4 benefits of an IRA

- IRAs are accessible and easy to set up. Most people are eligible to open and contribute to an IRA. To open and make...

- Take advantage of a traditional IRA tax break right now. Traditional IRAs offer the key advantage of tax-deferred...

- Or defer your Roth IRA tax break until retirement. While a traditional IRA may yield an upfront tax break,...

- IRAs are accessible and easy to set up. Most people are eligible to open and contribute to an IRA. ...

- Take advantage of a traditional IRA tax break right now. ...

- Or defer your Roth IRA tax break until retirement. ...

- Your IRA is exclusively yours.

What are the advantages and disadvantages of having an IRA?

- Not employer-sponsored: Unlike 401K, IRA is never dependent on your employer. ...

- You get control: With an IRA, you have plenty of options in deciding where to open an account, whether through Mutual Fund Company, bank or an investment company. ...

- More options: Employer-sponsored plans often come with limited investment options. ...

What are the pros and cons of an IRA?

What Are the Cons of an IRA?

- Contributions are capped. For traditional and Roth IRAs, the maximum amount that someone can contribute to their IRA is $5,500.

- The money is locked in under fear of penalization. There are age requirements in place on IRAs that required account holders to not access their money until at least ...

- It cannot be used as collateral. ...

What are the advantages of an annuity vs an IRA?

- the tax deductibility of contributions assuming you are eligible,

- the ability to manage it yourself and decide on your investment plan and strategies,

- the fact that you can avoid “management fees” in an IRA which you usually can’t avoid in things like a 401 (k);

- the fact that earnings and gains accrue without being taxed until withdrawal,

Who can put money into an IRA?

The most you can contribute to all of your traditional and Roth IRAs is the smaller of:

- For 2020, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

- your taxable compensation for the year.

- For 2021, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

- your taxable compensation for the year.

- For 2022, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

What are the pros and cons of an IRA?

Traditional IRA EligibilityProsConsTax-Deferred GrowthLower Contribution LimitsAnyone Can ContributeEarly Withdrawal PenaltiesTax-Sheltered GrowthLimited types of investmentsBankruptcy ProtectionAdjusted Gross Income (AGI) Limitation2 more rows•May 6, 2022

What are three 3 advantages of using an IRA?

IRA Benefits and DrawbacksBenefit #1: They come with more investment options than your 401(k) ... Benefit #2: They're more flexible than you think. ... Benefit #3: The fees are usually low. ... Drawback: The contribution limits are much lower. ... Choosing the right kind of IRA.

Is an IRA better than a 401k?

The 401(k) is simply objectively better. The employer-sponsored plan allows you to add much more to your retirement savings than an IRA – $20,500 compared to $6,000 in 2022. Plus, if you're over age 50 you get a larger catch-up contribution maximum with the 401(k) – $6,500 compared to $1,000 in the IRA.

Is an IRA a good investment?

Individual retirement accounts (IRAs) give investors a fantastic opportunity to save on taxes. Pay your future self by investing in an IRA, and you can also lower your income tax bill. Clever retirement investors know an even better strategy to minimize their taxes, though: Use a Roth IRA.

Can you lose money on an IRA?

Can I lose money in an IRA? In short, yes. Retirement accounts like IRAs invest your money in stocks and bonds, so your money fluctuates with the highs and lows of the market. You can also lose money if you take out cash before retirement and pay early-withdrawal penalties.

What are the cons of an IRA?

Disadvantages of an IRA rolloverCreditor protection risks. You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.Loan options are not available. ... Minimum distribution requirements. ... More fees. ... Tax rules on withdrawals.

Do IRAs earn interest?

Roth IRA Growth (They are not investments on their own.) Those investments put your money to work, allowing it to grow and compound. Your account can grow even in years when you aren't able to contribute. You earn interest, which gets added to your balance, and then you earn interest on the interest, and so on.

What is better a mutual fund or IRA?

Since your IRA is tax-advantaged already that can help to minimize your investment tax on gains. A passively managed index fund or an exchange-traded fund (ETF) on the other hand, could be a better fit for a taxable brokerage account. As mentioned, passively managed mutual funds tend to have lower turnover already.

Should I open an IRA with my bank?

Opening an individual retirement account (IRA) with a credit union or a bank might be a good call, depending on your risk tolerance and investing goals. If you're an extremely conservative investor, you're very close to retirement or already retired, a bank IRA might be right for you.

