Here are the top 10 employee benefits worldwide:

| US | Canada | UK | Australia |

| Health Care Plan (Medical, Dental & Visi ... | Extended Healthcare Plan (Medical, Disab ... | Private Healthcare Plan | Performance Bonus |

| Life Insurance (Basic, Voluntary & AD&D) | Group Life – AD&D – Critical Illness Ins ... | Life Assurance | Novated Leasing |

| Retirement Plan (401k, IRA) | RPP – Group RRSP | Pension Plans | Extra Superannuation – Pension plan |

| Paid Time Off (Vacation, Sick & Public H ... | Paid Time Off Benefits | Leave Package | Unpaid extended leave |

Which companies offer the best employee benefits?

The 20 Best Company Benefits And 11 Companies That Offer Them

- Gold’s Gym – offers 11 of top 20 benefits

- IBM – offers 11 benefits

- L’Oreal – offers 6 benefits

- Amazon – offers 6 benefits

- Aetna – offers 6 benefits

- UNICEF – offers 5 benefits

- Experian – offers 5 benefits

- Microsoft – offers 5 benefits

- Massage Envy – offers 5 benefits

- JPMorgan Chase – offers 5 benefits

What are the most common employee benefits?

Useful contacts and further reading

- Recent developments. More recently, some employers have adopted a more individualistic approach to employee reward, transferring more of the risk (and, potentially, reward) and cost of the provision to their ...

- Company cars and car allowances. ...

- Other benefits. ...

- Flexible and voluntary benefits. ...

- Contacts

- Books and reports. ...

- Journal articles. ...

What are the different types of employee benefits?

What types of employee benefits are required by federal law?

- Social security and medicare contributions. Most employers don’t consider social security and medicare contributions to be employee benefits, but they are.

- Workers' compensation insurance. Workers' compensation insurance is a form of insurance mandated by the U.S. ...

- Minimum wage and overtime pay. ...

- Unemployment compensation contributions. ...

What benefits do companies offer their employees?

- Disability insurance

- Life insurance

- Tuition reimbursement

- Gym memberships

- Financial wellness programs

- Commuter benefits

- Pet insurance

- Childcare

- Catered meals

- Time off for volunteering

What are employer provided benefits?

What is an employee benefits package?

How many hours does an employer have to provide health care?

How many non-government employers offer health benefits?

What are the minimum standards for health insurance?

What is the purpose of disability and workers compensation?

What are the benefits of a business?

See more

What are the 4 major types of employee benefits?

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Below, we've loosely categorized these types of employee benefits and given a basic definition of each.

What are examples of employee benefits?

Examples of benefits within a package may include:Medical insurance.Dental and vision coverage.Profit-sharing.Stock options.Retirement benefits.Wellness benefits such as reimbursement for gym memberships or race registrations, weight loss programs, and smoking cessation.More items...•

What are 5 employee benefits?

Here is a list of the top five types of benefits employers can offer to employees - each can be a valuable tool for recruiting and retaining employees.1) Health Benefits. ... 2) Retirement. ... 3) Workplace Flexibility. ... 4) Wellness Program. ... 5) Tuition Reimbursement.

What are six types of benefits an employer may provide?

Social Security, Medicare, and FICA. Social Security and Medicare are considered statutory benefits. ... Unemployment Insurance. ... Workers' Compensation Insurance. ... Health Insurance. ... Family and Medical Leave Act Protections. ... Disability insurance.

What are the most common types of employee benefits?

The most common benefits are medical, disability, and life insurance; retirement benefits; paid time off; and fringe benefits. Benefits can be quite valuable. Medical insurance alone can cost several hundred dollars a month. That's why it's important to consider benefits as part of your total compensation.

Are bonuses considered benefits?

Bonuses are usually considered “supplemental wages” by the IRS, which means that they're often taxed at a higher rate than your regular paycheck (read this article for more information on how bonuses are taxed).

What are the employee benefits of small business?

Here is a list of popular employee benefits in the United States:Health insurance.Paid time off (PTO) such as sick days and vacation days.Flexible and remote working options.Life insurance.Short-term disability.Long-term disability.Retirement benefits or accounts.Financial planning resources.More items...•

What are employee benefits and services?

Benefits and Services are called indirect compensation and are also known as “fringe benefits” and “Perks”. Perks (services) are something in addition to the payment like car fuel and free parking, clothing, and educational supports.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

What are the benefits of an employee?

