- Lower Fees. Credit unions tend to offer lower fees than banks. ...

- Better Savings. ...

- Lower Loan Rates. ...

- Local Experts. ...

- Commitment to Members. ...

- Elected Board of Directors. ...

- Investments in Your Community.

Better Rates

- Personalized customer service

- Higher interest rates on savings

- Lower fees

- Lower loan rates

- Community focus

- Voting rights

- Variety of service offerings

- Insured deposits

- Additional considerations when using a credit union

Friendliness and Accessibility

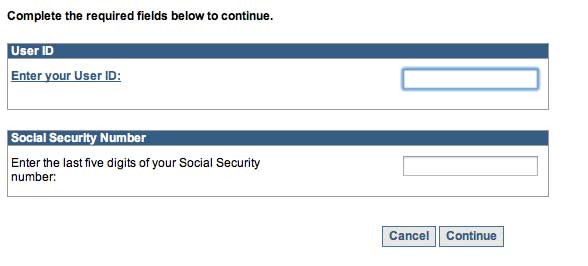

Typically, the information you’ll need includes:

- Your social security number or tax identification number

- A physical address where you can be reached

- Some form of valid identification, such as a passport or driver’s license

- Reasons why you’re eligible

A Co-Op, Not a Corporation

Credit unions tend to have lower fees and better interest rates on savings accounts and loans, while banks' mobile apps and online technology tend to be more advanced. Banks often have more branches and ATMs nationwide.

Nothing to Lose

Deposit accounts at credit unions offer consistently higher annual percentage yields, as banks are more concerned with returning higher dividends to their shareholders than providing benefits to their customers.

It's a Democracy

What are the benefits of banking with a credit union?

How do you open a credit union account?

Is credit union a good bank?

Should I open a credit union account?

Is Joining a credit union a good idea?

Better Rates on Loans and Savings Accounts Because they don't have to pay profits to shareholders as banks do, credit unions often can pass that money on to their members, by offering higher APYs on savings accounts and CDs and lower APRs on loans.

Why is it good to have a credit union account?

Credit unions typically offer lower fees, higher savings rates, and a more hands-and personalized approach to customer service to their members. In addition, credit unions may offer lower interest rates on loans. And, it may be easier to obtain a loan with a credit union than a larger impersonal bank.

What is the downside of a credit union?

Limited accessibility. Credit unions tend to have fewer branches than traditional banks. A credit union may not be close to where you live or work, which could be a problem unless your credit union is part of a shared branch network and/or a large ATM network like Allpoint or MoneyPass. Not all credit unions are alike.

What is the pros and cons of having a credit union account?

The Pros and Cons of Credit UnionsYou Are a Member. You are not just a customer at a credit union, you are a member. ... They Have Lower Fees. ... They Offer Better Rates. ... It is About the Community. ... The Customer Service is Better. ... You Have to Pay Membership. ... They Are Not All Insured. ... There Are Limited Branches and ATMs.More items...

Does credit union help build credit?

Joining a credit union can help build credit, provided you follow the right steps. For example, if you join a credit union with bad credit, you may want to consider getting a secured credit card to improve your credit score. This is also an option if you're new to credit.

Is it better to have your money in a bank or a credit union?

Why Choose a Credit Union? Lower interest rates on loans and credit cards; higher rates of return on CDs and savings accounts. Since credit unions are non-profits and have lower overhead costs than banks, we are able to pass on cost savings to consumers through competitively priced loan and deposit products.

Can you lose money in a credit union?

Credit Unions And Banks Are Insured All credit unions are insured by the NCUA up to $250,000, while banks are insured by the FDIC for the same amount. If you have over $250,000 in your accounts, work with your financial institution.

Which is safer bank or credit union?

Your money is just as safe in a credit union as it is in a bank. Money kept in banks is insured by the FDIC. Federally insured credit unions offer NCUSIF insurance. Both are federal insurance backed by the U.S. government.

