What are the disadvantages of a whole life insurance policy?

The main disadvantage of whole life is that you'll likely pay higher premiums. Also, you're likely to earn less interest on whole life insurance than other types of investments.

What are the advantages and disadvantages of whole life insurance?

Whole life insurance can be advantageous in its cash value benefitting you while you're alive, its whole life coverage, as well as its predictable premiums. However, it does have its drawbacks and disadvantages, such as its potential higher premiums, its slow accruing cash value, and its complex structure.

What is the point of whole life insurance?

Whole life insurance is a permanent insurance policy that pays the beneficiaries a specific amount upon the death of the insured. Because the insurance policy also builds up a tax-deferred cash value over the life of the policy, the policyholder can borrow against the cash value of the policy.

Why whole life insurance is a waste of money?

Whole life insurance premiums can be so costly that they often force policy holders into a situation where they can no longer pay. At that point, those policyholders lose their coverage and get nothing at all out of that money.

Is whole life ever a good idea?

Whole life insurance is generally a bad investment unless you need permanent life insurance coverage. If you want lifelong coverage, whole life insurance might be a worthwhile investment if you've already maxed out your retirement accounts and have a diversified portfolio.

Can I cash out my whole life insurance policy?

Surrendering an insurance policy will return to you the cash value of the policy, less some fees, and will cancel the policy3. The amount you recoup from the policy is taxable. So yes, you may withdraw money from your whole life insurance policy, or cash it out altogether.

What happens to cash value in whole life policy at death?

Insurers will absorb the cash value of your whole life insurance policy after you die, and your beneficiaries will receive the death benefit. The policyholder can only use the cash value while they are alive.

When should you cash out a whole life insurance policy?

Most advisors say policyholders should give their policy at least 10 to 15 years to grow before tapping into cash value for retirement income. Talk to your life insurance agent or financial advisor about whether this tactic is right for your situation.

How long does it take for whole life insurance to build cash value?

How long does it take for whole life insurance to build cash value? You should expect at least 10 years to build up enough funds to tap into whole life insurance cash value. Talk to your financial advisor about the expected amount of time for your policy.

How do rich people use whole life insurance?

Life insurance is a popular way for the wealthy to maximize their after-tax estate and have more money to pass on to heirs. A life insurance policy can be used as an investment tool or simply provide added financial reassurance.

Is life insurance worth it after 60?

If you retire and don't have issues paying bills or making ends meet you likely don't need life insurance. If you retire with debt or have children or a spouse that is dependent on you, keeping life insurance is a good idea. Life insurance can also be maintained during retirement to help pay for estate taxes.

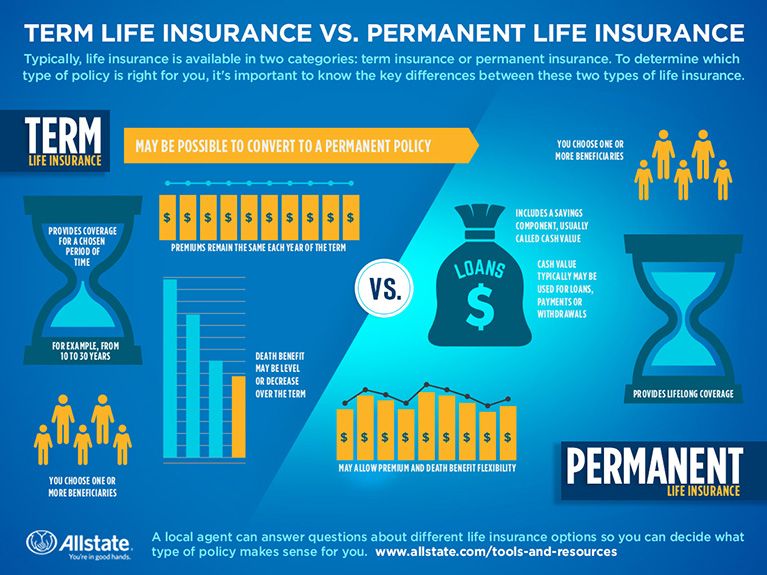

Is whole life better than term life?

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments. Whole life premiums can cost five to 15 times more than term policies with the same death benefit, so they may not be an option for budget-conscious consumers.