When should you start collecting Social Security benefits?

Today's Social Security ... should I file and suspend my retirement benefits and collect a spousal benefit? If so, will it be 50% of my husband’s benefit rate? Then at 70 I'd of course take my own increased retirement benefit. Thanks, Laura Hi Laura, You ...

What's the best age to begin Social Security benefits?

Key Points

- Seniors can file for Social Security at a variety of ages.

- Age 62 is the earliest opportunity to sign up.

- Before you hurry to claim benefits at 62, consider the drawbacks of doing so.

What is the maximum age for SS Benefits?

you are likely wondering if working past the age of 70 will increase your Social Security benefits. How To Get the Maximum Social Security Benefit Your Social Security retirement benefits are based on a combination of when you are taking benefits and your ...

What is the current retirement age for Social Security benefits?

- Start Social Security at full retirement age: 100% retirement benefits

- Delay until you're 67: 104% benefits due to the six-month interval

- Delay until you're 70: 128% benefits due to the 42-month delay

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the best age to start collecting Social Security benefits?

When it comes to calculating the best age for starting to collect your Social Security benefits, there's no one-size-fits all answer. As a rule, it's best to delay if you can. If you're in good health and don't need supplemental income, wait until age 70.

Can you collect Social Security at 62 and still work?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

What is the average Social Security benefit at age 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Is it better to take SS at 66 or 70?

You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

Do I pay taxes on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Why retiring at 62 is a good idea?

Probably the biggest indicator that it's really ok to retire early is that your debts are paid off, or they're very close to it. Debt-free living, financial freedom, or whichever way you choose to refer it, means you've fulfilled all or most of your obligations, and you'll be under much less strain in the years ahead.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $50000 a year?

For example, the AARP calculator estimates that a person born on Jan. 1, 1960, who has averaged a $50,000 annual income would get a monthly benefit of $1,338 if they file for Social Security at 62, $1,911 at full retirement age (in this case, 67), or $2,370 at 70.

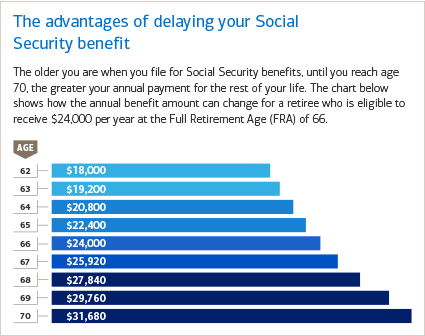

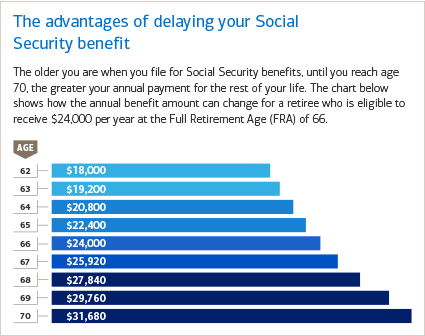

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

What age can I start receiving Social Security?

The starting age can differ for other types of Social Security benefits: Spousal benefits can begin at 62, as long as the spouse on whose work record you are claiming them is receiving retirement benefits.

When can I apply for Social Security?

You can apply once you reach 61 years and 9 months of age. However, Social Security reduces your payment if you start collecting before your full retirement age, or FRA. (FRA is currently 66 and 2 months and is gradually rising to 67 for people born in 1960 or later.)

When can I start receiving AARP benefits?

The earliest you can start receiving retirement benefits is age 62. The soonest you can apply is when you reach 61 years and 9 months of age. Skip to content. Stay connected to all things AARP — and earn up to 750 AARP Rewards points. Install AARP Perks™.

Is there an age limit for Social Security Disability?

There is no minimum age requirement for Social Security Disability Insurance . You may qualify for disability benefits with less time in the workforce than you need to collect retirement benefits, but you must also demonstrate that your medical condition meets Social Security’s strict definition of disability and show evidence ...

How much is a month of benefits at 62?

If, for example, you’d get $1,500 a month starting at age 62 or $2,000 a month starting at age 66, you will have received roughly the same amount in total benefits by age 77 or so. At that point the higher monthly benefits you’d get as a result of waiting will begin to pay off.

How long do you have to wait to get Medicare if you are 65?

The Social Security Administration (SSA) also cautions that even if you delay receiving Social Security benefits until after age 65, you might still need to apply for Medicare benefits within three months of turning 65 to avoid paying higher premiums for life for Medicare Part B and Part D.

How much extra insurance do you get at 70?

