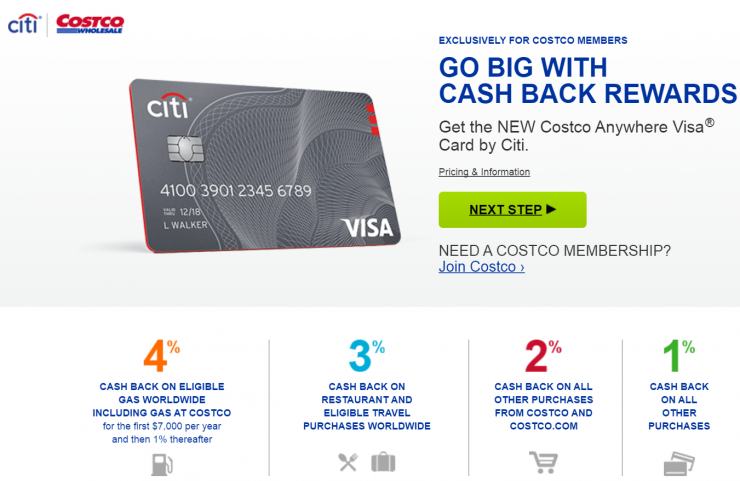

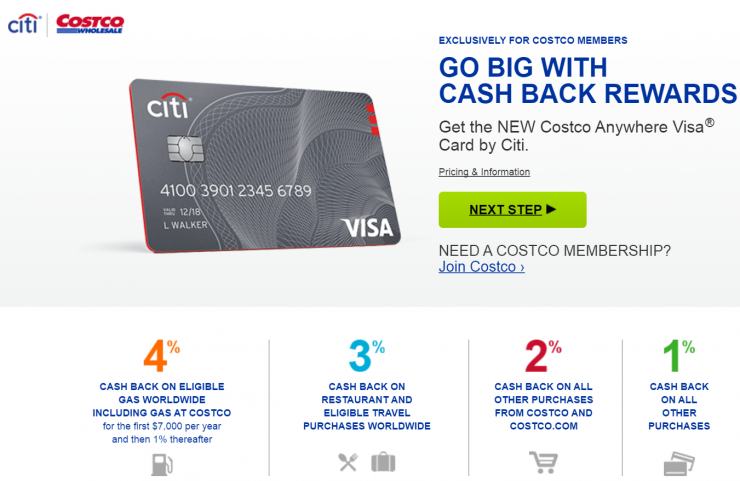

Benefits of the Citi Costco Credit Card

- Rewards on spending. The Costco Anywhere Visa® Card by Citi earns an impressive 4% cash back on gas purchases (at Costco...

- Shopping and entertainment protections and perks. If the items you buy with your card are damaged or stolen within 120...

Full Answer

Is Costco Citi credit card worth it?

The Costco Anywhere Visa® Card by Citi is one of the best store credit cards on the market. If you already have a Costco membership, this card is a solid way to earn rewards across a wide range of purchases, including eligible gas, restaurants, eligible travel and at Costco — both in-store and online. Card Rating*: ⭐⭐⭐.

What are the benefits of using Citi credit cards?

- Success While paying with your card, you collect points that you can later exchange for vouchers or cashback,

- Success Mastercard Priceless Specials program,

- Success Citi Specials Benefit Program

Which is the best Citi credit card?

- Flexibility to customize rewards by earning 5x points on up to $500 per billing cycle in your top spending category (from a list)

- Generous welcome offer for a no-annual-fee card

- No rotating bonus categories to sign up for or track

- Earn valuable Citi ThankYou points which you can redeem for cash back, travel, gift cards, merchandise, and more

When will I receive my Costco cash rewards from Citi?

You receive your rewards only once a year. In February, after your billing statement closes, you’ll get an annual credit card rewards certificate. The certificate can only be redeemed at a Costco warehouse, for cash back, or merchandise purchases, in a single transaction.

What is the advantage of a Costco credit card?

Cash back rewards 4% on eligible gas, for the first $7,000 per year and then 1% thereafter. 3% on restaurants and eligible travel. 2% on all other purchases from Costco and Costco.com. 1% on all other purchases.

Is the Costco Citi card worth it?

Costco Credit Card Review Summary The Costco Credit Card is worth applying for if you have a Costco membership and an excellent credit score. The Costco Anywhere Visa® Card by Citi has a $0 annual fee and offers 1 - 4% cash back, giving its bonus rates on gas, travel and dining purchases.

