Personal Record Identifier (PRI);

- The beneficiary's name and date of birth ; and

- Their address (with postal code).

What happens to my pension when I Die?

What happens to my pensions if I die? The main pension rule governing defined benefit pensions in death is whether you were retired before you died. If you die before you retire your pension will pay out a lump sum worth 2-4 times your salary.

Are death benefits from an annuity taxable?

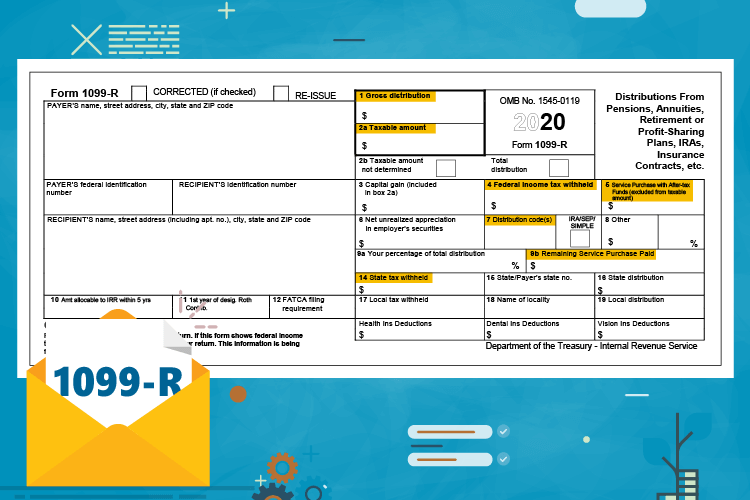

If an annuity contract has a death-benefit provision, the owner can designate a beneficiary to inherit the remaining annuity payments after death. The earnings on an inherited annuity are taxable. How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or someone else.

Are pension lump sum death benefits taxable?

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. For life insurance policies, death benefits are not subject to income tax and named beneficiaries ordinarily receive the death benefit as a lump-sum payment.

How are pension survivor benefits taxed?

They are not taxable when the member receives them as a refund or pension or when the member's beneficiary(ies) receives them as a death benefit. tax-deferred member contributions and the interest are taxable. The income tax treatment is the same as that described in subparagraph 1(c) above.

Do I have to pay tax on my deceased husband's pension?

Although the taxability of pension benefits depends largely on the specifics of the plan and the payment structure, most beneficiaries must pay taxes on money received. Recipients should typically report this inherited pension income the same way the plan participant did.

Do you pay taxes on Widows pension?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

Does a death benefit count as income?

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the beneficiary does not have to pay taxes on it.

What is pension plan?

Pension plans are a type of retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement. Pension plan options typically offer a lump-sum ...

What are the different types of pension plans?

Types of Pensions. There are two main types of pension plans: defined-benefit and defined-contribution . A defined-benefit plan is what people normally think of as a "pension.". It is an employer-sponsored retirement plan in which employee benefits are computed using a formula that considers several factors, such as length ...

How to notify a spouse of a death?

"When a plan participant dies, the surviving spouse should contact the deceased spouse’s employer or the plan’s administrator to make a claim for any available benefits. The plan will likely request a copy of the death certificate. Depending upon the type of plan, and whether the participant died before or after retirement payments had started, the plan will notify the surviving spouse as to: 1 the amount and form of benefits (in other words, lump sum or installment payments under an annuity); 2 whether death benefit payments from the plan may be rolled over into another retirement plan; and 3 if a rollover is possible, the method and time period in which the rollover must be made." 3

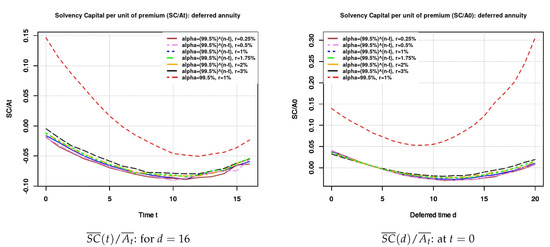

What is a period certain annuity?

Period Certain Annuity. A period certain annuity option allows the customer to choose how long to receive payments. This method allows beneficiaries to later receive the benefit if the period has not expired at the date of the member's death.

Why is defined benefit called defined benefit?

It is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to set the benefit paid out. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

Can a non-spouse beneficiary be a child?

However, in limited instances, some may allow for a non-spouse beneficiary, such as a child. According to the Internal Revenue Service (IRS): The Employee Retirement Income Security Act of 1974 (ERISA) "protects surviving spouses of deceased participants who had earned a vested pension benefit before their death.

Can a pension plan allow a non-spouse beneficiary?