Which is better a CD or IRA?

Certificates of deposit (CDs) and individual retirement accounts (IRAs) can help you earn money with your money. However, IRAs are long-term investment accounts that offer tax advantages and help you fund your retirement. CDs are investments that provide modest returns and often have terms of five years or less.

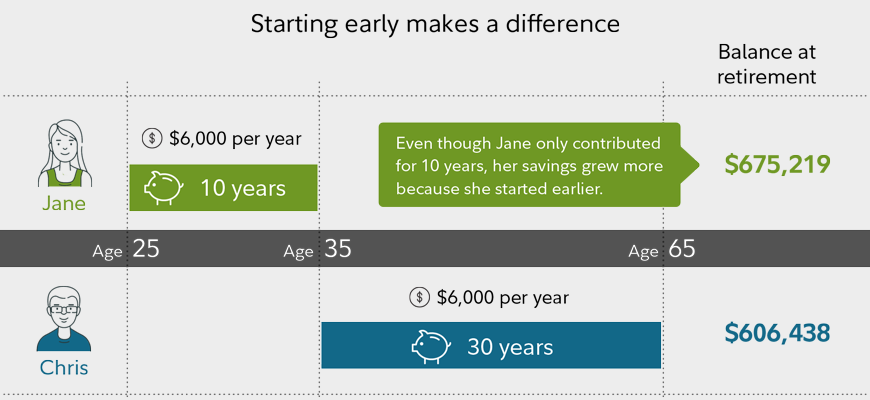

How much will an IRA grow in 10 years?

The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31st 2016, had an annual compounded rate of return of 6.6%, including reinvestment of dividends.

What are the 3 types of IRA?

There are several types of IRAs available:Traditional IRA. Contributions typically are tax-deductible. ... Roth IRA. Contributions are made with after-tax funds and are not tax-deductible, but earnings and withdrawals are tax-free.SEP IRA. ... SIMPLE IRA.

What are the benefits of investing in an IRA?

The main benefits of having a traditional IRA are the tax deduction for contributions, the tax-deferred investment compounding, and the ability to invest in virtually any stock, bond, or mutual fund you want.

What are some examples of IRA tax advantages?

Example of IRA tax advantages. This can make a big difference when it comes to long-term compounding. Consider this simplified example: You deposit $1,000 into a traditional brokerage account and invest in a stock you like. In five years, the stock is worth $3,000 so you sell.

What are the advantages of an IRA vs a 401(k)?

Benefits of an IRA vs 401 (k) There are also some big advantages to using an IRA as opposed to a 401 (k). An IRA allows you to invest in virtually any stocks, bonds, mutual funds, or ETFs you want, as opposed to limiting you to a small menu of investments.

What is the difference between a Roth IRA and a traditional IRA?

The tax structure of a traditional IRA is the main difference from a Roth IRA, and it can be a great benefit for people looking to reduce their taxable income right away. A traditional IRA is known as a tax-deferred account.

When can I contribute to an IRA?

It's also worth noting that you can contribute to an IRA until the tax deadline each year. For example, you can make 2020 traditional IRA contributions until April 15, 2021. So, for 2020 contribution and deduction purposes, here are the adjusted gross income (AGI) thresholds: Tax Filing Status in 2020.

Is a Roth IRA deductible?

Remember, Roth IRA contributions aren't deductible, but qualified withdrawals are tax-free.

Is a dividend in an IRA taxable?

For example, if you own a stock in a standard brokerage account and you get a dividend, that dividend is considered taxable income. If you own the same stock in an IRA and it pays you a dividend, it is not included in your taxable income. The same is true if you sell an investment you hold in an IRA at a profit.

What are the main benefits of an IRA?

IRAs can be invested almost anywhere—and the investor gets to choose where. An IRA can be opened at any number of financial institutions, including banks, brokerages, and credit unions.

Traditional IRA benefits

With a traditional IRA, investors get to enjoy upfront tax deductions. Similar to a 401 (k) plan, these pretax traditional IRA contributions can be deducted from taxable income in the year that they are made, as long as an investor meets certain income limits.

Roth IRA benefits

A Roth IRA works the opposite way. With this account, an investor contributes today with after-tax money, at their current tax rate. However, the money will grow tax-free and once they reach retirement, they can take withdrawals (on both the contributions and any growth) without paying additional taxes.

Drawbacks of an IRA account

Depending on the type of IRA and an investor’s financial plan, there are also few drawbacks to keep in mind.

