Are Social Security benefits same as a pension?

The US Social Security Administration provides benefits to people with disabilities. A key difference between a pension and Social Security is that the latter is an American government program versus a privately run pension plan. They are also administered and funded differently, and these benefits are designed for different people.

What are the benefits of a defined benefit pension plan?

Pros and cons

- Substantial benefits can be provided and accrued within a short time – even with early retirement

- Employers can contribute (and deduct) more than under other retirement plans

- Plan provides a predictable benefit

- Vesting can follow a variety of schedules from immediate to spread out over seven years

- Benefits are not dependent on asset returns

How much you will get from Social Security?

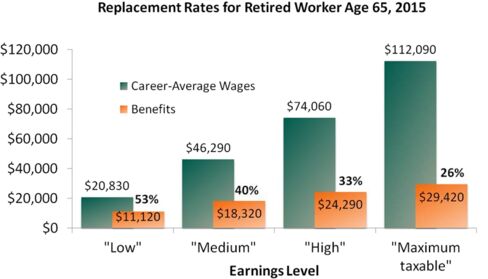

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment.

What exactly are Social Security benefits?

Key Points

- Retirees need to claim their Social Security benefits at a specific age to avoid reducing them.

- Many Americans are unaware when they can claim their standard benefit.

- This could inadvertently result in reduced Social Security income.

What is considered a defined-benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

Is Social Security a DB or DC plan?

Howard Iams is a senior research adviser to ORES , ORDP , SSA . Christopher Tamborini is a research analyst with the Office of Retirement Policy, ORDP , SSA ....Introduction.DBdefined benefitDCdefined contributionSSASocial Security AdministrationSIPPSurvey of Income and Program Participation

Is Social Security a pension plan?

Social Security is part of the retirement plan for almost every American worker. It provides replacement income for qualified retirees and their families.

How is Social Security different from a private defined-benefit plan?

Fewer companies offer guaranteed pensions but offer workers 401(k) plans, which are self-directed investments intended to generate retirement income. Social Security is a government-guaranteed basic income for older Americans, funded through a special tax paid by employees and employers.

Can you collect a pension and Social Security at the same time?

Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. But there are some types of pensions that can reduce Social Security payments.

What's the difference between Social Security and pension?

Pensions are retirement benefits that are provided to people who have paid into a plan or who have been granted pension benefits by an employer. Social Security is a social insurance program in the United States that provides a wide number of services, one of which is taxpayer-funded benefits to the elderly.

What type of system is Social Security?

Social Security is a federal program in the U.S. that provides retirement benefits and disability income to qualified people, as well as their spouses, children, and survivors. To qualify for Social Security retirement benefits, workers must be at least 62 years old and have paid into the system for 10 years or more.

Is Social Security different from 401k?

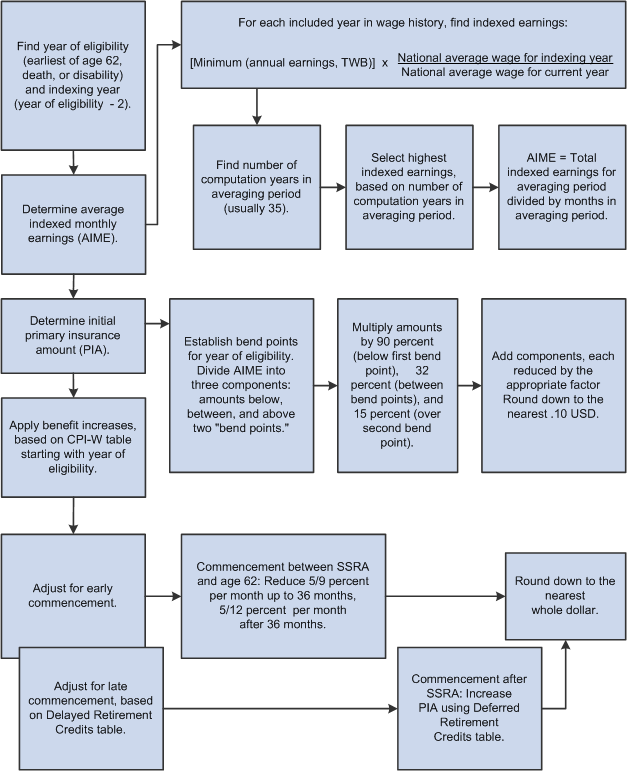

Social Security retirement benefit income does not change based on other retirement income, such as from 401(k) plan funds. Social Security income, instead, is calculated by your lifetime earnings and the age at which you elect to start taking Social Security benefits.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Which of the following would be an example of a defined contribution pension plan?

