How to file taxes when on SSDI?

- Your Social Security number

- Medical records from your doctors, therapists, hospitals, clinics and caseworkers

- Laboratory and test results

- Names, addresses, phone and fax numbers of your doctors, clinics and hospitals

- Names of all medications you are taking

- Names of your employers and job duties for the last 15 years

When does SSDI become taxable?

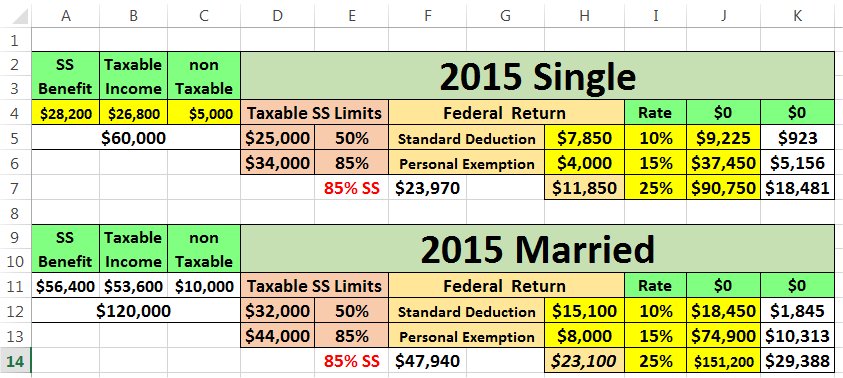

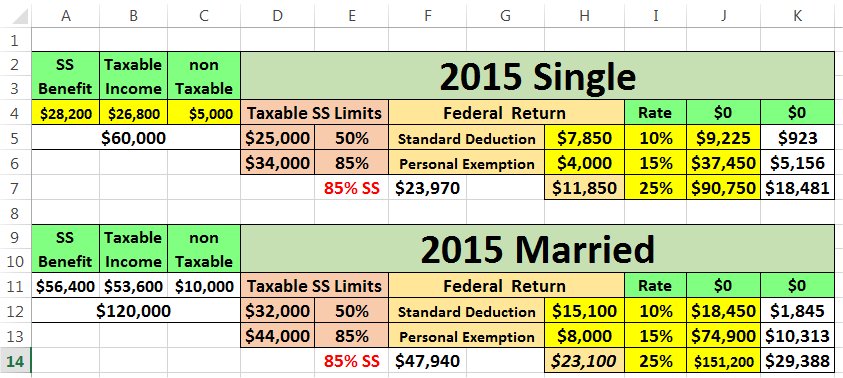

The IRS states that your Social Security Disability Insurance benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

How much SSD is taxable?

There is no maximum dollar amount for how much Social Security income is taxable. Instead, there is a maximum percentage of Social Security income that is taxable. If you make more than $34,000 if you’re a single filer or $44,000 if you’re married filing jointly, you may pay taxes on up to 85% of your Social Security benefits.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How much of my Social Security disability is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Is SSDI considered income?

As of 2020, SSDI payments are considered taxable for individuals who have over $25,000 in yearly income or married couples with over $32,000 in yearly income. (Your income is one-half of your SSDI benefit plus the full amount of any other sources of household income.)

Do I have to file taxes on SSDI?

None of your SSDI is taxable if half of your SSDI plus all your other income is less than: $25,000 if filing single, head of household, or married filing separately (if you and your spouse lived apart at all times during the year) $32,000 if married filing jointly.

Is disability income taxable by IRS?

Disability Pensions. If you retired on disability, you must include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040-SR until you reach minimum retirement age.

Can I have a savings account while on SSDI?

Yes. If you receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) you can have a savings account.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Can you get a tax refund on SSDI?

Tax Refunds Receiving SSDI or SSI benefits doesn't prevent you from receiving a tax refund. Whether you owe taxes or not, you should file a tax return if you think you qualify for any of the above credits discussed above. If you don't file a tax return, you will miss out on many of the credits.

How much can you make on Social Security disability without being penalized?

During the 36-month extended period of eligibility, you usually can make no more than $1,350 ($2,260 if you are blind) a month in 2022 or your benefits will stop. These amounts are known as Substantial Gainful Activity (SGA).

Federal Taxation of Social Security Disability Benefits

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of...

Taxation of Social Security Disability Backpay

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump...

State Taxation of Social Security Disability Benefits

Most states do not tax Social Security disability benefits. The following states, however, do. Some of these states use the same income brackets as...

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.

How much is taxable for Social Security Disability?

The IRS states that your Social Security Disability Insurance benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status: Single, head of household, qualifying widow (er), and married filing separately taxpayers: $25,000.