Typically, pension plans allow for only the member—or the member and their surviving spouse—to receive benefit payments. However, in limited instances, some may allow for a non-spouse beneficiary, such as a child.

What happens to pension when you die?

If you die before you retire your pension will pay out a lump sum worth 2-4 times your salary. If you’re younger than 75 when you die, this payment will be tax-free for your beneficiaries. Defined benefit pensions also usually pay what’s called a ‘survivor’s pension’ to either a spouse, civil partner or dependent child, ...

What happens to defined contribution pensions when you die?

Defined contribution pensions. The main pension rule governing defined contribution pensions in death is your age when you die and whether you’ve already started drawing your pension. If you die before your 75th birthday and haven’t started drawing your pension it can be passed to your beneficiaries tax-free.

What is a private pension?

If you’re part of a workplace pension scheme or have set up your own pension, such as a SIPP or self employed pension, you’ll have what’s known as a private pension. There are two main types, defined contribution pensions and defined benefit pensions. The type you have will determine how much of your pension your beneficiaries can claim ...

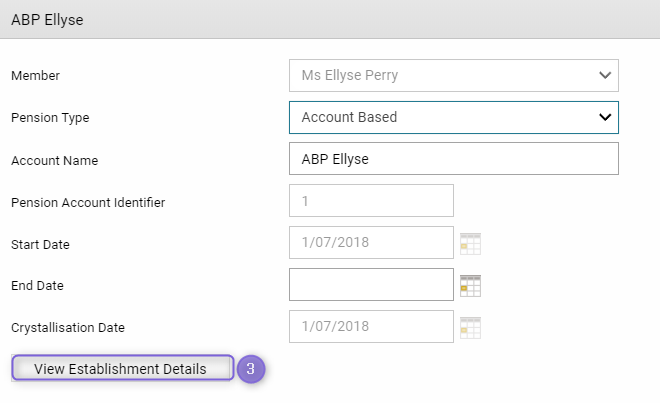

How to ensure pension gets passed on after you die?

To ensure your pension gets passed on after you die it’s important to let your pension provider know the contact details of your nominated beneficiaries. If you’re a PensionBee customer you can do this in just a few clicks in your online dashboard.

How does defined benefit pension work?

Defined benefit pensions work a little differently as their value is linked to your salary and how many years you’ve worked for your employer. The main pension rule governing defined benefit pensions in death is whether you were retired before you died.

How long do you have to claim death pension?

Your beneficiaries have two years to claim a death pension, after which point tax may be charged. If you die before your 75th birthday, but have already started drawing your pension, the way you have chosen to access your savings will determine the action your beneficiaries can take. If you’ve withdrawn a lump sum and you have remaining cash in ...

Do pensions sit outside of estate?

Pensions are considered to sit outside your estate, which means that when you die your beneficiaries can access your retirement savings without having to pay inheritance tax. Most workplace and private pension schemes provide death benefits and, in the event that you pass away, your beneficiaries should contact your pension scheme administrator ...

What are the taxes on pension death benefits?

There are 4 taxes pension death benefits can be subject to: income tax. lifetime allowance charge. inheritance tax. special lump sum death benefits charge. These mostly apply regardless of whether death benefits are paid as a lump sum, beneficiary income drawdown or beneficiary annuity. In this article we look at each tax in turn.

When did pension death benefits depend on income tax?

Since 6 April 2015, the income tax situation of pension death benefits has depended on the age of the deceased member or the deceased beneficiary (in the case of someone who dies while entitled to a beneficiary income drawdown plan).

What is a special lump sum death benefit?

Special lump sum death benefits charge. If death benefits are subject to income tax and are paid as a lump sum to a trust, a 45% tax charge applies. This is called a special lump sum death benefits charge. Any payments made to the beneficiaries from the trust will be subject to income tax but the tax payable can be offset against ...

How long after Sean died would he have to pay taxes?

In the above example if the death benefits were paid out more than 2 years after the scheme administrator knew of Sean’s death, the death benefits would have been subject to income tax despite Sean having died at age 64.

How old was Sean when he died?

Sean dies age 64 and his widow Shona took the death benefits in the form of beneficiary income drawdown. Any withdrawals made by Shona will be free of income tax.

How long does it take to get income tax after death?

As well as applying where the deceased dies age 75 or over, income tax also applies if the death benefits are paid more than 2 years after the date the scheme administrator knew (or should have known) of the death, even if death was before age 75. In the above example if the death benefits were paid out more than 2 years after ...

Does death benefit affect lifetime allowance?

Note that the payment of death benefits does not affect the beneficiary’s lifetime allowance – the check is against the lifetime allowance of the decease member. In the case of the death of the beneficiary of a beneficiary drawdown plan, there’s no lifetime allowance check at all. The scheme administrator will always pay death benefits out in full ...

