Can an employer deny vacation benefit?

Yes, the decision to approve or deny the use of accrued vacation time is up to you, assuming you do so in a consistent and non-discriminatory manner.

What is considered a fringe benefit?

A fringe benefit is something that your employer offers you that is above and beyond your annual salary or other wages. These are perks that employers offer in order to attract and retain the best talent.

Are there any disadvantages to fringe benefits?

There are, however, some disadvantages to such structures; the owners can take advantage of fewer tax-favored and tax-free benefits than those that would be available as fringe benefits for employees of a "normal" C corporation.

What are some advantages of fringe benefits?

What are the advantages of fringe benefits?

- Lure for talent. Benefits are some of the best tools for attracting and retaining high-quality talent. ...

- Presenteeism prevention. Presenteeism occurs when employees are physically present at work but not fully engaged due to physical or emotional distractions.

- Culture Improvement. ...

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

What are 4 examples of fringe benefits?

What Are Fringe Benefits Examples. Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What are three examples of excluded fringe benefits?

2. Fringe Benefit Exclusion RulesAccident and health benefits.Achievement awards.Adoption assistance.Athletic facilities.De minimis (minimal) benefits.Dependent care assistance.Educational assistance.Employee discounts.More items...•

How are vacation fringe benefits calculated?

How To Calculate A Fringe Rate Benefit?Add together the cost of an employee's fringe benefits for the year.Divide it by the employee's annual salary.Multiply the total by 100 to determine the percentage of fringe benefit rate.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

What are the kinds of fringe benefits?

Types of fringe benefitsEmployee stock options.Free or discounted meals.Free gym membership.Transportation assistance.Tuition reduction or assistance.Life, dental or vision insurance.Childcare reimbursement.Company-owned vehicle.More items...

Are company paid trips taxable?

If the employer pays a per diem or mileage allowance and the amount paid exceeds the amount the employee substantiated under IRS rules, you must report the excess as wages on Form W-2. The excess amount is subject to income tax withholding and Social Security and Medicare taxes.

What are examples of taxable fringe benefits?

Examples of taxable fringe benefits include:Bonuses.Vacation, athletic club membership, or health resort expenses.Value of the personal use of an employer-provided vehicle.Amounts paid to employees for moving expenses in excess of actual expenses.Business frequent-flyer miles converted to cash.More items...•

Is 401k a fringe benefit?

Typical forms of fringe benefits include: Medical and dental insurance. Year-end and performance bonuses. 401k, IRA or other employer-sponsored retirement plan, including employee matching contribution plans.

What do you mean by fringe benefit?

fringe benefit, any nonwage payment or benefit (e.g., pension plans, profit-sharing programs, vacation pay, and company-paid life, health, and unemployment insurance programs) granted to employees by employers. It may be required by law, granted unilaterally by employers, or obtained through collective bargaining.

What is included in the fringe benefit rate?

A fringe benefit rate is the proportion of benefits paid to the wages paid to an employee. The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid.

How much should fringe benefits be?

Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, the average fringe benefit rate (aka benefit costs) is 30%.

