What are the 10 essential health benefits under the ACA?

The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits (EHB), which include items and services in the following ten benefit categories: (1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and ...

What is an example of an essential benefit?

emergency services. hospitalization. maternity and newborn care. mental health and substance abuse disorder services, including behavioral health treatment.

What is not considered an essential health benefit?

Examples of non-essential benefits might include: Chiropractic muscle manipulation. Diabetes management education. Orthotics.

What benefits does the Affordable Care Act provide?

The ACA protects people with preexisting conditions from discrimination. ... Medicaid expansion helped millions of lower-income individuals access health care and more. ... Health care became more affordable. ... Women can no longer be charged more for insurance and are guaranteed coverage for services essential to women's health.More items...•

Which are the essential health services which should be included in the annual plan?

Essential health benefits ensure that health plans cover care that patients needAmbulatory patient services (outpatient services)Emergency services.Hospitalization.Maternity and newborn care.Mental health and substance use disorder services, including behavioral health treatment.Prescription drugs.More items...

What is meant by essential health care?

The definition of essential health care is individual health care, family health care and community health care. Community health care includes the other 2, while family health care includes individual health care. Family health care activities include those which are best organized with the family unit as the target.

What is not considered essential health benefit under the Affordable Care Act?

Essential health benefits do not include certain services, such as: Dental coverage for adults, though some plans may offer this as a benefit. Vision coverage for adults, though some plans may offer this as a benefit. Long-term nursing-home care.

What does a MEC plan cover?

Minimum Essential Coverage (MEC for short) is a health insurance product that generally covers preventative medical services, such as vaccinations, checkups and screenings. MECs can be purchased as a standalone product, or they can be combined with various types of healthcare coverage.

What is no longer an ACA essential?

Policies that are not major medical coverage and not regulated by the ACA do not count as minimum essential coverage. This includes discount plans, limited-benefit plans, critical illness plans, accident supplements, and dental/vision plans.

Who benefits most from the Affordable Care Act?

Who does the Affordable Care Act help the most? Two categories of individuals will benefit the most from the exchanges: those who don't have health insurance right now and those who buy insurance on the individual market.

What does minimum essential coverage include?

Minimum essential coverage, also called qualifying health coverage, is any health plan that meets Affordable Care Act (ACA) requirements for having health coverage. Qualifying plans include marketplace insurance, job-based health plans, Medicare, Medicaid and the Children's Health Insurance Program (CHIP).

What are the main provisions of the Affordable Care Act?