Employee benefits include non-wage compensation in addition to regular salary. Various types of employee benefits typically include medical insurance, dental and vision coverage, life insurance and retirement planning, but there can be many more types of benefits and perks that employers choose to provide to their employees.

What is disability insurance?

Some employers may offer temporary disability insurance plans that provide income support to employees who have suffered an injury or illness outside of work. While disability benefits can vary between employers, many offer some form of short-term disability coverage in the event you're injured on the job.

What is vacation time accrual?

Employees who have vacation allowances accrue a certain number of hours each pay period, similar to paid time off allowances. The biggest difference between a PTO plan and paid vacation time is that PTO can be used for any kind of time off from work, whereas vacation allowance is only for employees to take a vacation or break away from work.

What are the options for retirement?

Several common retirement options employers offer include 401 (k) and IRA plans, 403 (b) retirement plans (especially if you're employed with a nonprofit), simplified employee pension (SEP) plans and more.

What is group term life insurance?

Often, these life insurance policies are group-term life insurance, which means the insurer provides the employer with a master contract that extends life insurance coverage to all staff members and is in effect for a certain time period.

How long does life insurance last?

Usually, the life insurance term lasts for as long as the employee works for their employer. Other life insurance plans may be available depending on the employer, but group-term plans typically cost less than individual insurance policies.

When will the benefits package be available for 2021?

February 22, 2021. Most employers offer employee benefits packages, which can include basic health coverage and retirement planning. In addition to basic health coverage, employers offer a variety of other perks, depending on the nature of their companies. It can be worthwhile to find out what your employer offers in terms of benefits packages, ...

What is retirement benefit?

Retirement. Retirement benefits help employees feel more secure about their future after retirement. In the U.S., for example, a common benefit is the 401 (k) in which both company and employee make defined contributions to the employee’s account on a regular basis.

How does employee benefit affect HR?

Employee benefits have a significant impact on the administrative aspect of HR, especially when regulatory issues are involved. But there are ways to manage benefit plans more effectively to save time and reduce the possibility of mistakes. Here are five things to consider:

