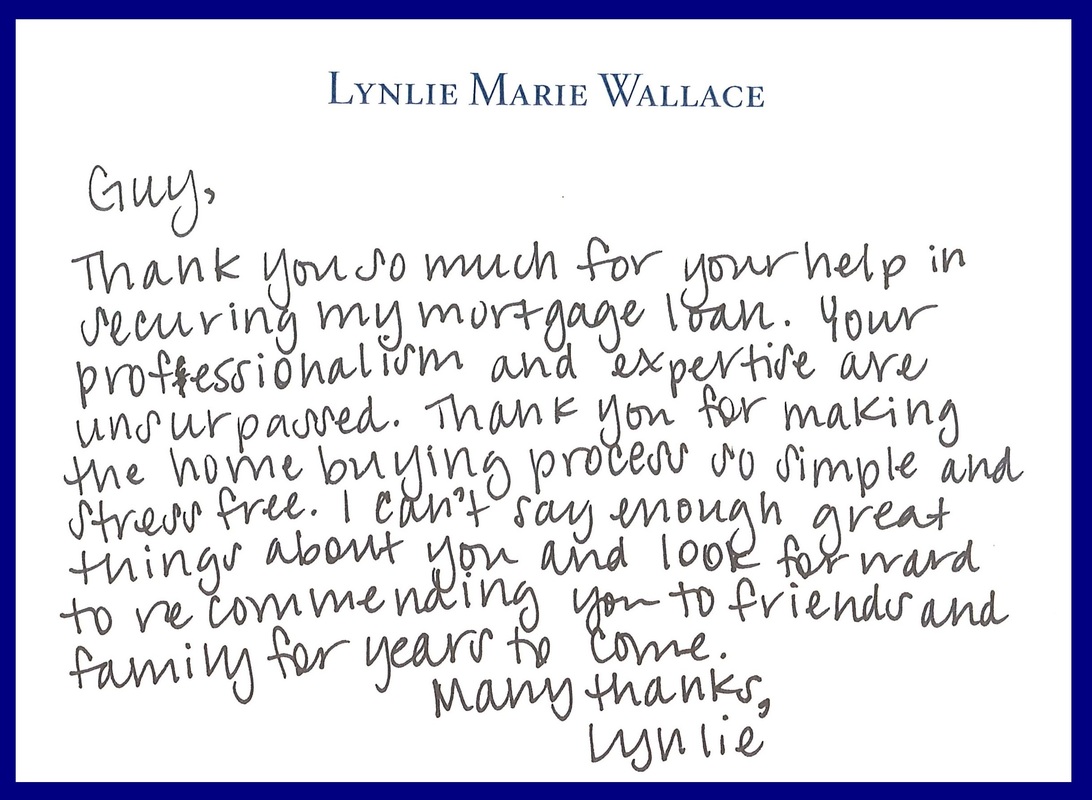

The following are the benefits of working with a mortgage broker:

- Saves a lot of time. Working with a broker saves you a significant amount of time in shopping for loans. It can take...

- Helps you find favorable rates. Mortgage brokers have access to wholesale mortgage rates, which are lower than...

- Compare more loan offers. On your own, you might compare around three to...

Full Answer

What are the advantages of using a mortgage broker?

The Advantages

- Expertise in the Market. One of the most notable advantages of working with a mortgage broker is the valuable expertise they offer in the home buying or refinancing process.

- Access to Lower Rates. Mortgage brokers also have access to wholesale rates on home loans. ...

- A Single Application. ...

- Availability of Multiple Loan Options. ...

- Potential Reduction of Fees. ...

What are the traits of a successful mortgage broker?

What are the benefits of online courses?

- Career advancement and hobbies

- Flexible schedule and environment

- Lower costs and debts

- Self-discipline and responsibility

- More choice of course topics

What are the job duties of a mortgage broker?

The day-to-day responsibilities of a mortgage broker usually include:

- Establishing professional relationships with mortgage lenders to recommend them to clients

- Gathering documents, credit history and employment verification for prospective homebuyers

- Applying for mortgage loans with established lenders on behalf of the borrower

Why is a mortgage broker better than a bank?