Is Costco membership free with Citi credit card?

No, a Costco membership is not free with any Citi credit card. Even if you get the Costco Anywhere Visa® Card by Citi or the Costco Anywhere Visa® Business Card by Citi, you will still have to pay a Costco membership fee every year. Costco Credit Card users do not receive discounts on membership fees, either.

How do I get my Citi rewards from Costco?

Costco Cash Rewards from Citi are distributed annually with your February credit card billing statement. If you've signed up for paperless statements, you'll receive it via email instead. If you need to replace your reward, you may do so by logging in to your online Citi account here: www.citicards.com.

Which Costco card is best?

Perhaps the most obvious choice is the Costco Anywhere Visa® Card by Citi. There is no annual fee, and the Costco membership requirement shouldn't be an issue since you need a membership to shop at the warehouse (unless you share with a family member or friend).

Can you cash out Costco rewards?

Can you cash out Costco rewards? Costco credit card rewards certificates can be redeemed for merchandise in the Costco warehouse, or you can cash it out. If you want cash, Costco reserves the right to pay you by cash, check, or electronic transfer.

Does Costco Citi card have annual fee?

Key features of the Costco Anywhere Visa® Card by Citi Card type: Store. Annual fee: $0 for the card, but you have to be a Costco member. A baseline Gold Star membership costs $60 per year, while the higher-tier Executive membership is $120 per year.

What is eligible gas for Costco Citi card?

Eligible gas purchases for Costco Anywhere Visa® Card by Citi cardholders are those made at Costco and at most gas stations worldwide. Non-qualifying gas purchases include fuel used for non-automobile purposes as well as gas charges at supermarkets, superstores, and warehouse clubs other than Costco.

Is Costco worth the membership?

Conclusion. If you're just shopping for food at Costco, the savings aren't as competitive for the same items you'd find elsewhere, so the $60 annual membership fee might not be worth it for you. But other in-store brands are really on par, quality-wise, as Costco's Kirkland Signature brand.

Does Costco give rewards on gas?

Earn cash back rewards on purchases wherever Visa® is accepted. You'll get 4% back on eligible gasoline purchases for the first $7,000 per year and then 1% thereafter. You'll also earn 3% on restaurants and eligible travel purchases, including Costco Travel.

Do Costco rewards expire?

The Costco Credit Card rewards expire on December 31st of the year they were issued in. To be exact, you'll receive your rewards in the form of a Costco reward certificate once every year, in February.

How does Costco Citi card work?

The Costco Anywhere Visa® Card by Citi earns an impressive 4% cash back on gas purchases (at Costco or elsewhere) on up to $7,000 of spending a year. That translates to $280 back a year if you hit that limit. (After $7,000 in spending, the rewards rate goes down to 1%.)

What are some of the benefits that comes with the Costco Anywhere Visa ® Card by Citi?

The Costco Anywhere Visa® Card by Citi provides cardmembers with some of the following benefits: No matter where you’re traveling, you’ll enjoy no...

Does the Costco Anywhere Visa ® Card by Citi offer cash back?

Yes. Earn Costco cash back rewards anywhere Visa® is accepted, with the Costco Anywhere Visa® Card by Citi. Earn 4% cash back rewards on eligible g...

Can anyone apply for the Costco Anywhere Visa ® Card by Citi?

The Costco Anywhere Visa® Card by Citi is exclusively for Costco members. If you do not already have a Costco membership, you can purchase one at C...

Is the Costco Anywhere card a Visa ® or Mastercard ® ?

The Costco Anywhere Card is a Visa® credit card. Earn cash back rewards on every purchase anywhere Visa® is accepted. Learn more and apply online n...

How do you redeem your cash back with the Costco Anywhere Visa ® Card by Citi?

The Costco Anywhere Visa® Card by Citi can be redeemed for cash back by following these steps: Cash back will be provided as an annual credit card...

How do you apply for the Costco Anywhere Visa® Card by Citi?

The application process for the Costco Anywhere Visa® Card by Citi is easy and straightforward. If you're not already a Costco member, you can appl...

Is there a Costco Visa® Card by Citi for small businesses?

Yes, the Costco Anywhere Visa® Business Card by Citi is designed specifically for small business use. If you're not already a Costco member, you ca...