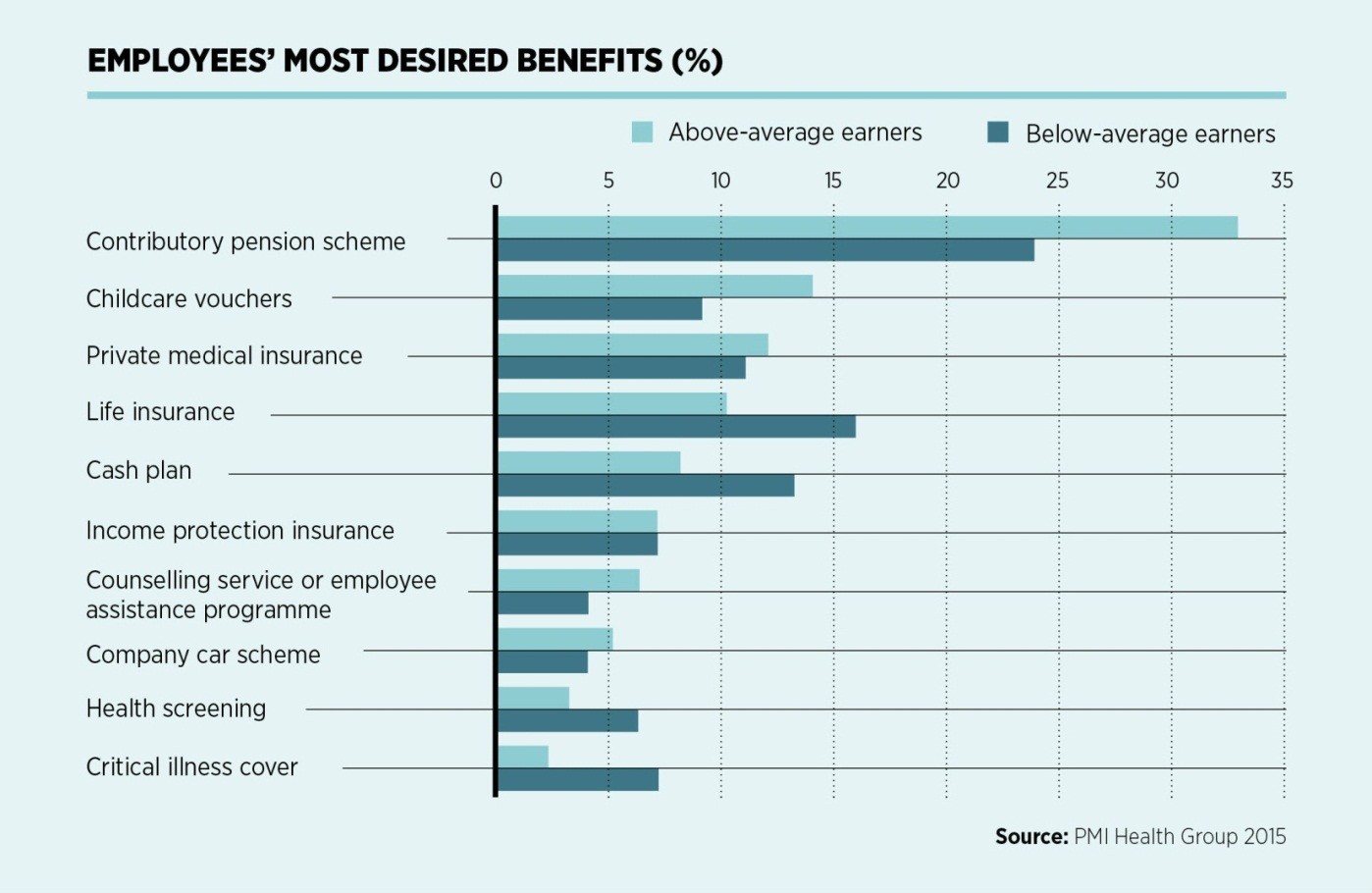

Why do employers pay attention to demographics?

Also, some employers pay attention to the demographics of their employee base to give everyone the benefits they need most based on their characteristics. For example, in order to retain and engage millennials, businesses may offer them benefits such as student loan repayment support and co-sign support for auto loans.

What is fringe benefit?

Before we get into the nitty-gritty of employee benefits (or fringe benefits), let’s define the term: Employee benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. This employee benefits definition points to examples of job benefits such as insurance (including medical, dental, ...

How do employees choose to invest?

Employees choose how to invest contributions, or how much to contribute from their paycheck through pre-tax deductions. Employers may also contribute, in some cases by matching a certain percentage of employees’ contributions. At retirement, employees receive the balance in their account.

How to find the right software for HR?

To find the right software, do your research and make a compelling business case. Measure benefits and costs diligently . This will be the responsibility of the finance department, but it’s important for HR to keep track of rising or plummeting costs and gains.

Does disability insurance cover long term disability?

Disability insurance may cover long-term and short-term disability or illness. For example, if an employee gets sick, they can receive payments for as long as their sickness lasts. In the U.S., some employers may sometimes use short-term disability policies to fund paid maternity leave for female employees.

What is disability insurance?

Disability Insurance. Disability insurance pays a portion of an employee’s income if they can’t work for an extended period because of an illness or injury. There are two types of disability insurance you can offer: short-term and long-term.

What does medical insurance cover?

It covers things including hospital and doctor visits, surgeries, and prescriptions. Employers usually cover a portion of this premium. 2. Dental Insurance.

What is HRA in health insurance?

Health Reimbursement Account (HRA) Health Reimbursement Accounts (HRAs), sometimes called Health Reimbursement Arrangements, are group health plans funded by you, the employer, from which your employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year.

What is life insurance?

Life Insurance. A life insurance policy is a contract with an insurance company. In exchange for premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to beneficiaries upon the insured’s death. 11. Accidental Death & Dismemberment Insurance.

What is a 403b?

A 401 (k) or a 403 (b) is a retirement plan named for the section of the tax code that governs it. ( WSJ ). A 401 (k) plan can be an important tool for a small business to attract and retain employees.

What is an EAP?

15. Employee Assistance Program (EAP)#N#According to SHRM, “An employee assistance program (EAP) is a work-based intervention program designed to identify and assist employees in resolving personal problems (e.g., marital, financial or emotional problems; family issues; substance/alcohol abuse) that may be adversely affecting the employee’s performance.”

What is a FSA account?

Flexible Spending Account (FSA) According to Healthcare.gov, a Flexible Spending Account (also known as a flexible spending arrangement) is a special account employees put money into that they use to pay for certain out-of-pocket health care costs.

What is the importance of employee benefits?

