The options for Dependent Care Benefits include:

- Child care

- Daycare

- Babysitting

- Nursery school, preschool (not private school, summer school, or tutoring)

- Sick child care

- Nanny, au pair (not housekeeping or child support payments)

- Before and after school programs (not music or sports lessons)

- Summer day camp (not overnight camp)

- Adult Care

- Custodial elder care

- Day nursing care

- Disabled dependent care

- Transportation to/from eligible dependent care

- Registration fees for child/adult care

- Payroll taxes related to eligible dependent care

What are the rules for Dependent Care?

- The child was under age 13 or wasn't physically or mentally able to care for himself or herself;

- The child received over half of his or her support during the calendar year from one or both parents who are divorced or legally separated under a decree of divorce ...

- The child was in the custody of one or both parents for more than half the year; and

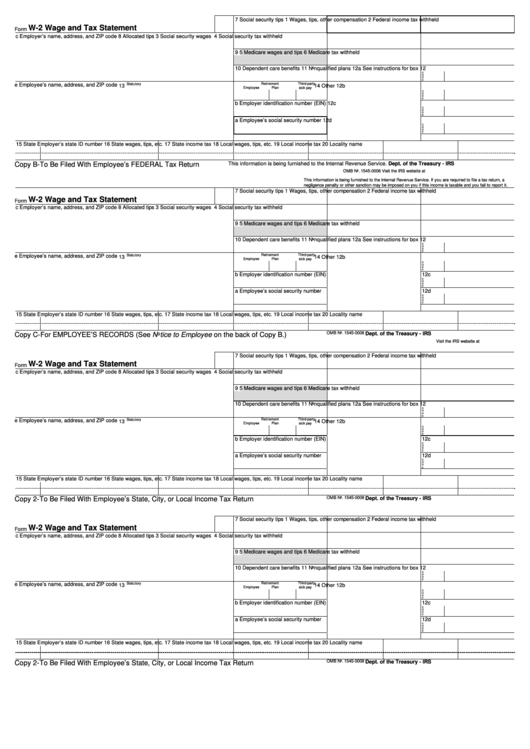

How do I get my W2 from ADP Payroll?

- Click on the REGISTER NOW button located below on the login page.

- Then you have to provide a Registration code or passcode: schwans-w2 for navigating to the next step.

- Then you have to follow the Enter information option and provide First Name, Last Name, and Employee ID, Last 4 digits of SSN / EIN / ITIN, Birthdate, and reCAPTCHA ...

Why are my dependent care benefits taxable?

- Earned income includes wages, salaries, tips, and other taxable employee compensation, and net earnings from self-employment. ...

- There is an exception for a disabled person or a person who is a student. ...

- If the Filing Status is Married Filing Joint (MFJ), both the Taxpayer and Spouse must have earned income.

What is the income limit for Dependent Care Credit?

For the child and dependent tax care credit, there is no income limit, however, the amount of credit decreases with your income, according to the Internal Revenue Service (IRS).

What are dependent care benefit items?

Dependent Care FSA Eligible Expenses Care for your child who is under age 13. Before and after school care. Babysitting and nanny expenses. Daycare, nursery school, and preschool. Summer day camp.

Do dependent care benefits count as income?

As per the Internal Revenue Services (IRS), the benefits related to the care of dependents are tax-exempt; hence, they can be claimed on the tax return. The credit applicable to the dependent care benefits can reduce an individual's taxable income by hundreds or thousands of dollars.

What are dependent care benefits IRS?

You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn't able to care for himself or herself. The credit can be up to 50% of your employment-related expenses.

What would make dependent care benefits taxable?

If the value of the benefits is more than $5,000, your employer will report everything over $5,000 as taxable income. If the value is less than $5,000, it's not taxable income. For 2021 only, the maximum employer-provided dependent care benefit exclusion is increased from $5,000 to $10,500.