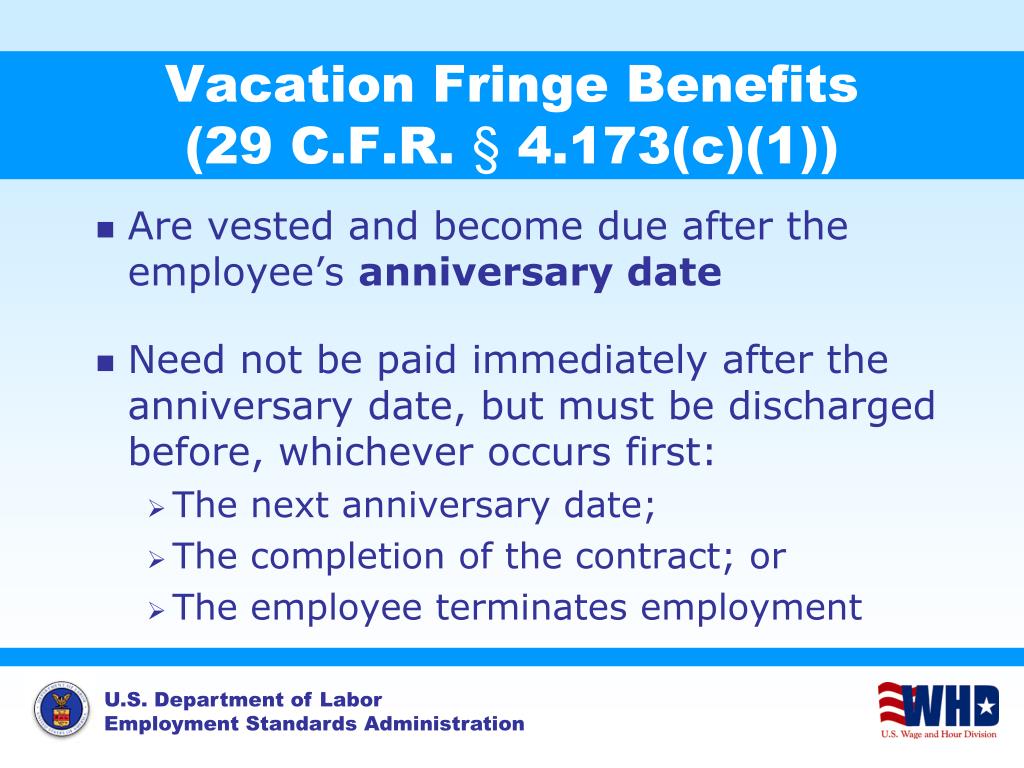

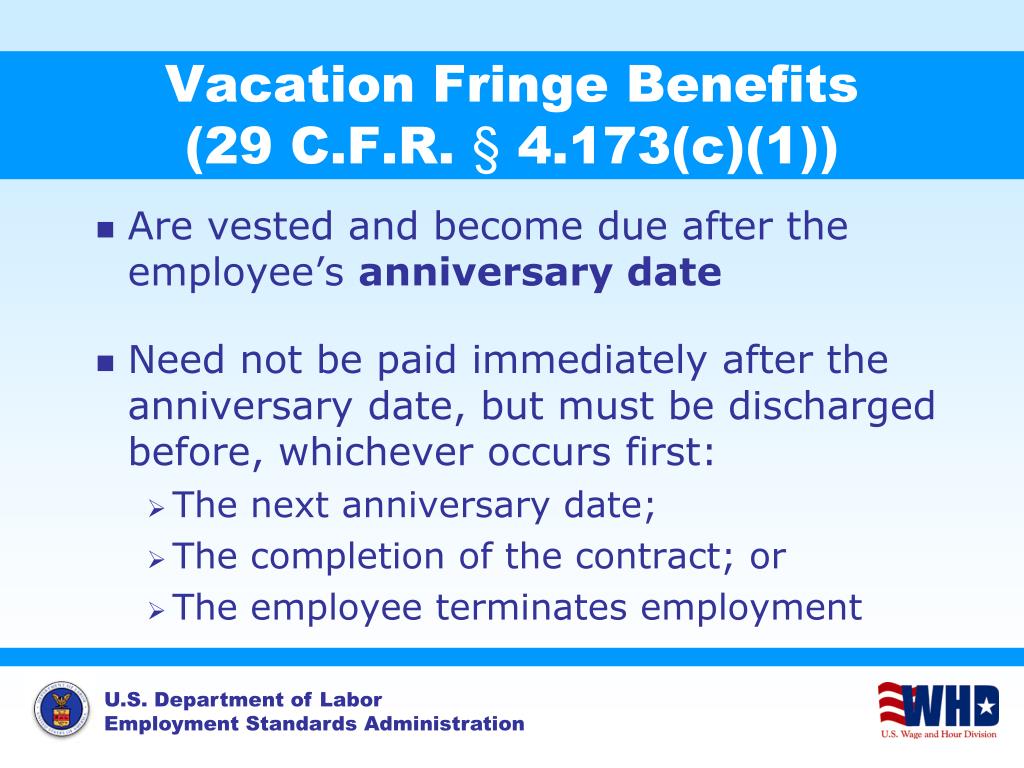

What is the reference point for vesting of vacation eligibility?

The individual employee's anniversary date (and each annual anniversary date of employment thereafter) is the reference point for vesting of vacation eligibility, but does not necessarily mean that the employee must be given the vacation or paid for it on the date on which it is vested.

How long is a contractor eligible for vacation?

In that example, if a contractor has an employee who has worked for him for 18 months on regular commercial work and only for 6 months on a Government service contract, that employee would be eligible for the one week vacation since his total service with the employer adds up to more than 1 year.

Is prior service counted toward vacation?