Employee benefits are an important part of any employment contract. Before taking a job offer, be sure to carefully consider the employee benefits package and do not be afraid to ask about the possibility of adding more perks. Most employers value their employee’s satisfaction, and some may be willing to negotiate the terms ...

What are the benefits of an employer?

Here are the most common employee benefits: Health insurance. Disability insurance. Dental and vision insurance. Life insurance. PTO/paid holidays. Retirement planning. Family leave.

Why do employers prioritize quality benefits?

Many employers prioritize offering quality benefits because they contribute to employee satisfaction, retention and overall productivity.

Why do employers give PTO?

The goal of giving PTO on holidays is to allow employees (and the employer) to spend quality time with loved ones.

What is the most common benefit for an employee?

The most common type of employee benefit is health insurance. Corporations, small businesses and even non-profit organizations offer health insurance for their employees. The health insurance provider, the details of the policy and the amount of coverage are usually decided upon by the company. In some cases, if an employee already has health insurance, they can make a request or negotiate to keep their original healthcare plan.

What is long term disability insurance?

Long-term disability insurance protects you by making sure you will not lose your salary if you become unable to work for a long period of time. Long-term disability insurance is one of the most valuable components of an employee’s benefits package.

When you agree to work for a company or organization, should they offer you an employee benefits package?

When you agree to work for a company or organization, they should offer you an employee benefits package. Many individuals take the quality of a comprehensive benefits package into account when deciding whether or not to accept a job offer.

What is employee benefits?

Employee benefits are defined as the non-wage compensation provided to employees by an organization in addition to their normal salaries or wages. These benefits may include, group insurance (health, dental, life etc.) retirement benefits, education loan, other loans (house loan, vehicle loan etc), sick leaves, ...

How to reward employees for their efforts?

To reward their efforts announce the winner if you are conducting competitions and motivate others to participate in such get-togethers , to promote health and fitness amongst your employees. 2. Sponsor Events for your Employees . People often stress when they have a lot of work and deadlines to meet.

How many employees say they are happier with no dress code policy at work?

A whopping 94% employees said they were a lot happier with no dress code policy at work. There are many organizations who have adopted and practice a certain standard of casual dressing and if those standards are met by the employees it is a good adaptation for them as well as the organization. 4.

How to help employees with stress?

To help your employees lower their stress levels, you should organize social meetings and promote the satisfaction of your employees in general. Many organizations have a “Friday” culture where there are different kinds of recreational activities included during the day.

What is the best way to build a commitment to your employees?

1. Cover the Medical Expenses and Insurance Cost. As goes an old saying, “health is wealth”. If you want your employees to be happy, keep them healthy and fit! To build the level of commitmentfrom your employees it is essential that you provide them with benefits first.

Why is a healthy work environment important?

A healthy work environment not only keeps a person fit but also relieve s them of stress and this is scientifically proven. There are many organizations that incorporate this work culture into their routine, there are other organizations that offer to pay the cost of membership for their employees.

What are the signs of a disengaged workforce?

Organizations stagnate, sales dip all-time low, there is a sudden rise in employee attrition and you experience financial losses. All these are signs of a disengaged and highly unmotivated workforce. To avoid such a sudden downfall make sure to keep your employees motivated and enthusiastic towards their work, don’t let employees lose interest in their work, make sure you know their needs and implement immediately any changes that might positively affect their performance.

What is employee benefits?

Definition: Employee benefits are payments employers make to employees that are beyond the scope of wages. Typically, employers pay employees and hourly wage or a salaried wage. These wages can be based on the amount of time the employees worked or even the employees’ performance.

How much do employers contribute to retirement?

Typically, employers match employee contributions up to 3 percent. Retirement plans like 401 (k)s and IRAs are basically savings accounts that allow employees to save money tax free until they retire. Pension plans are slightly different ...

What is pension plan?

Pension plans are slightly different than retirement plans in that a pension plan is a fund that makes regular payments to the employee indefinitely after they retire. Most employers have stopped offering private pension plans because of the increasing cost.

Do employers pay for medical insurance?

Many employers pay a portion or all of the medical, dental, optical, life, and disability insurance premiums for their employees. Since medical insurance rates have risen in the past two decades, medical insurance is one of the most sought after employee benefits.

What is an employee benefit?

Employee benefits entail any non-salary compensation included in an employee's contract, including health insurance, a retirement plan, or paid vacation time. Typically, benefits are included to create a more competitive package for an employee. Benefits will attract and retain top talent, and can help communicate your company's ...