Can I take my savings out of credit union?

You can usually withdraw money at any time. If your savings account is a 'Notice' account, you'll have to give the credit union a set amount of notice to make a withdrawal. Some credit unions will give you a debit card that you can use at a normal high street cash machine.

Do credit unions give interest on savings?

Because credit unions serve their members and not their investors, they can offer higher interest rates on savings accounts (including CDs) and lower rates on mortgages.

What is the best credit union to bank with?

Best credit unionsBest overall: Alliant Credit Union (ACU)Best for rewards credit cards: Pentagon Federal Credit Union (PenFed)Best for military members: Navy Federal Credit Union (NFCU)Best for APY: Consumers Credit Union (CCU)Best for low interest credit cards: First Tech Federal Credit Union (FTFCU)

What's the difference between a credit union and a regular bank?

Although both financial institutions do similar things, each offer different pros for their members. The biggest difference between a bank and a credit union is that a bank is a for-profit institution and a credit union is a non-for-profit institution.

What is a share draft account?

A share draft account is a credit union checking account. It works similarly to a bank checking account, but you may be more likely, as a credit un...

How much financial benefit do members receive as part of their credit union membership?

According to the June 2021 Membership Benefits Report from CUNA (Credit Union National Association), the direct annual financial benefits of credit...

What are some other examples of how credit unions support their communities?

Credit unions provide community involvement and financial support in several major ways beyond their day-to-day operations, such as providing finan...

What is a credit union?

Credit unions are community-based banking institutions that are owned, in part, by the union's depositors and customers. Similar in many ways to traditional banks, credit unions also come with some additional advantages that some may find attractive. A focus on the community, attractive rates, and added perks might lure you away from your bank ...

What is the most outstanding feature of credit unions?

Perhaps the most outstanding feature of credit unions is that they are member-owned and member-run. Credit unions are free to make decisions to benefit their members, rather than seeking to please stockholders, who may have different interests than the members' interests.

What is the mistake about credit unions?

Louis Suburban Teacher's Association in 1957, noted that credit unions are mistakenly an “exclusive club that requires you to be a part of a union or work in a certain field.” 1 2.

Do I need to live in the area to join a credit union?

The only standard requirement for membership in most credit unions is that you live in the area. Credit unions offer the same services as banks, such as checking, saving loans, and investment options.

Can credit unions make money on their own?

Since profits to stockholders aren't a part of the company vision, credit unions are free to pass surplus money on to members in the form of fewer fees, more services, lower interest on loans, and higher dividends on deposits.

Is a credit union a corporation?

Credit unions can be friendlier in atmosphere and tone, and simply more accessible on every level. 2. A Co-Op, Not a Corporation. Credit unions often consider themselves " financial cooperatives " rather than financial institutions.

Is a credit union the best place to put money?

If you're frustrated with long lines and unresponsive customer service, a credit union might just be the best place to put your money. It's tough to beat a place that's community-focused, friendly, and offers better interest rates. Just be sure to do the comparison shopping with both traditional and online banks and make sure the credit union you are considering offers the best rates for the service you need.

What Is a Credit Union?

A credit union is a cooperative, nonprofit, member-owned financial institution. Unlike banks, which are owned by shareholders and must distribute profits to their owners, credit unions are owned by their members, who are also their customers. More than 122 million Americans are members of credit unions.

Advantages of Credit Unions

Credit unions have an overall mission of improving the financial well-being of their members and serving their communities. There are several important credit union benefits you can expect if you join a credit union.

How to Join a Credit Union

Credit unions may have limits on who can qualify for membership. For example, some credit unions serve the military community, and you can only join if you are active-duty military, a veteran, certain other government employees or contractors, or their family members.

Credit Unions vs. Banks

After seeing the advantages of a credit union, you might wonder why anyone would choose to put their money in a bank. It’s true that credit unions have some valuable benefits and attractive offerings. There are complex reasons why people choose their banking relationship.