However, prior service as a Federal employee is not counted toward an employee's eligibility for vacation benefits under fringe benefit determinations issued pursuant to the Act . (4) Some fringe benefit determinations may require an employer to furnish a specified amount of paid vacation upon completion of a specified length ...

Can I get paid vacation if I have not met the one year of service requirement?

An employee who has not met the “one year of service” requirement would not be entitled to any portion of the “one week paid vacation”. (2) Eligibility for vacation benefits specified in a particular wage determination is based on completion of the stated period of past service.

What are fringe benefits?

IRS Publication 15-B defines a fringe benefit as a form of compensation in addition to a wage or salary for services performed. These services may be rendered by an employee, independent contractor, partner or director. Fringe benefit rules also apply to individuals who enter an agreement not to compete or not to perform services.

What are examples of fringe benefits?

Some fringe benefits are so widely available that many workers consider them a normal part of a compensation package. These include health insurance, family and medical leave, workers’ compensation and retirement savings plans. Smaller businesses may offer a combination of these and other attractive yet more economical provisions.

Which fringe benefits are taxable?

The IRS states that any fringe benefit is taxable unless specifically excluded under the law. Its full value is subject to federal income, Social Security, Medicare and federal unemployment taxes. The taxable portion can be reduced by any amount that the recipient contributes to the benefit or any amount that the law allows to be excluded.

What are the advantages of fringe benefits?

Benefits are some of the best tools for attracting and retaining high-quality talent. Perks are an important component of an employee’s compensation because they demonstrate a company’s tangible commitment to its workforce.

Fringe benefits FAQs

Employee training is a “ working condition ” fringe benefit, which encompasses services and property needed for an employee to do their job. Job-related education provided to workers qualifies as a business expense to the company.

What is fringe benefit?

Fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Fringe benefits include, but are not limited to, the costs of leave (vacation, family-related, sick or military), employee insurance, pensions, and unemployment benefit plans.

How are fringe benefits assigned?

Fringe benefits may be assigned to cost objectives by identifying specific benefits to specific individual employees or by allocating on the basis of entity-wide salaries and wages of the employees receiving the benefits.

Is tuition for family members unallowable?

Tuition benefits for family members other than the employee are unallowable. (2) Fringe benefits in the form of tuition or remission of tuition for individual employees not employed by IHEs are limited to the tax-free amount allowed per section 127 of the Internal Revenue Code as amended.

Is fringe benefit allowable?

Except as provided elsewhere in these principles, the costs of fringe benefits are allowable provided that the benefits are reasonable and are required by law, non-Federal entity -employee agreement, or an established policy of the non-Federal entity . (b) Leave.

What is fringe benefit?

De minimis fringe benefits include any property or service, provided by an employer for an employee, the value of which is so small in relation to the frequency with which it is provided, that accounting for it is unreasonable or administratively impracticable. The value of the benefit is determined by the frequency it’s provided to each employee, or, if this is not administratively practical, by the frequency provided by the employer to the workforce as a whole. IRC Section 132(e); Treas. Reg. Section 1.132-6(b)

What is the supplemental rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026). Treas. Regs. 31.3402(g)-1 and 31.3501(a)-1T

How long did a railroad conductor stay in a hotel?

railroad conductor regularly rented a hotel room near a railroad station where he slept and ate during a 5-hour layover as part of an 18-hour workday. He could deduct his meals and lodging costs because his layover was long enough to obtain sleep or rest and he was required by his job to do so.

How to prevent financial hardship to employees traveling away from home on business?

To prevent a financial hardship to employees traveling away from home on business, employers often provide advance payments to cover the costs incurred while traveling. Travel advances may be excludable from employee wages if they are paid under an accountable plan. (Allowable travel expenses are discussed in Transportation Expenses) There must be a reasonable timing relationship between when the advance is given to the employee, when the travel occurs and when it is substantiated. The advance must also be reasonably calculated not to exceed the estimated expenses the employee will incur. Treas. Reg. Section 1.62-2(f)(1)

Is fringe benefit taxable?

In general, taxable fringe benefits are subject to withholding when they are made available. The employer may elect to treat taxable noncash fringe benefits as paid in a pay period, or on a quarterly, semiannual or annual basis, but no less frequently than annually. Ann. 85-113

Can an employer withhold income tax on fringe benefits?

In general, an employer does not have a choice whether to withhold on taxable fringe benefits. However, an employer may elect not to withhold income taxes on the employee’s taxable use of an employer’s vehicle that is includible in wages if the employer: Notifies the employee, and