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.

Do federal employees get a pension and Social Security?

FERS is a three-tiered system includ- ing Social Security, a Federal pension, and a tax-deferred savings plan. All workers enrolled in FERS are covered by Social Security. They contribute to it at the current tax rate and are eligible for the same benefits as all other workers covered by the program.

Which retirement plans can be integrated with Social Security?

An integrated pension plan is an employer-based pension plan in which Social Security is counted as part of the employees' total benefits. An integrated pension plan can help employers reduce the cost of a traditional pension plan, while still offering their workers stable retirement income.

Defined Benefit Plans: A Definition

In a defined benefit plan, a company takes charge of its workers’ retirement income. Using a formula based on each worker’s salary, age and time wi...

Defined Benefit Plan vs. Defined Contribution Plan

Defined benefit plans used to be common, particularly in heavily unionized industries, like the auto industry. Today, though, they have largely bee...

Frozen Defined Benefit Plans

Many of the remaining defined benefit plans have been “frozen.” This means the company wants to phase out its retirement plan, but will wait to do...

The Solo Defined Benefit Plan

There is a way certain savers can start a DIY defined benefit plan. It’s built off of contributions you make yourself, without any help from your e...

An Overview

One option for increasing the amount of money you can save for retirement is to claim benefits early. The earlier you start, the larger the lump sum you can receive. Usually, you have three years after full retirement age before you can request to receive an equal monthly amount instead of the actual cash value of your benefits.

Social Security Benefits

However, if you delay your retirement age by three years, you would only be taxed once every two years. This is because Medicare already includes income taxes when you become eligible for Medicare. Thus, delaying your eligibility to Medicare is not really a burdensome thing to do.

In the End

You also have a choice when it comes to the Social Security Defined Benefit Plan. Under this plan, you can choose the benefit amount based on your personal retirement income. However, if you do not choose the right benefit amount at the right time, you could end up losing much of your money.

What is defined benefit plan?

What are defined benefit plans? Defined benefit plans are qualified employer-sponsored retirement plans. Like other qualified plans, they offer tax incentives both to employers and to participating employees. For example, your employer can generally deduct contributions made to the plan.

How to calculate retirement benefits?

Many plans calculate an employee's retirement benefit by averaging the employee's earnings during the last few years of employment (or, alternatively, averaging an employee's earnings for his or her entire career), taking a specified percentage of the average, and then multiplying it by the employee's number of years of service.

What is hybrid retirement plan?

Some employers offer hybrid plans. Hybrid plans include defined benefit plans that have many of the characteristics of defined contribution plans. One of the most popular forms of a hybrid plan is the cash balance plan.

Is it too early to start planning for retirement?

It's never too early to start planning for retirement. Your pension income, along with Social Security, personal savings, and investment income, can help you realize your dream of living well in retirement. Start by finding out how much you can expect to receive from your defined benefit plan when you retire.

Do pension benefits hinge on performance?

Benefits do not hinge on the performance of underlying investments, so you know ahead of time how much you can expect to receive at retirement. Most benefits are insured up to a certain annual maximum by the federal government through the Pension Benefit Guaranty Corporation (PBGC).

What is defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex ...

What is an excise tax plan?

Most administratively complex plan. An excise tax applies if the minimum contribution requirement is not satisfied. An excise tax applies if excess contributions are made to the plan.

What is defined benefit plan?

A defined benefit plan is a retirementplan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades. This decline is especially pronounced in the private sector, where more and more employers have shifted ...

Why do you have to keep funding a defined benefit plan?

Because the benefits of a defined benefit plan are very specific, you have to keep funding the plan to make sure it will pay those benefits in your retirement. Plus, you’ll need to have an actuary perform an actuarial analysis each year.

What is the difference between defined benefit and defined contribution?

Some companies offer both defined benefit and defined contribution plans. The key difference between each of these employer-sponsored retirement plans is in their names. With a defined contribution plan, it’s only the employee’s contributions (and the employer’s matching contributions) that’s defined. The benefits they receive in retirement depend ...

Do defined benefit plans grow with inflation?

Many defined benefit plans also grow with to inflation. As a result, inflation over long periods of time won’t affect your money as much as a defined contribution plan participants. Defined benefit plans also feature low fees, meaning more of your money will stay in your pocket.

Is the defined benefit plan frozen?

This has led to the shift in responsibility from employers to employees. Many of the today’s remaining defined benefit plans have been “ frozen.”. This means the company is phasing out its retirement plan, though it’s waiting to do so until the enrollees surpass the age requirement.