Frequently Asked Questions (FAQs)

A share draft account is a credit union checking account. It works similarly to a bank checking account, but you may be more likely, as a credit union member, to earn dividends (that is, interest) with a share draft account than with a bank checking account.

Why do credit unions offer lower interest rates?

Credit unions offer higher savings rates and lower interest rates on loans. Since they're not focused on making profits but on covering their operating costs instead, credit unions are able to offer better interest rates to their members. The interest rates can be a lot lower for loans, and you may qualify for further discounts if you set up automatic payments. This means that their members are better served and might be able to save a significant amount on car loans, student loans, and mortgages.

What are the disadvantages of a credit union?

In addition to imposing membership requirements that you may not be able to meet, credit unions tend to be smaller than banks, which can make it difficult to find a branch or an ATM when you travel or move.

What happens when you open a credit union account?

When you open an account with a credit union, you become a member or owner of that credit union. A credit union doesn't have stockholders, so it works to please its members. This shift from a for-profit to a nonprofit model changes the business focus from generating the most profits possible to creating the best customer service and support experience. Thus, many credit union policies are more customer friendly. 1

Can a credit union help you overdraw?

A credit union is also more likely to have rules in place that are more forgiving if you overdraw your checking account or have a lower credit score. And you may find that credit union representatives are more willing to work with you if you find yourself temporarily out of work or in another difficult situation.

Do credit unions belong to FDIC?

Credit unions don't belong to the FDIC as banks do. Instead, they belong to the National Credit Union Administration, which is comparable to the FDIC for banks . The same amount of money is guaranteed by the NCUA as by the FDIC, which means that your account would be guaranteed up to $250,000 if your credit union failed. 4

Is overdraft fee lower than credit union fees?

Overdraft fees, which tend to be a big moneymaker for banks, are lower too. The lower fees mean that you can save money by joining a credit union. 1 . Whether you use a credit union or bank be sure to carefully read the policies regarding any fees that you may end up paying.

Do credit unions charge ATM fees?

Many credit unions don't charge ATM usage fees within their networks, but if you're away on a regular basis, then a credit union may not be your best option. 1 . You may also have fewer options at a credit union than at a bank.

What is a credit union?

Credit unions cater to a specific segment of the population. For example, some credit unions may work with students or people who work and live in a certain area. This allows them to offer checking accounts that come with fewer restrictions.

What does CUNA mean?

Tailored customer service efforts mean members have more pleasurable banking experiences. The Credit Union National Association (CUNA), a financial services trade association that advocates for US-based credit unions, found that credit unions have increased their number of members since the last financial recession that took place in 2008.

How are credit unions different from other financial institutions?

Did you know that credit unions are uniquely different to other financial institutions? There is one very important difference; credit unions are not-for-profit. #N#That’s right – credit unions exist only for the benefit of the people who use the credit union, called the members of the credit union. Credit unions are not motivated to make profits for the stock markets or shareholders. They only strive to make a surplus so they can either return this surplus to their members in the form of a dividend, or a loan interest rebate for those members who have loans with the credit union. Or, they might re-invest the surplus in the credit union to improve and enhance facilities, products and services. Find out more about credit union dividends here .#N#Every credit union is run independently, so each credit union makes its own decisions at a local level. The services and products offered by each credit union are tailored specifically to suit the best interests of their members, and so services might vary from credit union to credit union.#N#All credit union members however will receive a range of benefits – some not offered by any other financial institutions. Read on to find out the top advantages to being a credit union member.

Do credit unions have flexible repayments?

Flexibility with Loan Repayments. Credit unions are very flexible when it comes to loan repayments. Find out all you need to know about the unique benefits of a credit union loan here. If you find you can pay back the loan faster than originally thought, you are free to do so without any penalties or additional costs.

Do credit unions make profits?