- More lending expertise and training

- More loan options

- Better loan guidance and advice

- More willing to negotiate on terms

- Faster loan closing

Do you save money using a mortgage broker?

Working with a mortgage broker can save you time and fees. Cons to consider include that a broker's interests may not be aligned with your own, you may not get the best deal, and they may not guarantee estimates. Take the time to contact lenders directly to find out first hand what mortgages may be available to you.

Is it better to deal with a mortgage broker or bank?

A mortgage broker can offer a wider array of options and streamline the mortgage process, but working directly with a bank gives you more control and costs less.

What is a substantial disadvantage to using a mortgage broker?

What is a substantial disadvantage to using a mortgage broker? The broker may charge more points and higher closing fees than a traditional lender.

What exactly does a mortgage broker do?

Mortgage brokers research loan options and negotiate with lenders on behalf of their clients. A broker can also pull the buyer's credit reports, verify their income and expenses and coordinate all of the loan paperwork.

Can I use 2 mortgage brokers?

The answer to this question is yes you can use multiple brokers to act on your behalf, but the problem is, it might not help you get the mortgage you want and, in some cases, can prevent you from getting a mortgage altogether.

Does it matter which mortgage lender you use?

When it comes to rates, there's no hard-and-fast rule about mortgage lenders vs. banks. The rate you're offered has more to do with your qualifications — credit score, down payment, loan amount — than the specific lender.

Why should I go through a broker?

A broker then deals with the lender and manages your application process through to approval. That's why a broker makes sense. They do this day in and day out. They know the lenders and their products, and they're up-to-date with any changes when it comes to lender policies and products.

Are mortgage advisors worth it?

An adviser might also be able to find a deal you can't find on your own. They can also improve your chances of being accepted for a mortgage as they'll know which lenders are best suited to your particular circumstances.

Do most people use a mortgage broker?

You don't need a mortgage broker to get a mortgage. Many homebuyers find a lender on their own, whether that's through word of mouth or online research. But a broker can make the process easier and expose you to loan opportunities you might not have found yourself.

How do mortgage brokers make their money?

They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay. When you take out a larger loan, your mortgage broker makes more money. A mortgage broker's total compensation can be paid through various means, including cash or an addition to the loan balance.

When should you talk to a mortgage broker?

Here are five reasons you should talk to a mortgage lender before you begin the house-hunting process.It sets realistic expectations. ... You can still shop around. ... It helps catch sellers' eyes. ... You'll finish the paperwork earlier. ... It helps you know what you'll pay at closing.

What are the advantages of using a mortgage broker?

Advantages of Using a Mortgage Broker. A broker can assist a client with fee management concerning their desire to obtain a mortgage or approach a new lender. The fees include the application fees, potential appraisal fees.

What is a mortgage broker?

Summary. A mortgage broker refers to a middleman who manages the mortgage loan process for businesses or people. A broker can assist a client with fee management in relation to obtaining a mortgage or approaching a new lender. The broker saves their client work and time because they usually have a great deal of information on lenders, ...

What documents do mortgage brokers collect?

The broker collects documents such as proof of employment, proof of income, credit reports, details of the client’s assets (if any), and any other important details that may be required to determine the borrower’s ability to secure financing from the lender. The mortgage broker makes an estimation of the appropriate loan amount and type for ...

Why do lenders trust brokers?

Brokers tend to be well acquainted with lenders and are trusted by lenders. This makes the process easier because some lenders prefer to work only with clients. Brokers can also obtain good rates from lenders because they bring in clientele for the lender.

Why do brokers save time?

The broker saves their client work and time because they usually possess a great deal of information about lenders, repayment terms, and administrative fees or other fees that can be disguised in their contracts. However, borrowers are still encouraged to perform their own research.

What is a lender?

Lender A lender is defined as a business or financial institution that extends credit to companies and individuals, with the expectation that the full amount of. and borrowers without using their own funds to establish the connection.

What is asset based lending?

Asset-based Lending Asset-based lending refers to a loan that is secured by an asset. In other words, in asset-based lending, the loan granted by the lender is collateralized with an asset (or assets) of the borrower.