Why is wellness important at work?

Additionally, putting some of your company's finances towards your employees' health and wellness can actually decrease long-term healthcare costs.

What is PTO in the workplace?

It's important to offer your employees some form of paid time-off (PTO), which employees can use at their discretion. While some employees might use their PTO to take a trip with family or friends, other employees might simply use it to attend doctor's appointments or take care of a sick child. Without offering PTO, you risk your employees more quickly reaching burnout in their roles -- a well-rested and happy employee is a more productive one, so this is a worthwhile investment.

What is the most traditional retirement account?

The most traditional employer-offered retirement account is a 401 ( k). A national survey of small businesses found 94 percent of small business owners say offering a 401 (k) drives their employee recruitment and retention. If you think you're too small to participate, think again -- anyone can offer a 401 (k) benefit to employees, ...

Why is health insurance important?

According to a Glassdoor survey, employees report health insurance to be the most important benefit they receive from their employer. To make your employees happy, it's critical you offer a good health insurance package. Plus, offering health insurance to your employees can save you money on taxes .

What percentage of companies offer life insurance?

Life Insurance. According to the Bureau of Labor Statistics (BLS), 59 percent of civilian companies and 55 percent of private firms offered life insurance in 2018. While not as common as health insurance, it's still a good benefit you should consider providing.

Do you want your salary to increase over time?

People don't just want their salary to increase over time -- they also want to know they'll have paid parental leave when the time comes, or tuition reimbursement if they decide to go back to school. To ensure you're offering employee benefits that will delight your employees and motivate them to grow with your company long-term, ...

What is employer provided life insurance?

Employer-provided life insurance is meant to compensate your survivors for your lost wages and income should you die while employed in your new job. If you are single and not supporting anyone else, you may not require life insurance.

Can employers match employee contributions?

Many employers match employee contributions up to a certain amount, based on how much you contribute annually. Not taking advantage of an employer match is the equivalent of leaving "free money" on the table.

Can I contribute to 401(k) for retirement?

The IRS allows you to contribute up to a set maximum, which changes from year to year. Many experts agree that it is best to contribute as much as you can afford right away instead of going back and trying to catch up later when you are already accustomed to a bigger budget. In the future, you'll be glad that you did. 1

What are employer provided benefits?

Types of Employer-Provided Benefits and Perks. In addition to benefits required by law, other benefits are provided by companies because they feel socially responsible to their employees and opt to offer them beyond the level required by law. Depending on the company, these benefits may include health insurance ...

What is an employee benefits package?

An employee benefits package includes all the non-wage benefits, such as health insurance and paid time off, provided by an employer. There are some types of employee benefits that are mandated by federal or state law, including minimum wage, overtime, leave under the Family Medical Leave Act, unemployment, and workers' compensation ...

How many hours does an employer have to provide health care?

Employers are required to provide health care to employees who work at least 30 hours per week. 4 Some (though not many) part-time workers are covered by employer plans.

How many non-government employers offer health benefits?

Among non-government employers, 87% offered health benefits according to the BLS. Another 67% offered their employees a pension or retirement program. 3. In addition, more employers are using bonuses, perks, and incentives to recruit and retain employees.

What are the minimum standards for health insurance?

Under the Patient Protection and Affordable Care Act (Obamacare), minimum standards are set for health insurance companies regarding services and coverage. Most employers with 50 or more employees are required to offer healthcare plans or pay a fine.

What is the purpose of disability and workers compensation?

The purpose of both workers' compensation and disability is to make sure that an injured or sick employee continues to get paid (usually a portion of their normal pay) until they are well enough to return to work.

What are the benefits of a business?

These perks, also known as "benefits in kind," can include: Bonuses; profit sharing. Medical, disability and life insurance. Paid vacations. Free meals. Use of a company car.

Fringe Benefits

- Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships i...

Unemployment Insurance

- The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee's wages. The Department of Labor provides information and li…

Workers' Compensation

- The Department of Labor's Office of Workers' Compensation Programs (OWCP)administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. Individuals injured on the job while e…

Health Plans

- If an employer pays the cost of an accident or health insurance plan for his/her employees (including an employee's spouse and dependents), then the employer's payments are not wages and are not subject to social security, Medicare, and FUTA taxes, or federal income tax withholding. Generally, this exclusion also applies to qualified long-term care insurance contract…