Credit unions are not motivated to make profits for the stock markets or shareholders. They only strive to make a surplus so they can either return this surplus to their members in the form of a dividend, or a loan interest rebate for those members who have loans with the credit union.

Do credit unions refuse loans?

Credit unions will always consider every loan application individually, and will take the time to hear your story, and all of the reasons behind the loan. Credit unions will not automatically refuse a loan application if you are in receipt of social welfare, or if you don't have the best credit history.

Is a credit union loan insured?

Loans and Savings Are Insured. Your loan and/or savings in the credit union are insured at no direct cost to you. Loans are insured by the credit union’s own policy. This means that in the event of death, your loan will be paid off, and will not fall to yout family to pay.

Why do people choose a credit union?

A lot of people choose their bank or credit union on the basis of proximity or convenience, but few stop to consider key differences between the two. While it may be tempting to boil things down to the big-business feel of banks versus the friendly neighborhood feel of credit unions, doing so would be an oversimplification of the deeper motivations that truly make credit unions great for members. At their core, credit unions are predicated on the philosophy of people helping people.

What sets a credit union apart from a bank?

To understand what sets credit unions apart from banks, you have to understand the operating model of each institution. Banks are for profit, while credit unions are not-for-profit and member owned. When you become a member of a credit union, you also become a co-owner alongside other members. This gives you access to member perks, as well as ...

Why are credit unions called members?

That’s one reason why credit union customers are called members. But, many credit unions have multiple qualifying ways to join, including family membership ties and memberships in some non-profit organizations. The truth is, credit unions tend to have more forgiving standards for qualifications than banks.

Why are banks more likely to charge service fees?

Attractive Rates for All. Because they operate on a for-profit model, banks must deliver their profits to stockholders. This is why banks are more likely to charge service fees and loan origination fees.. While this model is great for stockholders, it doesn’t really do much for members.

Do credit unions require membership?

Some people hear the term “credit union” and assume membership requires a specific affiliation or status. It’s true, credit unions require some kind of eligibility, (such as a certain employer or geographic qualifiers) to use the credit union. That’s one reason why credit union customers are called members.

Do credit unions have to sacrifice?

No Sacrifice Required. Some people think opting for a credit union means they’ll get a limited selection of financial products and services when compared to what’s offered by banks. But don’t be fooled by their size. Just because credit unions are smaller, it doesn’t mean they can’t meet your financial needs.

Do credit unions have more forgiving standards?

The truth is, credit unions tend to have more forgiving standards for qualifications than banks. This means consumers with poor credit scores or limited financial history are more likely to qualify for a credit card or loan. Education is a big part of the members-first ethos that’s characteristic of credit unions.

Why are credit unions better than banks?

Due to their community-focused mission and comparably small size, credit unions tend to offer higher quality and more personal customer service than banks. In fact, in a 2017 American Customer Satisfaction Index Finance and Insurance Report, credit unions received a customer satisfaction score of 82%, higher than that of banks.

Do credit unions have customers?

Banks and most other financial institutions have customers. Credit unions, on the other hand, have members. That's because, while banks are corporations, credit unions are non-profit cooperatives. Everyone who gets an account at a credit union is considered a member of that cooperative. That means, as a member of a credit union, you are considered literally a part-owner of that credit union.

Do banks and credit unions take deposits?

Banks and credit unions both take and secure deposit s and invest money to raise funds to lend to people and businesses. Banks and credit unions are also beholden to similar agencies and laws regarding mortgages, loans, and financial security.

Is a credit union more secure than a bank?

A common concern people raise about credit unions is that they are less secure than banks. The truth is, however, is that credit unions are equally as secure as banks, only through a different federal mechanism. Where deposits into a bank account up to $250,000 per account are insured by the Federal Deposit Insurance Corporation, deposits into a federally-chartered credit union account are likewise insured up to the same $250,000 limit per account, only by the National Credit Union Share Insurance Fund.