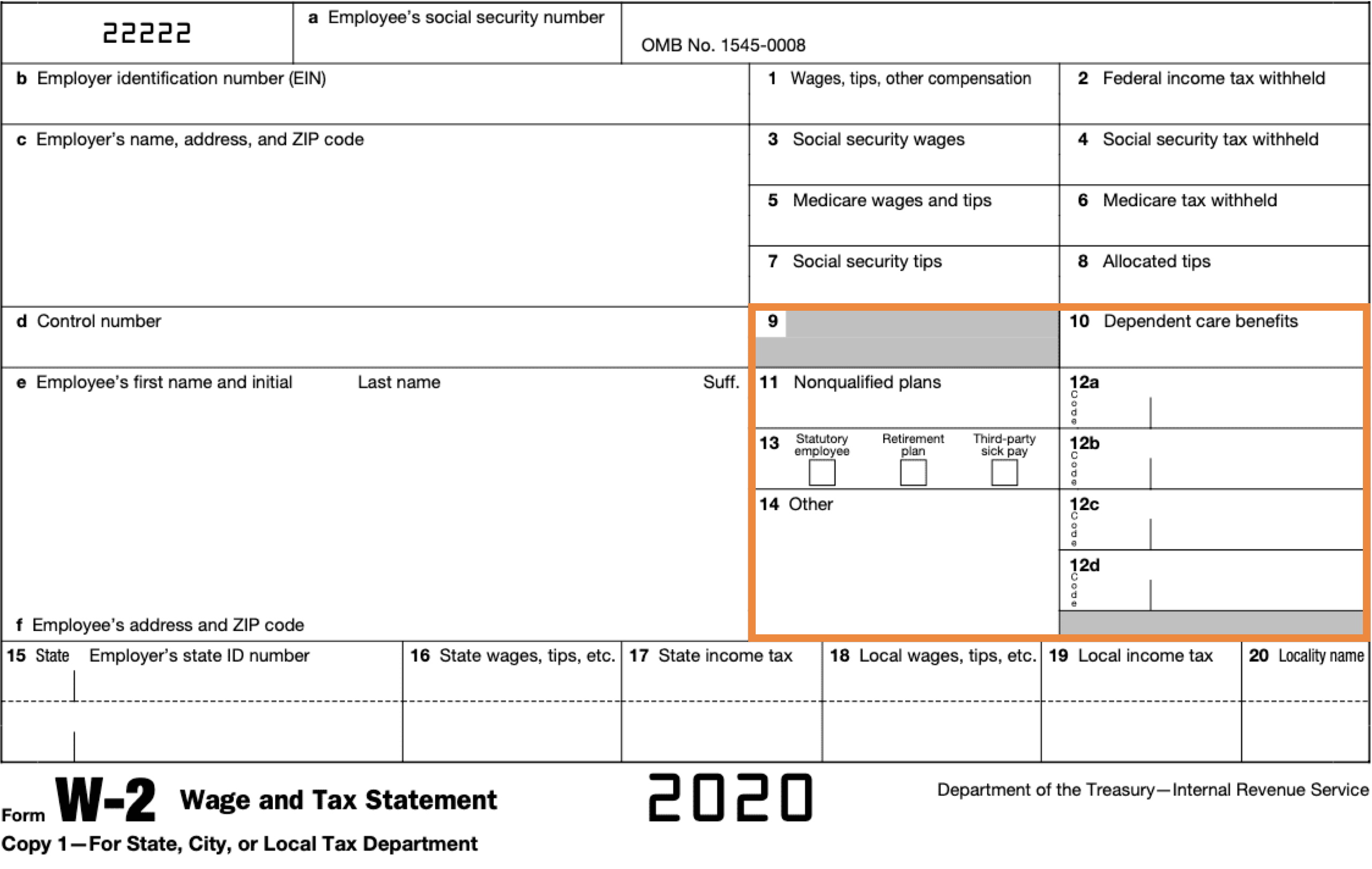

How is dependent care FSA reported on W-2?