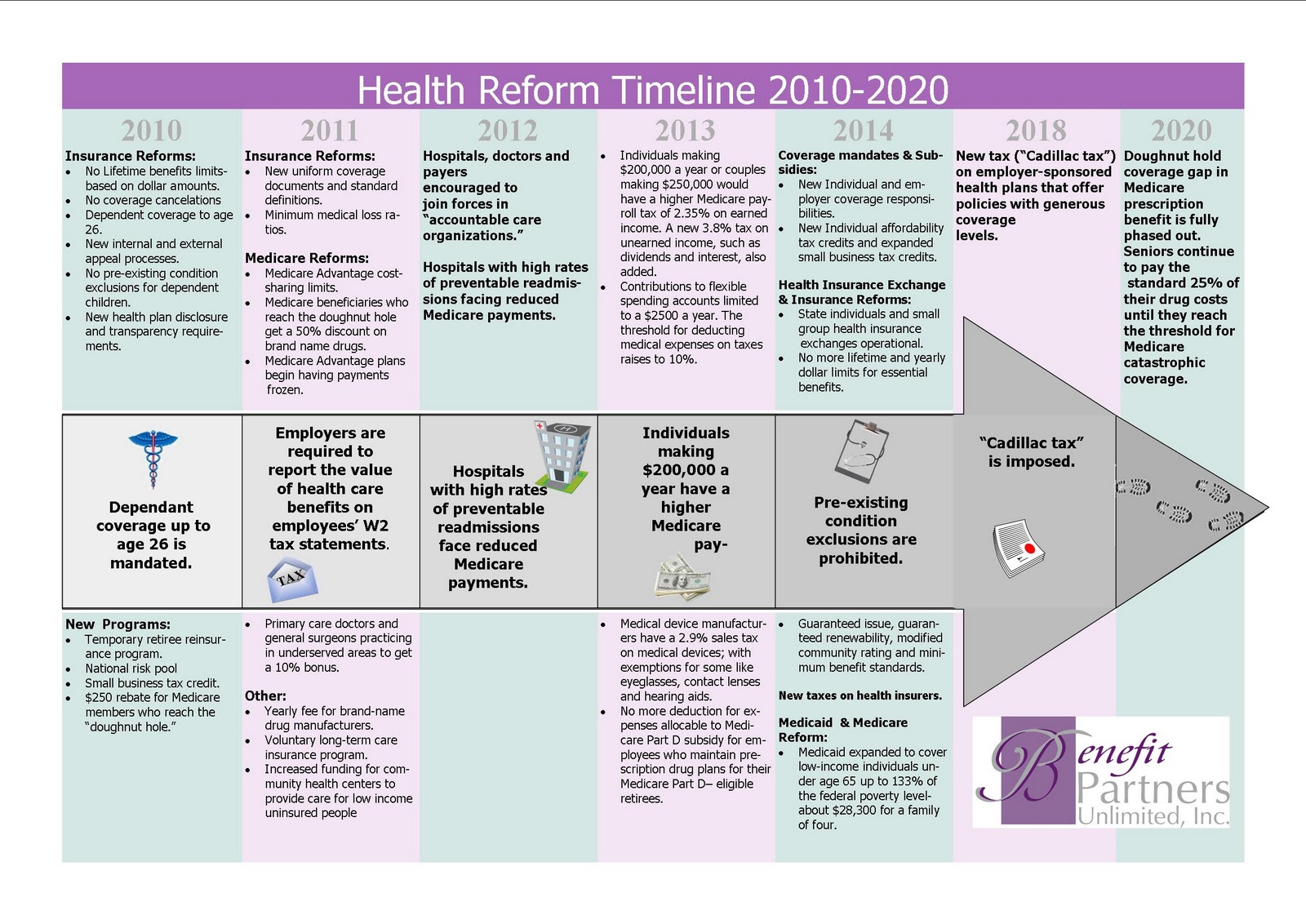

Key Federal Provisions Provisions included in the ACA are intended to expand access to insurance, increase consumer protections, emphasize prevention and wellness, improve quality and system performance, expand the health workforce, and curb rising health care costs.

What was the scope of coverage before the Affordable Care Act?

Before the Affordable Care Act (ACA, also known as Obamacare) took effect, the scope of coverage offered by health insurance plans varied considerably from one state to another. Consumer protections amounted to a patchwork of state-based regulations that were robust in some states and minimal in others.

Can health insurance cover emergency services?

Although health insurance carriers can limit most coverage to in-network providers, that's not true for emergency services.

Does the ACA have a parity requirement for mental health?

Under the parity requirement, a health plan cannot have more restrictive coverage limits for mental health treatment than it has for medical/surgical treatment. 15

Do health insurance plans cover dental?

There's no requirement that health plans cover dental or vision for adults.

Is preventive care covered by insurance?

Preventive care is covered with no cost-sharing for the patient (ie, the insurance company pays the full cost), but only if the preventive service in question is on the list of covered preventive care. 5

How did the ACA solve the problem of insurance?

The ACA solved this by requiring that insurers provide coverage to anyone, regardless of pre-existing health conditions, ensuring it would no longer be difficult or expensive for consumers to buy health insurance on their own.

What was the ACA before?

Before the ACA, health plans available on the individual market were permitted to exclude certain types of coverage without penalty. Many people found out too late that their plan wouldn’t pay for the care they needed, or that they had to pay large premiums just to cover their pre-existing conditions.

Why were essential health benefits created?

The core essential health benefits were created to bridge the gap between a comprehensive and affordable plan for all consumers by ensuring essential services are covered and consumer out-of-pocket expenses are limited .

Why is it important to research essential health benefits?

Researching essential health benefits in advance can make it easier for you to pick a new health insurance plan that covers everything you need. If your employer offers an HRA, you’ll get an even more comprehensive health benefit that will ensure your essential health benefits are covered.