The bottom line

An IRA is a retirement savings tool that can offer additional investment and growth opportunities for an investor’s’ future. Whether an investor chooses a traditional IRA or a Roth IRA comes down to factors like their income, current, and future tax brackets, and their liquidity preference.

What is a traditional IRA?

Traditional and Roth IRAs: An Overview. Two widely popular types of individual retirement accounts (IRAs) are the traditional IRA and the Roth IRA. They have many advantages and a few drawbacks for retirement savers. The IRA was created decades ago as defined-benefit pension plans were declining.

What can I invest in with a Roth IRA?

In a traditional or Roth IRA account, you can invest in all sorts of traditional financial assets such as stocks, bonds, exchange-traded funds (ETFs), and mutual funds. You can invest in a wider range of investments through a self-directed IRA (one in which you the investor, not a custodian, makes all the investment decisions)—commodities, ...

How much penalty do you pay for IRA withdrawals?

With the traditional IRA, you face a 10% penalty on top of the taxes owed for any withdrawals before age 59½. With the Roth IRA, you can withdraw a sum equal to your contributions penalty and tax-free at any time. 2. However, you can only withdraw earnings without getting dinged with the 10% penalty if you’ve held the account for five years ...

How much can I contribute to an IRA in 2021?

To contribute to an IRA, you or your spouse need earned income. For 2020 and 2021, the maximum contribution amount per person is $6,000, or $7,000 if you’re age 50 or older.

When do you have to withdraw from an IRA?

Required Withdrawals. There are mandatory withdrawals for your traditional IRA called required minimum distributions (RMDs), starting when you reach age 72. The amount of the withdrawal is calculated based on your life expectancy, and it will be added to that year's taxable income.

When is the IRA contribution deadline for 2021?

As well, given the winter storms that hit Texas, Oklahoma, and Louisiana in February 2021, the IRS had delayed the 2020 federal individual and business tax filing deadline for those states to June 15 , 2021. The IRA contribution deadline for those affected by these storms is extended to June 15, 2021. 14 15 16.

Can you withdraw money from a Roth IRA?

A popular benefit of the Roth IRA is that there is no required withdrawal date. You can actually leave your money in the Roth IRA to let it grow and compound tax-free as long as you live. What's more, any money you do choose to withdraw is tax-free. 20 .

Is it too late to contribute to a Roth IRA?

It's not too late! You can still contribute up to the limit for 2020—as long as you set up your account and contributions by April 15, 2021. Talk to a financial professional. Opens in new window. to learn more about opening a traditional or Roth IRA account.

Can you save up to a certain amount in a Roth IRA?

Depending on your income, you can contribute to either or both types of accounts. However, you can only save up to a certain amount. The contribution limits.

Will my IRA contribution be higher in 2020?

And, if you expect that your taxable income for 2020 will be higher than the income you expect to earn in 2021, having the flexibility to max out last year's IRA contributions might help you save more money in taxes.

Do Roth IRA withdrawals count as income?

This means that when you use take distributions in retirement, they generally won't count as taxable income.

Is it too late to get a Roth IRA for 2020?

It's not too late to get IRA contribution tax benefits for the 2020 tax year. A traditional IRA could net you tax deductions for 2020, while a Roth IRA could mean tax-free withdrawals down the road. Are you looking to save money on your 2020 taxes while also investing for your retirement?

Do you get tax deductions for IRA contributions in 2020?

Each type of IRA has different tax benefits and implications. For example, if you contribute to a traditional IRA for 2020, you'll likely get a tax deduction when you file your 2020 return. The savings in that account will grow tax deferred, and you'll owe taxes when you withdraw money in retirement. On the other hand, if you contribute ...

What is an IRA?

An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. The 3 main types of IRAs each have different advantages: 1 Traditional IRA - You make contributions with money you may be able to deduct on your tax return, and any earnings can potentially grow tax-deferred until you withdraw them in retirement. 1 Many retirees find themselves in a lower tax bracket than they were in pre-retirement, so the tax-deferral means the money may be taxed at a lower rate. 2 Roth IRA - You make contributions with money you've already paid taxes on (after-tax), and your money may potentially grow tax-free, with tax-free withdrawals in retirement, provided that certain conditions are met. 2 3 Rollover IRA - You contribute money "rolled over" from a qualified retirement plan into this traditional IRA. Rollovers involve moving eligible assets from an employer-sponsored plan, such as a 401 (k) or 403 (b), into an IRA.