Can you deduct contributions to a defined benefit plan?

The problem with making your own defined benefit plan is that you have to meet the annual minimum contribution floor.

Why are pensions called defined benefit plans?

Pensions nowadays are known officially as defined-benefit plans because the payment amount you'll receive in retirement is decided or defined in advance. 3 4 1 .

How is Social Security funded?

Social Security is handled by the federal government and funded through payroll taxes collected from employees and companies. 1 2 . Read on for more about how the two programs are structured and how each may benefit retirees who have paid into such programs.

What is a private pension?

A private pension is a retirement account created by an employer for their employees’ future benefit. Employers, governed by certain laws and regulations, contribute on behalf of employees and invest the money as they see fit. Upon retirement, the employee receives monthly payments.

When do pensions and social security start?

Both pensions and Social Security may provide an income stream to retirees. Pensions can begin as early as 55, are usually taken around age 65, and must begin to be withdrawn at age 72. 14 Social Security can begin at age 62. 9 . Pensions and Social Security operate for the same goal—to provide retirement funds—but they are not funded ...

Does Social Security cover disability?

Social Security offers a disability insurance program that covers workers with enough credits (earned through work and payment into the system) if they become disabled. 12 Pensions normally don’t provide disability benefits unless the employee is disabled in an on-the-job accident.

Can a spouse receive a partial pension?

Although spouses may receive a partial pension payment, it’s unlikely that a child would also benefit from pension income—as is the case with Social Security. 13 Finally, pensions may offer a lump-sum payout upon retirement. This option is not available through the Social Security system. Both pensions and Social Security may provide an income ...

Is Social Security considered a pension?

Although many seniors receive Social Security benefits in retirement, the Social Security system isn't considered a pension. It may look like a pension because upon retirement (if you have paid into the system during your working years), you are eligible to receive monthly benefits. These benefits can begin at the age of 62. 9 .

What is a disability pension plan?

This plan includes a disability retirement benefit that provides monthly pension payments, and for those employees under the Governor’s jurisdiction and most independent employers, majority state-paid retiree health insurance for the term of your disability retirement benefit.

How does SERS pension work?

In the SERS defined benefit pension plan, your benefit is defined by a calculation that considers your years of service and salary. Your benefit grows each year based on an annual benefit accrual rate and, when you retire, is paid to you in equal monthly payments for your lifetime. In this type of plan, the majority of the investment risk is on ...

What is SERS retirement statement?

It lists the service credit you earned, contributions you made, and interest you earned on your contributions during the year and over the course of your membership in the pension system. If you are eligible for monthly pension payments, or “vested,” you will see pension estimates calculated to several payment options.

Do you have to contribute to your pension each day?

You and your employer make mandatory contributions to your pension each pay day. The amounts are set by law in the State Employees’ Retirement Code and are generally fixed with the exception of a shared-risk/shared-gain provision on your contribution.

What is defined benefit pension?

Defined benefit pension plans offer participants security, in that they know their income stream upon retirement. Also, the Pension Guaranty Corporation (PBGC) protects the administration of their defined benefit plans. If something happened to the company, the PBGC would step in and cover pension distributions. 6

Why are integrated pension plans used?

Why Integrated Pension Plans Are Used. Several factors likely play a role in a firm’s decision to adopt an integrated pension plan. First, there are several payroll considerations that accompany an integrated pension plan; in particular, firms can reduce their required OASDI payment.

What is integrated pension?

An integrated pension plan is an employer-based pension plan where the employer counts Social Security benefits as part of the total benefit that the plan participant receives. Said another way, employers that use an integrated plan reduce the pension benefits that their employees receive by a percentage of the amount that they receive in their ...

What is OASDI payroll tax?

OASDI (old age, survivors, and disability insurance) is the payroll tax that employers collect from employees to fund the nation’s social security program. Employers withhold 6.2% of their employees' pay and then forward it to the government.

Why did pensions go away?

Pension plans have largely gone away due to the financial cost and responsibility that the employer has for their worker's retirement benefits.

What are the disadvantages of 401(k) plans?

Along those lines, another potential disadvantage of defined benefit pension plans is that participants do not have control over the investments.

Is an integrated pension plan less expensive?

As a result, an integrated pension plan is less costly and less financially burdensome for the employer. Integrated pension plan participants collect from their employer as well as Social Security. Some integrated plans have a specified total benefit in mind when determining payout; these plans look for Social Security and pension funds ...