Do you need a Costco membership to get the Costco Anywhere Visa® Card by Citi?

Yes, the Costco Anywhere Visa® Card by Citi is exclusively for Costco members. If you do not already have a Costco membership, you can purchase one...

Can I use my Costco credit card by Citi as proof of Costco membership?

Yes, your Costco Anywhere Visa® Card by Citi can act as your Costco membership ID while you are a cardmember.

What are the benefits of Costco?

Benefits of a Costco Credit Card 1 4% cash back on the first $7,000 spent per year on eligible gas purchases and 1% cash back thereafter. 2 3% cash back at restaurants and on eligible travel expenses. 3 2% cash back on Costco and Costco.com purchases. 4 1% cash back on non-bonus-category purchases. 5 Worldwide Travel Accident Insurance provides coverage if you or an eligible family member dies or sustains certain injuries during your trip. 6 Damage & Theft Purchase Protection covers repairs or refunds on items purchased with a Costco Credit Card that are damaged or stolen within a certain time period of the purchase date. 7 Extended Warranty protection adds an additional number of years onto an existing manufacturer’s warranty and will cover repair or replacement costs. 8 0% foreign transaction fee on purchases abroad or online through internationally-based merchants. 9 Worldwide Car Rental Insurance covers your rental car against theft and damage from an accident, natural disaster or vandalism when you pay with a Costco Credit Card and decline the rental company’s insurance. 10 Travel & Emergency Assistance provides travel support services 24/7 before and during a trip, including help with travel arrangements, medical and legal referrals, and more. 11 Citi Entertainment provides cardholders special access to buy tickets to certain exclusive events. 12 Citi Quick Lock allows you to block access to your account without having to order a new card.

How long is Costco rental car insurance?

… read full answer. There are some rules, however. The maximum length of a covered rental is 31 days, so your car won’t be covered if the rental agreement is longer than that.

What is travel accident insurance?

The travel accident insurance benefit covers you, your spouse, your domestic partner and/or your dependents up to $250,000 per person against death or dismemberment. The coverage applies while you are traveling on a common. carrier like a plane, train, bus or boat, as long as you paid for the full fare using the card.

Does Costco give you cash back?

Costco routinely offers great deals, and the Costco Credit Card gives you up to 4% cash back on eligible purchases. So all in all, Costco Credit Card can save you a significant amount.

Does Costco insurance cover car rental?

Costco Credit Card rental car insurance does not cover rentals used as a “car for hire,” rentals from peer-to-peer car sharing companies, or damage done by operating the car in a way that violates the rental agreement. It also won’t cover bodily injury expenses.

How to earn rewards with Costco credit card?

To earn rewards with your Costco credit card, simply swipe the card when making purchases in the qualifying categories. The cash back you earn will be provided as an annual credit card reward certificate. The real downside to this card is that you can only redeem your cash back rewards at Costco, in one single transaction per year.

Does Costco offer cash back?

The Costco credit card is not the only option available for earning cash back at the retailer. There are a few cards that offer cash back savings at wholesale clubs, including Costco.

What are the benefits of Citi?

Enjoy Citi exclusive benefits. One of the added benefits is access to Citi Entertainment, a feature that comes with most Citi cards. Citi Entertainment offers exclusive access to thousands of events, including presale tickets to concerts and sporting events and special dining experiences in.

What is value penguin?

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site (including for example, the order in which they appear). To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Does Valuepenguin include all financial institutions?

ValuePenguin does not include all financial institutions or all products offered available in the marketplace. How We Calculate Rewards: ValuePenguin calculates the value of rewards by estimating the dollar value of any points, miles or bonuses earned using the card less any associated annual fees.

Does Costco offer a sign up bonus?

Although the card offers great long-term gains, it does not , however, offer a sign-up bonus.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

If you’re unsure how a purchase will be categorized, look at your card’s program disclosures and terms. Merchant category codes can also be a big help.

Check the fine print

The first place to start looking to find out if a certain expense qualifies for a bonus is the fine print of your card terms. If you go to the website of the card you have, you should be able to find a link with basic financial information on the card – such as its interest rate, annual fee and late fee.

When in doubt, look for the MCCs

If you’re still unsure about a purchase, you can always check the merchant category code (MCC). Banks and issuers use MCCs to categorize and track certain types of purchases. If you can figure out which MCCs earn you extra points, you can look up specific merchants using an online tool to see if they qualify.