Box 10 of your W-2 shows the total amount of dependent care benefits that your employer paid to you or incurred on your behalf.

What qualifies as Dependant care?

To be considered qualified, dependents must meet the following criteria: Children under the age of 13. A spouse who is physically or mentally unable to care for him/herself. Any adult you can claim as a dependent on your tax return that is physically or mentally unable to care for him/herself.

How do I get my dependent care money back?

Claiming the Credit. Families must file a federal income tax return and submit Form 2441, “Child and Dependent Care Expenses.” You will need to submit the provider's name, address, and Taxpayer Identification number (TIN). To complete the tax form, you will also need to know how much you spent on care in 2021.

How do I claim dependent care on my taxes?

To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person.

What does dependent care expenses mean?

Dependent care includes the cost for supervision of teenage children (under age 18), as well as care of a child or disabled adult not part of your SNAP household (for example, a foster child or non-citizen child).

What does DD mean on W-2?

Health Insurance Cost on W-2 - Code DD Many employers are required to report the cost of an employee's health care benefits in Box 12 of Form W-2, using Code DD to identify the amount. This amount is reported for informational purposes only and is NOT taxable.

Do you have to report Box 10 on W-2?

Box 10 is for the dependent care FSA contributions for the year. Unless you have childcare expenses during the year that qualify to offset the amount, then it becomes taxable income.

What happens if you don't use dependent care FSA?

If you don't use all of the money in your dependent care FSA by the end of your plan year, the money is forfeited. The best way to avoid this situation is to carefully plan for your expenses and make adjustments to your account if you experience any qualifying events.

How do dependent care benefits help employees?

Expenses that taxpayers incur in the care of their eligible dependents while they are at work or are looking for work can be heavy on the pocket. Spending money on child care, elderly care, daycare, preschool, and even transportation to and from these care centers can be expensive.

What are forms of dependent care benefits?

Dependent care benefits include flexible spending accounts (FSA) for dependent care, paid leave for the care of dependents, or tax credits.

What is a dependent care Flexible Spending Account (FSA)?

A dependent care Flexible Spending Account (FSA) is a type of dependent care benefit that is offered or set up through an employer. A dependent care FSA is an account where funds are used to pay for various types of eligible care services for young children or elderly care.

How does a Dependent Care Flexible Spending Account (FSA) work?

In a flexible spending account, participants agree and authorize a specific amount of money to be withheld from each pay period’s paycheck. The money withheld shall then go to the flexible spending account or FSA. The amount withheld can be up to $5,000 per year in total for single parents and married couples who are filing jointly.

What are the kinds of expenses that can qualify for dependent care benefits reimbursement?

Eligible dependent care services are those services rendered to dependents while the employee (and spouse, if married) was either at work or looking for work. This means that the services are necessary so that the employee (and spouse, if married) can work and earn.

What are the kinds of expenses that do not qualify for dependent care benefits reimbursement?

As mentioned above, please note that eligible dependent care services are those that are necessary so that the employee (and spouse, if married) can work and earn. Here are examples of expenses that do not qualify for reimbursement:

I am an employer. Can I give contributions to the dependent care FSAs of my employees?

Employers are not required to make contributions to the FSAs of their employees. But employer contributions are allowed. Keep in mind that the maximum combined employer and employee contributions per year are $5,000 for married employees and $2,500 if filings are made separately.

Who can claim dependent care benefits?

Dependent care benefits are available to individuals whose children are cared for by a daycare facility or provider. Such benefits may take the form of childcare tax credits or a dependent care flexible spending account (FSA). Each provides tax savings based on money spent on childcare.

What is dependent care?

Dependent care benefits are provided by an employer to an employee for use in caring for dependents, such as young children or disabled family members. Dependent care benefits may include flexible spending accounts (FSAs), paid leave, and certain tax credits and can be worth thousands of dollars to eligible participants.

What is the child and dependent care credit?