What happens to your life insurance when your spouse dies?

When your spouse dies, whatever life insurance payments or other death benefits has set up become available to you. Depending on the circumstances and terms, it may also pay off for the IRS. Many employers offer death benefits as part of the company's retirement planning, but some of the money may go to the government instead of you.

Is there a tax on death benefits?

If the accident policy kicks in because it covered your spouse's accidental death, the same rules apply as for life insurance. If all you get is the flat death benefit, with no interest, there's no tax.

Is life insurance taxable?

Life Insurance. The payout from insurance when someone dies may be taxable. If your spouse named you as beneficiary of a $150,000 policy, the $150,000 is tax free. If the policy earns interest, however, any extra money you get above the face value is taxable income.

Is a survivor benefit taxable?

There are many other types of survivor benefits your spouse's employer may pay you besides those in the retirement plan. If your spouse had any wages due when he died, for instance, you probably get the money. In that case, it's as taxable to you as it would have been to your spouse.

Is an annuity taxable if you have a pension?

Pension and Annuity. Death benefits bought under a pension or an annuity work much the same as life insurance. They're not taxable unless they exceed the value of the contract. If the death benefit is more than that, then the IRS gets a cut. The number-crunching guidelines for figuring this one are in Publication 575.

When is an annuity distribution taxed?

If a beneficiary receives a lump sum amount from an employer-sponsored variable annuity after the owner’s death, the distribution is usually taxed only if it exceeds the unrecovered cost of the annuity contract. If you decide to receive annuity payments instead of a lump sum, these distributions are only subject to tax when exceeding ...

Is a company retirement plan taxable?

There are a few factors that determine whether or not death benefits from a company retirement plan are taxable, including the kind of benefits and the relationship between the beneficiary and the deceased.

Can a beneficiary leave a 401(k)?

If the beneficiary is not the surviving spouse, she may leave the 401 (k) with the plan provider if the plan allows for this. Such heirs may also roll over the funds into an inherited IRA. Depending on the 401 (k) plan, this heir may have to remove the entire amount in the account within five years or take a lump sum distribution.

Can a surviving spouse withdraw from 401(k)?

The surviving spouse may also leave the funds in his late spouse’s 401 (k) plan and begin making withdrawals at the time in which the deceased would have turned 70 ½, with the withdrawals again subject to tax based on his income tax bracket.

Is a pension plan taxable income?

If the beneficiary begins receiving death benefits from a pension plan, t his amount is usually taxable as ordinary income. Pension plan beneficiaries usually receive a percentage of the amount of the deceased’s plan benefit, often about two-thirds.

Is life insurance income taxed?

Payments to beneficiaries from company life insurance policies are generally not taxed. However, that also depends on the nature of the policy. If a spouse leaves $100,000 to the other spouse, that $100,000 is not taxable. If the life insurance policy earns interest, say $4,000 annually, that amount is taxable. If the beneficiary decides to take the life insurance proceeds as monthly installments rather than a lump sum, it is critical to determine what percentage of each payment is interest and pay tax on the amount accordingly.

Is a death benefit plan taxable?

Whether death benefits from a company’s retirement plan are taxable for the beneficiary depends on the type of death benefit as well as the beneficiary’s relationship to the deceased. Company death benefit plans do not go through probate, as the late account owner designated beneficiaries at the time of the account's establishment.

What is an Annuity Death Benefit?

When the holder of an annuity contract passes away, the money and the death benefit available from the annuity come into play. Many annuity products come with the provision for the annuity holder to include a death benefit for a beneficiary, which they choose while setting up the contract.

Annuities and Income Taxes

Now, let us get back to the point where we started this discussion. Any money in an annuity contract grows tax-deferred until the annuitant decides to withdraw the same. Any payment that an individual receives from the contract throughout his or her lifespan is taxed as per income tax law.

Tax Scenario for Non-Spouse Beneficiaries

If the selected beneficiary of an annuity is anyone other than the spouse, the recipient will have to pay tax on the available amount as per the normal tax rate for him or her. In order to spread out this tax liability, the recipient may choose to receive the money in payments over a period of time, rather than as a lump sum.

Different Annuity Contracts can Bring Different Situations

Though death benefits are available with many annuities, your annuity product selection will determine your potential tax implications in the future. To select the most appropriate annuity strategy for you, it is a good idea to seek a recommendation from a knowledgeable, experienced financial or insurance professional.

Ready for Personal Guidance?

You may be attracted to annuities for their ability to offer guaranteed lifetime income, a guaranteed minimum interest rate, or a guard against financial losses. If you are ready to investigate different annuity strategies and see what might make sense for you, a financial professional at SafeMoney.com can help you.