If you wait until you’re 70 to start claiming benefits, you’ll get an extra 8% per year , or, in total, 132% of your primary insurance amount ($2,640 per month in the example above) for the rest of your life.

How much is my unemployment check at 62?

In other words, you’ll get 25% less per month, and your check will be $1,500. 1 .

Can a spouse get Social Security if they don't work?

Spouses who don’t qualify for their own Social Security. Spouses who didn’t work at a paid job or didn’t earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouse’s record.

Do marginal tax rates affect Social Security?

At today’s marginal tax rates, they may not have much of an impact on most people. Still, tax rates and income thresholds can change, so it’s worth remembering that you will lose less of your Social Security to taxes if you are in a lower marginal tax bracket when you begin to collect.

Is Social Security taxable?

Your Social Security benefits may be partially taxable if your combined income exceeds certain thresholds. Regardless of how much you make, the first 15% of your benefits are not taxed. 10

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

What is the best age to retire from Social Security?

The Best Age for Social Security Retirement Benefits - SmartAsset. You can take Social Security benefits at age 62 , but you will lose a percentage. These tables will help you figure out the best age to retire. Menu burger. Close thin.

What is the full retirement age?

Full retirement age is the age at which you become eligible to start receiving full retirement benefits. It was 65 for many years, but the Social Security Administration amended that rule in 1983 because of increases in average life expectancy.

How much are Social Security benefits reduced?

Benefits are reduced by 30% if you opt to start receiving benefits just five years early. If you wait until you full retirement ageyou’ll receive 100% of your benefits. You can also elect to postpone benefits beyond full retirement age, up until you are 70.

How much will Social Security lose in 2021?

And, if you reach full retirement age in 2021, the Social Security Administration raises the earnings limit up to $50,520. This means that you will lose $1 in benefits for every $3 you make over the limit.

How does Social Security work?

How Social Security Works. Social Security is meant to supplement your retirement income and ease financial concerns as you get older. It’s essentially a support system for America’s elderly, enabled by the 1935 Social Security Act. Most beneficiaries are retirees and their families.

Do you pay Social Security on your paycheck?

Workers make Social Security contributions each month, which appear on your paycheck as Federal Insurance Contributions Act(FICA) taxes. Upon retirement, you can begin to receive Social Security payments, which will continue throughout the rest of your life.

What age can I claim Social Security?

By now, you may have heard: 70 is the best age for claiming Social Security benefits. Here’s why.

When can I start receiving Social Security?

If you wait until age 70 to start receiving Social Security retirement benefits, you generally stand to get the biggest checks. But if you do not want to delay for that long, there is a second option where you will not take as much of a pay cut.

How long should I wait to receive my spouse's benefits?

Often, the benefits they are eligible to receive through their spouse will exceed what they would get if they wait until age 70. For single people, it is preferable to wait until 70 for the highest monthly checks. But those retirees have more flexibility — and a second best option.

Why wait to claim Social Security if married?

One reason for that is Social Security payments are based on mortality tables that have not been updated since 1983. And life expectancies have increased since that time .

Can I wait to claim my spouse's benefits?

For the lower-earning spouse, it generally does not pay to wait to claim beyond full retirement age, Jones said. That is because they have a choice between their own benefits or spousal or survivor benefits based on their spouse’s record, whichever is higher. Often, the benefits they are eligible to receive through their spouse will exceed ...

What is the most popular age to start Social Security?

The most popular ages to start Social Security benefits. According to the Center for Retirement Research, the most popular age to claim benefits is 62, while claiming at full retirement age (FRA) is the second most popular.

Why is 62 considered a good age to start Social Security?

It's likely 62 is such a popular age to start benefits because when health issues, lack of jobs, or family care responsibilities hit late in life, many people end up simply claiming Social Security as soon as possible to enable their exit from the working world.

Why is 62 considered a good age to retire?

Knowing that 62 is such a popular age can be helpful because if you know you're likely to claim early, you may want to save more money. Then your supplementary income can combine with your benefits to give you enough money to live comfortably as a retiree. The Motley Fool has a disclosure policy. Prev.

Does age affect Social Security?

As you can see, the age when you start your benefits can have an effect on the size of your Social Security checks. And it's the factor that you have the most control over when it comes to how much income Social Security provides to you.

Do you get reduced Social Security benefits if you file for benefits earlier?

Those who file for benefits earlier will get reduced amounts in each check than people who wait, though. The decision of when to first claim Social Security benefits is a very personal one, as it depends on many factors.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.