The child and dependent care credit is a tax credit available to taxpayers who paid for the care of their child, spouse, or dependent so they can work or look for work. The IRS maintains a comprehensive information page related to the child and dependent care credit, which includes eligibility and timing requirements, how much can be claimed, ...

How many hours can a dependent be in a home?

A dependent care flexible spending account is available for individuals who care for a child or adult who is incapable of self-care, who lives in the taxpayer's home for at least eight hours each day, and who can be claimed as a dependent on an income tax return.

Can dependents be relatives?

For example, dependents may also be relatives, roommates, or even romantic partners. The IRS provides a guide on who may be claimed as a dependent.

Does the IRS give child care credit?

The IRS provides a child and dependent care tax credit to eligible taxpayers who paid child or dependent care expenses for the tax year. Eligible employees can allocate a portion of their pay to be put into a special flexible spending account to later be reimbursed for qualifying out-of-pocket dependent care expenses.

Who can receive dependent care benefits?

by hundreds or thousands of dollars. Other than the qualifying children, dependent care benefits can also apply to relatives, partners, and roommates.

What are the benefits of dependent care?

Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care. As per the Internal Revenue Services (IRS), the benefits related to the care of dependents are tax-exempt; hence, they can be claimed on the tax return. The credit applicable to the dependent care ...

How to determine if a dependent is a dependent?

A person is qualified as a dependent if he/she matches the following criteria: 1 An employee’s qualifying child or relative who is below 13 years when the care is offered 2 Spouse of the employee, who is mentally or physically unfit to take care of himself/herself and has lived with the employee for more than six months 3 Any family member who, mentally or physically, was unable to take care of himself/herself and has lived with the employee for more than six months. The person cannot be considered a dependent if he/she earns an income of $4,200 or more or has filed a joint return#N#Married Filing Jointly Married filing jointly for tax purposes refers to the filing status in the U.S. for a married couple that is married as of the end of a tax#N#.

What is the child and dependent care credit?

Child and Dependent Care Tax Credit. If an employee is paying another entity or person to take care of his/her children or another dependent while he/she works, the employee may be eligible for the child and dependent care credit. The credit offsets the costs of taking care of a child or a dependent person with a disability.

What is dependent care flexible spending?

A dependent care flexible spending is an account in which employees get pre-tax benefits. It is a benefit account used to pay for services availed to care for dependents while employees are at work. The payroll taxes are not applied to the money contributed by employees to the dependent care flexible spending account.

What is taxable income?

Taxable Income Taxable income refers to any individual's or business’ compensation that is used to determine tax liability. The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the government for the specific tax period. by hundreds or thousands of dollars.

What is the American Child Tax Credit?

Additional Child Tax Credit (ACTC) The Additional Child Tax Credit (ACTC) refers to a refundable tax credit that an individual may receive if their Child Tax Credit is greater than the total.

How much can you deduct for dependent care?

If you exclude or deduct dependent care benefits provided by a dependent care benefit plan, the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses (generally, $3,000 if one qualifying person was cared for or $6,000 if two or more qualifying persons were cared for).

What is a dependent on taxes?

A dependent is a person, other than you or your spouse, for whom you could claim an exemption. To be your dependent, a person must be your qualifying child (or your qualifying relative). However, the deductions for personal and dependency exemptions for tax years 2018 through 2025 are suspended, and therefore, the amount of the deduction is zero. But in determining whether you may claim a person as a qualifying relative for 2020, the person's gross income must be less than $4,300, not zero.

How much of your expenses can you claim for a dependent?

The credit can be up to 35% of your expenses. To qualify, you must pay these expenses so you can work or look for work.

How much income can I claim as a qualifying relative for 2020?

But in determining whether you may claim a person as a qualifying relative for 2020, the person's gross income must be less than $4,300, not zero.

What form do I need to file for child care?

To be able to claim the credit for child and dependent care expenses, you must file Form 1040, 1040-SR, or 1040-NR, and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next.

Can you exclude dependent care benefits from your income?