What is essential health insurance?

Essential health benefits are a minimum package of ten items and services that must be covered by all plans in the individual and small group market. This includes health plans offered on the ACA’s health insurance exchange and off-exchange.

Can HRAs be integrated with insurance?

In order to comply with the ACA, some HRAs must be integrated with other coverage as part of a group health plan, such as individual health insurance. The individual insurance would naturally comply with essential health benefit regulations, while your HRA is used for reimbursements.

Do HRAs require insurance?

However, there are other HRAs that don’t require insurance. The IRS Publication 502 contains the list of all the HRA-eligible expenses, so if any of your essential healthcare needs aren’t covered by your insurance, or you don’t have insurance, your out-of-pocket expense will be reimbursed.

What preventive health services does the ACA mandate?

One category of essential health benefits that applies to almost everyone is preventive care.

How much do you pay out of pocket for essential health benefits?

An ACA health insurance plan requires a monthly premium and may have more out-of-pocket costs when you receive care.

Do ACA insurance plans cover other health benefits?

In addition to the essential health benefits, which are a minimum requirement, some plans may offer other benefits for adults, including:

How Are Essential Benefits Covered?

Once you’ve hit the out-of-pocket limit (excluding premiums) for the year for essential health benefits, your health plan will cover 100% of the cost of those benefits. The out-of-pocket maximum for 2020 is $8,150 for individuals and $16,300 for families. For 2021, the limits are $8,550 for individuals and $17,100 for families. 20

What was excluded from the Affordable Care Act?

Before the Affordable Care Act (ACA) was implemented in 2014, health plans available on the individual market often excluded certain types of coverage, including maternity care, substance abuse treatment, and mental health. That made it more difficult or more expensive for many people to buy health insurance on their own.

What is preventive wellness?

Preventive and wellness services and chronic disease management. Preventive and wellness care covers routine doctor’s visits, such as annual exams and vaccinations. If you get preventive health services, such as a pap test, from an in-network provider, their services are free. 13 However, not every service that you receive at a checkup is covered, so check your benefits before you go.

What is hospitalization benefit?

Hospitalization. This benefit includes surgery or other overnight, in-patient stays at a hospital. 7. Pregnancy, maternity, and newborn care. Insurance must cover medical services for you and your child, both before and after birth, as well as the cost of the delivery itself.

Does the Affordable Care Act require insurance to cover pre-existing conditions?

They discovered too late that their plan wouldn’t pay for the care they needed or that they had to pay huge premiums for insurance that would covered their pre-existing conditions. 3 The Affordable Care Act also requires that insurers provide coverage to anyone, regardless of preexisting health conditions.

Does Healthcare.com sell insurance?

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Can you get subsidy for Obamacare?

If you’re purchasing a plan via the marketplace, you may be eligible for a subsidy to offset the premiums, depending on your income.

What are essential health benefits?

Since 2014, under the Affordable Care Act, all new individual and small-group health insurance policies (including those sold in the ACA’s health insurance exchanges and off-exchange) must cover essential health benefits for all enrollees.

What is ambulatory care?

ambulatory services (visits to doctors and other healthcare professionals and outpatient hospital care)

Do large group plans have to cover essential health benefits?

Large group plans are also not required to cover essential health benefits (but if they do, they cannot impose dollar limits on the benefit), although they are required to cover recommended preventive care without any cost-sharing, unless they’re grandfathered.

Can an insurance company pay for physical therapy?

And there cannot be annual or lifetime caps on the amount of money the insurer will pay for the services (note that there can still be a cap on the number of covered visits; for example, an insurer might cover 20 physical therapy visits in a year , and that’s still allowed).

Do grandfathered plans have to cover ACA?

Grandmothered and grandfathered plans are not required to cover the ACA’s essential health benefits, although grandmothered plans are required to cover recommended preventive care with no cost-sharing.

What are the essential health benefits of the Affordable Care Act?

Those covered benefits include hospital services, prescription drugs, pregnancy care, and childbirth.

What Are the 10 Essential Health Benefits?

Ambulatory patient services. This is the outpatient care, from doctor’s visits to same-day surgery, that you receive without being admitted to a hospital.