What is Roth IRA?

Roth IRA - You make contributions with money you've already paid taxes on (after-tax), and your money may potentially grow tax-free, with tax-free withdrawals in retirement, provided that certain conditions are met. 2. Rollover IRA - You contribute money "rolled over" from a qualified retirement plan into this traditional IRA.

What is a rollover IRA?

Rollover IRA - You contribute money "rolled over" from a qualified retirement plan into this traditional IRA. Rollovers involve moving eligible assets from an employer-sponsored plan, such as a 401 (k) or 403 (b), into an IRA.

What is a Fidelity IRA?

A Fidelity IRA can help you: Supplement your current savings in your employer-sponsored retirement plan. Gain access to a potentially wider range of investment choices than your employer-sponsored plan. Take advantage of potential tax-deferred or tax-free growth.

How much of your pre-retirement income do you need?

Many financial experts estimate that you may need up to 85% of your pre-retirement income in retirement. An employer-sponsored savings plan, such as a 401 (k), might not be enough to accumulate the savings you need. Fortunately, you can contribute to both a 401 (k) and an IRA. A Fidelity IRA can help you:

What age can you take an IRA withdrawal?

If you take an early withdrawal from a traditional IRA before age 59½, you'll likely face both an income-tax bill and a 10% early withdrawal penalty. (There are some exceptions; read more about traditional IRA withdrawals.)

When do you have to start withdrawing money from an IRA?

Money in a traditional IRA is subject to RMDs, or required minimum distributions, which means savers are required to start withdrawing from their accounts at age 72. Forget to cash the check, and the IRS could hit you with a punishing 50% penalty excise tax on the amount you didn’t withdraw.

Is a traditional IRA deductible?

A traditional IRA offers an upfront tax break: Contributions may be deductible in the year they are made to the account. When you pull money out of a traditional IRA in retirement, you owe income taxes. With the Roth, you have to wait longer for the tax-savings payoff.

What are the benefits of IRAs?

Another benefit of IRAs is that your child may be able to tap into them for other important expenses—particularly if they are Roths, which allow withdrawals of contributions, provided the account is at least five years old. Regular IRAs are tougher but allow penalty-free withdrawals in special circumstances. Such needs could include the following: 1 Education expenses: The account-holder can withdraw money for college, but they will pay taxes on the earnings. However, there is no 10% early withdrawal penalty if the money is used for qualified education expenses (tuition, fees, books, supplies, equipment, and most room and board charges). 13 2 Buying a house: The account-holder can withdraw funds to buy a house before reaching 59½. The money must be used as a down payment or for closing costs. The withdrawal is limited to $10,000. Early withdrawals for a home purchase are penalty-free and tax-free. 14 3 For emergencies: The owner of a Roth IRA can withdraw money in an emergency. But the withdrawal will be subject to taxes on the earnings, plus a 10% early withdrawal fee. 15

Why open an IRA for kids?

Opening an IRA for your child provides them not only a head start on saving for retirement, but also valuable financial lessons. Even a small IRA can provide an introduction to investing and a platform to teach your child about money and the relationship between earning, saving, and spending.

How much can I contribute to my child's Roth IRA at age 15?

If you make a single, one-time $6,000 contribution to a child’s Roth IRA when they are 15, for example, that can grow to more than $176,000 of tax-free money by the time they hit 65, assuming a 7% annual return.

What is the difference between IRA and regular IRA?

Otherwise, the main difference between these IRAs and regular ones is that they are custodial or guardian accounts. By law, banks, brokers, and investment companies require custodial or guardian accounts if your child is a minor (under age 18 in most states; under age 19 and 21 in others).

What are the different types of IRAs for kids?

Types of IRAs for Kids. Two different types of IRAs are suitable for children: traditional and Roth. The primary difference between traditional and Roth IRAs is when you pay taxes on the money that you contribute to the plan.

How much can a child contribute to an IRA in 2021?

For 2021, the maximum your child can contribute to an IRA (either traditional or Roth) is the lesser of $6,000 or their taxable earnings for the year.

Can I open an IRA for my child?

How to Open an IRA for a Child. Although you may see brokers trumpeting "A Roth IRA for Kids" (as Fidelity Investments does) or some such, there's nothing special in the way a child's IRA works, at least as far as the IRS is concerned. 6 The opening amount to invest may be less than the brokerage's usual minimum.