How much of Social Security disability income is included in taxes?

As a single filer, you may need to include up to 50% of your benefits in your taxable income if your income falls between $25,000 and $34,000. Up to 85% gets included on your tax return if your income exceeds $34,000. For married couples who file jointly, you'd pay taxes: Up to 50% of the Social Security Disability Insurance benefits you receive ...

How much do you pay for Social Security if you are married?

For married couples who file jointly, you'd pay taxes: Up to 50% of the Social Security Disability Insurance benefits you receive when your combined income falls between $32,000 and $44,000. Up to 85% of your disability benefits if your combined income exceeds $44,000.

How does Social Security Disability Insurance work?

The amount you receive from Social Security Disability Insurance depends on your average lifetime earnings before your disability began. Generally, the more you earned over a longer period, the more you'll benefit. The Social Security Administration calculates your disability benefit based on the amount of your Social Security "covered earnings.".

How long can you be disabled on Social Security?

The program's administrator, the Social Security Administration (SSA), allows you to earn coverage benefits if you meet their definition of disabled which includes becoming disabled for at least 12 months or in a way that is expected to be fatal. The Social Security Disability Insurance program provides modest — though vital — benefits to you ...

How does Social Security calculate disability?

The Social Security Administration calculates your disability benefit based on the amount of your Social Security "covered earnings.". Generally, these are your past earnings that have been subject to Social Security tax. You need to take your covered earnings and average them over the 35-year period representing your top earning years.

How much income can you report if you are married and file jointly?

Married filing separately but lived with your spouse during the tax year: $0. For example, if you are married and file jointly, you can report up to $32,000 of income before needing to pay taxes on your Social Security Disability Insurance benefits.

How many states tax Social Security disability?

As of 2020, 12 states imposed some form of taxation on Social Security disability benefits, though they each apply the tax differently. Nebraska and Utah, for example, follow federal government taxation rules.

Who is eligible for SSI?

SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed to help meet basic needs for living expenses. Social Security retirement benefitsare paid out based on your past earnings, regardless of disability status.

How long does a disability last?

Your disability must have lasted at least 12 months or be expected to last 12 months. Social Security disability benefits are different from Supplemental Security Income (SSI)and Social Security retirement benefits. SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed ...

How much of my Social Security benefits do I get if I'm married?

Up to 50% of your benefits if your income is between $25,000 and $34,000. Up to 85% of your benefits if your income is more than $34,000. If you’re married and file a joint return, you’d pay taxes on: Up to 50% of your benefits if your combined income is between $32,000 and $44,000.

How much income can you report on Social Security?

This means that if you’re married and file a joint return, you can report a combined income of up to $32,000 before you’d have to pay taxes on Social Security disability benefits. There are two different tax rates the IRS can apply, based on how much income you report and your filing status.

Is disability income taxable?

Whether you receive SSDI or SSI, your disability benefits are generally not taxable. Here's how to determine if you need to pay income tax on your benefits. Menu burger. Close thin.

Is Social Security taxable if you are working part time?

Social Security retirement benefits, on the other hand, can be taxable if you’re working part-time or full-time while receiving benefits. Is Social Security Disability Taxable? This is an important question to ask if you receive Social Security disability benefits and the short answer is, it depends.

How much is SSDI income for 2021?

Let’s say you’re single and your income for the 2020 tax year—the tax return you file in 2021—includes $12,000 in SSDI benefits and $20,000 in other income. Combining your other income with half your SSDI benefits gives you taxable income of $26,000.

How many states are taxing Social Security?

These rules apply only at the federal level. Thirteen states also tax Social Security benefits as of 2020: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia, although exactly how they do so varies by state. 6

How much will Social Security increase in 2021?

This increases to $1,470 in 2021. 2. The number of work credits you’ll need to qualify for Social Security disability benefits depends on how old you are when you become disabled. 1.

What is short term disability?

They shouldn't be confused with short-term disability, a type of insurance coverage often included in an employment compensation package. To qualify, you must also have worked long enough and recently enough at a job at which you and your employer paid into Social Security.

When will Social Security send out 1099?

The Social Security Administration will send you tax form SSA-1099 after the end of the tax year. This is the “Social Security Benefit Statement.”.

Do you have to include half of your Social Security?

Add half of your Social Security benefits you received to any other income you might have, including unearned income like interest or dividends. If you’re married, you must also include any income or benefits your spouse earns or receives, even tax-exempt interest.

Is Social Security taxable?

Social Security retirement and disability benefits might be taxable if you have other sources of income that push your total annual income above a certain threshold. About one-third of people who receive Social Security Disability Insurance (SSDI) benefits pay taxes on at least a portion of what they receive.