If you received any dependent care benefits from your employer during the year, you may be able to exclude all or part of them from your income . You must complete Form 2441, Part III, before you can figure the amount of your credit. See Dependent Care Benefits under How To Figure the Credit, later.

Do you have to pay child care expenses?

You must pay child and dependent care expenses so you (and your spouse if filing jointly) can work or look for work. (See Are These Work-Related Expenses, later.) You must make payments for child and dependent care to someone you (and your spouse) can't claim as a dependent.

What is the dependent care credit for 2020?

For tax years through 2020, the Dependent Care Credit is 20% to 35% of qualified expenses. The percentage depends on your adjusted gross income (AGI). The maximum amount of qualified expenses you’re allowed to calculate the credit is:

What is the maximum amount of dependent care benefits for 2021?

For 2021 only, the maximum employer-provided dependent care benefit exclusion is increased from $5,000 to $10,500. Some employers offer Section 125 plans. These are also called cafeteria plans or flexible spending accounts (FSAs). They allow employees to reduce their salaries for one or more nontaxable benefits.

What are qualified expenses for child care?

Qualified expenses for the Child and Dependent Care Credit. Qualified child- or dependent-care expenses are those you incur while you work or look for work. The main purpose of the expenses must be well-being and protection. Qualified expenses for the Child and Dependent Care Credit include:

How much income can a spouse earn if they are disabled?

If that’s the case, IRS assigns one of these earned income amounts to that spouse: $250 per month for one child. $500 per month for two or more children.

How many hours does a dependent care center need to be in your home?

This applies if the qualifying person regularly spends at least eight hours each day in your home. If the qualifying person receives the care in a dependent-care center, the center must comply with all relevant state and local laws. A dependent-care center is one that cares for more than six people for a fee.

How old do you have to be to claim a dependent?

You and the person (s) being cared for live in the same home for more than half of the year. The person providing the care can’t be: Your spouse. Parent of your qualifying child under age 13. Person you can claim as a dependent. If your child provides the care, he or she: Must be age 19 or older.

Can you deduct child care expenses on your taxes?

No, there are no tax deductions available for child care for individuals —just a credit. However, you might qualify for other credits or deductions. To learn more, read about the top five common tax credits. If you think you qualify for the Child Care Tax Credit or other tax credits or deductions, get help!

PSA - Think carefully before filing your tax return early in the filing season

I've seen several people asking how they can correct their return because they got a W-2 or 1099 that they weren't expecting after they had already filed. As far as I know, there's no way to do that other than filing an amended return which is more work and I think can't even be done yet (at least with some preparers).

Excel 1040 Spreadsheet

Excel1040.com - Updated for 2021, this free spreadsheet helps you do your own taxes. Created by my dad and refreshed annually since 1996.

FreeTaxUSA for the win, again

Earlier in the week I was looking for some sort of breakdown on where people are doing their own taxes and wanted to provide my experiences for others who care.

I think this company is ripping me off by offering to pay me as a 1099 contractor

So I need an internship to complete my degree. I worked it out and if I work for this company for a month all my hours would count. They offered to pay me $12.50 an hour as a 1099 contractor for 40 hours a week. I know I don't get any benefits and have to pay a lot of taxes.

Dependent Care Benefits – Qualifying Dependents

Various Dependent Care Benefits

- 1. Child and Dependent Care Tax Credit

If an employee is paying another entity or person to take care of his/her children or another dependent while he/she works, the employee may be eligible for the child and dependent care credit. The credit offsets the costs of taking care of a child or a dependent person with a disabili… - 2. Dependent Care Flexible Spending

A dependent care flexible spending is an account in which employees get pre-tax benefits. It is a benefit account used to pay for services availed to care for dependents while employees are at work. The payroll taxes are not applied to the money contributed by employees to the dependen…

Additional Resources

- CFI offers the Commercial Banking & Credit Analyst (CBCA)™certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful: 1. American Child Tax Credit 2. How to Use the IRS.gov Website 3. Schedule C 4. Social Security