How Are Essential Benefits Covered?

Once you’ve hit the out-of-pocket limit (excluding premiums) for the year for essential health benefits, your health plan will cover 100% of the cost of those benefits. The out-of-pocket maximum for 2020 is $8,150 for individuals and $16,300 for families. For 2021, the limits are $8,550 for individuals and $17,100 for families. 20

What was excluded from the ACA?

Prior to the ACA’s implementation in 2014, health plans available on the individual marketplace often excluded certain types of coverage, including maternity care, substance abuse treatment, and mental health. That made it more difficult or more expensive for many people to buy health insurance on their own: They discovered too late that their plan wouldn’t pay for the care they needed or that they had to pay huge premiums for it. 3 The ACA also requires that insurers provide coverage to anyone, regardless of preexisting health conditions.

What is preventive care?

Preventive and wellness care covers routine doctor’s visits, such as annual exams and vaccinations. If you get preventive health services, such as a pap test, from an in-network provider, their services are free. 13 However, not every service that you receive at a checkup is covered, so check your benefits before you go.

Can you get subsidy for Obamacare?

The best plan for you depends on your health, your financial circumstances, and the services provided by a specific plan. If you’re purchasing a plan via the marketplace, you may be eligible for a subsidy to offset the premiums, depending on your income.

Do employers have to cover essential health insurance?

While many insurance plans offered by large employers cover essential health benefits, they’re not required to do so. 18 Employers who offer such plans may not impose an annual or lifetime cap on those benefits, but annual or lifetime limits are allowed on benefits that do not fall into the 10 categories of essential health benefits.

What is essential health benefits package?

“Essential health benefits package” refers to health insurance coverage that will provide “essential health benefits,” will not exceed out-of-pocket and deductible limits specified in the law, and will not impose a deductible on preventive services.

How many people will have health insurance by 2016?

An estimated 30 million individuals who would otherwise be uninsured are expected to obtain insurance through the private health insurance market or state expansion of Medicaid programs.

Is prescription drug coverage an essential health benefit?

Prescription Drug Coverage as an Essential Health Benefit. Prescription drugs are one of the 10 essential health benefits that the ACA statute requires marketplace and individual and small group health policies plans to cover, effective January 1, 2014. .

Does the ACA mandate health insurance?

The Patient Protection and Affordable Care Act (ACA) 3 does not directly change or preempt state laws that require or "mandate" coverage of specific benefits and provider services. In the 2010-2013 start-up period, there are no direct effects on existing state health mandates. However, beginning January 1, 2014, the new ACA Exchange marketplaces will require a more uniform, 50-state standard coverage of "essential benefits"- partly defined in statute (below) and partly subject to federal HHS regulations, being issued in preliminary form and in parts as of February 2012. [See material and citations above .] As noted below, starting 2014, if state laws mandate benefit features not-included in the final HHS "essential benefits" list, the state will pay any additional costs for those benefits for exchange enrollees.

What are the benefits of the Affordable Care Act?

The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits (EHB), which include items and services in the following ten benefit categories: (1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and newborn care; (5) mental health and substance use disorder services including behavioral health treatment; (6) prescription drugs; (7) rehabilitative and habilitative services and devices; (8) laboratory services; (9) preventive and wellness services and chronic disease management; and (10) pediatric services, including oral and vision care.

What is the HHS notice of benefits and payment parameters for 2020?

For plan year 2020 and after, the Final 2019 HHS Notice of Benefits and Payment Parameters promulgated 45 CFR 156.111, which provides States with greater flexibility by establishing new standards for States to update their EHB-benchmark plans, if they so choose. For the 2020 plan year, CMS approved changes to the Illinois EHB-benchmark plan (ZIP).

Can EHB be applied to essential health benefits?

The EHB-benchmark plans displayed may include annual and/or lifetime dollar limits; however, in accordance with 45 CFR 147.126, these limits cannot be applied to the essential health benefits. Annual and lifetime dollar limits can be converted to actuarially equivalent treatment or service limits.

Does EHB comply with MHPAEA?

However, as described in 45 CFR 156.115 (a) (3), EHB plans must comply with the standards implemented under MHPAEA, including standards that are effective in the 2017 plan year.